North America Furniture Market- Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Material, Category, End User, and Region

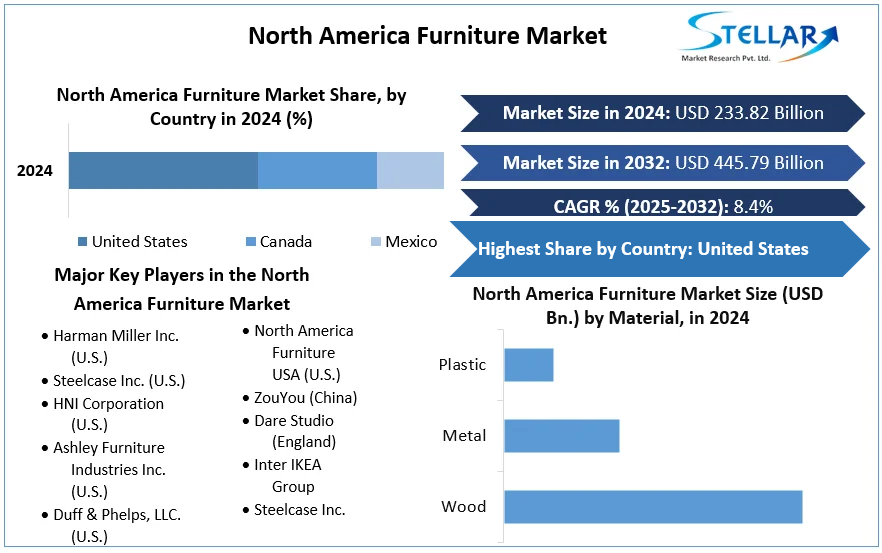

North America Furniture Market was valued at USD 233.82 billion in 2024. North America Furniture Market size is estimated to grow at a CAGR of 8.4 % over the forecast period

Format : PDF | Report ID : SMR_507

North America Furniture Market Definition:

Laboratories, spas, workplaces, clean rooms, restaurants, camping, bedrooms, outdoor, libraries, parks, and stores all have furniture. The majority of furniture is made from a range of materials and comes in a number of styles. Chairs, beds, cupboards, tables, shelves, and other moveable things, as well as decorative art, are all examples of furniture. Furniture can be used for a variety of purposes, including sleeping, dining, seating, and storage. Furniture plays a vital part in seating arrangements and document storage in commercial areas. Furniture designs can be altered using machine-based methods and handcrafting, depending on the eventual usage.

North America Furniture Market Dynamics:

The expansion in consumer purchasing power and the real estate sector are the primary growth drivers in the North America furniture market. Customers in the area, due to a rise in environmental awareness, consumers in the region are gravitating toward eco-friendly furniture. However, rising raw material costs, such as wood and leather, may limit the expansion of the North America furniture market. The rise of the furniture market in North America is being fueled by online shopping and an increase in demand for multifunctional furniture.

The rapid expansion of the real estate sector as a result of 100 % foreign direct investment in townships, smart cities, commercial buildings, and settlement development projects is attracting investors and raising the quality of residential units. The requirement to outfit new projects will fuel growth in both housing and commercial development, which would boost furniture demand. Tourism has been rapidly growing in the region. With the expansion in hotel rooms, the tourism sector is helping to meet the demand for various furniture products such as mattresses, sofas, and tables. The furniture business is expected to benefit as a result of the increased demand for hotel furnishings.

Furniture manufacturers are confronted with a slew of issues and obstacles as a result of high wood costs and a scarcity of good-quality wood in sufficient quantities. The industry as a whole has been hurt by the high cost of furnishings. The cost of raw materials used in furniture production, such as chipboard, wood, foam, polishing chemicals, color paints, and hardware, has risen. Deforestation, on the other hand, has resulted in a significant reduction in timber production.

The coronavirus outbreak had a big influence on the furniture market in North America. As a result of the lockdown, a new trend of working from home emerged. During the epidemic, purchases of home office furniture surged. Consumers are increasingly purchasing furniture online in order to update their homes to meet the demands of modern living. Online orders for all products, from needs to home repair and furnishings, have surged by over 80% in North America since January 2020.

To get more Insights: Request Free Sample Report

DIY furniture is growing in popularity among millennials, and the availability of such things is expected to enhance furniture sales through online retailers. Consumers' growing environmental awareness is influencing their shopping decisions in a good way, and sustainable furniture is becoming more popular in the region. Furthermore, the number of green homes being built in the United States is rapidly increasing, paving the way for environmentally friendly furnishings. Furthermore, the growth of the furniture sector in North America is being aided by the increasing migration of manufacturers with handcrafted furniture goods developed in the United States by American Eco Furniture, LLC.

With the advancement of technology, high-end furniture has gradually begun to attract more client attention. The use of power tools to shape wood for various designs has aided the high-end furniture industry is becoming more tailored to consumer desires. Customers in the region are also searching for more multifunctional furniture to meet their changing needs. They are converting to multifunctional and high-durability furniture in order to maximize the potential of limited space in their houses, which is assisting the residential end-user segment is recording more transactions. This pattern is expected to continue in the future period, assisting the market in registering more transactions.

Housing building in the United States is picking up steam, and there is an increase in residential activity in the country, which is boosting demand for home furniture products as new home sales see an increase in demand. This is projected to boost market demand even further. There were over 139 million household units in 2018. In 2019, over 1.0 million new housing units were started in single-family and multifamily housing.

North America Furniture Market Segment Analysis:

By Material, the wood category has a market share of 43 % due to the cost-effectiveness of such items when compared to other sorts. In addition, the continual supply of well-built wooden chairs and sofa sets in related industries is expected to lessen the demand for such products in household settings.

The metal sector is expected to grow greatly since metal objects are more durable and sturdy than other types. Metal-based products are also common in commercial gardens and playgrounds. As a result, increased demand for such products is being driven by developing playground and garden infrastructure settings.

North America Furniture Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a North America presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive North America networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the North America market, key players in the market, particularly in Europe and North America, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the North America Furniture market to the stakeholders in the industry. The report provides trends that are most dominant in the North America Furniture market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the North America Furniture Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the North America Furniture market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the North America Furniture market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the North America Furniture market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the North America Furniture market. The report also analyses if the North America Furniture market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the North America Furniture market. Economic variables aid in the analysis of economic performance drivers that have an impact on the North America Furniture market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the North America Furniture market is aided by legal factors.

North America Furniture Market Scope:

|

North America Furniture Market |

|

|

Market Size in 2024 |

USD 233.82 Bn. |

|

Market Size in 2032 |

USD 445.79 Bn. |

|

CAGR (2025-2032) |

8.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Material

|

|

By Category

|

|

|

|

By End User

|

|

|

By Country

|

North America Furniture Market Key Players:

- Harman Miller Inc. (U.S.)

- Steelcase Inc. (U.S.)

- HNI Corporation (U.S.)

- Ashley Furniture Industries Inc. (U.S.)

- Duff & Phelps, LLC. (U.S.)

- North America Furniture USA (U.S.)

- ZouYou (China)

- Dare Studio (England)

- Inter IKEA Group

- Steelcase Inc.

Frequently Asked Questions

The United States region is expected to hold the highest share in the North America Furniture Market.

The market size of the North America Furniture Market by 2032 is expected to reach USD 445.79 Billion.

The forecast period for the North America Furniture Market is 2024-2032.

The market size of the North America Furniture Market in 2024 was valued at USD 233.82 Billion.

-

1. Scope of the Report

2. Research Methodology

- Research Process

- North America North America Furniture Market: Target Audience

- North America North America Furniture Market: Primary Research (As per Client Requirement)

- North America North America Furniture Market: Secondary Research

3. Executive Summary

4. Competitive Landscape

- Market Share Analysis by Region in 2024(%)

- North America

- Stellar Competition Matrix

- North America Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

5. North America North America Furniture Market Segmentation

- North America North America Furniture Market, by Country (2024-2032)

- United States

- Mexico

- Canada

- North America North America Furniture Market, by Material (2024-2032)

- Wood

- Metal

- Plastic

- Others

- North America North America Furniture Market, by Category (2024-2032)

- Indoor

- Outdoor

- North America North America Furniture Market, by End User (2024-2032)

- Residential

- Office

- Hotel

- Others

6. Company Profiles

- Key Players

- Harman Miller Inc. (U.S.)

- Company Overview

- Product Portfolio

- Harman Miller Inc. (U.S.)

-

-

- Financial Overview

- Business Strategy

- Key Developments

- Steelcase Inc. (U.S.)

- HNI Corporation (U.S.)

- Ashley North America Furniture Industries Inc. (U.S.)

- Duff & Phelps, LLC. (U.S.)

- North America North America Furniture USA (U.S.)

- ZouYou (China)

- Dare Studio (England)

- Inter IKEA Group

- Steelcase Inc.

-

- Key Findings

- Recommendations