Fastener Market Global Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics, Segmentation by Raw Material, Application, Product Types, and Region.

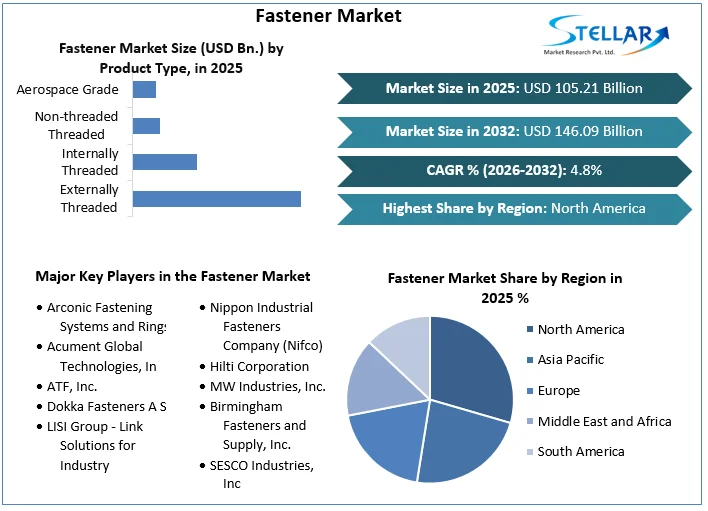

Fastener Market size was valued at USD 105.21 Bn. in 2025 and the Fastener’s total revenue is expected to grow by 4.8% from 2026 to 2032, reaching nearly USD 146.09 Bn

Format : PDF | Report ID : SMR_1375

Fastener Market Overview: -

The fastener is a hardware device that mechanically joins or attaches two or more objects together. The market is expected to be driven by the growing population, high investments in the construction sector, and rising demand for industrial fasteners in the automotive and aerospace sectors. Infrastructure development is one of the key parameters to be considered while tracking the regional development of the market. The construction industry notably impacts the demand for industrial fasteners as they are extensively used in buildings, bridges, walls, and roofs. Unlike other industries, fasteners used in construction are standardized and subject to stringent quality checks.

Government intervention through a regulatory framework pressurizes the manufacturers to offer standardized products with superior performance characteristics. The U.S. is one of the largest fasteners importing countries in the world and is likely to witness a similar trend over the forecast period on account of high product demand in automation, aerospace, and other industrial applications. Moreover, owing to the growing demand for lightweight vehicles and aircraft, companies are shifting from standard to customized fasteners, which in turn is expected to drive demand. The market for industrial fasteners is characterized by intensive

Technological developments to produce advanced, lightweight products that find usage in automotive and other industrial applications. With the enhancement in technology, the rising demand for hybrid fasteners, which incorporate a combination of injection-molded plastic components with metal elements, is expected to drive the demand. Increasing metal prices and the decelerating growth of these fasteners owing to their replacement by plastic fasteners, automotive tapes, and adhesives are expected to be key barriers formetal fastener manufacturers over the forecast period. Plastic fastener manufacturers are expected to gain an advantage owing to the rising demand for lightweight components from automotive manufacturers. Companies engaged in the manufacturing of fasteners require significant capital investment owing to the high production volumes and stringent specifications concerning testing and labeling.

To get more Insights: Request Free Sample Report

Fastener Market Dynamics:

Growth in Building & Construction Industry is Driving Industrial Fasteners Market Growth Increasing demand for commercial and residential housing projects and government spending on infrastructure activities will foster the construction market growth. They are used in the construction industry to join two or more objects together in a non-permanent way. Building & construction fasteners are used in heavy-duty applications to join materials together, as the sector requires strength and precision. Stainless steel, alloy steel, and carbon steel are different fastening types used in the construction sector. Common types of building construction products include nuts, bolts, washers, screws, and rivets. Each infrastructure project requires various types of fastening products to ensure safe and robust construction. Most of the products are manufactured using carbon steel as it offer affordability, strength, and workability. Whereas, stainless steel is the most preferred material for construction, owing to its ability to resist heat, corrosion, and strength, thereby boosting the demand for industrial fasteners.

Growing Demand from Aerospace Industry to Drive Market Growth Aircraft structural hardware items used in aircraft construction include nuts, bolts, rivets, screws, cables, washers, and guides. Rapid technological advancement and increasing R&D spending in the defence sector and growing commercial aircraft production capacity are the key attributes driving the aerospace fasteners market. An increase in the number of aircraft and increasing passenger traffic globally will eventually increase the products ‘needs. Aerospace producers focus on regional expansion due to high aircraft demand and partner with OEMs for business expansion. In April 2022 Birmingham Fastener announced the acquisition of Champion Sales and Manufacturing, Inc. This acquisition strengthens Birmingham Fastener’s waterworks product offering and manufacturing diversity. Also in September 2021 LINC Systems, LLC, an industrial fastener and industrial packaging distribution platform of Centre Rock Capital Partners, announced that it acquired Air-O Fasteners. The acquisition will increase the company’s presence in the Western U.S. In January 2021 LISI Aerospace extended its contract with the Boeing Company. Under the contract, LISI Aerospace will continue to provide close to 6,000 different part numbers in support of all Boeing commercial programs.

Fastener Market Segment Analysis:-

Based on Raw Material

Metal fasteners account for the largest market share of 91.2% in 2025. It includes various materials such as stainless steel, bronze, cast iron, superalloys, and titanium. The high mechanical strength is expected to be an important factor triggering their growth over the forecast period. Plastic fasteners are growing at the fastest CAGR of 5.4%. During the forecast period. It is gaining importance in the automotive industry owing to its low-cost, lightweight, and superior chemical & corrosion resistance properties. These are manufactured using various raw materials, including polycarbonate, polyurethane, polyvinylchloride (PVC), polyacrylamide (PA), polystyrene (PS), polyethylene (PE), and nylon. Plastic fasteners are witnessing high growth, in terms of demand, especially from the automotive and aerospace industries, owing to their superior corrosion and chemical-resistant properties. In addition, characteristics such as low cost, availability in a wide variety, and lightweight are expected to be the key parameters driving demand for the product in the manufacturing of high-efficiency and lightweight vehicles.

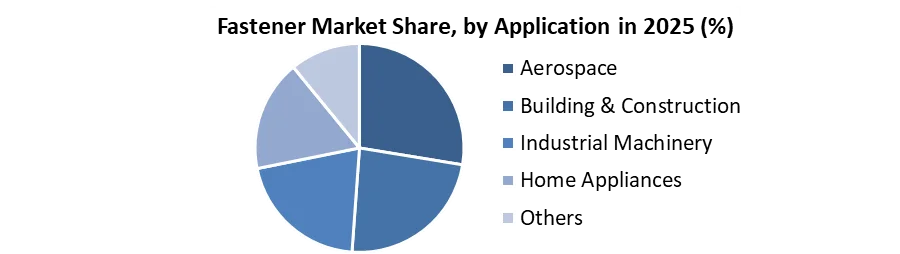

Based on the Application,

The automotive segment accounted for the largest revenue share of 30.2% in 2025 and is expected to expand at a CAGR of 3.8% during the forecast period. High production volumes of automotive vehicles across Asia Pacific have been a key factor driving industry growth over the past few years. Fasteners are an essential component of the automotive industry and are available in numerous varieties, sizes, and shapes. The common fasteners used in the automotive industry include nuts, bolts, screws, rivets, studs, bits, anchors, and panel fasteners. Metal fasteners have been dominating the fastener industry traditionally, and this trend is likely to continue over the projected period. Aerospace has been a major application segment in the global industrial fasteners market as it consumes high volumes of primegrade fasteners. The aerospace industry is considered to be a key market for industrial fasteners, as the quantity used in the manufacturing of an aircraft is significantly higher in comparison tany other applications, including automotive, industrial machinery, and railways.

Based on the Product type,

Based on product, the market of industrial fasteners is classified into externally threaded, internally threaded, non-threaded, and aerospace grade. The externally threaded segment is expected to dominate the market, owing to an increase in the number of vehicle production. Studs are externally threaded and are preferred for aerospace applications as the configuration is stronger than the bolt. Aluminium brass, and alloy steel are the other raw materials that are used for manufacturing these products. Externally threaded fasteners accounted for the highest revenue share of 48.4% in 2024. Bolts and screws are the most widely utilized type of externally threaded fasteners. Bolts hold a dominant share in the market owing to their availability in a wide variety and broad application scope. Non-threaded fasteners accounted for the second largest revenue share of 25.3% in 2024 and are expected to drive the market at a CAGR of 4.2% over the forecast period. Rising demand for nonthreaded fasteners in the construction industry for various applications such as subflooring, decking, and roofing is expected to have a positive impact on growth over the projected period. Aerospace-grade fasteners are expected to expand at the fastest CAGR of 5.9% from 2025 to 2032. This fastener varies significantly as compared to ordinary commercial-grade fasteners in terms of quality, performance, raw material, price, and other technical specifications. The most commonly used aerospace nuts include fiber inserts and castle nuts. Internally threaded fasteners accounted for a significant share of the market. Stainless steel is the most common material used for manufacturing internally threaded industrial fasteners. Brass, alloy, steel, and aluminum are the other materials used to manufacture these industrial fasteners.

Fastener Market Region:

The North America Fastener Market area is estimated to grow rapidly during the projected timeframe, owing to an increase in cardiac problems and diabetes leading to the development of innovation in syringes and needles products. In addition, the growing number of diseases prevalence in the North American region will boost the market growth. Leading market players invested heavily in research and development (R&D) to scale up their manufacturing units and product lines, which will help the Fastener Market grow worldwide.

Market participants are also undertaking various organic or inorganic strategic approaches to strengthen and expand their footprint, with important market developments including new product portfolios, contractual deals, mergers and acquisitions, capital expenditure, higher investments, and strategic alliances with other organizations. Businesses are also coming up with marketing strategies such as digital marketing, social media influencing, and content marketing to increase their scope of profit earnings. The Syringe and Needle industry must offer cost-effective and sustainable options to survive in a dynamic market. Manufacturing locally to minimize operational expenses is a key business strategy manufacturer’s use in the Syringe and Needle industry to benefit customers and capture untapped market share and revenue.

|

Fasteners Market Scope |

|

|

Market Size in 2025 |

USD 105.21 Bn. |

|

Market Size in 2032 |

USD 146.09 Bn. |

|

CAGR (2026-2032) |

4.8% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Raw Material Stainless Steel Iron Aluminum Plastic |

|

By Application Automotive Aerospace Building & Construction Industrial Machinery Home Appliances Others |

|

|

By Product Type Externally Threaded Internally Threaded Non-threaded Threaded Aerospace Grade |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America

|

Fastener Market Key Players

- Arconic Fastening Systems and Rings

- Acument Global Technologies, In

- ATF, Inc.

- Dokka Fasteners A S

- LISI Group - Link Solutions for Industry

- Nippon Industrial Fasteners Company (Nifco)

- Hilti Corporation

- MW Industries, Inc.

- Birmingham Fasteners and Supply, Inc.

- SESCO Industries, Inc

Frequently Asked Questions

The North American region is expected to hold the highest share of the Fastener Market.

The market size of the Fastener Market by 2032 is expected to reach US$ 146.09 Bn.

The forecast period for the Fastener Market is 2026-2032.

The market size of the Fastener Market in 2025 was valued at US$ 105.21 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Fastener Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Fastener Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Fastener Market: Dynamics

4.1. Fastener Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Fastener Market Drivers

4.3. Fastener Market Restraints

4.4. Fastener Market Opportunities

4.5. Fastener Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Fasteners Production Technologies

4.8.2. Machining

4.8.3. Thread Production

4.8.4. Injection Molding Technology

4.8.5. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Fastener Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Fastener Market Size and Forecast, by Raw Material (2025-2032)

5.1.1. Stainless Steel

5.1.2. Iron

5.1.3. Aluminum

5.1.4. Plastic

5.2. Fastener Market Size and Forecast, by Application (2025-2032)

5.2.1. Automotive

5.2.2. Aerospace

5.2.3. Building & Construction

5.2.4. Industrial Machinery

5.2.5. Home Appliances

5.2.6. Others

5.3. Fastener Market Size and Forecast, by Product Type (2025-2032)

5.3.1. Externally Threaded

5.3.2. Internally Threaded

5.3.3. Non-threaded Threaded

5.3.4. Aerospace Grade

5.4. Fastener Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Fastener Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Fastener Market Size and Forecast, by Raw Material (2025-2032)

6.1.1. Stainless Steel

6.1.2. Iron

6.1.3. Aluminum

6.1.4. Plastic

6.2. North America Fastener Market Size and Forecast, by Application (2025-2032)

6.2.1. Automotive

6.2.2. Aerospace

6.2.3. Building & Construction

6.2.4. Industrial Machinery

6.2.5. Home Appliances

6.2.6. Others

6.3. North America Fastener Market Size and Forecast, by Product Type (2025-2032)

6.3.1. Externally Threaded

6.3.2. Internally Threaded

6.3.3. Non-threaded Threaded

6.3.4. Aerospace Grade

6.4. North America Fastener Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Fastener Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Fastener Market Size and Forecast, by Raw Material (2025-2032)

7.2. Europe Fastener Market Size and Forecast, by Application (2025-2032)

7.3. Europe Fastener Market Size and Forecast, by Product Type (2025-2032)

7.4. Europe Fastener Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Fastener Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Fastener Market Size and Forecast, by Raw Material (2025-2032)

8.2. Asia Pacific Fastener Market Size and Forecast, by Application (2025-2032)

8.3. Asia Pacific Fastener Market Size and Forecast, by Product Type (2025-2032)

8.4. Asia Pacific Fastener Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Fastener Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Fastener Market Size and Forecast, by Raw Material (2025-2032)

9.2. Middle East and Africa Fastener Market Size and Forecast, by Application (2025-2032)

9.3. Middle East and Africa Fastener Market Size and Forecast, by Product Type (2025-2032)

9.4. Middle East and Africa Fastener Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Fastener Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Fastener Market Size and Forecast, by Raw Material (2025-2032)

10.2. South America Fastener Market Size and Forecast, by Application (2025-2032)

10.3. South America Fastener Market Size and Forecast, by Product Type (2025-2032)

10.4. South America Fastener Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Arconic Fastening Systems and Rings

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Acument Global Technologies, In

11.3. ATF, Inc.

11.4. Dokka Fasteners A S

11.5. LISI Group - Link Solutions for Industry

11.6. Nippon Industrial Fasteners Company (Nifco)

11.7. Hilti Corporation

11.8. MW Industries, Inc.

11.9. Birmingham Fasteners and Supply, Inc.

11.10. SESCO Industries, Inc

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook