Middle East and Africa Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

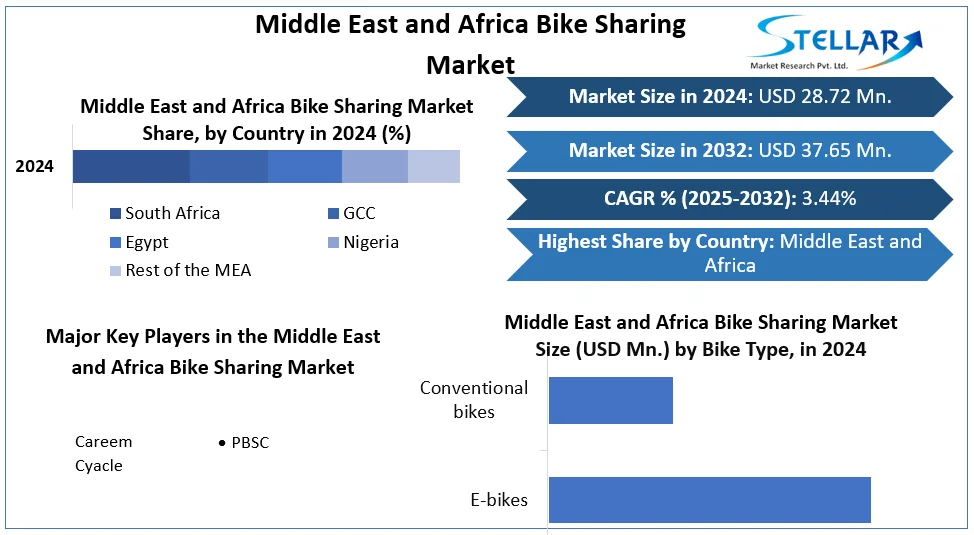

Middle East and Africa Bike Sharing Market size was valued at US$ 28.72 Million in 2024 and the total Middle East and Africa Bike Sharing Market revenue is expected to grow at 3.44% through 2025 to 2032, reaching nearly US$ 37.65 Million.

Format : PDF | Report ID : SMR_67

Middle East and Africa Bike Sharing Market Overview:

The Moroccan city of Marrakesh was the first in Africa to implement a bike-sharing scheme. Medina Bike was launched by the municipality in November 2016 for the 22nd United Nations Conference of Parties (COP 22), and it was phased down in 2020. (Having 7 bikes available in October 2020). Six systems are now operational in Africa. Nigeria joined Egypt, South Africa, and Morocco in 2019 by launching free-floating systems in two cities (Ede and Lagos), which are run by a local business (AWA Bikes).

To get more Insights: Request Free Sample Report

Middle East and Africa Bike Sharing Market Dynamics:

PBSC Urban Solutions, a leading smart bike-share solution provider, has announced a partnership with Careem, the Middle East's leading ride-hailing firm, and Dubai's Roads and Transport Authority (RTA) to introduce its electric bikes to the Emirate.

The company will begin rolling out its E-FIT electric pedal-assist bikes and smart stations across Dubai in the coming months. The multi-year agreement calls for 3,500 bikes and 350 charging stations. After successfully launching earlier this year in cities such as Barcelona, Buenos Aires, Santiago, and Monaco, PBSC is making its first venture into the Middle East. It's also the first large-scale electric bike-share network in the region. The RTA has made a determined effort in recent years to improve Dubai's mobility infrastructure by building a network of dedicated bike lanes, with plans to more than double these lanes by 2030. The E-FIT is the ideal vehicle for residents and visitors to take advantage of these initiatives. Despite the fact that Dubai's terrain is generally flat, the e-bike will provide a boost to riders when temperatures rise, lowering the amount of energy necessary to peddle.

The Careem Bike system in Dubai will use PBSC's smart station technology, which allows riders to charge their e-bikes right at the docking station. This eliminates the need for operators to replace the batteries or manually charge the e-bikes. The smart technology that feeds data regarding battery, bike, and network health back to operators, who monitor their system using a bespoke management platform, adds to the operational efficiency of PBSC's system. Both the smart stations and the PBSC e-bikes have undergone extensive testing and have received numerous safety certifications. Cyacle, a bicycle sharing startup founded in Abu Dhabi in 2014, has grown in popularity among the Emirati capital's population. The company now has approximately 75,000 regular customers and is a leader in micro-mobility in the Middle East, with 300 bicycles dispersed across 50 stations.

The success attracted Careem's attention. The VTC provider based in the United Arab Emirates announced the acquisition of Cyacle but did not disclose the purchase price. Careem is making its first push into the micromobility sector, having already established itself in the bike sharing market with Careem NOW in the United Arab Emirates and Saudi Arabia. The Emirati VTC Company has continued to extend its variety of services since being acquired by its American counterpart Uber.

Middle East and Africa Bike Sharing Market Scope

|

Middle East and Africa Bike-Sharing Market |

|

|

Market Size in 2024 |

USD 28.72 Mn. |

|

Market Size in 2032 |

USD 37.65 Mn. |

|

CAGR (2025-2032) |

3.44% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Bike Type

|

|

By Model

|

|

|

By Sharing System

|

|

|

Country Scope |

|

Middle East and Africa Bike Sharing Market Players

Frequently Asked Questions

Nigeria and GCC region have the highest growth rate of 3.5% and 3% respectively in the Middle East and Africa Bike Sharing market

Careem, Cyacle and PBSC are the key players in the Middle East and Africa Bike Sharing market

GCC and Nigeria are the top regions in the Middle East and Africa bike sharing market in terms of system installations

Middle East and Africa Bike Sharing Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

1. Middle East and Africa Bike Sharing Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Middle East and Africa Bike Sharing Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Middle East and Africa Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Middle East and Africa Bike Sharing Market: Dynamics

4.1. Middle East and Africa Bike Sharing Market Trends

4.2. Middle East and Africa Bike Sharing Market Drivers

4.3. Middle East and Africa Bike Sharing Market Restraints

4.4. Middle East and Africa Bike Sharing Market Opportunities

4.5. Middle East and Africa Bike Sharing Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Middle East and Africa Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Middle East and Africa Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Middle East and Africa Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station-based

5.3. Middle East and Africa Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

5.4. Middle East and Africa Bike Sharing Market Size and Forecast, by Country (2024-2032)

5.4.1. South Africa

5.4.2. GCC

5.4.3. Egypt

5.4.4. Nigeria

5.4.5. Rest of the Middle East and Africa

6. Company Profile: Key Players

6.1. Careem

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Cyacle

6.3. PBSC

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook