North America Plant Sterols Esters Market- Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Form, Type, Application and Region

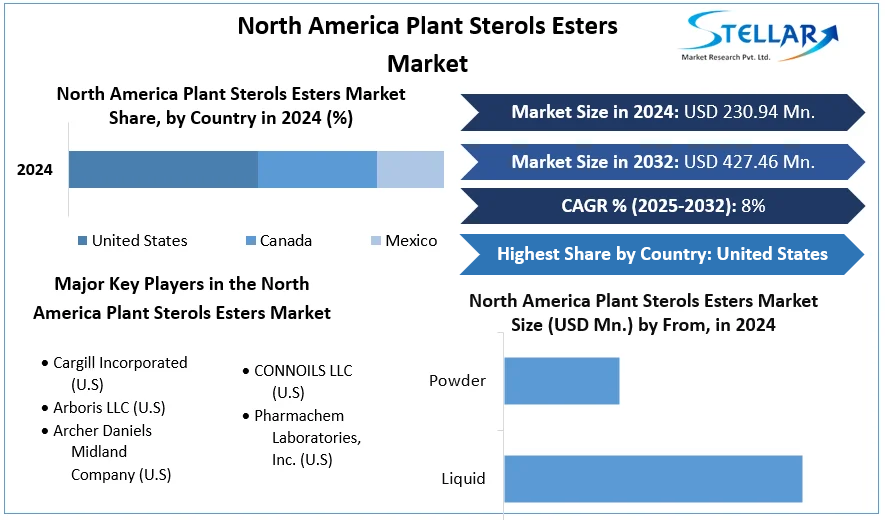

North America Plant Sterols Esters Market was valued at USD 230.94 million in 2024. Market size is estimated to grow at a CAGR of 8 % over the forecast period

Format : PDF | Report ID : SMR_762

North America Plant Sterols Esters Market Definition:

The growth of the plant sterol esters market is significantly driven by their rising use in food supplements and products. In North America, the demand is further fueled by the prevalence of cardiovascular disease (CVD), highlighting plant sterol esters' role in promoting heart health. This combined demand is expected to drive substantial market growth.

Plant sterol esterification with fatty acids from common oilseeds produces North America Plant Sterol Esters. The esters have a comparable fatty acid content to the parent vegetable oil, which is employed as a source of fatty acids. Phytosterols are esterified to change their physical characteristics so that they may be easily included in a range of meals. In the cells of eukaryotes, sterol esters are present in minute amounts. They are chemical composites generated when sterols are esterified with fatty acids. Campesterol, Sitosterol, Stigmasterol, and Brassicasterol are the most frequent phytosterols in the diet.

Further, the North America Plant Sterol Esters market is segmented by product type, distribution channel, and geography. On the basis of form, the North America Plant Sterol Esters market is segmented under powder and liquid. Based on the type, the market is segmented under the channels of Campesterol, Sitosterol, Stigmasterol and Brassicasterol. Based on the application, the market is segmented under the channels of foods, beverages, pharmaceutical, cosmetics and dietary supplements. By geography, the market covers the major countries in North America i.e., US, Canada and Mexico. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Million).

To get more Insights: Request Free Sample Report

North America Plant Sterols Esters COVID 19 Insights:

Most industries around the world have been adversely affected in the last 18 months. This is due to significant disruptions in the operation of their respective manufacturing and supply chains as a result of various preventive blockades and other restrictions enforced by government agencies around the world. The same applies to the market for North America Plant Sterol Esters. In addition, consumer demand is also down as individuals are keen to reduce non-essential spending from their budgets as the overall economic situation of most individuals has been severely impacted by this outbreak. Then it decreased. These above factors are expected to weigh on earnings trends in the phytosterol ester market during the forecast period. However, as each government agency begins to lift these compulsory blockades, the phytosterol ester market is expected to recover accordingly.

North America Plant Sterols Esters Market Dynamics:

The United States is likely to take a sizable share of the market. Over the forecast period, the United States is forecast to lead the North American market, with a substantial value share in terms of consumption. Because North America Plant Sterol Esters are created with plant sterol, growth in the plant sterol business is closely tied to growth in the North America Plant Sterol Esters market.

The usage of North America Plant Sterol Esters in a variety of end-use applications, such as yoghurts, salad dressings, mayonnaise, milk, vegetable oils, pharmaceuticals, nutritional supplements, and beverages, such as beer and cold drinks, is likely to drive the plant sterol market throughout the forecast period. Because of the health advantages associated with North America Plant Sterol Esters, end-use businesses have increased their use of them.

The significant use of the compounds in fortified food items such as cheese goods, oatmeal, bread, yoghurt, milk, soy drinks, pasta, frankfurters, fruit beverages, and chicken meat balls is driving the growth of the North America Plant Sterol Esters market in North America throughout the forecast timeline. Apart from that, approval of these items by food authorities such as the United States Food and Drug Administration (US FDA) would boost regional market growth in the coming years.

North America Plant Sterols Esters Market Segment Analysis:

By Form:

North America Plant Sterol Esters are chemicals derived from plant oils. In the shape of liquid plant sterols, they are located in a whole lot of plants, which include wheat germ, soybeans, corn germ, and rice bran. They help to reduce ldl cholesterol absorption and transport to the liver for excretion as bile acids, lowering the risk of cardiovascular disease (CVD) and coronary heart disease (CHD).

Powder is a fine, dry, white or brown solid that has higher waft traits than liquid. It may be produced through the mechanical separation of the aggregate or a chemical extraction process. Powder form is generally favoured over liquid as it's far more strong and less complicated to store.

By Application:

North America Plant Sterol Esters are used in a variety of applications, including the food, cosmetics, and pharmaceutical industries. The food industry dominated the North American market in 2024, with sales exceeding 40%. Increasing awareness of a healthy diet among the growing middle class is expected to drive demand for phytosterol esters over the forecast period. In addition, increased consumption of dietary supplements is forecast to drive demand for phytosterol ester derivatives in the dietary and health supplement application segments during the study period. The cosmetics industry also offers promising growth prospects as consumers' preference for natural skin care ingredients derived from plants such as ginseng root is increasing. Cosmetic manufacturers are using North America Plant Sterol Esters instead of synthetic compounds. This is because North America Plant Sterol Esters are considered safer.

North America Plant Sterols Esters Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the europemarket, key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the North America Plant Sterols Esters market to the stakeholders in the industry. The report provides trends that are most dominant in the North America Plant Sterols Esters market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the North America Plant Sterols Esters Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the North America Plant Sterols Esters market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the North America Plant Sterols Esters market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the North America Plant Sterols Esters market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the North America Plant Sterols Esters market. The report also analyses if the North America Plant Sterols Esters market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the North America Plant Sterols Esters market. Economic variables aid in the analysis of economic performance drivers that have an impact on the North America Plant Sterols Esters market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the North America Plant Sterols Esters market is aided by legal factors.

North America Plant Sterols Esters Market Scope:

|

North America Plant Sterols Esters Market |

|

|

Market Size in 2024 |

USD 230.94 Mn. |

|

Market Size in 2032 |

USD 427.46 Mn. |

|

CAGR (2025-2032) |

8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By From

|

|

By Type

|

|

|

By Application

|

|

|

Country Scope |

United States Canada Mexico |

North America Plant Sterols Esters MARKET KEY PLAYERS:

- Cargill Incorporated (U.S)

- Arboris LLC (U.S)

- Archer Daniels Midland Company (U.S)

- CONNOILS LLC (U.S)

- Pharmachem Laboratories, Inc. (U.S)

Frequently Asked Questions

The market size of the North America Plant Sterols Esters Market by 2032 is expected to reach USD 427.46 Million.

The forecast period for the North America Plant Sterols Esters Market is 2025-2032

The market size of the North America Plant Sterols Esters Market in 2024 was valued at USD 230.94 Million.

1. North America Plant Sterols Esters Market: Research Methodology

2. North America Plant Sterols Esters Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. North America Plant Sterols Esters Market: Dynamics

3.1. North America Plant Sterols Esters Market Trends

3.2. North America Plant Sterols Esters Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technology Roadmap

3.6. Regulatory Landscape

3.7. Analysis of Government Schemes and Initiatives For North America Plant Sterols Esters industry

4. North America Plant Sterols Esters Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume Tonnes) (2024-2032)

4.1. North America Plant Sterols Esters Market Size and Forecast, by Form (2024-2032)

4.1.1. Liquid

4.1.2. Powder

4.2. North America Plant Sterols Esters Market Size and Forecast, by Type (2024-2032)

4.2.1. Campesterol

4.2.2. Sitosterol

4.2.3. Stigmasterol

4.2.4. Brassicasterol

4.3. North America Plant Sterols Esters Market Size and Forecast, by Application (2024-2032)

4.3.1. Food

4.3.2. Beverages

4.3.3. Pharmaceutical

4.3.4. Cosmetics

4.3.5. Dietary Supplements

4.4. North America Plant Sterols Esters Market Size and Forecast, by Region (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. North America Plant Sterols Esters Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Leading North America Plant Sterols Esters Market Companies, by Market Capitalization

5.5. Market Structure

5.5.1. Market Leaders

5.5.2. Market Followers

5.5.3. Emerging Players

5.6. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Cargill Incorporated (U.S)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Arboris LLC (U.S)

6.3. Archer Daniels Midland Company (U.S)

6.4. CONNOILS LLC (U.S)

6.5. Pharmachem Laboratories, Inc. (U.S)

7. Key Findings

8. Industry Recommendations