Middle East & Africa Building Insulation Materials Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

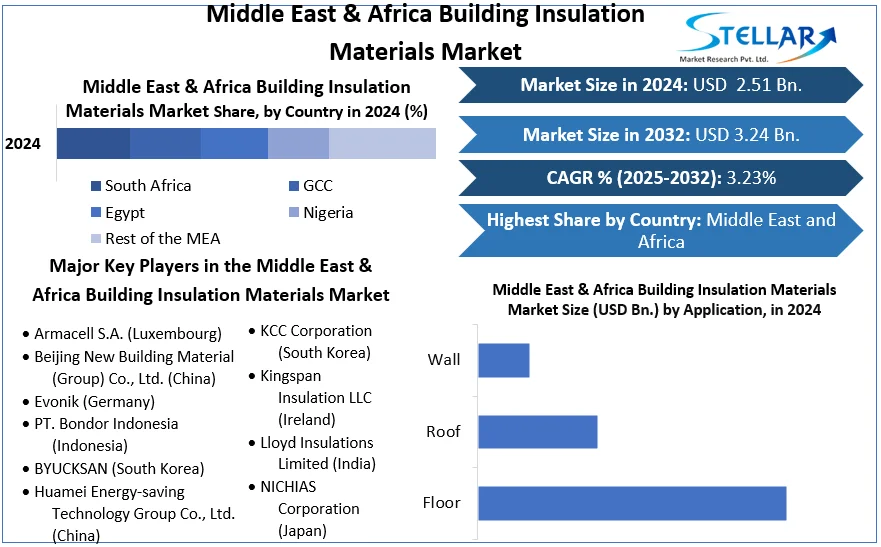

Middle East & Africa Building Insulation Materials Market size was valued at US$ 2.51 Bn. in 2024 and the total revenue is expected to grow at CAGR of 3.23% through 2025 to 2032, reaching nearly US$ 3.24 Bn. by 2032.

Format : PDF | Report ID : SMR_1264

Middle East & Africa Building Insulation Materials Market Definition

Building Insulation materials are used in the construction industry to prevent heat, electricity, or sound from passing through electrical appliances and building materials. The insulation materials market is essentially classified in three broad categories, including thermal insulation, electrical insulation, and heat insulation. The proper installation of high-quality insulation materials is the key to a successful insulation system. Insulation is an important technology for reducing energy usage and preventing heat gain/loss in buildings. It acts as a heat barrier and is necessary for keeping homes warm in the winter and cool in the summer. The appropriate level and type of insulation are influenced by the weather. The thermal conductivity of insulating materials is typically less than 0.1 W/mK. Insulation materials include polyurethane foam, mineral wool, polyethylene, polyvinyl chloride, expanded polystyrene, and extruded polystyrene. These materials exist solely to save energy while also protecting and providing comfort to occupants.

A structure serves as an environmental divider. It divides the inside from the outside. Residential insulation is a critical technique for lowering energy consumption in homes by limiting heat absorption and loss via the building envelope. Insulation materials used in residential construction include polyurethane foam and extruded polystyrene. Increased demand for thermal insulators in residential, non-residential, and industrial buildings has resulted from rising global temperatures and significant climatic changes over the last few decades, in order to save energy and provide comfort for inhabitants.

To get more Insights: Request Free Sample Report

Middle East & Africa Building Insulation Materials Market Dynamics

Market Drivers

- More commercial buildings in the region – Due to rising awareness of energy conservation and increased installation of thermal insulation to bridge the gap between energy demand and supply, the commercial building segment accounted for the largest share of market revenue. Furthermore, increased government spending on public infrastructure construction and redevelopment, such as the AL Askar IPP power plant in Bahrain and AL DUR Phase 2 in Bahrain, Banban PV IPP in Egypt, Bokpoort CSP IPP in South Africa, and Hassyan Energy Phase 1 PSC in the UAE, would positively influence market growth in the MEA building thermal insulation market. Several commercial projects are in the works in the United Arab Emirates, assisting in the country's ability to maintain high growth rates. As the government wants to build high-value service sectors, commercial infrastructure is emerging as a major outperformer in the industry. Furthermore, as the government seeks to diversify its economy beyond oil, Abu Dhabi's proportion of the construction sector is expected to rise in the coming years. In addition, the commercial infrastructure intends to bring in a large number of tourists each year. As a result, all of these factors are projected to bolster the building insulation market's growth over the forecast period.

- Contribution by Key Players – Middle East & Africa is the region with many key players in the market and the contribution by them has been massive for the market in the region. For example - Stone wool and its products, such as insulation, fire prevention, and noise control, are developed and produced by Rockwool International A/S. Acoustic ceilings, façade panels, and horticultural substrates are among the company's offerings. In the insulation industry, Rockwool offers a strong product portfolio, with goods available all over the world, including in the Middle East and Africa.

- Government Efforts for the growth of the market – Governments of these region are investing a lot of money, time and brain in this market leading to growth of the market in this region. Turkey's investment, as part of its five-year development strategy, contributes to the market's growth. Furthermore, the country's total construction project pipeline comprises all projects from conception to completion, with a preference for late-stage projects. As a result, all of the aforementioned reasons are anticipated to have an impact on the demand for building insulation materials, pushing the market for building insulation in Turkey. The home construction business is growing as a result of recent government changes in South Africa, as well as greater competition among mortgage lenders. Furthermore, banks' cheap lending rates are another element that is likely to promote the residential construction sector's expansion. Above all, the government's attempts to improve residential, transportation, and infrastructure projects will certainly propel the construction industry forward. As a result, such innovations are projected to supplement the expansion of the building insulation industry.

Market Restraints

- Covid-19 Impact on Construction Industry in Middle East & Africa - In Middle East & Africa, the COVID-19 pandemic is having a significant impact on the market for building insulation materials. Construction for both the residential and commercial sectors was delayed or halted as a result of the global lockdowns imposed to prevent the spread of the COVID-19 pandemic. The upkeep of pre-existing structures has also been postponed. However, the supply chain was disrupted, making it impossible to move people, resources, and money in order to re-establish growth in the global building insulation materials industry. Furthermore, the financial impact of the COVID-19 outbreaks on the construction and building sector, as well as individuals, has caused builders to refuse to build and the general public to refuse to buy or repair their companies.

- More investments in other markets and bad economic conditions – Bad economic conditions in the region is the biggest factor for the slow down of the building insulation material market. For example - The high unemployment rate and low level of household income in South Africa have had a negative impact on the residential sector.

Middle East & Africa Building Insulation Materials Market Segment Analysis

By Product, the Middle East & Africa Building Insulation Materials Market is segmented as Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Mineral Wool, Others. Expanded Polystyrene dominates the Building Insulation Materials Market with the market share of 53% in 2024 because it is one of the most extensively utilised foamed polymers for constructing thermal insulation It's a type of insulation with impressive properties such as sound absorption, light weight, and earthquake resistance. One of the most prevalent applications is pipe insulation to minimise heat gain, condensation, or frost formation on water and air conditioning lines and also this region is mostly deserted and have summer all over the year and that’s why this segment is most popular. Extruded Polystyrene has the market share of 28.7% in 2024 because of its water resistance, ability to reduce moisture-related damages, and ability to conserve energy Its ability to suppress microbial or fungal growth in the insulated region is also expected to help with growth. Mineral wool has the market the market share of 15% in 2024 owing to the product's exceptional qualities, such as fire resistance, effective heat barrier, environmental compatibility, and dimensional stability Over the forecast period, mineral wool's growth is expected to be driven by its increasing use in thermal barrier applications. Other materials such as PU foam and PIR foam has the market share of 3.3% in 2024.

By Application, the Middle East & Africa Building Insulation Materials Market is segmented as Roof, Wall, Floor. Wall segment dominates the Middle East & Africa Building Insulation Materials Market with the market share of 37% in 2024. It was used in high-end architecture and maintained high levels of energy efficiency in both residential and commercial structures. The tropical conditions in the Middle East and Africa region enable considerably to keep the buildings cool and less humid, and walls are vital in reaching a building's energy consumption targets. Roof Segment has the market share of 34% in 2024. Since of the availability of firm sites throughout the Middle East and Africa, particularly in rising economies, and because insulation materials are so important in the market, demand for insulation materials is projected to grow as the importance of meeting thermal construction criteria grows. Floor segment has the market share of 29% in 2024 as a result of rising demand for HVAC applications to be as energy efficient as possible Thermal insulation is used in the basement, garage, cantilever, and crawl space flooring. Increased product penetration for floor insulation in extremely cold locales is projected to fuel market growth.

The objective of the report is to present a comprehensive analysis of the Middle East & Africa Building Insulation Materials Market to the stakeholders in the industry. The report provides trends that are most dominant in the Middle East & Africa Building Insulation Materials Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Middle East & Africa Building Insulation Materials Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Middle East & Africa Building Insulation Materials Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Middle East & Africa Building Insulation Materials Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Middle East & Africa Building Insulation Materials Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Middle East & Africa Building Insulation Materials Market. The report also analyses if the Middle East & Africa Building Insulation Materials Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Middle East & Africa Building Insulation Materials Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Middle East & Africa Building Insulation Materials Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Middle East & Africa Building Insulation Materials Market is aided by legal factors.

Middle East & Africa Building Insulation Materials Market Scope

|

Middle East & Africa Building Insulation Materials Market |

|

|

Market Size in 2024 |

USD 2.51 Bn. |

|

Market Size in 2032 |

USD 3.24 Bn. |

|

CAGR (2025-2032) |

3.23% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Product

|

|

by Application

|

|

|

Country Scope |

|

Middle East & Africa Building Insulation Materials Market Key Players

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- PT. Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

- Huamei Energy-saving Technology Group Co., Ltd. (China)

- Johns Manville (U.S.)

- Kaneka Corporation (Japan)

- KCC Corporation (South Korea)

- Kingspan Insulation LLC (Ireland)

- Lloyd Insulations Limited (India)

- NICHIAS Corporation (Japan)

- ROCKWOOL International A/S (Denmark)

- U.P. Twiga Fiberglass Limited (India)

- GAF (U.S.)

Frequently Asked Questions

The Middle East & Africa Building Insulation Materials Market is expected to reach 3.05 Bn. by 2030 at a CAGR of 3.23% during the forecast period.

The Middle East & Africa Building Insulation Materials Market size was USD 2.51 Billion in 2024.

The Middle East & Africa Building Insulation Materials Market is growing at a CAGR of 3.23% during forecasting period 2025-2032.

Middle East & Africa Building Insulation Materials Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Middle East & Africa Building Insulation Materials Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. Middle East & Africa Building Insulation Materials Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Middle East & Africa Building Insulation Materials Market: Dynamics

4.1. Middle East & Africa Building Insulation Materials Market Trends

4.2. Middle East & Africa Building Insulation Materials Market Drivers

4.3. Middle East & Africa Building Insulation Materials Market Restraints

4.4. Middle East & Africa Building Insulation Materials Market Opportunities

4.5. Middle East & Africa Building Insulation Materials Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Value Chain Analysis and Supply Chain Analysis

4.9. Technological Analysis

4.9.1. XPS foam technology

4.9.2. ECOSE technology

4.9.3. Air sealing

4.9.4. Reflective roofing materials

4.9.5. Technological Roadmap

4.10. Regulatory Landscape

5. Middle East & Africa Building Insulation Materials Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Middle East & Africa Building Insulation Materials Market Size and Forecast, by Product (2024-2032)

5.1.1. Expanded Polystyrene (EPS)

5.1.2. Extruded Polystyrene (XPS)

5.1.3. Mineral Wool

5.1.4. Others

5.2. Middle East & Africa Building Insulation Materials Market Size and Forecast, by Application (2024-2032)

5.2.1. Floor

5.2.2. Roof

5.2.3. Wall

5.3. Middle East & Africa Building Insulation Materials Market Size and Forecast, by Country (2024-2032)

5.3.1. South Africa

5.3.2. GCC

5.3.3. Egypt

5.3.4. Nigeria

5.3.5. Rest of the Middle East and Africa

6. Company Profile: Key Players

6.1. Armacell S.A. (Luxembourg)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Beijing New Building Material (Group) Co., Ltd. (China)

6.3. Evonik (Germany)

6.4. PT. Bondor Indonesia (Indonesia)

6.5. BYUCKSAN (South Korea)

6.6. Huamei Energy-saving Technology Group Co., Ltd. (China)

6.7. Johns Manville (U.S.)

6.8. Kaneka Corporation (Japan)

6.9. KCC Corporation (South Korea)

6.10. Kingspan Insulation LLC (Ireland)

6.11. Lloyd Insulations Limited (India)

6.12. NICHIAS Corporation (Japan)

6.13. ROCKWOOL International A/S (Denmark)

6.14. U.P. Twiga Fiberglass Limited (India)

6.15. GAF (U.S.)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook