Germany Coffee Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

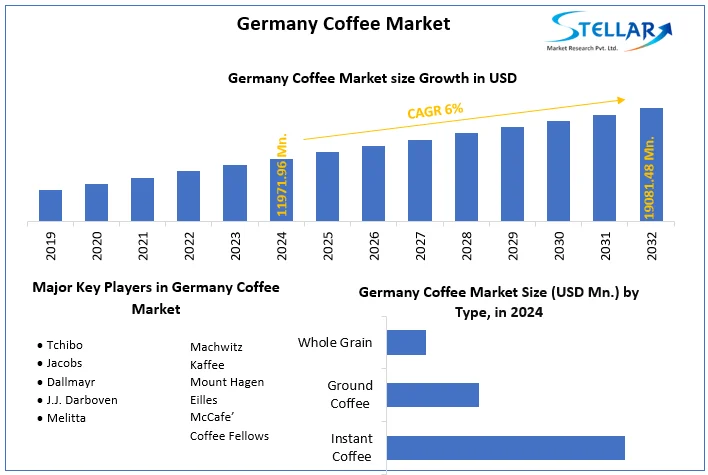

Germany Coffee Market size was valued at US$ 11971.96 Mn in 2024. Coffee will encourage a great deal of transformation in Beverage Sector in Germany.

Format : PDF | Report ID : SMR_59

Germany Coffee Market Definition:

Coffee is one of the most widely consumed brewed beverages. Roasted coffee beans are often used for preparation. These beans are berry seeds produced by certain types of coffee. Coffee beans are collected, processed, and dried when the color changes from green to bright red. The ripeness of the berries is indicated by the change in color. Coffee has a refreshing effect due to the caffeine content of the drink. The Universal Trade Zone (UTZ) certification program is the largest in the coffee and cocoa industry. Certified coffee gives consumers’ confidence in the reliability of their products. The purpose of this certificate is to standardize sustainable agriculture by encouraging farmers to use environmentally friendly agricultural practices. This report on Germany Coffee Market provides segment wise analysis on the basis of source, type, process and region.

To get more Insights: Request Free Sample Report

Germany Coffee Market Dynamics:

Germany Coffee Market has the highest volumes of sales in Europe and the country accounted for 29% of the total European coffee consumption. More than 96% of the coffee imported by Germany is sourced directly from producing countries. Increasing population, rising disposable income, increasing busy lifestyle, etc. are the factors driving the demand of the coffee market in this region. The growing niche market for specialty coffees in Germany also brings interesting opportunities for exporters of high-quality coffees from special origins with unique stories. Germany is Europe's largest importer of green coffee beans. Its coffee roasting industry is enormous, serving both its domestic market, the largest in Europe, and exports markets. Sustainability commitments for coffee are increasingly important factors in the German coffee market.

Coffee is one of the most popular private label items at supermarkets. German retailers offer a wide assortment of private label coffees, including premium quality and organic ranges. Germany's private label market share in 2023 reached 45% of the entire retail market. Private label products are increasingly popular, as they tend to offer the same quality and characteristics as branded products but are usually offered at more competitive prices which boosts the growth of Germany Coffee Market. Examples of organic private-label brands on the German retailer market that sell organic coffees are REWE Bio, Aldi Bio, etc.

Germany Coffee Market is one of the largest market for Fairtrade-certified coffee across the globe. In 2020, almost 31 thousand tonnes of Fairtrade coffee were sold in Germany, making up about 5% of the entire German coffee market. 75% of Fairtrade-certified coffee sold in Germany was also certified organic. Important suppliers of Fairtrade-certified coffees to Germany are Brazil, Colombia, Honduras, and Peru.

Sales of coffee with sustainability certifications are rapidly growing in Germany. Consumers increasingly demand coffees with positive social and environmental impacts. When it comes to social impact, German consumers are most concerned about child labor, fair wages, and good working conditions. In 2023, more than 50% of German coffee consumers indicated that they are willing to pay more for sustainably sourced coffees.

In Germany, demand for freshly brewed coffee is increasing, primarily due to the growing preference for specialty coffee and freshly ground coffee pods. Mainly due to the increasing number of specialty cafes, coffee consumption in the office, and in-house brewing. The consumer tendency to make coffee at home from roasted whole grains often results in the preparation of a batch of fresh coffee. These are driving the Germany Coffee Market growth.

The trend of coffee consumption in Germany is remarkable. Germany is a pioneer in coffee consumption in the office. The main players offered freshly brewed coffee made from whole roasted beans, mainly in the office space, as the demand for whole roasted coffee increased and coffee pods were banned by government agencies.

Germany Coffee Market Segment Analysis:

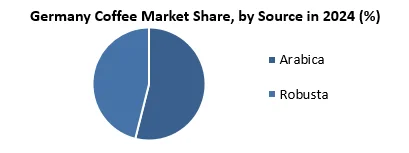

By Source, German consumers prefer high-quality, lightly roasted Arabica coffee. Arabica coffee beans are at the forefront among German consumers compared to Robusta beans. Companies like Tchibo use only these high-quality coffee beans in their coffee blends. Arabica coffee segment is shifting to Brazilian natural flavors and other mild flavors. To maintain the enjoyment of Arabica coffee, German coffee houses focus on procuring the type of coffee that consumers prefer.

The objective of the report is to present a comprehensive analysis of the Germany Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Germany Coffee market and how these trends will influence new business investments and market development throughout forecast period. The report also aids in the comprehension of the market dynamics and competitive structure of market by analyzing market leaders, market followers and regional players.

The qualitative and quantitative data provided in the Germany Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Germany Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are and how their product quality is in Germany Coffee market. The report also analyses if the Germany Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Germany Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Germany Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the market is aided by legal factors.

Germany Coffee Market Scope:

|

Germany Coffee Market |

|

|

Market Size in 2024 |

USD 11971.96 Mn. |

|

Market Size in 2032 |

USD 19081.48 Mn. |

|

CAGR (2025-2032) |

6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

Geography |

|

Germany Coffee Key Players:

• Tchibo

• Jacobs

• Dallmayr

• J.J. Darboven

• Melitta

• Machwitz Kaffee

• Mount Hagen

• Eilles

• McCafe’

• Coffee Fellows

Frequently Asked Questions

Germany Coffee Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

Germany Coffee Market size was USD 11971.96 Mn. in 2024

1. Germany Coffee Market: Research Methodology

2. Germany Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Germany Coffee Market: Dynamics

3.1. Germany Coffee Market Trends

3.2. Germany Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Germany Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2032)

4.1. Germany Coffee Market Size and Forecast, by Source (2024-2032)

4.1.1. Arabica

4.1.2. Robusta

4.2. Germany Coffee Market Size and Forecast, by Type (2024-2032)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.3. Germany Coffee Market Size and Forecast, by Geography (2024-2032)

4.3.1. Berlin

4.3.2. Hamburg

4.3.3. Brandenburg

4.3.4. Bavaria

4.3.5. Bremen

5. Germany Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Tchibo

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Jacobs

6.3. Dallmayr

6.4. J.J. Darboven

6.5. Melitta

6.6. Machwitz Kaffee

6.7. Mount Hagen

6.8. Eilles

6.9. McCafe’

6.10. Coffee Fellows

7. Key Findings

8. Industry Recommendations