Pearl Jewelry Market Industry Analysis and Forecast (2026-2032)

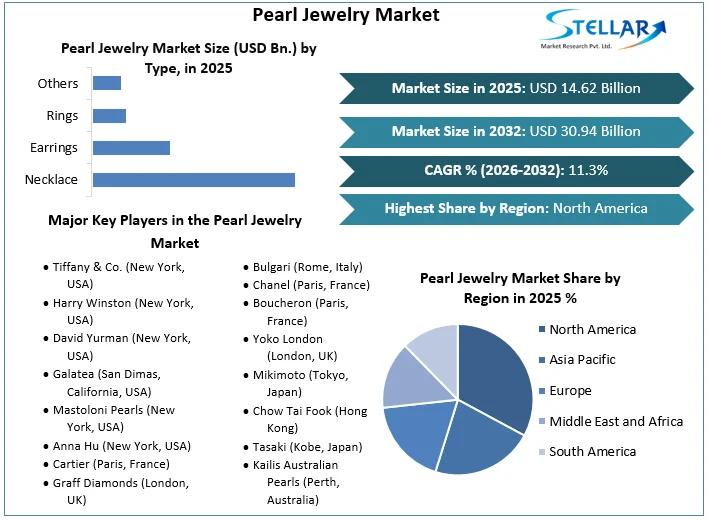

The Pearl Jewelry Market size was valued at USD 14.62 Bn. in 2025 and the total Pearl Jewelry revenue is expected to grow at a CAGR of 11.3% from 2026 to 2032, reaching nearly USD 30.94 Bn.

Format : PDF | Report ID : SMR_1882

Pearl Jewelry Market Overview

Pearl jewelry refers to accessories and adornments crafted from pearls, which are organic gemstones formed within mollusks. These exquisite gems are prized for their natural luster, iridescence, and timeless elegance. Pearl jewelry encompasses a wide range of products, including necklaces, earrings, bracelets, rings, and pendants, available in various shapes, sizes, and colors.

The application of pearl jewelry spans across diverse cultural and fashion contexts, making it a versatile choice for both formal occasions and everyday wear. From classic pearl necklaces that exude sophistication to contemporary pearl earrings that add a touch of understated elegance, pearl jewelry complements a wide range of styles and preferences. In terms of production, the demand for pearl jewelry market has driven innovation in pearl cultivation techniques, leading to advancements in pearl farming practices. Cultured pearls, produced through controlled farming methods, have revolutionized the pearl industry, making pearls more accessible and affordable to consumers worldwide.

The demand for pearl jewelry market is influenced by shifting consumer preferences, fashion trends, and cultural influences. As a result, the industry has witnessed continuous innovation in jewelry design, with designers experimenting with new shapes, settings, and combinations of pearls with other gemstones and materials to create unique and eye-catching pieces. Technological advancements have also played a significant role in the production of pearl jewelry, enabling precise sorting, grading, and shaping of pearls, as well as enhancing the efficiency of jewelry manufacturing processes. From automated pearl sorting machines to laser cutting and engraving technologies, these advancements have improved the quality and consistency of pearl jewelry production.

The impact of pearl jewelry extends beyond aesthetics, as it contributes to the economic development of pearl-producing regions and supports livelihoods in coastal communities. Moreover, the timeless appeal and enduring value of pearl jewelry have made it a popular choice for investment and heirloom pieces, further bolstering its significance in the global jewelry market.

To get more Insights: Request Free Sample Report

Pearl Jewelry Market Dynamics:

The Affordable and Sophisticated Pearl Jewelry is perfect for Both Festive Occasions and Everyday Wear Which Drives the Pearl Jewelry Market Growth

Pearls, heralded as one of nature's most captivating treasures, exude timeless beauty and versatility. Their enchanting allure transcends trends, offering a flattering accent to every complexion. The ethereal radiance of pearls or the captivating darkness of Tahitian pearls, their varied hues make them the quintessential jewel for any occasion. Decorating with pearl earrings or a necklace yields an almost magical transformation to an instant facelift, without the need for surgical intervention. The dynamic landscape of the Pearl Jewelry Market, the unwavering dedication to the timeless beauty of pearls persists, with artisans infusing their aspirations into every exquisite creation.

This year, the industry redoubles its commitment to coexisting harmoniously with nature, particularly the nurturing seas that cultivate these radiant gems. Advancing towards a zero-emissions pearl farming system, efforts to collect and recycle process waste reflect a decade-long endeavor, demonstrating the industry's steadfast resolve for sustainability. Collaborating with industry partners, the market embraces a culture of waste reduction, reuse, and recycling, repurposing oyster shells for decorative use and extracting valuable pearl proteins for cosmetics and supplements. This growth, the Pearl Jewelry Market remains steadfast in its mission to promote sustainable pearl farming practices, championing biodiversity preservation and ecosystem conservation as integral pillars in pearl industry.

The affordable and sophisticated pearl jewelry is perfect for both festive occasions and everyday wear. From stunning pearl earrings to versatile choker sets, long necklaces, charming pendants, rings, and bracelets, the collection radiates quality and instills confidence. Experience timeless elegance with Real Pearl Necklace Sets, meticulously crafted to showcase the innate beauty of pearls. Elevate style with the latest Women's Trendy Pearl Sets available online, offering convenience and global accessibility. Immerse in the luxurious world of pearls, where each set is expertly curated for perfection. With Pearls, indulge in the allure and refinement of genuine pearls that transcend fleeting trends, all while enjoying exceptional quality and affordability.

In 2021, the global production of pearl oysters in marine environments, directly attributed to aquaculture, reached 1,415 tonnes. This figure represents a mere 0.0045% of the total global aquaculture production from marine areas, which excludes brackish waters. Despite its relatively small share in global aquaculture, the production of pearl oysters commanded a substantial production value, amounting to nearly $200 million. However, this value accounts for only 0.22% of the total global aquaculture value, indicating that while pearl oyster aquaculture is lucrative, it constitutes a relatively minor portion of the overall aquaculture industry in terms of value.

Table 1. Marine pearl oyster production volumes reported in FAO Fisheries and Aquacultures

|

Country |

Production Region |

Primary ASFIS2 |

Live Weight (Tonnes) 2021 |

|

French Polynesia |

Pacific, Eastern Central |

Blacklip pearl oyster |

1365 |

|

Indonesia |

Pacific, Western Central |

Pearl oyster shells nei |

1000^ |

|

Australia |

Indian Ocean, Eastern |

Pearl oyster shells nei |

200 |

|

Indonesia |

Pacific, Western Central |

Penguin wing oyster |

18.6 |

|

French Polynesia |

Pacific, Eastern Central |

Pearl oyster shells nei |

17.14 |

|

Japan |

Pacific, Northwest |

Pearl oyster shells nei |

12.6 |

|

Indonesia |

Indian Ocean, Eastern |

Pearl oyster shells nei |

10 |

|

China |

Pacific, Northwest |

Pearl oyster shells nei |

2.01 |

|

Papua New Guinea |

Pacific, Western Central |

Pearl oyster shells nei |

0.47 |

Environmental Impact of Pearl Farming Practice poses a threat to the Pearl Jewelry Market

One significant restraining factor in the pearl jewelry market is the environmental impact of pearl farming practices. The pearls are naturally formed within oysters, the process of cultivating pearls through farming can have detrimental effects on marine ecosystems. For instance, excessive harvesting of oysters for pearl cultivation can lead to habitat destruction and loss of biodiversity in marine environments. In addition, pearl farming often involves the use of chemicals and antibiotics to maintain oyster health, which can pollute surrounding waters and harm marine life. An example of this is the use of antibiotics in pearl farming operations in some regions, leading to antibiotic resistance in marine organisms and disrupting the ecological balance. Another restraining factor is the challenge of ensuring ethical sourcing and labor practices within the pearl industry.

In some cases, pearl farming operations exploit laborers, subjecting them to poor working conditions and low wages. For example, there have been reports of child labor in pearl farming communities, particularly in developing countries where labor regulations. Additionally, unethical sourcing practices, such as illegal harvesting of pearls from protected areas or using unsustainable methods, can tarnish the reputation of companies and the industry as a whole. Furthermore, market competition poses a significant restraint on the pearl jewelry market.

With the rise of synthetic pearls and imitation jewelry, traditional pearl jewelry faces competition from more affordable alternatives. For instance, cultured pearls, which are produced through human intervention, compete with natural pearls, leading to pricing pressures within the market. Additionally, the emergence of online platforms and direct-to-consumer brands has intensified competition, making it challenging for traditional retailers to maintain market share.

Capitalizing on Consumer Trends and Technological Advances Impact on the Pearl Jewelry Market Growth

Ensuring a seamless online shopping journey remains Pearl Paradise's paramount focus. They harness Shopify's capabilities to explore novel strategies and technologies continually. Jeremy underscores the pivotal role of real-time chat, enabling direct website communication and even face-to-face interactions for customers. Moreover, they embrace the impact of video on social media, captivating audiences with engaging content. Jeremy highlights an upcoming website redesign aimed at optimizing customer flow and conversion rates. Through meticulous analysis of customer behavior and product popularity, they tailor communications such as emails and SMS to align with individual interests in Pearl Jewelry Market.

Collaborations with esteemed fashion designers and influencers have emerged as a potent tool for amplifying brand visibility and relevance. This strategic alliance not only infuses fresh perspectives into design but also resonates with diverse consumer segments, thereby expanding market reach. Recognizing the untapped potential of emerging markets, industry players are strategically positioning themselves to capitalize on increasing opportunities. The products and marketing initiatives to suit the unique preferences of these regions, brands are fostering organic growth and establishing a strong foothold.

Innovation remains a cornerstone, with a focus on developing avant-garde pearl jewelry market that transcend conventional boundaries. Embracing customization and personalization trends, brands are empowering customers to create bespoke pieces that reflect their style and preference. Moreover, there is a concerted effort towards promoting sustainability across the entire value chain. Investments in sustainable pearl farming practices not only mitigate environmental impact but also resonate with socially conscious consumers, thereby enhancing brand reputation and loyalty.

Pearl Jewelry Market Segment Analysis:

Based on Type, the market is divided into Necklace, Earrings, Rings, and Others. The Necklace segment witnessed the highest market share in 2025 and continued its dominance during the forecast period. Necklaces serve as versatile adornments, seamlessly transitioning from formal events to everyday wear, thereby catering to a broad spectrum of consumer preferences and occasions. Their timeless appeal transcends fleeting trends, making them enduring staples in jewelry collections worldwide. Moreover, necklaces offer a canvas for creativity and innovation, allowing designers to showcase the natural beauty of pearls through intricate designs and craftsmanship.

The classic string of pearls or a contemporary statement piece, necklaces offer endless possibilities for customization, catering to diverse tastes and style sensibilities. Furthermore, necklaces hold symbolic significance, often bestowed as cherished gifts to mark special occasions such as weddings, anniversaries, or milestones. This emotional connection fosters strong brand loyalty and drives demand for pearl necklaces as timeless heirlooms are passed down through generations. Additionally, the prominence of necklaces in the pearl jewelry market is bolstered by their ability to effortlessly elevate any ensemble, imparting a touch of glamour and sophistication.

Pearl Jewelry Market Regional Insights:

North America witnessed highest market share in 2025 and continue its dominance during the forecast period. The region stands as a prominent hub for luxury and fashion, driving demand for premium pearl jewelry offerings across various demographics. One notable trend in North America is the resurgence of vintage-inspired pearl jewelry, which appeals to consumers seeking timeless elegance and nostalgia. Designs reminiscent of iconic styles from past eras, such as Art Deco or Victorian influences, are gaining popularity, reflecting a desire for enduring sophistication. Moreover, the region showcases a growing affinity for sustainable and ethically sourced pearl jewelry.

Consumers are increasingly conscious of environmental and social impact, prompting a shift towards brands that prioritize responsible sourcing and production practices. For instance, companies like The Pearl Source and Honora Pearls have gained traction for their commitment to sustainability and ethical sourcing, resonating with eco-conscious consumers. Additionally, North America's vibrant cultural landscape fosters diversity in pearl jewelry market, with varying regional influences shaping design aesthetics. For example, the coastal regions of California inspire laid-back, bohemian styles, while the urban centers of New York and Chicago favor sleek, contemporary designs with a touch of sophistication.

|

Pearl Jewelry Market Scope |

|

|

Market Size in 2025 |

USD 14.62 Billion |

|

Market Size in 2032 |

USD 30.94 Billion |

|

CAGR (2026-2032) |

11.3% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Necklace Earrings Rings Others |

|

By Pearl Nature Cultured Natural |

|

|

By Material Gold Silver Others |

|

|

By Distribution Channel Offline Channels Online Channels |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Pearl Jewelry Market

North America:

1. Tiffany & Co. (New York, USA)

2. Harry Winston (New York, USA)

3. David Yurman (New York, USA)

4. Galatea (San Dimas, California, USA)

5. Mastoloni Pearls (New York, USA)

6. Anna Hu (New York, USA)

Europe:

1. Cartier (Paris, France)

2. Graff Diamonds (London, UK)

3. Van Cleef & Arpels (Paris, France)

4. Bulgari (Rome, Italy)

5. Chanel (Paris, France)

6. Boucheron (Paris, France)

7. Yoko London (London, UK)

Asia-Pacific

1. Mikimoto (Tokyo, Japan)

2. Chow Tai Fook (Hong Kong)

3. Tasaki (Kobe, Japan)

4. Kailis Australian Pearls (Perth, Australia)

5. Autore Pearls (Sydney, Australia)

6. Pacific Pearls International (Gold Coast, Australia)

Frequently Asked Questions

The growth of the pearl jewelry market is primarily propelled by increasing consumer appreciation for sustainable and timeless fashion choices, alongside innovative marketing strategies adopted by key players to attract a wider demographic.

The leveraging technological advancements for sustainable pearl cultivation, expanding into emerging markets with rising disposable incomes, and tapping into the growing trend of personalized and customizable jewelry to meet evolving consumer preferences. Additionally, collaborations with fashion designers and influencers can enhance brand visibility and appeal to younger demographics.

The Pearl Jewelry Market size was valued at USD 14.62 Billion in 2025 and the total Global Pearl Jewelry revenue is expected to grow at a CAGR of 11.3% from 2026 to 2032, reaching nearly USD 30.94 Billion by 2032.

The segments covered in the market report are Type, Pearl Nature, Material, Distribution Channel, and region.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Pearl Jewelry Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Pearl Jewelry Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Pearl Jewelry Market: Dynamics

4.1. Pearl Jewelry Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Pearl Jewelry Market Drivers

4.3. Pearl Jewelry Market Restraints

4.4. Pearl Jewelry Market Opportunities

4.5. Pearl Jewelry Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Pearl Jewelry Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Pearl Jewelry Market Size and Forecast, by Type (2025-2032)

5.1.1. Necklace

5.1.2. Earrings

5.1.3. Rings

5.1.4. Others

5.2. Pearl Jewelry Market Size and Forecast, by Pearl Nature (2025-2032)

5.2.1. Cultured

5.2.2. Natural

5.3. Pearl Jewelry Market Size and Forecast, by Material (2025-2032)

5.3.1. Gold

5.3.2. Silver

5.3.3. Others

5.4. Pearl Jewelry Market Size and Forecast, by Distribution Channel (2025-2032)

5.4.1. Offline Channels

5.4.2. Online Channels

5.5. Pearl Jewelry Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Pearl Jewelry Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Pearl Jewelry Market Size and Forecast, by Type (2025-2032)

6.1.1. Necklace

6.1.2. Earrings

6.1.3. Rings

6.1.4. Others

6.2. North America Pearl Jewelry Market Size and Forecast, by Pearl Nature (2025-2032)

6.2.1. Cultured

6.2.2. Natural

6.3. North America Pearl Jewelry Market Size and Forecast, by Material (2025-2032)

6.3.1. Gold

6.3.2. Silver

6.3.3. Others

6.4. North America Pearl Jewelry Market Size and Forecast, by Distribution Channel (2025-2032)

6.4.1. Offline Channels

6.4.2. Online Channels

6.5. North America Pearl Jewelry Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Pearl Jewelry Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Pearl Jewelry Market Size and Forecast, by Type (2025-2032)

7.2. Europe Pearl Jewelry Market Size and Forecast, by Pearl Nature (2025-2032)

7.3. Europe Pearl Jewelry Market Size and Forecast, by Material (2025-2032)

7.4. Europe Pearl Jewelry Market Size and Forecast, by Distribution Channel (2025-2032)

7.5. Europe Pearl Jewelry Market Size and Forecast, by Country (2025-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Pearl Jewelry Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Pearl Jewelry Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Pearl Jewelry Market Size and Forecast, by Pearl Nature (2025-2032)

8.3. Asia Pacific Pearl Jewelry Market Size and Forecast, by Material (2025-2032)

8.4. Asia Pacific Pearl Jewelry Market Size and Forecast, by Distribution Channel (2025-2032)

8.5. Asia Pacific Pearl Jewelry Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Rest of Asia Pacific

9. Middle East and Africa Pearl Jewelry Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Pearl Jewelry Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Pearl Jewelry Market Size and Forecast, by Pearl Nature (2025-2032)

9.3. Middle East and Africa Pearl Jewelry Market Size and Forecast, by Material (2025-2032)

9.4. Middle East and Africa Pearl Jewelry Market Size and Forecast, by Distribution Channel (2025-2032)

9.5. Middle East and Africa Pearl Jewelry Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Nigeria

9.5.4. Rest of ME&A

10. South America Pearl Jewelry Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Pearl Jewelry Market Size and Forecast, by Type (2025-2032)

10.2. South America Pearl Jewelry Market Size and Forecast, by Pearl Nature (2025-2032)

10.3. South America Pearl Jewelry Market Size and Forecast, by Material (2025-2032)

10.4. South America Pearl Jewelry Market Size and Forecast, by Distribution Channel (2025-2032)

10.5. South America Pearl Jewelry Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Tiffany & Co. (New York, USA)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Harry Winston (New York, USA)

11.3. David Yurman (New York, USA)

11.4. Galatea (San Dimas, California, USA)

11.5. Mastoloni Pearls (New York, USA)

11.6. Anna Hu (New York, USA)

11.7. Cartier (Paris, France)

11.8. Graff Diamonds (London, UK)

11.9. Van Cleef & Arpels (Paris, France)

11.10. Bulgari (Rome, Italy)

11.11. Chanel (Paris, France)

11.12. Boucheron (Paris, France)

11.13. Yoko London (London, UK)

11.14. Mikimoto (Tokyo, Japan)

11.15. Chow Tai Fook (Hong Kong)

11.16. Tasaki (Kobe, Japan)

11.17. Kailis Australian Pearls (Perth, Australia)

11.18. Autore Pearls (Sydney, Australia)

11.19. Pacific Pearls International (Gold Coast, Australia)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook