Germany IVF Services Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

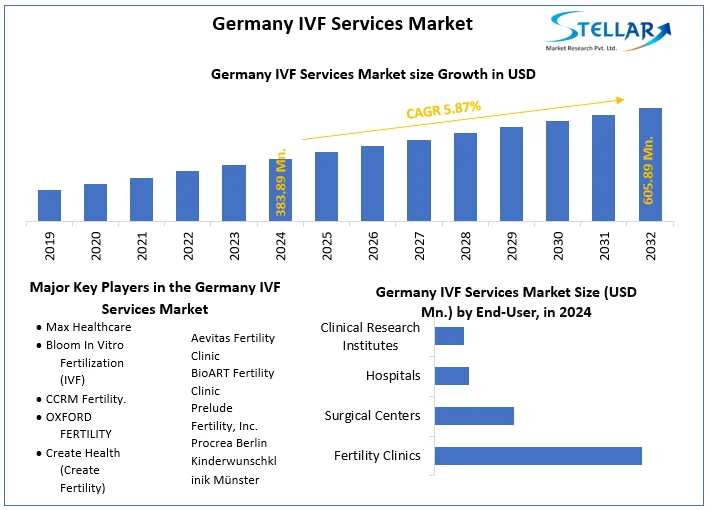

The German IVF Services Market size was valued at USD 383.89 Million in 2024. The total German IVF Services Market revenue is expected to grow at a CAGR of 5.87 % from 2025 to 2032, reaching nearly USD 605.89 Million in 2032.

Format : PDF | Report ID : SMR_1587

Germany IVF Services Market Overview

The Stellar Report Comprehensive research on the German in vitro fertilization (IVF) services market shows a significant increase in recent years. The increase is attributed to factors such as rising infertility rates, advances in reproductive technologies, and increased awareness of fertility treatments. Private IVF clinics grow because of limited public coverage and high demand, creating the path for growth, mergers, and acquisitions. The growing demand for fertility technologies such as PGD, embryo culture, and genetic testing drives investments in R&D. Financial assistance, psychological therapy, and fertility coaching are in great demand as patients navigate the complications of IVF. Demographic trends show an increasing intermediate age for first-time mothers and a growing public acceptance of IVF.

Technological advancements improve success rates and increase treatment options through tailored diagnostics. Increased awareness and educational activities eliminate stigma while distributing factual information about IVF. Potential government policy changes could increase insurance coverage or create financial incentives to encourage fertility treatments. Increasing infertility rates, influenced by economic status and environmental variables are expected to lead to the sustained need for IVF procedures. Ongoing technological developments, particularly in embryo cultivation and genetic testing, help to increase success rates and attract a larger patient base. Destigmatization of IVF promotes higher societal acceptability and openness to therapy. Government actions, such as increased insurance coverage, are estimated to further drive market growth.

To get more Insights: Request Free Sample Report

Growing Demand for IVF Services in Germany

Germany has witnessed a growing demand for IVF Services because of several factors such as delayed childbearing, rising infertility rate, and increased awareness about assisted reproductive technologies. In Germany, a growing trend of postponing parenting inspired by job goals and financial stability leads to an increased dependence on IVF. Environmental effects, changing lifestyles, and health difficulties all contribute to the increased fertility rate, which drives up demand for IVF. Greater awareness and societal acceptance combined with technology developments such as PGD improve success rates and make IVF a possibility for a broader range of couples.

According to Stellar Research, In Germany, Public health insurance covers a restricted number of IVF cycles and only under certain conditions. Only 8.9% of cycles were refunded, showing the dependence on private funding and its impact on market dynamics.

High Cost of IVF Services

The financial burden of Germany's IVF environment is significant, with an average cycle costing $XX Mn, which is frequently exceeded by out-of-pocket payments due to insufficient governmental assistance. The burden is expected to discourage patients, reducing demand and possibly delaying family planning. Elevated debt and financial stress influence overall well-being, creating imbalances that disproportionately affect low-income families and people. Increased treatment costs in Germany's IVF business reduce the market size by eliminating people who cannot afford it. The implications include less revenue for clinics, fewer chances for research and development, and the probable closure or scaling back of smaller clinics due to lower profitability.

Improving public support for IVF cycles reduces the financial strain on patients, promoting more accessibility. Implementing financial support programs, such as grants and subsidies, makes IVF more accessible for low-income people. Clinics can explore cost-cutting techniques while preserving quality through effective resource allocation. Implementing open pricing processes and potential restrictions avoids exploitation and ensures that patients receive fair and accessible pricing.

Germany IVF Service Market Segment Analysis

By Procedure Type, The fresh donor segment holds a 15% share of the German IVF Services Market. Fresh donor cycles meet missing demands by providing critical treatment alternatives for couples suffering special reproductive issues, such as severe ovarian injury or same-sex couples seeking donor help. For those who have little options, these cycles bring hope and make it easier to create families. The use of demanding medical and psychological screening in fresh donor matching raises per-cycle costs, increasing revenue possibilities for specialized clinics. The market's diversification not only enhances the total fertility market but also assures that it adapts to changing patient preferences and technology improvements, making it more resilient and responsive to a wide range of needs.

In 2024, XX numbers of cycles involved fresh donor eggs in Germany, representing roughly 15% of all IVF cycles.

.webp)

|

Germany IVF Services Market Scope |

|

|

Market Size in 2024 |

USD 383.89 Mn. |

|

Market Size in 2032 |

USD 605.89 Mn. |

|

CAGR (2025-2032) |

5.87% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Procedure

|

|

By End-User

|

|

Key Players in the Germany IVF Services Market

- Max Healthcare

- Bloom In Vitro Fertilization (IVF)

- CCRM Fertility.

- OXFORD FERTILITY

- Create Health (Create Fertility)

- Medicover

- Aevitas Fertility Clinic

- BioART Fertility Clinic

- Prelude Fertility, Inc.

- Procrea Berlin

- Kinderwunschklinik Münster

Frequently Asked Questions

. Financial support programs, including grants, loans, or subsidies specifically designed for IVF treatment, can make it more affordable for low-income couples and individuals

. The Germany IVF Services Market size was valued at USD 383.89 Million in 2024. The total Germany IVF Services market revenue is expected to grow at a CAGR of 5.87 % from 2025 to 2032, reaching nearly USD 605.89 Million by 2032.

1. Germany IVF Services Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Germany IVF Services Market: Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Germany IVF Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Service Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Germany IVF Services Market: Dynamics

4.1. Germany IVF Services Market Trends

4.2. Germany IVF Services Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Germany IVF Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Germany IVF Services Market Size and Forecast, by Procedure (2024-2032)

5.1.1. Fresh Donor

5.1.2. Fresh Non-donor

5.1.3. Frozen Donor

5.1.4. Frozen Non-donor

5.2. Germany IVF Services Market Size and Forecast, by End-User (2024-2032)

5.2.1. Fertility Clinics

5.2.2. Surgical Centers

5.2.3. Hospitals

5.2.4. Clinical Research Institutes

6. Company Profile: Key Players

6.1. Max Healthcare

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bloom In Vitro Fertilization (IVF)

6.3. CCRM Fertility.

6.4. OXFORD FERTILITY

6.5. Create Health (Create Fertility)

6.6. Medicover

6.7. Aevitas Fertility Clinic

6.8. BioART Fertility Clinic

6.9. Prelude Fertility, Inc.

6.10. Procrea Berlin

6.11. Kinderwunschklinik Münster

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook