Europe Industrial Automation Services Market- Industry Analysis and Forecast (2025-2032) Trends, Statistics, Dynamics, Segmentation by Type of Service, Product Type, End User and Countries

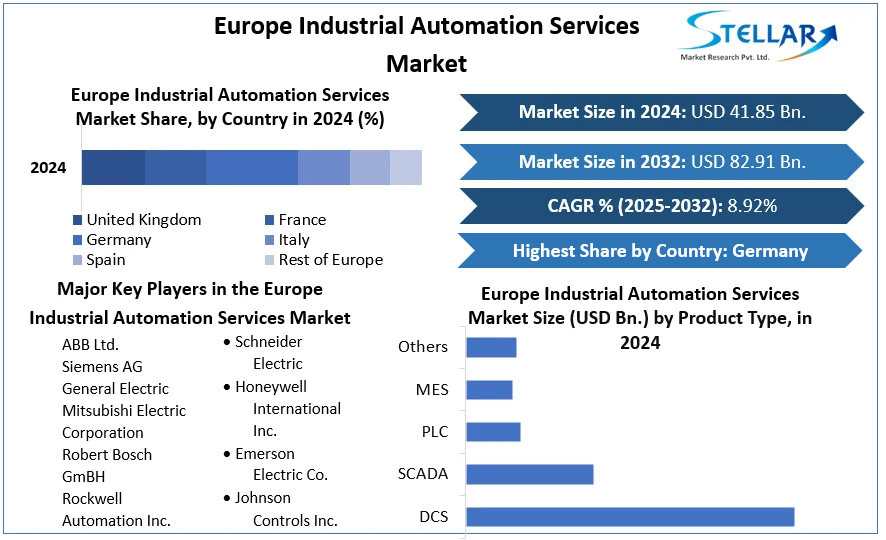

Europe Industrial Automation Services Market is estimated to grow at a CAGR of 8.92% and is expected to reach at US$ 82.91 Bn. by 2032.

Format : PDF | Report ID : SMR_239

Europe Industrial Automation Services Market Overview & Dynamics:

Industrial automation services are more efficient at managing vast amounts of unstructured data than manual management. Automation in manufacturing plants ensures fast production, lowers costs, monitors product quality, standardises manufacturing, reduces waste, and supervises production.

To get more Insights: Request Free Sample Report

Artificial intelligence (AI) and robotics advancements in recent years have aimed to help, if not totally automate, various clerical and social interaction duties. Along with industrial robots, the usage of service robots is growing in the European region's fast-growing industry. Many EU research and innovation projects have consistently helped the development of solutions and technology that allow the European industrial industry to fully exploit digital opportunities. The Factories of the Future Public-Private Partnership is funding many of the projects, which include digital automation, process optimization of manufacturing assets, simulation and analytics technology, and ICT innovation for manufacturing SMEs.

Increased Adoption of Autonomous Mobile Robots in European Markets:

Robotics' rapid adoption and implementation, combined with the rise of AI and IoT, is drastically altering automation operations across industries in the United Kingdom. According to the Industrial Robots report produced by the International Federation of Robotics (IFR), roughly 21,700 industrial robots have been deployed in industries in the UK, according to World Robotics 2020. Furthermore, major initiatives like the National Robots Executive Committee are intended to accelerate the use of robotics and automation in European economies.

High Initial Capital Expenditures Are Limiting The Growth Of The European Industrial Automation Services Market.

High initial capital investments have been identified as the most major barrier impeding market expansion in the Europe. Following the advent of the COVID-19 pandemic, cost has become a source of concern for many firms, which have seen capital investment declines and other company losses. As a result, large early capital inputs are likely to stifle market expansion. Furthermore, due to the fragmented nature of the market, the return on investment (ROI) cannot be predicted. As a result, small-scale producers are wary about automating their operations.

Discrete Industries Segment Is Expected To Grow At The Largest CAGR Of 10.05% During The Forecast Period

By End User, Discrete Industries segment was valued US$ XX Bn in 2024 and is expected to reach at US$ XX Bn by 2032 at a CAGR of 10.05% over forecast period. In Europe, the discrete manufacturing industry segment, which includes heavy manufacturing, automotive, and electronics, is predicted to have a considerable market share. In the United Kingdom, there are over 3,000 aeronautical enterprises. Furthermore, indigenous firms such as Rolls-Royce, BAE Systems, Cobham, Ultra Electronics, and QinetiQ have carved out substantial market positions in the United Kingdom. As a result, technologically advanced enterprises are projected to add to the segment's dominant position by driving the growing need for automated manufacturing processes, such as industrial automation, across the industry.

The U.K. is expected to lead the European market, generating revenue worth US$ XX Bn. by 2026.

The U.K. is expected to grow at a CAGR of 11.5% over the forecast period. In the United Kingdom, the industrial automation business is fiercely competitive. As traditional and non-traditional automation providers compete for market dominance, the competition among industry competitors is projected to continue fierce. The ability to manage and prepare competitive market conditions is aided by a high-quality client base and networks, which distinguish the suppliers from their competitors.

By actively engaging in innovation activities, UK industrial sectors are likely to invest considerably in technological systems. The UK government is expected to implement new policies as part of the digital service plan to encourage digital transformation across industries and support market growth in the future years.

Strategic Expansion:

In recent years, major players in the European Industrial automation services market have taken several strategic measures, such as facility expansions and partnerships. Such as, in November 2020, OMRON Corporation announced a partnership with Reeco Automation to offer collaborative robots for the UK manufacturers. Through this partnership, the companies aim to deliver de-risk and develop complex automation.

The objective of the report is to present a comprehensive analysis of the Europe Industrial Automation Services Market to the stakeholders in the industry. The report provides trends that are most dominant in the Europe Industrial Automation Services Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Europe Industrial Automation Services Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Europe Industrial Automation Services Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Europe Industrial Automation Services Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Industrial Automation Services Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Europe Industrial Automation Services Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Europe Industrial Automation Services Market is aided by legal factors.

Europe Industrial Automation Services Market Scope:

|

Europe Industrial Automation Services Market |

|

|

Market Size in 2024 |

USD 41.85 Bn. |

|

Market Size in 2032 |

USD 82.91 Bn. |

|

CAGR (2025-2032) |

8.92% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type of Service

|

|

By Product Type

|

|

|

By End User

|

|

|

By Country

|

|

Major players in Europe Industrial Automation Services Market:

- ABB Ltd.

- Siemens AG

- General Electric

- Mitsubishi Electric Corporation

- Robert Bosch GmBH

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Johnson Controls Inc.

Frequently Asked Questions

Total CAGR expected to be recorded for the Industrial Automation Market in UK is 11.5%.

Major competitors of the market are Siemens AG, Rockwell, and Omron.

The market size of the Europe Industrial Automation Market in 2024 is US$ 41.85 Bn.

The market size of the Europe Industrial Automation Market by 2032 is US$ 82.91 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe Industrial Automation Services Market Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. Europe Industrial Automation Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Europe Industrial Automation Services Market: Dynamics

4.1. Europe Industrial Automation Services Market Trends

4.2. Europe Industrial Automation Services Market Drivers

4.3. Europe Industrial Automation Services Market Restraints

4.4. Europe Industrial Automation Services Market Opportunities

4.5. Europe Industrial Automation Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Europe Industrial Automation Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030)

5.1. Europe Industrial Automation Services Market Size and Forecast, by Type of Service (2024-2030)

5.1.1. Project Engineering and Installation

5.1.2. Maintenance and Support Services

5.1.3. Consulting Services

5.1.4. Operational Services

5.2. Europe Industrial Automation Services Market Size and Forecast, by Product Type (2024-2030)

5.2.1. DCS

5.2.2. SCADA

5.2.3. PLC

5.2.4. MES

5.2.5. Others

5.3. Europe Industrial Automation Services Market Size and Forecast, by End User (2024-2030)

5.3.1. Discrete Industries

5.3.2. Process Industries

5.4. Europe Industrial Automation Services Market Size and Forecast, by Country (2024-2030)

5.4.1. UK

5.4.2. France

5.4.3. Germany

5.4.4. Italy

5.4.5. Spain

5.4.6. Sweden

5.4.7. Austria

5.4.8. Rest of Europe

6. Company Profile: Key Players

6.1. ABB Ltd.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Siemens AG

6.3. General Electric

6.4. Mitsubishi Electric Corporation

6.5. Robert Bosch GmBH

6.6. Rockwell Automation Inc.

6.7. Schneider Electric

6.8. Honeywell International Inc.

6.9. Emerson Electric Co.

6.10. Johnson Controls Inc.

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook