Mobile Phone Protective Cover Market - Global Industry Analysis and Forecast (2025-2032)

The Mobile Phone Protective Cover Market size was valued at USD 28.16 Bn. in 2024 and the total Global Mobile Phone Protective Cover revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 50.23 Bn. by 2032.

Format : PDF | Report ID : SMR_1750

Mobile Phone Protective Cover Market Overview

A mobile phone protective case is an outer layer of protection for your phone that shields it from scratches, dirt, fall damage, and other risks. It prolongs the life of devices and protects them rather than decreasing them.

- According to SMR analysis, in the US 79% of smartphone owners used a protective case for their smartphones.

The Mobile Phone Protective Cover Market report offers a comprehensive analysis of the sector, providing in-depth insights into market divisions based on type, product, application, and geographical region. Through meticulous research, the report reveals crucial information such as market size, share, growth trajectory, competitive framework, and key factors that drive or hinder market growth. This complete perspective of the Global Mobile Phone Protective Cover Market assists stakeholders in identifying growth opportunities within the industry and making well-informed decisions. By thoroughly scrutinizing market dimensions, growth patterns, and key drivers and barriers, the report serves as a reliable guide in navigating the complexities of the market landscape.

The Mobile Phone Protective Cover market is poised for significant growth between 2025 and 2032 driven by a mix of factors that offer promising opportunities. The increasing consumer preference and a shift towards sustainability and eco-friendly products contribute to the market's upward trajectory. As consumers prioritize products that resonate with their lifestyle choices, the market is expected to thrive. This scenario provides a fertile ground for established companies and new entrants to capitalize on emerging trends and favorable market dynamics.

Based on the analysis conducted by Stellar Market Research, the Mobile Phone Protective Cover Market is poised for growth, with a focus on critical metrics such as CAGR, revenue, and market share. The utilization of cutting-edge primary and secondary research techniques ensures the precision and dependability of the findings. Detailed evaluations of regional markets offer thorough insights into market dynamics across various geographical regions. Additionally, the profiles of key industry players provide valuable information on market presence, production, revenue, and recent advancements, assisting stakeholders in making informed strategic decisions.

The world imports most of its Mobile phone protective cover from China, Vietnam, and South Korea.

To get more Insights: Request Free Sample Report

Mobile Phone Protective Cover Market Dynamics

Interplay of Smartphone Adoption and Protective Cover Demand

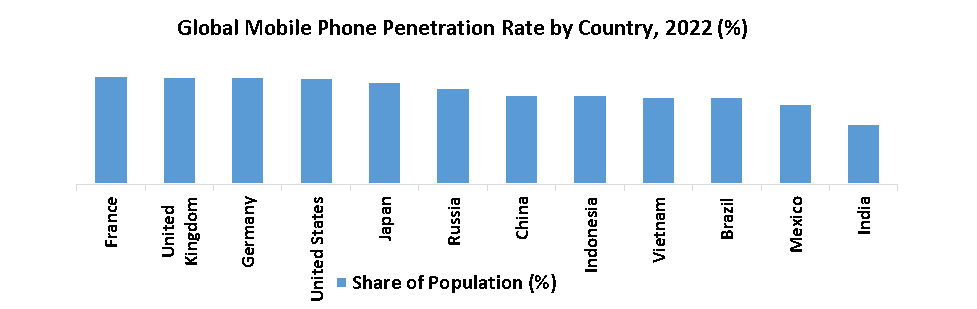

A comprehensive value chain analysis underscores the interplay between smartphone adoption rates and the demand for protective cover, revealing a symbiotic relationship between the two. As smartphones become more common, consumers place a higher priority on protecting their investment, which has led to a significant increase in the purchase of protective cover, which drives the mobile phone protective cover market. Manufacturers and retailers are benefiting from this as they enjoy healthy profit margins owing to the high demand for quality and stylish covers. The changing landscape of smartphone designs has fueled mobile phone protective cover market growth, as customers look for protective cases that enhance the look of their devices.

This shift has spurred companies to be more creative, providing a variety of styles, materials, and features to meet the varying demands of consumers. Additionally, feasibility studies highlight the potential of investing in the mobile phone protective cover market, with positive growth predictions and numerous opportunities for market growth. By utilizing a combination of online and offline distribution channels, companies maximize their reach and take advantage of the increasing demand for protective cover.

As smartphones continue to advance, the market for protective cover also evolves, presenting profitable prospects for companies to capitalize on changing consumer preferences and market dynamics. By focusing on product innovation, expanding market presence, and optimizing distribution strategies, manufacturers position themselves for sustained growth and success in this dynamic and continuously expanding mobile phone protective cover market.

Navigating Competition and Innovation

In the global market for mobile phone protective cover, the presence of saturation and intense competition pose significant challenges, which are further exacerbated by various key factors. As the market reaches maturity, barriers to entry become prominent obstacles for new players, impeding their ability to establish a foothold. This saturation is compounded by the volatility of consumer preferences and technological advancements, making it increasingly arduous for companies to differentiate their products and gain market share. Additionally, uncertainties surrounding reimbursement policies and evolving trade policies introduce layers of complexity, discouraging potential entrants and stifling innovation.

The consolidation trend among leading market players solidifies their dominance, creating barriers for smaller firms to penetrate. In this fiercely competitive and uncertain landscape, companies need to strategically navigate these challenges to maintain competitiveness in the global mobile phone protective cover market.

Mobile Phone Protective Cover Market Segment Analysis

By Material Type, According to SMR research, the Polycarbonate segment is dominant in 2024 with a significant market share and dominates the Mobile Phone Protective Cover market. Market segmentation studies indicate a noticeable consumer preference for the durability and versatility of polycarbonate materials in protective phone cases. Manufacturers have leveraged the lower manufacturing costs of polycarbonate to provide competitive pricing while upholding quality standards. The dominance of the polycarbonate segment is evident from the production volume statistics, as manufacturers are increasing their operations to meet the growing demand driving the Mobile Phone Protective Cover Market.

The availability of polycarbonate phone covers has been made possible through various distribution channels, including both physical stores and online platforms, ensuring widespread market reach. Innovation trends in the mobile accessories sector have led to the widespread use of polycarbonate materials. Manufacturing advancements have allowed for the creation of thinner, lighter covers that are still durable, improving product positioning in a highly competitive market. Polycarbonate's flexibility has also enabled the customization of designs, catering to specific consumer groups looking for personalized mobile device solutions.

Pricing strategies have played a crucial role in solidifying polycarbonate's market dominance in the Mobile Phone Protective Cover Market. Despite the availability of other materials, the competitive pricing of polycarbonate cover has set them apart, appealing to budget-conscious consumers while maintaining quality. The polycarbonate segment is expected to continue its strong presence in the global mobile phone protective cover market. With its durability, affordability, and versatility, polycarbonate is likely to remain the preferred choice for consumers seeking reliable protection for their mobile devices in an increasingly digital world.

Mobile Phone Protective Cover Market Regional Analysis

Asia Pacific the dominant region in the Mobile Phone Protective Cover Market in 2024 with the highest market share, with China being the leading market in the region. China, a manufacturing powerhouse and undisputed top-selling region has a massive smartphone user base, which fuels the demand for mobile phone protective cover market. Brand loyalty is a key driver, with established domestic brands like Spigen (South Korea) and Anker (China) enjoying strong customer bases. These companies understand the regional preferences for functionality and design, offering a diverse range of protective cover at competitive price points.

Additionally, the rise of e-commerce giants like Alibaba and JD.com in China has created a robust online distribution network, making it easier for manufacturers to reach a wider audience and establish themselves as market leaders. Also, South Korea, home to tech giants like Samsung, leads innovation in the market, introducing cutting-edge designs and materials driving the dominance of the region in the Mobile Phone Protective Cover Market. India, with its burgeoning smartphone user base, presents immense growth opportunities, fueled by increasing smartphone penetration and rising disposable incomes. International Trade plays an essential role in this dynamic landscape, as the region serves as a major exporter of mobile phone protective cover to various global markets, further solidifying its position as a formidable player in the mobile phone protective cover market.

- According to a study by SMR, the number of smartphone users in India reached 659 million by 2022, rising from 468 million users in 2017.

Mobile Phone Protective Cover Market Competitive Landscape

The global mobile phone protective cases market is characterized by the presence of leading manufacturers, brands, retailers, and online sellers. Key players in the market include Otter Products, LLC (OtterBox), Incipio Group, Belkin International, Inc., Griffin Technology, Spigen Inc., and Case-Mate, Inc., among others. These companies compete based on factors such as product quality, durability, design innovation, brand reputation, pricing, distribution network, and customer service, striving to maintain market share and brand loyalty in a competitive marketplace.

- The i-BLADES Smartcase, introduced in 2023 is a cutting-edge phone case that seamlessly incorporates intelligent technology. By simply attaching Smartblades, users can enhance and expand the capabilities of their smartphones, providing an innovative and customizable experience.

- In 2023, CASETIFY created sustainable yet protective phone cases for iPhone models, including iPhone 14, iPhone 14 Pro, iPhone 14 Plus, and iPhone 14 Pro Max. They also offer tech accessories.

- In 2022, OtterBox, a U.S.-based company, unveiled the introduction of phone cases designed specifically for iPad Air. These phone cases were released in a selection of spring-inspired colors, including pink and orange.

- In 2022, U.S.-based Atom Studios announced the launch of phone cases for Samsung phones. The newly launched case is called Touch and is available for S22 and S22+ Samsung Galaxy models.

- In 2022, OtterBox launched waterproof cases for the iPhone for the first time, which are from the Fre Series, the no. 1 waterproof case series in the United States.

|

Mobile Phone Protective Cover Market Scope |

|

|

Market Size in 2024 |

USD 28.16 Bn. |

|

Market Size in 2032 |

USD 50.23 Bn. |

|

CAGR (2025-2032) |

7.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Material Type Silicone Polycarbonate Thermoplastic Polyurethane Leather Others |

|

|

By Product Body Gloves Pouch Phone Skin Hybrid Cases Others |

|

|

By Distribution Channel Online Offline |

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Mobile Phone Protective Cover Market

- OtterBox (USA)

- Speck (USA)

- Case-Mate (USA)

- Case Logic (USA)

- Proporta (UK)

- Spigen (South Korea)

- Nillkin (China)

- Ringke (South Korea)

- X One (UAE)

- Moarmouz (China)

- Hoco (China)

- Muvit (France)

- Piel Frama (Spain)

- Krusell International AB (Sweden)

- StilGut GmbH (Germany)

- Ozone (India)

- Gear4 (UK)

- Tactus Ltd. (U.K.)

- Shenzhen Ipaky Electronic (China)

- Belkin International Inc. (USA)

- ZAGG Inc (USA)

- Incipio LLC (California)

- Griffin Technology LLC (USA)

- BodyGuardz (USA)

- Tech21 (UK)

- Mophie Technology (California)

- Moshi (USA)

- Apple Inc (USA)

Frequently Asked Questions

Growing demand for premium cover, emerging online sales channels, and personalization & customization are the opportunities in the Mobile Phone Protective Cover market.

The Asia Pacific region is expected to dominate the market throughout the forecasted period.

The Market size was valued at USD 28.16 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 50.23 billion.

The segments covered in the market report are material type, product, distribution channel, and region.

1. Mobile Phone Protective Cover Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Mobile Phone Protective Cover Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Mobile Phone Protective Cover Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Mobile Phone Protective Cover Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Mobile Phone Protective Cover Market Size and Forecast by Segments (by Value USD Million)

5.1. Mobile Phone Protective Cover Market Size and Forecast, By Material Type (2024-2032)

5.1.1. Silicone

5.1.2. Polycarbonate

5.1.3. Thermoplastic Polyurethane

5.1.4. Leather

5.1.5. Others

5.2. Mobile Phone Protective Cover Market Size and Forecast, By Product (2024-2032)

5.2.1. Body Gloves

5.2.2. Pouch

5.2.3. Phone Skin

5.2.4. Hybrid Cases

5.2.5. Others

5.3. Mobile Phone Protective Cover Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Online

5.3.2. Offline

5.4. Mobile Phone Protective Cover Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Mobile Phone Protective Cover Market Size and Forecast (by Value USD Million)

6.1. North America Mobile Phone Protective Cover Market Size and Forecast, By Material Type (2024-2032)

6.1.1. Silicone

6.1.2. Polycarbonate

6.1.3. Thermoplastic Polyurethane

6.1.4. Leather

6.1.5. Others

6.2. North America Mobile Phone Protective Cover Market Size and Forecast, By Product (2024-2032)

6.2.1. Body Gloves

6.2.2. Pouch

6.2.3. Phone Skin

6.2.4. Hybrid Cases

6.2.5. Others

6.3. North America Mobile Phone Protective Cover Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.1. Online

6.3.2. Offline

6.4. North America Mobile Phone Protective Cover Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Mobile Phone Protective Cover Market Size and Forecast (by Value USD Million)

7.1. Europe Mobile Phone Protective Cover Market Size and Forecast, By Material Type (2024-2032)

7.2. Europe Mobile Phone Protective Cover Market Size and Forecast, By Product (2024-2032)

7.3. Europe Mobile Phone Protective Cover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Europe Mobile Phone Protective Cover Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Mobile Phone Protective Cover Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Mobile Phone Protective Cover Market Size and Forecast, By Material Type (2024-2032)

8.2. Asia Pacific Mobile Phone Protective Cover Market Size and Forecast, By Product (2024-2032)

8.3. Asia Pacific Mobile Phone Protective Cover Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Asia Pacific Mobile Phone Protective Cover Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Mobile Phone Protective Cover Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Mobile Phone Protective Cover Market Size and Forecast, By Material Type (2024-2032)

9.2. Middle East and Africa Mobile Phone Protective Cover Market Size and Forecast, By Product (2024-2032)

9.3. Middle East and Africa Mobile Phone Protective Cover Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. Middle East and Africa Mobile Phone Protective Cover Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Mobile Phone Protective Cover Market Size and Forecast (by Value USD Million)

10.1. South America Mobile Phone Protective Cover Market Size and Forecast, By Material Type (2024-2032)

10.2. South America Mobile Phone Protective Cover Market Size and Forecast, By Product (2024-2032)

10.3. South America Mobile Phone Protective Cover Market Size and Forecast, By Distribution Channel (2024-2032)

10.4. South America Mobile Phone Protective Cover Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. OtterBox (USA)

11.1.1. Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Speck (USA)

11.3. Case-Mate (USA)

11.4. Case Logic (USA)

11.5. Proporta (UK)

11.6. Spigen (South Korea)

11.7. Nillkin (China)

11.8. Ringke (South Korea)

11.9. X One (UAE)

11.10. Moarmouz (China)

11.11. Hoco (China)

11.12. Muvit (France)

11.13. Piel Frama (Spain)

11.14. Krusell International AB (Sweden)

11.15. StilGut GmbH (Germany)

11.16. Ozone (India)

11.17. Gear4 (UK)

11.18. Tactus Ltd. (U.K.)

11.19. Shenzhen Ipaky Electronic (China)

11.20. Belkin International Inc. (USA)

11.21. ZAGG Inc (USA)

11.22. Incipio LLC (California)

11.23. Griffin Technology LLC (USA)

11.24. BodyGuardz (USA)

11.25. Tech21 (UK)

11.26. Mophie Technology (California)

11.27. Moshi (USA)

11.28. Apple Inc (USA)

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook