Mexico Ceramic Sanitary Ware Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

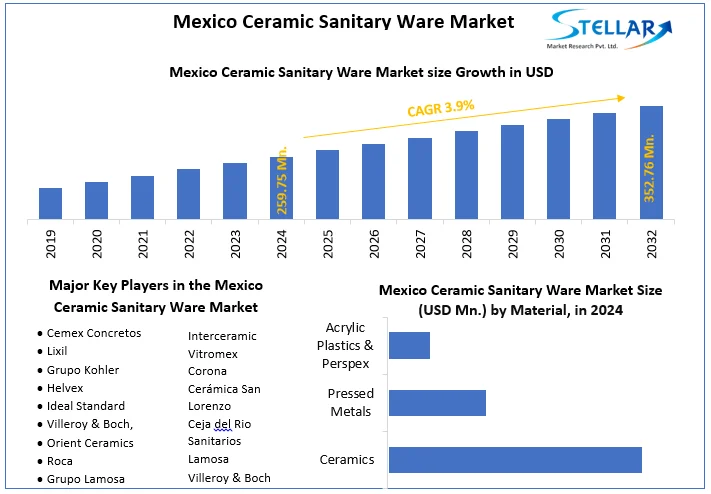

The Mexico Ceramic Sanitary Ware Market size was valued at USD 259.75 Mn. in 2024 and the total Mexico Ceramic Sanitary Ware revenue is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 352.76 Mn. in 2032.

Format : PDF | Report ID : SMR_1650

Mexico Ceramic Sanitary Ware Market Overview-

Ceramic sanitary ware with our special coating ensures effortless, sparkling cleanliness. Resistant to lime scale, fat, and dirt, the coating, burnt permanently into the surface, repels germs without toxins. Hydrophilic, it distributes water thinly, facilitating easy rinsing and wiping. Effectively combating bacteria, fungi, and odors, our products are ideal for hygiene-critical areas, reducing cleaning costs, and environmental impact.

The report explores the dynamic landscape of the Mexico Ceramic Sanitary Ware market, delivering actionable insights for stakeholders. It analyzes trends, technological advancements, and potential disruptions, assessing market size, growth, economic factors, regulations, and commercial drivers. The exploration of the competitive landscape emphasizes the differentiation among important operators. Prompted by an economic downturn, the report aims to empower healthcare professionals, government agencies, policymakers, and pharmaceutical companies with crucial information for making resilient decisions in this industry.

To get more Insights: Request Free Sample Report

Mexico Ceramic Sanitary Ware Market Dynamics:

Increased focus on hygiene and sanitation to drive the Mexico Ceramic Sanitary Ware Market

The increased emphasis on hygiene in Mexico's ceramic sanitary ware market yields positive outcomes, including increased demand driven by growing awareness and a consumer preference for high-quality, hygienic bathroom fixtures. This trend fuels product innovation, with manufacturers incorporating features like antimicrobial properties and self-cleaning surfaces. Additionally, consumers' willingness to pay a premium for improved hygiene contributes to increased profitability for manufacturers and retailers. Also, government support through sanitation-focused initiatives fosters investment in public infrastructure, creating additional demand for ceramic sanitary ware in critical institutions such as schools, hospitals, and public restrooms.

The pursuit of new hygiene features in ceramic sanitary ware increases production costs, potentially resulting in higher consumer prices and affecting affordability. Growing demand for hygiene attracts New Mexico Ceramic Sanitary Ware Market entrants, intensifying competition and pressuring profit margins. Increased production strains the environment, necessitating sustainable practices. Stricter regulations to meet hygiene standards also impose additional compliance costs on manufacturers.

The increasing emphasis on hygiene in Mexico's ceramic sanitary ware market is to bring positive outcomes. Also, potential negative consequences necessitate attention from manufacturers and policymakers for effective mitigation strategies.

Mexico Ceramic Sanitary Ware Market Segment Analysis

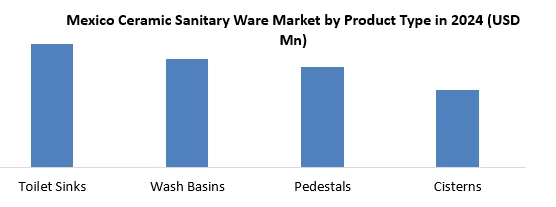

Based on Product Type, theToilet Sinks segment held the largest market share of about 40% in the Mexico Ceramic Sanitary Ware Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 3.9% during the forecast period. It stands out as the dominant segment within the Mexico Ceramic Sanitary Ware Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

In the Mexico Ceramic Sanitary Ware Market Toilet sinks prove advantageous in space optimization, particularly suitable for small bathrooms or powder rooms with limited space, combining two essential functionalities in one unit. They offer cost-effectiveness, often more budget-friendly than separate units. Some feature dual flush mechanisms, contributing to water efficiency. Additionally, modern toilet sinks improve aesthetics, providing a sleek and integrated look for contemporary bathroom designs.

Toilet sinks serve a function Mexico Ceramic Sanitary Ware Market, with a smaller share than traditional separate toilets and sinks due to their specific functionality. Installation complexity raises costs, demanding specialized expertise. They offer reduced functionality with smaller sink areas, lacking features like built-in soap dispensers or storage compartments. Design options for toilet sinks are often more limited than those for separate units.

Toilet sinks serve a main role in Mexico ceramic sanitary ware market, providing advantages like space optimization and cost-effectiveness for specific applications. However, their limited market size, installation complexities, and functional limitations warrant consideration when assessing their impact on the broader market.

Mexico Ceramic Sanitary Ware Market Scope:

|

Mexico Ceramic Sanitary Ware Market |

|

|

Market Size in 2024 |

USD 259.75 Million |

|

Market Size in 2032 |

USD 352.76 Million |

|

CAGR(2025-2032) |

3.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product Type

|

|

By Material

|

|

|

By Distribution Channel

|

|

Leading Key Players in the Mexico Ceramic Sanitary Ware Market

- Cemex Concretos

- Lixil

- Grupo Kohler

- Helvex

- Ideal Standard

- Villeroy & Boch,

- Orient Ceramics

- Roca

- Grupo Lamosa

- Interceramic

- Vitromex

- Corona

- Cerámica San Lorenzo

- Ceja del Rio

- Sanitarios Lamosa

- Villeroy & Boch

Frequently Asked Questions

High costs and Limited reimbursement are expected to be the major restraining factors for the Mexico Ceramic Sanitary Ware market growth.

The Mexico Ceramic Sanitary Ware Market size was valued at USD 259.75 Million in 2024 and the total Mexico Ceramic Sanitary Ware revenue is expected to grow at a CAGR of 3.9 % from 2025 to 2032, reaching nearly USD 352.76 Million By 2032.

1. Mexico Ceramic Sanitary Ware Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Mexico Ceramic Sanitary Ware Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 - 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Mexico Ceramic Sanitary Ware Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Headquarter

3.3.3. Product Segment

3.3.4. End-User Segment

3.3.5. Y-O-Y%

3.3.6. Revenue (2024)

3.3.7. Profit Margin

3.3.8. Market Share

3.3.9. Company Locations

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.5.1. Strategic Initiatives and Developments

3.5.2. Mergers and Acquisitions

3.5.3. Collaboration and Partnerships

3.5.4. Product Launches and Innovations

4. Mexico Ceramic Sanitary Ware Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Regulatory Landscape

5. Mexico Ceramic Sanitary Ware Market Size and Forecast by Segments (by Value USD Million and Volume in Units)

5.1. Mexico Ceramic Sanitary Ware Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Toilet Sinks

5.1.2. Wash Basins

5.1.3. Pedestals

5.1.4. Cisterns

5.2. Mexico Ceramic Sanitary Ware Market Size and Forecast, By Material (2024-2032)

5.2.1. Ceramics

5.2.2. Pressed Metals

5.2.3. Acrylic Plastics & Perspex

5.3. Mexico Ceramic Sanitary Ware Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Retail Distribution

5.3.2. Wholesale Distribution

6. Company Profile: Key players

6.1. Cemex Concretos

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.2.1. Total Revenue

6.1.2.2. Segment Revenue

6.1.3. Product Portfolio

6.1.3.1. Product Name

6.1.3.2. Product Details (Price, Features, etc.)

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. Lixil

6.3. Grupo Kohler

6.4. Helvex

6.5. Ideal Standard

6.6. Villeroy & Boch,

6.7. Orient Ceramics

6.8. Roca

6.9. Grupo Lamosa

6.10. Interceramic

6.11. Vitromex

6.12. Corona

6.13. Cerámica San Lorenzo

6.14. Ceja del Rio

6.15. Sanitarios Lamosa

6.16. Villeroy & Boch

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook