Latin America Coffee Market: Industry Analysis and Forecast (2024-2030) by Source, Type, Process and Region.

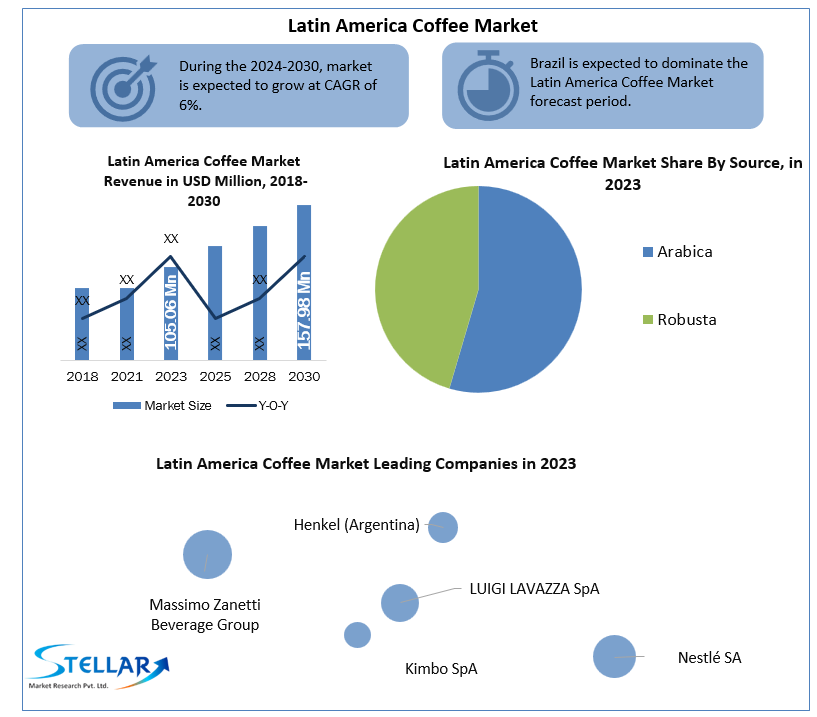

Latin America Coffee Market size is volume at 105.06 Mn. 60 kgs bag in 2023. Coffee will encourage a great deal of transformation in Beverage Sector in Latin America.

Format : PDF | Report ID : SMR_71

Latin America Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product. Roasted coffee is crushed into small pieces, usually soaked in hot water, and then filtered to make a cup of coffee.

To get more Insights: Request Free Sample Report

Latin America Coffee Market Dynamics:

Coffee consumption is a widespread culture in Latin America and has been a traditional practice ever since. Like Colombia, the coffee tradition has existed for over a century. Consumer sophistication has increased and specialty coffee products have been created along with specialty stores. These factors are driving the demand for coffee in this region.

Increased purchasing power and strong economic growth have led consumers to switch to quality products. This leads to innovations in alternative brewing methods. The busy lifestyle of consumers has attracted them to their ready-to-drink energy sources and concentration. Coffee serves this purpose and is in demand across Latin America.

Café culture in shopping malls and other public places has made them widely and easily accessible, increasing their popularity and leading to the demand of even more consumers in this region. Coffee producers' business strategies, especially for young people and through innovation and the introduction of new products to expand the product base, and through targeted marketing, directly and indirectly through price competition among producers is also driving the growth of the coffee market in this region.

Coffee is not rewarding for many of the hundreds of thousands of Latin American farmers who produce soft Arabica beans for the best soils in the world. They are increasingly giving up and becoming part of the wider stream of immigrants to the US-Mexico border. As farmers move to the United States from Latin America. This factor is restraining the growth of the market in this region.

The increase in the content of various flavorings and the increase in per capita consumer spending on coffee make coffee a flavor enhancer for consumers, increasing population growth, an increasing number of cafes and restaurants, young people's tendency to focus on coffee, and increasing demand for ready-to-drink coffee products due to busy lifestyles. Changing the lifestyle of companies with the desire to consume more breweries between jobs. These factors are expected to drive the growth of the coffee market in Latin America.

Coffee has been enjoyed in Latin American culture for many years, a space for higher-quality specialty coffee is emerging in major cities in some countries, such as Peru, Colombia, etc. There appears to be an evolving culture with a focus on coffee and coffee roasting at a local level which is driving the demand for coffee in the market.

Lima and Peru have a thriving coffee shop scene. Local organizations such as Le Cordon Bleu in Lima work with Prom Peru (the government) to give specialty coffee shops awards that certify them as a specialty. As these coffee shops are using Peruvian coffee, it helps promote domestic consumption of local coffee as well.

The increasing interest in processing and fermentation as coffee producers look for ways to differentiate their coffee and attract specialty buyers. Argentina’s capital city, Buenos Aires has witnessed an increase in specialty coffee amongst its traditional scene, something that has become popular by the growth of specialty coffee at events such as the Festival de Café de Buenos Aires (FECA). This factor is driving the demand for coffee in Latin America.

Latin America Coffee Market Segment Analysis:

By Source, Robusta dominated the market with a 54 % share in 2023. Robusta coffee beans have a high caffeine content, which makes them less sour and much stronger. These beans are strong and tasty, with a pleasant chocolate aroma in the mouth. Italians prefer strong and bitter coffee. These factors are driving the growth of the segment in the market.

Country Insights:

Dominican Republic: Coffees from the Dominican Republic, Haiti, Cuba, and Puerto Rico are grown at moderate altitudes and have moderate acidity and simple flavors. These wet-processed coffees are best suited for making roasted espresso. Cibao, Bani, Ocoa, and Barahona are the four main names in the Dominican Republic coffee market.

Ecuador: Ecuador produces a large amount of coffee and currently ranks twelfth in the world. Ecuador produces as much Robusta as Arabica, but the difference is that the coffees are undistinguished, with pale to medium flavors and mild acidity.

El Salvador: Volcanic peaks make up a large part of the landscape of this Central American country, providing a good environment for coffee growing. The taste of Salvadoran coffee is smooth, well-balanced, and medium-bodied, with crisp acidity and a hint of sweetness. The best quality Salvadoran coffee is known as Strictly Cultivated Coffee. All coffees are produced using the wet process.

Guatemala: Guatemala occupies sixth place in the ranking of coffee producers in the world and some of the best coffee in the world is produced in the central highlands of Guatemala. The high altitude and rich volcanic soil of many of the volcanoes in the region create ideal conditions for the production of top-quality coffee. High-quality Guatemalan coffee is produced wet and has high acidity and medium body, with smoky, spicy, and chocolate flavors. Guatemalan coffees are usually marketed by grade, with the highest grade being hard-seeded, only coffee grown at an altitude of 4,500 feet or more. A secondary category is the firm bean, which denotes a coffee grown between 4000 and 4500 feet.

Panama: Panama is a relatively small coffee-producing country, but it has two very different growing regions that produce distinct coffees. Coffee produced in Panama is smooth, bright and balanced, and similar to coffee from the Tres Rios region of Costa Rica. This wet-processed coffee is often used for brewing, but it's great as a breakfast drink.

Peru: Due to its mild character, Peruvian coffee is used for blending, French roasting, and as a base for flavored coffees. Good coffee can be found in the Andes, in the Chanchamayo and Urubamba valleys, and northern Peru is developing a reputation as a producer of good quality certified organic coffee.

Venezuela: The majority of Venezuelan coffee grows at altitudes between 1,000 and 5,000 feet in the border regions of Colombia. It produces about 1 million bags per year but exports much less due to high internal consumption.

The objective of the report is to present a comprehensive analysis of the Latin America Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Latin America Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Latin America Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Latin America Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Latin America Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Latin America Coffee market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Latin America Coffee market. The report also analyses if the Latin America Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Latin America Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Latin America Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the Latin America Coffee market is aided by legal factors.

Latin America Coffee Coffee Market Scope:

|

Latin America Coffee Market |

|

|

Market Size in 2023 |

USD 105.06 Mn. 60 kgs bag. |

|

Market Size in 2030 |

USD 157.98 Mn. 60 kgs bag. |

|

CAGR (2024-2030) |

6.0% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

|

Country Scope |

United States Canada Mexico |

KEY PLAYERS:

• LUIGI LAVAZZA SpA

• Kimbo SpA

• Massimo Zanetti Beverage Group

• Illycaffè SpA

• Casa del Caffe' Vergnano SpA

• Aromatica SRL

• Gruppo Gimoka SRL

• Pellini Caffè SpA

• Hausbrandt Trieste 1892 SpA

• CAFFÈ DE ROCCI

Frequently Asked Questions

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. South America Coffee Market: Target Audience

2.3. South America Coffee Market: Primary Research (As per Client Requirement)

2.4. South America Coffee Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2023-2030

4.1.1.South America Market Share Analysis, By Source, By Value, 2023-2030 (In %)

4.1.1.1. Brazil Market Share Analysis, By Source, By Value, 2023-2030 (In %)

4.1.1.2. Argentina Market Share Analysis, By Source, By Value, 2023-2030 (In %)

4.1.1.3. Rest of South America Market Share Analysis, By Source, By Value, 2023-2030 (In %)

4.1.2.South America Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.2.1. Brazil Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.2.2. Argentina Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.2.3. Rest of South America Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.South America Market Share Analysis, By Process, By Value, 2023-2030 (In %)

4.1.3.1. Brazil Market Share Analysis, By Process, By Value, 2023-2030 (In %)

4.1.3.2. Argentina Market Share Analysis, By Process, By Value, 2023-2030 (In %)

4.1.3.3. Rest of South America Market Share Analysis, By Process, By Value, 2023-2030 (In %)

4.2. Stellar Competition matrix

4.2.1. South America Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1. Key Players Benchmarking by Source, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1.M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1.Market Drivers

4.5.2.Market Restraints

4.5.3.Market Opportunities

4.5.4.Market Challenges

4.5.5.PESTLE Analysis

4.5.6.PORTERS Five Force Analysis

4.5.7.Value Chain Analysis

Chapter 5 South America Coffee Market Segmentation: By Source

5.1. South America Coffee Market, By Source, Overview/Analysis, 2023-2030

5.2. South America Coffee Market, By Source, By Value, Market Share (%), 2023-2030 (USD Million)

5.3. South America Coffee Market, By Source, By Value, -

5.3.1.Arabica

5.3.2.Robusta

Chapter 6 South America Coffee Market Segmentation: By Type

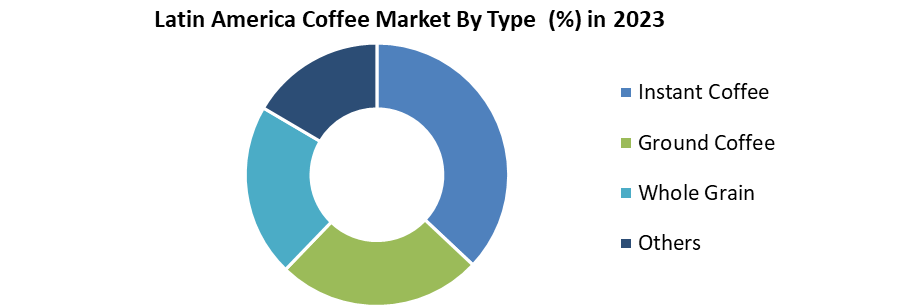

6.1.South America Coffee Market, By Type, Overview/Analysis, 2023-2030

6.2.South America Coffee Market Size, By Type, By Value, Market Share (%), 2023-2030 (USD Million)

6.3.South America Coffee Market, By Type, By Value, -

6.3.1.Instant Coffee

6.3.2.Ground Coffee

6.3.3.Whole Grain

6.3.4.Others

Chapter 7 South America Coffee Market Segmentation: By Process

7.1. South America Coffee Market, By Process, Overview/Analysis, 2023-2030

7.2. South America Coffee Market Size, By Process, By Value, Market Share (%), 2023-2030 (USD Million)

7.2.1.South America Coffee Market, By Process, By Value, -

7.2.1.1. Caffeinated

7.2.1.2. Decaffeinated

Chapter 8 South America Coffee Market Size By Country, By Value, 2023-2030 (USD Million)

8.1.1.Brazil

8.1.2.Argentina

8.1.3.Rest of South America

Chapter 9 Company Profiles

9.1. Key Players

9.1.1.LUIGI LAVAZZA SpA

9.1.1.1. Company Overview

9.1.1.2. Source Portfolio

9.1.1.3. Financial Overview

9.1.1.4. Business Strategy

9.1.1.5. Key Developments

9.1.2.Nestlé SA

9.1.3.Kimbo SpA

9.1.4.Massimo Zanetti Beverage Group

9.1.5.Illycaffè SpA

9.1.6.Casa del Caffe' Vergnano SpA

9.1.7.Aromatica SRL

9.1.8.Gruppo Gimoka SRL

9.1.9.Pellini Caffè SpA

9.1.10.Hausbrandt Trieste 1892 SpA

9.1.11.CAFFÈ DE ROCCI.

9.1.12.Xiaomi Corp.

9.2. Key Findings

9.3. Recommendations