In-Flight Catering Services Market Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics, Segmentation

Global In-Flight Catering Services market was valued at USD 18.92 Billion in 2025, growing from USD 40.59 Billion in 2032. It is estimated that the Global Market is to grow at a CAGR of 11.52% over the forecast period.

Format : PDF | Report ID : SMR_1169

In-Flight Catering Services Market Overview:

The COVID-19 pandemic has triggered a full-fledged crisis, with travel restrictions and airline cancellations imposed around the world in an effort to halt the virus's spread. Some airlines supplied cold meals/pre-packaged food to their passengers with bottled water due to safety regulations. Even if the sector showed signs of improvement in 2021, passenger traffic, particularly foreign traffic, was much lower than it had been prior to COVID-19. However, airlines in the North American and European areas have begun to reintroduce their pre-COVID-19 lunch menus.

Though caterers have traditionally placed a premium on food safety, the pandemic has introduced new dynamics and critical safety standards to professional commercial aircraft kitchens, as old protocols were geared to combat foodborne illnesses.

The pandemic is also to blame for raising catering standards in food safety, cleaning, and sanitizing, however this has resulted in inflight caterers paying greater costs in order to maintain optimal standards. As airline rivalry heats up, several tactics are being implemented to improve the in-flight meal experience. These tactics cover everything from ordering to providing food. Such events may have a long-term impact on the market's prospects over the forecast period.

To get more Insights: Request Free Sample Report

In-Flight Catering Services Market Dynamics:

The meals come in a wide range of flavors and differ from one company to the next and from one region to the next. Various guidelines and regulations regulate the inflight catering provider in providing passengers with high-quality food and food products. EgyptAir, Emirates, Etihad Airways, Garuda Indonesia, and other airlines, for example, delivered Halal-certified meals free of pork and alcohol in conformity with Islamic standards. Non-Muslim travelers can still get wine from Emirates, Etihad, and Qatar if they ask for it. A modest snack or beverage in short-haul economy class to a seven-course gourmet dinner in first class on a long-haul flight are all options. The food on offer frequently incorporates characteristics of local cuisine, sometimes from both the destination and origin nations.

An exponential increase in the number of passengers travelling by air is predicted to be the key driver of the in-flight catering service industry's expansion in recent years. Despite slower economic growth in some nations, the number of domestic and international passengers flying domestically and internationally has increased, increasing market growth. However, industry growth is likely to be strong because to an increase in flyers' expectations for nutritious and healthy cuisine. Furthermore, the main airline companies' increased embrace of online platforms for meal booking is likely to enhance meal booking. Furthermore, as automation and inflight catering management have grown in popularity, caterers and airlines have been able to collaborate and provide a rich passenger experience at a low cost. Furthermore, increased investment in the aviation sector is likely to benefit the catering service market, as global in-flight catering companies will continue to expand and significantly grow their market share.

Airlines employ in-flight culinary services to improve their passengers' in-flight experience. Leading airlines throughout the world are applying innovative technologies to improve their in-flight catering services while also introducing new food options that cater to clients' culinary preferences. Furthermore, they are following a unique trend of providing regional and continental food alternatives to their passengers, which helps them meet specific meal preferences and so increases passenger happiness. Furthermore, the majority of airline caterers and in-flight catering service providers are strengthening their supply chain management (SCM) in order to obtain high-quality products while keeping their in-flight catering operations cost-effective.

The growing number of people opting for air travel is likely to increase demand for in-flight catering services, fueling the in-flight catering market's rise over the forecast period. According to the IATA (International Air Transport Association), by the end of 2036, more than seven billion passengers would have chosen air travel, with a 3.6 percent year-on-year increase.

In-Flight Catering Services Market Segment Analysis:

By Aircraft Class, In-Flight Catering Services are segmented into Economy Class, Business Class, and First Class. In 2025, the economy class sector commanded more than 60% of the market share, owing to rising consumer preference for economy class for short to medium length travel distances. Over the last few years, APAC has experienced a rise in disposable income and middle-class population, boosting demand for economy class aeroplane seating in the industry.

By Source, In-Flight Catering Services are segmented into In-House and Outsource. By 2032, the outsourcing section of the in-flight catering services industry will be worth USD 16 billion. Due to the availability of a wide choice of international cuisines and meals, outsourcing in-flight catering service is expected to be the favored option for the majority of airlines and private aircraft over the forecast time period. Government rules governing food safety and hygiene will increase the need for outsourced in-flight catering services, which require a lot of food safety certification. Major airlines have solid contract relationships with in-flight catering service providers, which will boost demand for outsourced food products during the forecast period.

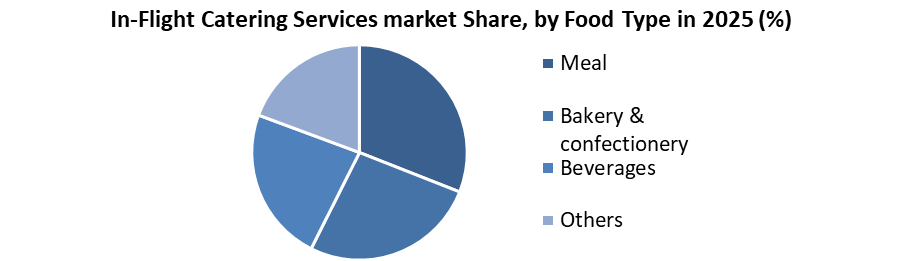

By Food Type, In-Flight Catering Services are segmented into Meal, Bakery & Confectionery, Beverages and Others. In 2025, the meal category accounted for 45 percent of total sales. Across airlines, classes, and trip lengths, in-flight meals vary in quantity, quality, and expense. Following the proper menu design and preparation procedure, safety precautions are implemented. Airline chefs produce meals in land-based kitchens, which are then reheated and served to passengers by flight attendants. To keep the aroma, color, flavor, and look of the components, careful attention to cooking procedures is paid. In order to entice consumers, airlines are also offering a variety of meals, including continental delicacies.

In-Flight Catering Services Market Regional Insights:

Despite the fact that North American airlines' full-year passenger traffic plummeted by 65.6 percent compared to 2019, the area still had the world's greatest share of passenger traffic (RPK), accounting for around 32.6 percent of worldwide RPKs, according to IATA. As passenger traffic grows in 2021, numerous airlines in the region are resuming transatlantic routes with inflight menus similar to those available prior to COVID-19.

Each state's diet in North America differs significantly. The dietary habits of the two largest North American countries, the United States and Canada, are vastly different. In Canada, the Quebec area has a different dietary intake than the rest of the provinces. The differences between smaller countries on the continent are considerably more pronounced. As a result, carriers must plan and stock food in accordance with their routes and the region in which they operate. However, there is a growing trend toward consuming nutritious foods across the continent, particularly in the United States. More over a quarter of Americans still eat fast food every day, but the figure is steadily declining. Healthy eating has gained a lot of traction. Inflight catering has seen a surge in demand for foods including yoghurt, poultry, sandwiches, and fresh fruits. Aside from that, the country is a big market for chocolates, bakeries, and other sweets. The demand for low-calorie meals has resulted in a substantial shift in the food options available on planes.

Following the outbreak of the COVID-19 pandemic, new quality control measures in the region's kitchens were introduced to ensure that no infection was transmitted via onboard food. In addition, airlines made significant changes to their in-flight catering services in 2020 and the first half of 2021. As the situation improved and new safety measures were implemented, airlines reopened certain lounges and extended their onboard food and beverage services. During the forecast period, such advancements are expected to propel the North American region's growth.

The report aims to provide industry stakeholders with a comprehensive analysis of the In-Flight Catering Services market. The report includes the most dominant trends in the In-Flight Catering Services market and how these trends affect new business investment and market development during the forecast period. The report also helps to understand the dynamics of the In-Flight Catering Services market and the competitive structure of the market by examining market leaders, market followers, and regional players.

Qualitative and quantitative data provided in the In-Flight Catering Services Market Report will drive market-influencing factors and industry and market growth, which market segments and regions are expected to grow at a faster rate. The forecast period is designed to help you understand the critical areas of opportunity to do. The report also includes the competitive landscape of key industry players, as well as recent developments in the In-Flight Catering Services market. The report looks at factors such as company size, market share, market growth, sales, production, and profits of key players in the In-Flight Catering Services market.

The document affords Porter's Five Force Model, which facilitates designing the enterprise techniques withinside the marketplace. The Report facilitates in figuring out what number of competitors are existing, who they are, and the way their product exceptional is withinside the Global In-Flight Catering Services marketplace. The Report additionally analyses if the Global In-Flight Catering Services marketplace is straightforward for a brand-new participant to benefit a foothold withinside the marketplace, do they input or go out the marketplace often if the marketplace is ruled via way of means of some Players, etc.

The document additionally consists of a PESTEL Analysis, which aids withinside the improvement of enterprise techniques. Political variables assist in identifying how an awful lot a central authority can have an impact on the Global In-Flight Catering Services marketplace. Economic variables useful resource withinside the evaluation of monetary overall performance drivers which have an effect at the Global In-Flight Catering Services marketplace. Understanding the effect of the encircling surroundings and the have an impact on of environmental issues at the Global In-Flight Catering Services marketplace is aided via way of means of felony factors.

In-Flight Catering Services Market Scope:

|

In-Flight Catering Services Market |

|

|

Market Size in 2025 |

USD 18.92 Bn. |

|

Market Size in 2032 |

USD 40.59 Bn. |

|

CAGR (2026-2032) |

11.52% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Aircraft Class

|

|

By Source

|

|

|

By Food Type

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

In-Flight Catering Services Market Key Players:

- Gate Gourmet (Switzerland)

- Saudi Airlines Catering (Saudi Arabia)

- LSG Group (Germany)

- Dnata (UAE)

- Servair (France)

- Goddard Catering Group (U.S.)

- Newrest Catering (France)

- Royal Holdings (Japan)

- Journey Group PLC (U.K.)

- DO & CO (Austria)

- SATS Ltd (Singapore)

- Emirates Flight Catering (UAE)

- ANA Catering Service Co. Ltd. (U.K.)

Regional Breakdown:

Asia Pacific In-Flight Catering Services Market: Industry Analysis and Forecast (2024-2030)

Europe In-Flight Catering Services Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

The In-Flight Catering Services Market is expected to grow at a CAGR of 11.52%.

U.S. is dominating the market by having the highest share.

Economy Class Segment.

USD 40.59 Billion.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. In-Flight Catering Services Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global In-Flight Catering Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. In-Flight Catering Services Market: Dynamics

4.1. In-Flight Catering Services Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. In-Flight Catering Services Market Drivers

4.3. In-Flight Catering Services Market Restraints

4.4. In-Flight Catering Services Market Opportunities

4.5. In-Flight Catering Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. In-Flight Catering Services Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2025-2032)

5.1.1. Economy class

5.1.2. Business class

5.1.3. First class

5.2. In-Flight Catering Services Market Size and Forecast, by Source (2025-2032)

5.2.1. In-house

5.2.2. Outsource

5.3. In-Flight Catering Services Market Size and Forecast, by Food Type (2025-2032)

5.3.1. Meal

5.3.2. Bakery & confectionery

5.3.3. Beverages

5.3.4. Others

5.4. In-Flight Catering Services Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America In-Flight Catering Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2025-2032)

6.1.1. Economy class

6.1.2. Business class

6.1.3. First class

6.2. North America In-Flight Catering Services Market Size and Forecast, by Source (2025-2032)

6.2.1. In-house

6.2.2. Outsource

6.3. North America In-Flight Catering Services Market Size and Forecast, by Food Type (2025-2032)

6.3.1. Meal

6.3.2. Bakery & confectionery

6.3.3. Beverages

6.3.4. Others

6.4. North America In-Flight Catering Services Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe In-Flight Catering Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2025-2032)

7.2. Europe In-Flight Catering Services Market Size and Forecast, by Source (2025-2032)

7.3. Europe In-Flight Catering Services Market Size and Forecast, by Food Type (2025-2032)

7.4. Europe In-Flight Catering Services Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific In-Flight Catering Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2025-2032)

8.2. Asia Pacific In-Flight Catering Services Market Size and Forecast, by Source (2025-2032)

8.3. Asia Pacific In-Flight Catering Services Market Size and Forecast, by Food Type (2025-2032)

8.4. Asia Pacific In-Flight Catering Services Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa In-Flight Catering Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2025-2032)

9.2. Middle East and Africa In-Flight Catering Services Market Size and Forecast, by Source (2025-2032)

9.3. Middle East and Africa In-Flight Catering Services Market Size and Forecast, by Food Type (2025-2032)

9.4. Middle East and Africa In-Flight Catering Services Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America In-Flight Catering Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2025-2032)

10.2. South America In-Flight Catering Services Market Size and Forecast, by Source (2025-2032)

10.3. South America In-Flight Catering Services Market Size and Forecast, by Food Type (2025-2032)

10.4. South America In-Flight Catering Services Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Gate Gourmet (Switzerland)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Saudi Airlines Catering (Saudi Arabia)

11.3. LSG Group (Germany)

11.4. Dnata (UAE)

11.5. Servair (France)

11.6. Goddard Catering Group (U.S.)

11.7. Newrest Catering (France)

11.8. Royal Holdings (Japan)

11.9. Journey Group PLC (U.K.)

11.10. DO & CO (Austria)

11.11. SATS Ltd (Singapore)

11.12. Emirates Flight Catering (UAE)11.13. ANA Catering Service Co. Ltd. (U.K.)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook