Juicer Market: Global Industry Analysis and Forecast (2025-2032)

Juicer Market size was valued at USD 2.59 Bn. in 2024 and the total Juicer Market size is expected to grow at a CAGR of 6.60% from 2025 to 2032, reaching nearly USD 4.31 Bn. by 2032.

Format : PDF | Report ID : SMR_2098

Juicer Market Overview

A juicer, also known as a juice extractor, is a tool used to extract juice from fruits, herbs, leafy greens, and other types of vegetables in a process called juicing. It crushes, grinds, and/or squeezes the juice out of the pulp. A juicer clarifies the juice through a screening mesh to remove the pulp, unlike a blender where the output contains both the liquids and solids of the processed fruit or vegetable.

The growing demand for fruit and vegetable juices high in fiber is expected to propel the Juicer Market growth. Juicer industry growth is also being driven by increasing urbanization, shifting lifestyles, and middle-class populations adopting healthier lifestyles. Other significant factors that have accelerated the market growth rate are the rise in health awareness campaigns and high levels of disposable income. Additionally, new product launches and technological advancements are expected to result in profitable market growth opportunities. The Asia-Pacific region's high demand for juicers is a complex phenomenon influenced by health trends, changes in lifestyle, cultural norms, and economic factors.

Market participants have better adapted their strategies and products to meet the changing needs of consumers in the dynamic market by having a better understanding of these dynamics. Juicer manufacturers have benefited from these trends by emphasizing cold-press technology, personalizedization, emerging markets, health benefits, sustainability, and multifunctionality. By synchronizing their product development and marketing tactics with these patterns, companies can access novel consumer segments and propel expansion within a fiercely competitive marketplace.

- India exports most of its Electric juicers to Nigeria, the United States, and the United Arab Emirates.

- The top 3 exporters of Electric juicers are China with 7,980 shipments followed by Ukraine with 1,440 and Russia at the 3rd spot with 346 shipments.

- India exports most of its Manual juicers to Nigeria, Kenya, and Bangladesh and is the 2nd largest exporter of Manual juicers in the World.

- The top 3 exporters of Manual juicers are China with 2,736 shipments followed by India with 418 and Turkey at the 3rd spot with 138 shipments.

To get more Insights: Request Free Sample Report

Juicer Market Dynamics

Innovations in Speed Settings, Yield, and Ease of Cleaning Drive Growth Amid Rising Health

The juicer market has experienced a surge in 2023 owing to rising demand for multiple speed settings, high juice yields, and easy cleaning options that have escalated the market growth. The rise in the popularity of fresh juice over packaged juices thanks to the growing health concerns among consumers has boosted the market growth. Drinking organic and freshly-made vegetable juices is the most convenient way to get a dose of essential nutrients needed for the healthy functioning of the body.

A slow juicer grinds all parts of the vegetables, fruits, herbs, and all other ingredients you put inside the juicer, which increases the amount of juice produced by up to 50% compared to regular centrifugal juicers. This also means the amount of waste produced is significantly less. A company like Omega, known for high-end juicers, must invest significantly in R&D to develop models that can differentiate themselves from competitors with unique features such as cold press technology, higher yield, or easier cleaning mechanisms.

Quality Challenges in the Competitive Juicer Market

Juicers that are able to handle a greater variety of fruits and vegetables, operate more quietly, and are more efficient are becoming more in demand from consumers as a result to remain competitive, manufacturers need to constantly innovate the product that has been a major factor hindering the juicer market growth. Juicers need to be maintained and made sure to be durable, as bad press about products breaking down harms a brand's reputation. For instance, the well-known brand Breville has experienced problems with complaints of motor burnouts on some of its models. To keep the trust of their customers, they had to improve their motor designs and their quality control procedures.

Finding a balance between production costs and retail prices is crucial to maintaining competitiveness and profit margins resulting in slower growth of the juicer market. For instance, low-cost brands like Hamilton Beach, which have found it difficult to maintain quality without significantly sacrificing price, need to exercise extreme caution when managing production costs. This is because labor and material costs are on the rise. Sustaining client happiness and brand loyalty requires offering strong after-sales care and customer support has been a major challenge in the juicer market.

Rising Juicer Sales Driven by Health Trends, Technological Advances, and Environmental Consciousness

Juicer sales are rising quickly thanks to several trends reflecting shifts in consumer tastes, advances in technology, and environmental concerns that have been influencing the market growth. The rise in the interest in preserving the nutritional value of fruits and vegetables while extracting the maximum amount of nutrients from the juicer has been influenced by the juicer market trend. To preserve more vitamins and minerals, juicer manufacturers are concentrating on creating machines that make use of cutting-edge extraction techniques.

Highlighting the health advantages of utilizing cutting-edge juicers and aiming to attract fitness enthusiasts and health-conscious consumers which has driven the growth of the juicer market. Juicer sales have increased as a result of the use of recyclable and sustainable materials in manufacturing as well as the creation of energy-efficient models that appeal to buyers who care about the environment. Include features that reduce waste, like juicers that extract more pulp from fruits and vegetables. Additionally, intelligent functions such as recipe recommendations, app connectivity, and settings change automatically according to the type of produce.

Juicer Market Segment Analysis

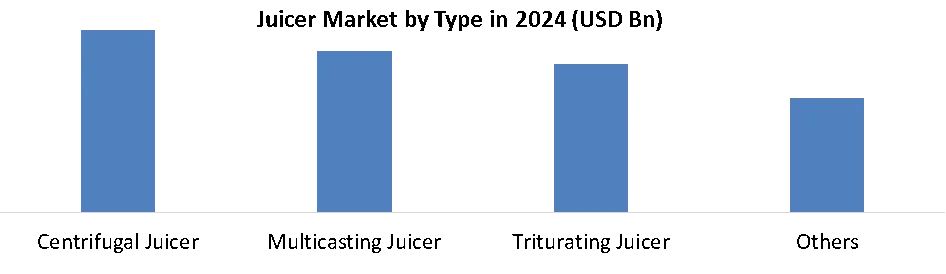

Based on Type, the Centrifugal juicers segment dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. Centrifugal juicers are usually known for their high-speed operation resulting in higher demand. It is convenient to use especially owing to a fast spinning blade that helps to swiftly extract juice from fruits and vegetables have propelled the juicer market growth. For people on the go who want a quick fix of juice in the morning before going to work, this is especially convenient. Simple controls and minimal preparation are standard on most models. Instead of chopping them up into tiny pieces, users can frequently place entire fruits and vegetables into the juicer.

Juicers that masticate or triturate are usually more expensive than those that use centrifugation. They can be purchased by a wider range of people, including those who are new to juicing and may not want to make a large initial investment, thanks to their reduced price. Prominent companies such as Breville have established a robust standing for dependability and excellence throughout time. Customer preference for their centrifugal juicers over less well-known competitors is influenced by their brand trust.

Juicer Market Regional Analysis

Asia Pacific region has dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. The surged awareness related to the health benefits of a healthy diet and consumers of the region incorporating fresh fruit and vegetable juices into their daily routines has been the major driving factor of the juicer market in the Asia Pacific. As juicer is perceived as an essential component in the region it has boosted its demand in the region.

Additionally, the rising trend of social media has been an influencing factor for the juicer market as a health influencer that promotes the benefits of juicing which has driven the market growth. Countries such as Japan, China, and South Korea have a strong culture of health and wellness has accelerated the market growth in the region. Products like green juices and smoothies are particularly popular, leading to a surge in demand for high-quality juicers.

The Asia-Pacific region's major countries' fast-paced urban lifestyles have made people prefer quick and easy ways to get their nutrients. The trend of consuming healthy drinks while on the go is growing, which is fuelling demand for portable and personal juicers. For instance, fast urbanization in China and India has resulted in a growing middle class with hectic schedules. Juicers that are portable and simple to operate are becoming more popular among urban consumers looking for quick and nutritious food options.

Juicers are available to a wider range of consumers thanks to their varied price points. High-end models appeal to wealthy customers, while entry-level models serve those on a tight budget. Strong market leaders with a range of products from entry-level to high-end juicers, like Breville, Philips, and Panasonic, have dominated the market in the Asia Pacific area. Additionally, targeted campaigns during holiday seasons and marketing strategies emphasizing the health benefits of juicing are expected to increase sales.

- India exports most of its Juicer to Australia, Bangladesh, and the United States and is the 2nd largest exporter of Juicer in the World.

- The top 3 exporters of Juicer are China with 68,622 shipments followed by India with 10,227 and South Korea at the 3rd spot with 6,257 shipments.

Juicer Market Competitive Landscape

- On Sept. 5, 2023, Conair LLC announced that it had acquired The Fulham Group, an exclusive maker of Cuisinart Outdoor Products and a long-term business partner. The transaction closed on August 31st and this is Conair's first acquisition since becoming part of American Securities' portfolio of companies.

- On 5th February 2023, Angela Juicers announced the launch of their new website. Angela Juicers is an online store that offers juicers, accessories, and recipes. Angela Juicers offers a wide selection of juicers, from masticating to centrifugal, as well as a variety of accessories.

- On January 10, 2023, Prestige launched a new product named Prestige Plus Atlas 750 W Juicer Mixer Grinder. The newly launched product is a locking system and the company provided a Liquidizing Jar of capacity 1.5 liters in this new product launch. Source: https://www.mordorintelligence.com/industry-reports/global-juicers-market

- On Oct. 24, 2023, Breville, the brand synonymous with innovation and design in premium kitchen appliances, announces the launch of Breville+, a new platform offering over 1,000 dynamic step-by-step video recipes from an unparalleled range of food experts, including The New York Times, America's Test Kitchen, Serious Eats and ChefSteps.

|

Juicer Market Scope |

|

|

Market Size in 2024 |

USD 2.59 Bn. |

|

Market Size in 2032 |

USD 4.31 Bn. |

|

CAGR (2025-2032) |

6.60 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type

|

|

By Category

|

|

|

By Applications

|

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Juicer Market Key Players

- AB Electrolux

- Bajaj Electricals Ltd.

- Borosil Ltd.

- Breville Group Ltd

- Conair

- Hamilton Beach Brands Holding Co.

- Havells India Ltd.

- SGL INDUSTRIES INC

- Koninklijke Philips NV

- The Legacy Companies

- Panasonic Holdings Corp.

- TTK Prestige Ltd.

- Hurom

- Kuvings

- Joyoung

- Supor

- Midea

- Breville

- Sunbeam

- Donlim(Guangdong Xinbao)

- XXX Ltd.

Frequently Asked Questions

Finding a balance between production costs and retail prices has restrained the market growth.

The Market size was valued at USD 2.59 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 6.60 % from 2025 to 2032, reaching nearly USD 4.31 Billion.

The segments covered in the market report are by Type, Category, Applications, and Distribution Channel.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Juicer Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Juicer Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Juicer Market: Dynamics

4.1. Juicer Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Juicer Market Drivers

4.3. Juicer Market Restraints

4.4. Juicer Market Opportunities

4.5. Juicer Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Juicer Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

5.1. Juicer Market Size and Forecast, by Type (2024-2032)

5.1.1. Centrifugal Juicer

5.1.2. Multicasting Juicer

5.1.3. Triturating Juicer

5.1.4. Others

5.2. Juicer Market Size and Forecast, by Category (2024-2032)

5.2.1. Electric Juicer

5.2.2. Manual Juicer

5.3. Juicer Market Size and Forecast, by Applications (2024-2032)

5.3.1. Households

5.3.2. Hotels and Restaurants

5.3.3. Bars

5.3.4. Shops

5.4. Juicer Market Size and Forecast, by Distribution Channel (2024-2032)

5.4.1. Super Market

5.4.2. Specialty Store

5.4.3. Online Stores

5.4.4. Department Stores

5.4.5. Others

5.5. Juicer Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Juicer Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

6.1. North America Juicer Market Size and Forecast, by Type (2024-2032)

6.1.1. Centrifugal Juicer

6.1.2. Multicasting Juicer

6.1.3. Triturating Juicer

6.1.4. Others

6.2. North America Juicer Market Size and Forecast, by Category (2024-2032)

6.2.1. Electric Juicer

6.2.2. Manual Juicer

6.3. North America Juicer Market Size and Forecast, by Applications (2024-2032)

6.3.1. Households

6.3.2. Hotels and Restaurants

6.3.3. Bars

6.3.4. Shops

6.4. North America Juicer Market Size and Forecast, by Distribution Channel (2024-2032)

6.4.1. Super Market

6.4.2. Specialty Store

6.4.3. Online Stores

6.4.4. Department Stores

6.4.5. Others

6.5. North America Juicer Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Juicer Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

7.1. Europe Juicer Market Size and Forecast, by Type (2024-2032)

7.2. Europe Juicer Market Size and Forecast, by Category (2024-2032)

7.3. Europe Juicer Market Size and Forecast, by Applications (2024-2032)

7.4. Europe Juicer Market Size and Forecast, by Distribution Channel (2024-2032)

7.5. Europe Juicer Market Size and Forecast, by Country (2024-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Russia

7.5.8. Rest of Europe

8. Asia Pacific Juicer Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

8.1. Asia Pacific Juicer Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Juicer Market Size and Forecast, by Category (2024-2032)

8.3. Asia Pacific Juicer Market Size and Forecast, by Applications (2024-2032)

8.4. Asia Pacific Juicer Market Size and Forecast, by Distribution Channel (2024-2032)

8.5. Asia Pacific Juicer Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. India

8.5.3. Japan

8.5.4. South Korea

8.5.5. Australia

8.5.6. ASEAN

8.5.7. Rest of Asia Pacific

9. Middle East and Africa Juicer Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

9.1. Middle East and Africa Juicer Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Juicer Market Size and Forecast, by Category (2024-2032)

9.3. Middle East and Africa Juicer Market Size and Forecast, by Applications (2024-2032)

9.4. Middle East and Africa Juicer Market Size and Forecast, by Distribution Channel (2024-2032)

9.5. Middle East and Africa Juicer Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Rest of the Middle East and Africa

10. South America Juicer Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

10.1. South America Juicer Market Size and Forecast, by Type (2024-2032)

10.2. South America Juicer Market Size and Forecast, by Category (2024-2032)

10.3. South America Juicer Market Size and Forecast, by Applications (2024-2032)

10.4. South America Juicer Market Size and Forecast, by Distribution Channel (2024-2032)

10.5. South America Juicer Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. AB Electrolux

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Bajaj Electricals Ltd.

11.3. Borosil Ltd.

11.4. Breville Group Ltd

11.5. Conair

11.6. Hamilton Beach Brands Holding Co.

11.7. Havells India Ltd.

11.8. SGL INDUSTRIES INC

11.9. Koninklijke Philips NV

11.10. The Legacy Companies

11.11. Panasonic Holdings Corp.

11.12. TTK Prestige Ltd.

11.13. Hurom

11.14. Kuvings

11.15. Joyoung

11.16. Supor

11.17. Midea

11.18. Breville

11.19. Sunbeam

11.20. Donlim(Guangdong Xinbao)

11.21. XXX Ltd.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook