Indonesia Automotive Engine Oil Market: Industry Analysis and Forecast (2024-2030)

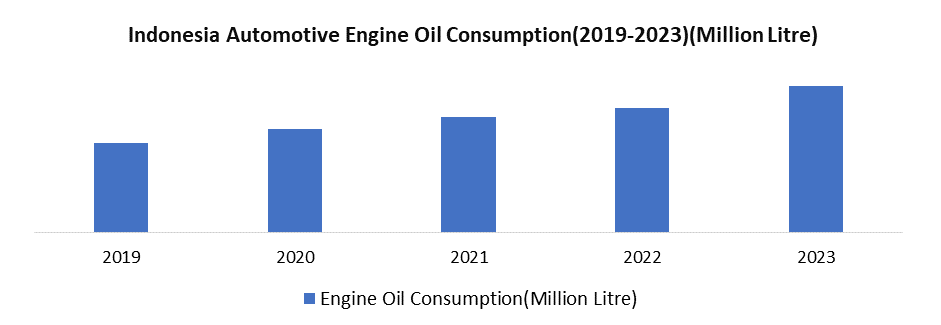

The Indonesia Automotive Engine Oil Market size was valued at USD 522.30 Mn. in 2023 and the total Indonesia Automotive Engine Oil revenue is expected to grow at a CAGR of 4.70% from 2024 to 2030, reaching nearly USD 720.36 Mn. in 2030.

Format : PDF | Report ID : SMR_1755

Indonesia Automotive Engine Oil Market Overview

In Indonesia, the automotive engine oil market thrives on the indispensable role these lubricants play in engine maintenance with a blend of base oils and additives, they minimize wear and tear and enhance efficiency. The market offers synthetic, semi-synthetic, and mineral oils tailored to diverse engine needs. The benefits include cleaner engines, prolonged lifespan, cost savings, and fuel efficiency. Evolving lubricant technology ensures protection against heat, corrosion, and deposits, optimizing engine performance and reliability.

- Indonesia's vehicle count rises yearly. In January 2023, registered vehicles hit 152.5M, up from 137.1M in 2022.

- Gasoline jumps 30% to 10,000 per litre. Petromax rises 20% to 14,500.

The comprehensive report by STELLAR offers a detailed analysis of the Indonesia Automotive Engine Oil Market, highlighting trends, innovations, and driving forces shaping its evolution. It delves deep into the current landscape, accurately outlining dimensions, growth patterns, and pivotal factors driving market growth along with growing opportunities.

To get more Insights: Request Free Sample Report

Rising Vehicle Population to Drive the Indonesia Automotive Engine Oil Market

The trend drives up the overall demand for engine oil and benefits manufacturers and distributors with higher sales volumes. As the number of vehicles on Indonesian roads increases, so does the demand for regular oil changes. Indonesia is experiencing economic growth and car owners gravitate towards premium options like synthetic or semi-synthetic oils. Also, with increased disposable income there's a potential shift towards these choices for superior engine performance and protection and reflecting evolving consumer preferences in the Indonesia automotive engine oil market. The diversification of Indonesia's vehicle fleet fuels increased demand for specific types of engine oil. For instance, the rise in automatic scooters drives the need for oils formulated for these engines and reflects a market shift toward tailored lubrication solutions.

The growing vehicle population in Indonesia has had a profound impact on its Indonesia automotive engine oil market. The direct consequence is an increased demand for engine oil thanks to more frequent oil changes and boosting sales for manufacturers and distributors. Additionally, the diverse vehicle landscape prompts the need for specific engine oil formulations, spurring market diversification and product line growth. As disposable income rises, consumers opt for premium options like synthetic or semi-synthetic blends, elevating market value. Economically, this growth fosters job creation across the supply chain and generates higher tax revenue for the government. However, managing used oil properly is essential to mitigate environmental concerns.

Indonesia Automotive Engine Oil Market Segment Analysis

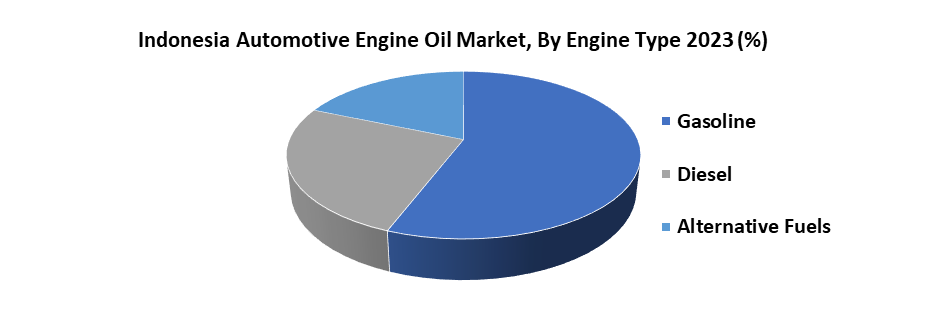

Based on Engine Type, the Gasoline segment held the largest market share of about 52% in the Indonesia Automotive Engine Oil Market in 2023. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 4.72% during the forecast period. Rapid technological advancements and the increasing adoption of smart devices with data connectivity make it the dominant segment in the Indonesia Automotive Engine Oil Market.

In the realm of the Indonesia Automotive Engine Oil Market, gasoline and engine oil serve distinct functions. Gasoline fuels the internal combustion engine and generates the energy required for vehicle propulsion. Equally, engine oil lubricates the engine's moving parts, mitigating friction, wear, and tear. While both are crucial for optimal engine performance, their roles are separate and not directly intertwined in market analysis. Understanding their unique functions is fundamental for maintaining engine efficiency and longevity in the automotive sector.

The gasoline consumption indirectly influences engine oil demand and other factors hold greater relevance in Indonesia Automotive Engine Oil Market analysis. The increasing vehicle population particularly in the motorcycle segment amplifies the market for engine oil. Consumer preferences for synthetic oil with extended change intervals also affect demand. Additionally, economic conditions, reflected in disposable income levels, dictate maintenance frequency, including oil changes. Understanding these dynamics provides insight into market trends and consumer behavior, guiding strategies for manufacturers and distributors in this dynamic sector.

|

Indonesia Automotive Engine Oil Market Scope |

|

|

Market Size in 2023 |

USD 522.30 Million |

|

Market Size in 2030 |

USD 720.36 Million |

|

CAGR (2024-2030) |

4.70 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Grade

|

|

By Engine Type

|

|

|

By Vehicle Type

|

|

Leading Key Players in the Indonesia Automotive Engine Oil Market

- BP PLC (Castrol)

- ExxonMobil Corporation

- PT Pertamina

- PT Wiraswasta Gemilang Indonesia (Evalube)

- Royal Dutch Shell Plc

- TotalEnergies

- Chevron

Frequently Asked Questions

Stringent regulation and Rising manufacturing costs are expected to be the major restraining factors for the Indonesia Automotive Engine Oil market growth.

The Indonesia Automotive Engine Oil Market size was valued at USD 522.30 Million in 2023 and the total Indonesia Automotive Engine Oil revenue is expected to grow at a CAGR of 4.70% from 2024 to 2030, reaching nearly USD 720.36 Million By 2030.

1. Indonesia Automotive Engine Oil Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Indonesia Automotive Engine Oil Market Trends

2.1 Market Consolidation

2.2 Adoption of Advanced Manufacturing Technologies

2.3 Pricing and Reimbursement Trends

3. Indonesia Automotive Engine Oil Market Import Export Landscape

3.1 Import Trends

3.2 Export Trends

3.3 Regulatory Compliance

3.4 Major Export Destinations

3.5 Import-Export Disparities

4. Indonesia Automotive Engine Oil Market: Dynamics

4.1.1 Market Driver

4.1.2 Market Restraints

4.1.3 Market Opportunities

4.1.4 Market Challenges

4.2 PORTER’s Five Forces Analysis

4.3 PESTLE Analysis

4.4 Regulatory Landscape

4.5 Analysis of Government Schemes and Initiatives for the Indonesia Automotive Engine Oil Industry

5. Indonesia Automotive Engine Oil Market: Market Size and Forecast by Segmentation (Value) (2023-2030)

5.1 Indonesia Automotive Engine Oil Market Size and Forecast, by Grade (2023-2030)

5.1.1 Mineral

5.1.2 Semi-Synthetic

5.1.3 Fully-synthetic

5.2 Indonesia Automotive Engine Oil Market Size and Forecast, by Engine Type (2023-2030)

5.2.1 Gasoline

5.2.2 Diesel

5.2.3 Alternative Fuels

5.3 Indonesia Automotive Engine Oil Market Size and Forecast, by Vehicle Type (2023-2030)

5.3.1 Passenger Cars

5.3.2 Light Commercial Vehicles

5.3.3 Heavy-Duty Vehicles

5.3.4 Motorcycle

6. Indonesia Automotive Engine Oil Market: Competitive Landscape

6.1 STELLAR Competition Matrix

6.2 Competitive Landscape

6.3 Key Players Benchmarking

6.3.1 Company Name

6.3.2 Service Segment

6.3.3 End-user Segment

6.3.4 Revenue (2023)

6.3.5 Company Locations

6.4 Leading Indonesia Automotive Engine Oil Companies, by market capitalization

6.5 Market Structure

6.5.1 Market Leaders

6.5.2 Market Followers

6.5.3 Emerging Players

6.6 Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1 BP PLC (Castrol)

7.1.1 Company Overview

7.1.2 Business Portfolio

7.1.3 Financial Overview

7.1.4 SWOT Analysis

7.1.5 Strategic Analysis

7.1.6 Scale of Operation (small, medium, and large)

7.1.7 Details on Partnership

7.1.8 Regulatory Accreditations and Certifications Received by Them

7.1.9 Awards Received by the Firm

7.1.10 Recent Developments

7.2 ExxonMobil Corporation

7.3 PT Pertamina

7.4 PT Wiraswasta Gemilang Indonesia (Evalube)

7.5 Royal Dutch Shell Plc

7.6 TotalEnergies

7.7 Chevron

8. Key Findings

9. Industry Recommendations

10. Indonesia Automotive Engine Oil Market: Research Methodology