North America Carbon Neutral Market- Industry Analysis and Forecast (2025-2032)

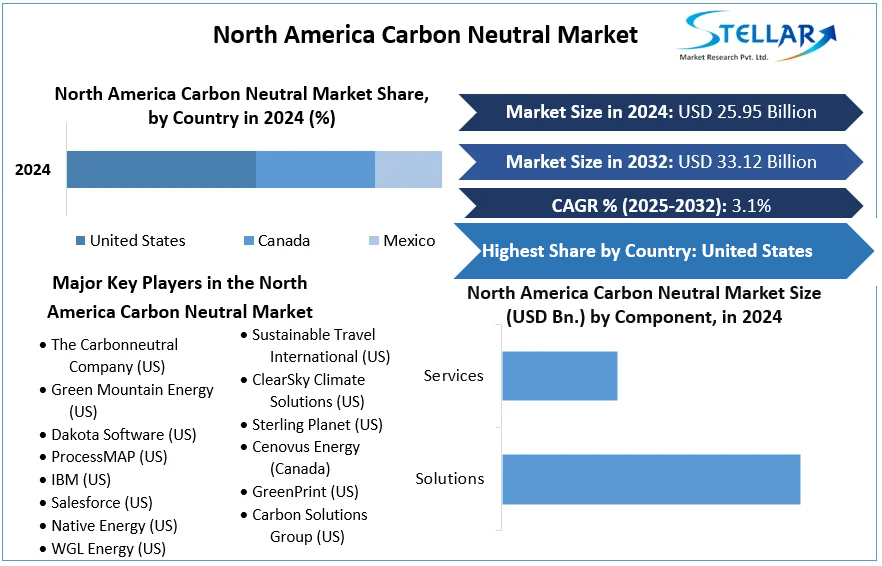

North America Carbon Neutral Market size was valued at US$ 25.95 Bn. in 2024 and the total revenue is expected to grow at a CAGR of 3.1%

Format : PDF | Report ID : SMR_220

North America Carbon Neutral Market Overview:

Carbon neutrality refers to a state in which there is no carbon dioxide emitted. By eliminating society's emissions of carbon dioxide or by balancing emissions with removals, it will be possible to achieve this. Carbon neutrality includes a variety of factors. Environmental pollution is reduced, and health is improved. A boost to long-term economic growth and green employment creation. Lessening the impact of climate change on food security. Carbon offsets are an important aspect of a comprehensive climate plan, in addition to avoidance and reduction. Greenhouse gases, such as CO2, have a uniform distribution in the atmosphere, suggesting that greenhouse gas concentrations are generally the same everywhere around the world. As a result, where greenhouse gases are produced or avoided on the world has no bearing on global greenhouse gas concentrations or the greenhouse gas effect. As a result, emissions that cannot be avoided in one location can be offset in another through carbon offset activities. This can be achieved through forest conservation, afforestation, or increased use of renewable energy sources.

To get more Insights: Request Free Sample Report

North America Carbon Neutral Market Dynamics:

In the face of escalating concerns from global climate change, an increasing number of organizations and governments throughout the world are vowing to reach net-zero carbon emissions by 2050. The United States (US) is well-positioned to lead by example, given its technical, financial, and natural resource advantages. The Net-Zero America transition scenarios are designed to help the United States make policy and investment decisions that will lead to net-zero emissions by 2050. A variety of technical approaches to net-zero emissions are defined using comprehensive national-level modelling. The scale and cost of physical assets, institutional transformation, and human-resource initiatives for all sectors are then quantified through time. The enormous scale, geographic impact, and velocity of change required to establish a net-zero emissions economy by 2050 may be illustrated with a high level of spatial clarity.

In North American society, people prefer to do business with organizations who are socially and environmentally conscious. Allowing employees to strive toward carbon-neutral solutions pushes them to think outside the box when developing new products and services, resulting in increased revenue streams. Adopting renewable energy solutions as a power source is a key aspect of becoming carbon-neutral. All enterprises, particularly large-scale commercial and industrial operations such as manufacturing, office buildings, hospitality operations such as restaurants and hotels, and retail, face significant electricity expenditures. These are the various key factors that are expected to boost the growth of the North America Carbon Neutral Market during the forecast period 2024-2030.

Maryland had a carbon footprint of 16.9 global acres per capita in 2018. The carbon footprint calculates the amount of productive land and marine area required to trap carbon dioxide emissions. The carbon footprint accounts for 67% of the ecological footprint in the United States.

North America Carbon Neutral Market Segment Analysis:

The North America Carbon Neutral Market is segmented by Carbon Neutral Fuel, Vertical, and Component.

Based on the Carbon Neutral Fuel, the market is segmented into Biodiesel, Bio-ethanol, Bio-butanol, and others. Biodiesel segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. Soybeans and palm oil trees, which provide biodiesel with their feedstocks, absorb carbon dioxide (CO2) as they develop, which is why the US government considers biodiesel to be carbon-neutral. The CO2 absorbed by these plants offsets the CO2 released during biodiesel synthesis and burning. The bulk of biodiesel made in the United States is made from soybean oil. Used vegetable oils or animal fats, such as grease and oil from restaurants, can also be used to make biodiesel.

In order to plant soybeans and palm oil trees for biodiesel manufacturing, large sections of natural vegetation and forests have been destroyed and burned in numerous parts of the world. Land clearing and burning may have greater negative environmental repercussions than utilising biodiesel derived from soybeans and palm oil trees. These are the major benefits that are expected to drives the growth of this segment in the North America Carbon Neutral market during the forecast period 2024-2030

Based on the Vertical, the market is segmented into Manufacturing, Energy and Utilities, Residential and Commercial Buildings, Transportation and Logistics, IT and Telecom, and others. Energy and Utilities segment is expected to hold the largest market shares of xx% by 2032. Consumers, businesses, and utilities in North America are developing and early adopting a number of technologies that are paving the path for both power users and power providers to become carbon-neutral. Individual customers can now go "off the grid" with their own renewable energy sources, while businesses and municipalities can achieve the same goal on a larger scale thanks to these technologies. The four types of technology used in sustainable energy generation are energy efficient technologies, generation technologies, grid technologies, and carbon sequestration, as well as their impact on customer choice and future business models for utility companies in North America region. These are the key major drivers that are expected to drives the growth of the energy and utilities segment in the North America Carbon Neutral market during the forecast period.

North America Carbon Neutral Market Country wise Insights:

In North America, Mexico is expected to dominate the North America Carbon Neutral market during the forecast period 2025-2032. Mexico is expected to hold the largest market shares of xx% by 2032. Mexico has the potential to transition to a low-carbon future quickly. Mexico is now implementing a wide range of cost-effective initiatives to reduce greenhouse gas (GHG) emissions, such as energy efficiency and sustainable transportation interventions. At the same time, many low-carbon solutions face obstacles, ranging from knowledge gaps to regulatory and policy hurdles. Mexico can benefit its economy while also demonstrating to the rest of the world the need of low-carbon growth in avoiding the harmful effects of climate change.

In recent years, Mexico's fossil CO2 emissions per capita have steadily dropped, reaching 3.67 metric tons per person in 2019. In comparison to 2016, this was a roughly six percent decrease. Mexico had the third largest fossil CO2 emissions per capita in continental Latin America that year, due to its emissions.

Mexico has committed to reducing greenhouse gas emissions by 22% by 2030. The second-largest economy in Latin America is also taking part in a global drive to limit methane emissions. The United States and Mexico will collaborate to meet the aim of decreasing emissions as soon as possible. These are the various key factors that are expected to drives the growth of the Mexico in the North America Carbon Neutral market during the forecast period.

The objective of the report is to present a comprehensive analysis of the North America Carbon Neutral Market to the stakeholders in the industry. The report provides trends that are most dominant in the North America Carbon Neutral Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the North America Carbon Neutral Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the North America Carbon Neutral Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the North America Carbon Neutral Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the North America Carbon Neutral Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the North America Carbon Neutral Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the North America Carbon Neutral Market is aided by legal factors.

North America Carbon Neutral Market Scope:

|

North America Carbon Neutral Market |

|

|

Market Size in 2024 |

USD 25.95 Bn |

|

Market Size in 2032 |

USD 33.12 Bn |

|

CAGR (2025-2032) |

3.1 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Carbon Neutral Fuel

|

|

by Vertical

|

|

|

by Component

|

|

|

Country Scope |

United States Canada Mexico |

North America Carbon Neutral Market Key Players

- The Carbonneutral Company (US)

- Green Mountain Energy (US)

- Dakota Software (US)

- ProcessMAP (US)

- IBM (US)

- Salesforce (US)

- Native Energy (US)

- WGL Energy (US)

- 3 Degrees (US)

- Sustainable Travel International (US)

- ClearSky Climate Solutions (US)

- Sterling Planet (US)

- Cenovus Energy (Canada)

- GreenPrint (US)

- Carbon Solutions Group (US)

Frequently Asked Questions

Mexico is expected to hold the highest share in the North America Carbon Neutral Market.

Native Energy (US), WGL Energy (US), 3 Degrees (US), Sustainable Travel International (US), ClearSky Climate Solutions (US), and Sterling Planet (US) are the top key players in the North America Carbon Neutral Market.

Energy and Utilities vertical segment hold the largest market share in the North America Carbon Neutral Market by 2032.

The market size of the North America Carbon Neutral market is expected to reach US $33.12 Bn by 2032.

The market size of the North America Carbon Neutral market was worth US $25.95 Bn. in 2024.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. North America Carbon Neutral Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. North America Carbon Neutral Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. North America Carbon Neutral Market: Dynamics

4.1. North America Carbon Neutral Market Trends

4.2. North America Carbon Neutral Market Drivers

4.3. North America Carbon Neutral Market Restraints

4.4. North America Carbon Neutral Market Opportunities

4.5. North America Carbon Neutral Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Carbon sequestration

4.8.2. Blockchain-based carbon footprint management development

4.8.3. Technological Roadmap

4.9. Regulatory Landscape

5. North America Carbon Neutral Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030)

5.1. North America Carbon Neutral Market Size and Forecast, by Carbon Neutral Fuel (2024-2032)

5.1.1. Biodiesel

5.1.2. Bio-ethanol

5.1.3. Bio-butanol

5.1.4. Others

5.2. North America Carbon Neutral Market Size and Forecast, by Vertical (2024-2032)

5.2.1. Manufacturing

5.2.2. Energy and Utilities

5.2.3. Residential and Commercial Buildings

5.2.4. Transportation and Logistics

5.2.5. IT and Telecom

5.2.6. Other

5.3. North America Carbon Neutral Market Size and Forecast, by Component (2024-2032)

5.3.1. Solutions

5.3.2. Service

5.4. North America Carbon Neutral Market Size and Forecast, by Country (2024-2030)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

5.4.4. Rest of North America

6. Company Profile: Key Players

6.1. The Carbonneutral Company (US)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Green Mountain Energy (US)

6.3. Dakota Software (US)

6.4. ProcessMAP (US)

6.5. IBM (US)

6.6. Salesforce (US)

6.7. Native Energy (US)

6.8. WGL Energy (US)

6.9. 3 Degrees (US)

6.10. Sustainable Travel International (US)

6.11. ClearSky Climate Solutions (US)

6.12. Sterling Planet (US)

6.13. Cenovus Energy (Canada)

6.14. GreenPrint (US)

6.15. Carbon Solutions Group (US)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook