Europe In-Flight Catering Services Market- Industry Analysis and Forecast (2025-2032)

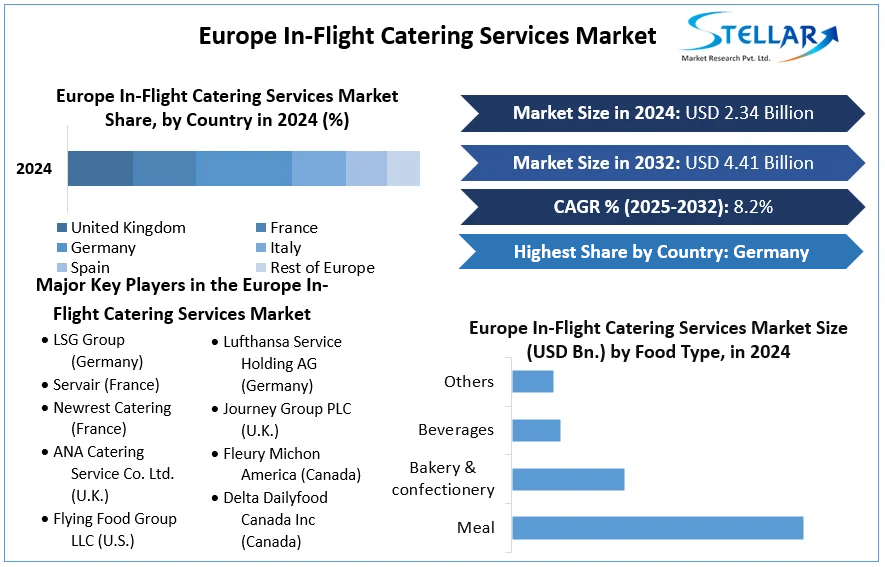

The Europe In-Flight Catering Services Market is estimated to grow at a CAGR of 8.2% during the forecast period. Market is expected to reach US$ 4.41 Bn. in 2032 from US$ 2.34 Bn. in 2024.

Format : PDF | Report ID : SMR_1255

Europe In-Flight Catering Services Market Overview:

One of the major aviation businesses that was significantly damaged by the COVID-19 outbreak was Europe. Airlines in the region had to drastically reduce their aircraft operations and limit their in-flight services, including meals. Nonetheless, passenger traffic is predicted to grow in 2021 compared to the previous year, with a full recovery by 2024. Airlines in the region are gradually restoring inflight food menus as passenger volume returns to pre-COVID-19 levels.

Currently, in the European region, the focus on food quality and offerings is particularly pronounced in economy class aeroplanes, which have grown notorious for serving subpar meals over time. Passengers in economy class contribute to airline income, and they remain the most important class of passengers for airlines. Most carriers are working to improve the quality of the meals they offer in order to maintain their market share.

Airlines are cooperating with well-known chefs to make a difference in the face of increasing competition on profitable long-distance routes. Partnering with celebrity chefs may help airlines create unique cuisine to attract customers and grow their market share. During the forecast period, this is expected to fuel the growth of the European inflight catering market.

Europe In-Flight Catering Services Market Dynamics:

- Though caterers have always prioritized food safety, the pandemic has introduced new dynamics and critical safety standards to professional commercial aircraft kitchens, as the previous protocols were mainly geared to combat foodborne illnesses. The pandemic is also to blame for raising catering standards in food safety, cleaning, and sanitizing, however this has resulted in inflight caterers paying greater costs in order to maintain optimal standards.

- As airline rivalry heats up, several tactics are being implemented to improve the in-flight meal experience. These tactics cover everything from ordering to providing food. Such events may have a long-term impact on the market's prospects over the forecast period.

To get more Insights: Request Free Sample Report

- Because of the existence of major airlines such as British Airways and EasyJet, the United Kingdom has the greatest market share in Europe. With the addition of additional destinations, these airlines are aiming to improve their global connection. As a result, new menus are being introduced onboard aircraft.

- Major businesses in the aviation industry are heavily investing in the United Kingdom and taking advantage of the country's prospects. For example, Alpha LSG and Emirates struck a deal in March 2020 to provide six daily flights from London-Heathrow Airport to Dubai Airport.

Europe In-Flight Catering Services Market Segment Analysis:

Based on Aircraft Class, the Europe In-Flight Catering Services Market is segmented into Economy Class, Business Class, and First Class. Among frequent flyers, Economy Class is still the favorite option, hence dominating the market. Low-cost carriers are expected to generate approximately US$ 10 billion in Global in-flight food revenue by the end of 2032. For short- and medium-haul portions, LCCs are commonly favored. To gain regional brand share, some of these LCCs are providing premium in-flight culinary services. Food and in-flight catering services are also used as a marketing technique by low-cost airlines.

Based on Source, The Europe In-Flight Catering Services market is segmented into In-House and Outsource. The market for in-flight food services is expected to be dominated by the outsourcing segment. Because of the availability of a wide choice of international cuisines and meals, outsourcing in-flight catering service is likely to be the favored option for the majority of airlines and private aircraft in Europe over the forecast period. Government-imposed food safety and hygiene rules would increase the demand for outsourced in-flight catering services, which would necessitate substantial food safety certification. Major airlines have strong contracts with in-flight catering service providers, resulting in increased demand for outsourced food products over the forecast period.

Based on Food Type, The In-Flight Catering Services market is segmented into Meal, Bakery & Confectionery, Beverages and Others. The bakery and confectionary segment now lead the European inflight catering business, and it is anticipated to do so for the foreseeable future, as travelers from the region prefer bread and other baked goods in most of their eating compared to passengers from other regions. Domestic and intra-Europe travel are expected to grow significantly in 2024, with a total market share of more than 60%. The average flight duration has increased from 45 to 60 minutes as a result of this adjustment in operations. The guests' preferences have changed as a result of such short flights, resulting in an increase in demand for bakery and confectionery items. Sweet and sour bread, flavored croissants, and cheese confectionaries had the biggest market share among bakery products. However, several regional airlines are transforming complimentary services into retail services, which might help them raise revenues and offset pandemic losses. As part of its recovery strategies from pandemic losses, Lufthansa began charging customers in Economy and Premium Economy on long-haul flights for mid-flight food and booze in December 2021. To boost onboard retail, the airline discontinued free snacks and drinks for economy class customers on short-haul itineraries earlier in 2024. The addition of additional snacks and sweets to their menu is expected to help the market flourish appropriately.

Europe In-Flight Catering Services Market Regional Insights:

UK air arrivals were 28.60 million in 2020 and 22.84 million in 2021, according to Advance Passenger Information (API) and Border and Immigration Transaction Data (BITD). In comparison to 2020, flight arrivals declined by 20.1 percent in 2021. However, compared to 2020, air arrivals climbed by almost 88 percent in the second half of 2021. Major airlines like British Airways and EasyJet are currently increasing their worldwide connectivity with the introduction of new routes, which is likely to offer new cuisines onboard aircraft as the country's aviation industry recovers gradually. As the country's airlines strive to improve their culinary offerings based on season and flight destination, collaborating with celebrity chefs allows them to make changes to their menus without incurring huge costs. In this regard, Virgin Atlantic debuted their new autumn menu options in October 2021, as well as reintroduced aboard favorites across all cabins, including new meal, beverage, and snack options. Major corporations are dramatically increasing their investments in the United Kingdom. For example, Alpha LSG and Emirates struck a deal in March 2020 to provide six daily flights from London-Heathrow Airport to Dubai Airport. The airline's regional operation in the United Kingdom is already serviced by the company, which flies from London to Gatwick, Stansted, Manchester, Birmingham, Newcastle, and Glasgow. These advancements are likely to aid the country's income growth over the forecast period.

The qualitative and quantitative data provided in the Europe In-Flight Catering Services market report will assist in understanding which market segments, regions, and factors affecting the Europe In-Flight Catering Services market, as well as key opportunity areas, will drive the industry and market growth over the forecast period. The Europe In-Flight Catering Services report also includes the competitive landscape of key industry players, as well as their recent developments in the Europe In-Flight Catering Services market. The Europe In-Flight Catering Services report investigates factors such as company size, market share, market growth, revenue, production volume, and profits of the market's key players.

The report includes Porter's Five Force Model, which aids in the development of market business strategies. The report assists in determining the number of competitors, who they are, and the quality of their products in the Europe In-Flight Catering Services market. The report also examines whether it is easy for a new player to gain a foothold in the Europe In-Flight Catering Services market, whether they enter or exit the market on a regular basis, whether the market is dominated by a few players, and so on.

The Europe In-Flight Catering Services report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Europe In-Flight Catering Services market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Europe In-Flight Catering Services market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Europe In-Flight Catering Services market is aided by legal factors.

Europe In-Flight Catering Services Market Scope:

|

Europe In-Flight Catering Services Market |

|

|

Market Size in 2024 |

USD 2.34 Bn. |

|

Market Size in 2032 |

USD 4.41 Bn. |

|

CAGR (2025-2032) |

8.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Aircraft Class

|

|

By Source

|

|

|

|

By Food Type

|

|

|

By Country

|

Europe In-Flight Catering Services Market Key Players

- LSG Group (Germany)

- Servair (France)

- Newrest Catering (France)

- ANA Catering Service Co. Ltd. (U.K.)

- Flying Food Group LLC (U.S.)

- Gate group (Switzerland)

- Lufthansa Service Holding AG (Germany)

- Journey Group PLC (U.K.)

- Fleury Michon America (Canada)

- Delta Dailyfood Canada Inc (Canada)

Frequently Asked Questions

U.K. is expected to hold the highest share in Europe In-Flight Catering Services Market.

The Europe In-Flight Catering Services Market is expected to grow at a CAGR of 8.2% during the forecast period. Europe In-Flight Catering Services Market is expected to reach US$ 4.41 Bn. in 2032 from US$ 2.34 Bn in 2024

1. Europe In-Flight Catering Services Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe In-Flight Catering Services Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Europe In-Flight Catering Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Europe In-Flight Catering Services Market: Dynamics

4.1. Europe In-Flight Catering Services Market Trends

4.2. Europe In-Flight Catering Services Market Drivers

4.3. Europe In-Flight Catering Services Market Restraints

4.4. Europe In-Flight Catering Services Market Opportunities

4.5. Europe In-Flight Catering Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Europe In-Flight Catering Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Europe In-Flight Catering Services Market Size and Forecast, by Aircraft Class (2024-2032)

5.1.1. Economy class

5.1.2. Business class

5.1.3. First class

5.2. Europe In-Flight Catering Services Market Size and Forecast, by Source (2024-2032)

5.2.1. In-house

5.2.2. Outsource

5.3. Europe In-Flight Catering Services Market Size and Forecast, by Food Type (2024-2032)

5.3.1. Meal

5.3.2. Bakery & confectionery

5.3.3. Beverages

5.3.4. Others

5.4. Europe In-Flight Catering Services Market Size and Forecast, by Country (2024-2032)

5.4.1. U.K.

5.4.2. Germany

5.4.3. France

5.4.4. Russia

5.4.5. Rest of Europe

6. Company Profile: Key Players

6.1. LSG Group (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Servair (France)

6.3. Newrest Catering (France)

6.4. ANA Catering Service Co. Ltd. (U.K.)

6.5. Flying Food Group LLC (U.S.)

6.6. Gate group (Switzerland)

6.7. Lufthansa Service Holding AG (Germany)

6.8. Journey Group PLC (U.K.)

6.9. Fleury Michon America (Canada)

6.10. Delta Dailyfood Canada Inc (Canada)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook