Heated Tobacco Products Market - Global Industry Analysis and Forecast (2025-2032)

Heated Tobacco Products Market size was valued at USD 36.70 Bn. in 2025 and the total Heated Tobacco Products revenue is expected to grow at a CAGR of 52.17 % from 2025 to 2032, reaching nearly USD 1055.20 Bn. by 2032.

Format : PDF | Report ID : SMR_1758

Heated Tobacco Products Market Overview:

Heated tobacco products (HTPs) are tobacco products that require the use of an electronic device to heat an insert or pod of compressed tobacco (tobacco insert). Inserts come in Flavors including menthol, vanilla, and a variety of fruit Flavors.

The research report encompasses the prevailing trends embraced by major manufacturers in the Heated Tobacco Products HTPs Market, such as the adoption of innovative technologies, government investments in research and development, and a growing emphasis on sustainability. The report also provides detailed information on the competitive landscape, which includes the market position and market share of the key players operating in the HTPs market.

Additionally, the report provides an in-depth analysis of the current and future trends in the HTPs market. It also offers a wide-ranging analysis of the key market segments, regional landscape, and value chain of the HTPs market and includes strategic recommendations for the success of the HTPs market. The report provides an overview of the different types of HTPs and their respective product offerings in the market. The information helps to identify the key product segments and understand the market potential in different regions.

- The HTP market is currently dominated by three tobacco companies such as Philip Morris International (PMI), Japan Tobacco International (JTI), and British American Tobacco (BAT). The leading brand, iQOS by PMI, is currently sold in over 40 countries.

To get more Insights: Request Free Sample Report

Heated Tobacco Products Market Dynamics:

Rising Health Concerns to Drive the Growth of Heated Tobacco Products Market

The health risks related to cigarettes are expected to drive the adoption of the heated tobacco Product Market. Cigarette smoking is associated with a heightened risk of lung cancer, heart disease, and numerous other respiratory and cardiovascular health issues while chewing tobacco increases the risk of gum disease and health problems. Rising demand for less harmful alternatives to traditional cigarettes, growing product innovations by manufacturers, and high demand by the young population followed by companies’ initiatives to increase production are factors propelling the growth of Heated Tobacco Products.

E-cigarettes and Alternative Tobacco Products Impact Heated Tobacco Market Growth

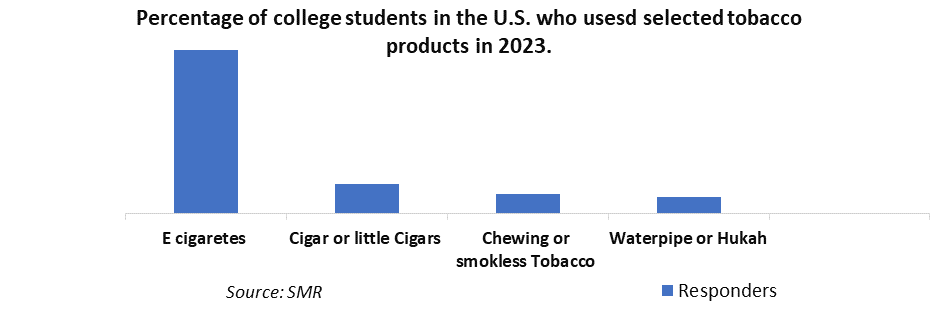

The rising acceptance of e-cigarettes is expected to restrain the adoption of HTPs and hinder the growth of the market. E-cigarettes do not contain tobacco and consist of relatively lesser amounts of harmful agents than conventional tobacco products. Such benefits are expected to increase the adoption of e-cigarettes and hinder the growth of the global heated tobacco products market.

The rising popularity of alternative tobacco products such as E-cigarettes, chewing tobacco, water smoking, dissolvable tobacco, etc is also restraining the Heated Tobacco Products Market. Chewing tobacco is usually a highly fermented and liquored form of tobacco that is designed to be chewed, not smoked. It’s supplied in long strands of very coarsely shredded leaves, or the form of rolls, sticks, strips, cubes, and blocks.

Heated Tobacco Products Market Segment Analysis:

By Product Type, Tobacco sticks, also known as heated tobacco units. The units of tobacco are inserted into a heated tobacco device. The device warms the tobacco unit without combustion, allowing the user to draw on it to enjoy the flavor of heated tobacco. Philip Morris International (PMI) offers a range of tobacco sticks manufactured for exclusive use with each of the heated tobacco holders. Capsule heat sticks are a key innovation for KT&G’s attempt to attain market share for its HTPs in Korea. IQOS heat sticks (HEETS) include a variety of flavors (tobacco, menthol, bubble gum, and lime), and no IQOS heat sticks include capsules. IQOS is authorized by the FDA for sale in the U.S. In January 2023, the FDA authorized three new versions of the HeatSticks in “Sienna,” “Bronze,” and “Amber.

- In October 2023, similarly to PMI, BAT announced that it had launched a new non-tobacco stick for glo, called veo, made with Rooibos tea leaves, and infused with nicotine and flavors

Heated Tobacco Products Market Regional Analysis:

North America held the largest share in 2024 of the Heated Tobacco Products Market. Heated Tobacco Products are new in the United States. The U.S. Food and Drug Administration (FDA) has authorized only IQOS and Eclipse heated tobacco products for sale in the country. Sales of other heated tobacco products are growing globally. In 2024, 1.0% of U.S. middle and high school students, combined, reported having used heated tobacco products. 40,000 US adults found that over 8% were aware of HTPs, but only 0.5% using them.

- Canada, Belarus, Moldova, and Georgia have legislated to include HTPs within their tobacco control laws so that both cigarettes and heating devices are covered by advertising bans, smoke-free laws, and, for Canada, the plain packaging law

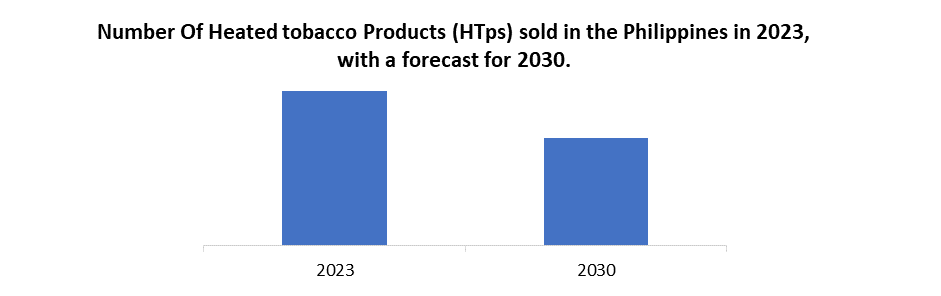

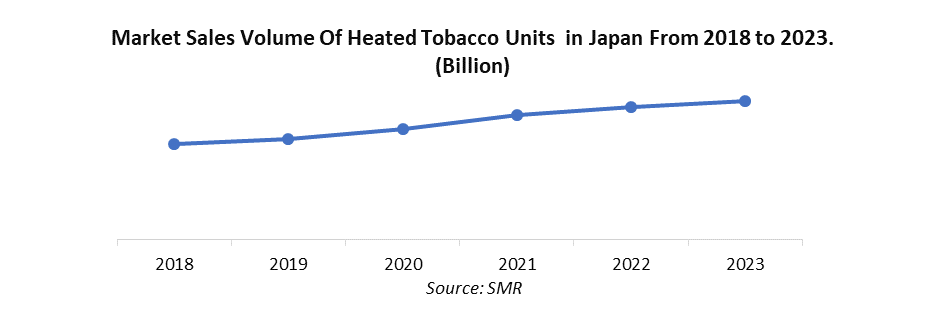

HTPs are available in at least 57 countries across Europe, North and South America, Eurasia, and East Asia. The market for HTPs in Africa and the Middle East is small but growing. Asia Pacific is the fastest-growing region in the Heated Tobacco Products Market. Japan has the highest prevalence of heated tobacco product use and is the country where heated tobacco products have captured the highest share of the tobacco market, allowing us to evaluate the real-world effects of HTPs on the combustible tobacco market. Japan Tobacco decided to spend 300 billion ($2.25 billion) in the next three years to boost its heated tobacco stick products, with 200 billion pegged for marketing the sticks outside of Japan.

BAT, PMI, and JTI have used Japan, and to a lesser degree South Korea, as trial markets for their HTPs. Both tobacco markets are dominated by companies that were former state monopolies, Japan Tobacco and Korea Tomorrow & Global Corporation (KT&G), with PMI in second place in both cases. Both had very high smoking rates and a preference for low-tar brands, which may make alternatives more appealing

Heated Tobacco Products Market Competitive Analysis:

- In 2023, KT&G entered a fifteen-year partnership agreement with PMI to expand its lil HTP line in the global market. PMI is also licensed to market lil SOLID 1.0 and lil SOLID 2.0.

- In September 2023, PMI announced that it had developed a product for IQOS devices called LEVIA containing “non-tobacco substrate infused with nicotine and tobacco, menthol and fruit flavorings.4960 It appeared that this was developed to circumvent regulations that apply to heat sticks containing tobacco, specifically bans on flavors.

Heated Tobacco Products Market Scope:

|

Heated Tobacco Products Market |

|

|

Market Size in 2024 |

USD 36.70 Bn. |

|

Market Size in 2032 |

USD 1055.20 Bn. |

|

CAGR (2025-2032) |

52.17 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Stick Leaf |

|

By Distribution Channel Online Retail stores |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Heated Tobacco Products Market Key Players:

- Philip Morris International - United States

- British American Tobacco - United Kingdom

- Imperial Brands - United Kingdom

- Japan Tobacco International - Switzerland

- Altria Group - United States

- PMFTC Inc. (Philip Morris Fortune Tobacco Corporation) - Headquarters: Manila, Philippines

- Korea Tobacco & Ginseng Corporation - South Korea

- Taiwan Tobacco & Liquor Corporation - Taiwan

- JUUL Labs - United States

- PAX Labs - United States

- Japan Tobacco Inc. - Japan

Frequently Asked Questions

Growing Demand of E-cigarettes is challenge for the Heated Tobacco Products market growth.

The Market size was valued at USD 36.70 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 52.17% from 2025 to 2032, reaching nearly USD 1055.20 Billion.

The segments covered in the market report are by Product Type and Distribution Channel.

1. Heated Tobacco Products Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Heated Tobacco Products Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Heated Tobacco Products Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. Total Production (2024)

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2024)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Heated Tobacco Products Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Heated Tobacco Products Market Size and Forecast by Segments (by Value USD Million)

5.1. Heated Tobacco Products Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Stick

5.1.2. Leaf

5.2. Heated Tobacco Products Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Online

5.2.2. Retail stores

5.3. Heated Tobacco Products Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Heated Tobacco Products Market Size and Forecast (by Value USD Million)

6.1. North America Heated Tobacco Products Market Size and Forecast, By Product Type (2024-2032)

6.1.1. Stick

6.1.2. Leaf

6.2. North America Heated Tobacco Products Market Size and Forecast, By Distribution Channel (2024-2032)

6.2.1. Online

6.2.2. Retail stores

6.3. North America Heated Tobacco Products Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Heated Tobacco Products Market Size and Forecast (by Value USD Million)

7.1. Europe Heated Tobacco Products Market Size and Forecast, By Product Type (2024-2032)

7.2. Europe Heated Tobacco Products Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Europe Heated Tobacco Products Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Heated Tobacco Products Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Heated Tobacco Products Market Size and Forecast, By Product Type (2024-2032)

8.2. Asia Pacific Heated Tobacco Products Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Asia Pacific Heated Tobacco Products Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Heated Tobacco Products Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Heated Tobacco Products Market Size and Forecast, By Product Type (2024-2032)

9.2. Middle East and Africa Heated Tobacco Products Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. Middle East and Africa Heated Tobacco Products Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Heated Tobacco Products Market Size and Forecast (by Value USD Million)

10.1. South America Heated Tobacco Products Market Size and Forecast, By Product Type (2024-2032)

10.2. South America Heated Tobacco Products Market Size and Forecast, By Distribution Channel (2024-2032)

10.3. South America Heated Tobacco Products Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Philip Morris International - United States

11.1.1. Company Overview

11.1.2. Product Segment

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. British American Tobacco - United Kingdom

11.3. Imperial Brands - United Kingdom

11.4. Japan Tobacco International - Switzerland

11.5. Altria Group - United States

11.6. PMFTC Inc. (Philip Morris Fortune Tobacco Corporation) - Headquarters: Manila, Philippines

11.7. Korea Tobacco & Ginseng Corporation - South Korea

11.8. Taiwan Tobacco & Liquor Corporation - Taiwan

11.9. JUUL Labs - United States

11.10. PAX Labs - United States

11.11. Japan Tobacco Inc. - Japan

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook