Europe In Vitro Fertilization Services Market- Industry Analysis and Forecast (2025-2032)

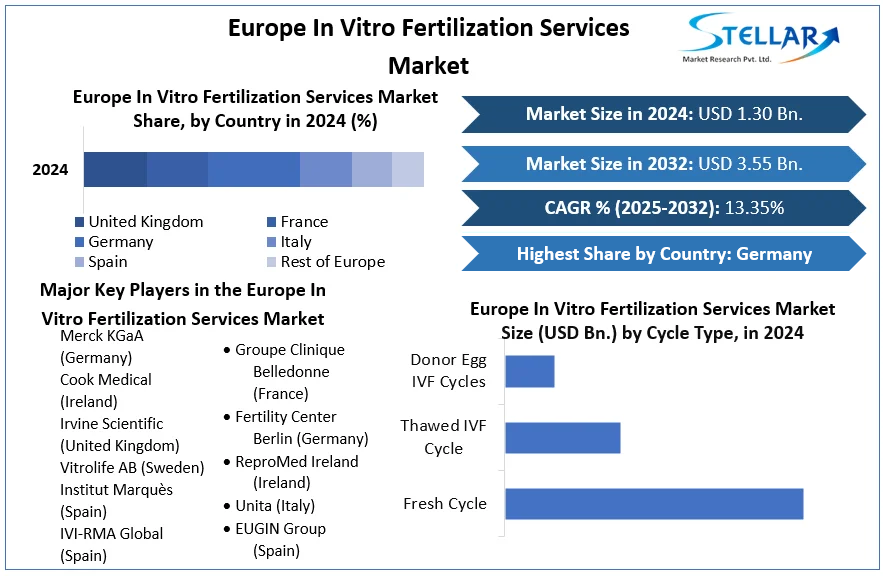

The Europe In Vitro Fertilization Services Market size was valued at USD 1.30 Bn. in 2024 and the total Europe In Vitro Fertilization Services Market revenue is expected to grow at a CAGR of 13.35% from 2025 to 2032, reaching nearly USD 3.55 Bn.

Format : PDF | Report ID : SMR_1688

Europe In Vitro Fertilization Services Market Overview

IVF stands for In Vitro Fertilization, which is an advanced fertilization procedure that helps infertile couples to conceive a child. In Vitro means something that takes place outside the body hence In vitro fertilization is a procedure where the fertilization of an egg with sperm is done in the lab.

The report focuses on the in-depth analysis of several factors that influenced the market growth in Europe. Thanks to strong demand for services like in-vitro fertilization (IVF), genetic testing, reproductive tissue storage, and donor services, the fertility market is primed for continued development. The surge in the IVF services market in European countries such as the UK, Germany, and France is expected to grow during the forecast period.

- Over 25 million people in Europe face infertility

- 41 countries provide insemination with donor sperm to straight couples – yet only 19 countries provide this to female couples and just 30 countries provide it to single women.

- With 678,000 babies born in 2023, France has set a new record for the lowest number of births.

To get more Insights: Request Free Sample Report

Europe IVF Services Market Dynamics

Driving Factors Fueling Growth in the European IVF Services Market

Increased Infertility rate in European regions has led to an increase in demand for IVF services. Several factors are expected to drive the IVF services market such as increasing age in women and reduction of eggs in the ovaries. Surged in male infertility issues related to low sperm count has boosted the market of IVF. Increased in Women’s eggs are lower in quantity and quality due to the natural aging process. With IVF, only the most viable eggs are selected for the procedure. In Europe, A high level of knowledge concerning IVF as a method of infertility treatment was demonstrated by 19.9% of respondents resulting in accelerating the market growth. Increased technologies of IVF treatment have led to market growth.

Challenges in the European IVF Services Market

The higher cost of IVF treatment has hindered the market growth of the Europe IVF services market. IVF treatment is time-consuming and expensive resulting in creating barriers in the Europe IVF services market. The aspects of IVF that are perceived as stressful by patients are multifaceted and affect all parts of their life/lives such as marital, social, physical, emotional, financial, and religious. The first treatment cycle is the most stressful for patients, with the possibility of high levels of confusion, bewilderment, and anxiety.

Europe IVF Services Market Segment Analysis

Based on Cycle Type, Fresh Cycle dominated the market with a growing CAGR during the forecast year. A frozen embryo transfer, or FET, is a common choice for those undergoing IVF. Such as giving the body time to recover from ovarian stimulation and allowing embryos to be tested for viability. Result in both a healthier embryo being implanted and a better overall environment for increasing implantation success. Fresh embryo transfers were viewed as superior and produced significantly greater success rates.

Based on End Users, Fertility clinics hold the highest share of 68% and are expected to maintain their dominance till 2032. Fertility clinics are specialized clinics that offer specialized care services to couples and individuals related to their pregnancy and fertility problems Fertility Clinics provide a wide range of treatments to patients who are facing infertility issues. Enabling patients to access advanced treatment with the help of advanced technological implementation. Fertility clinics in Europe are also more consistent in their quality of service. Over 70% of global fertility cycles are carried out in Europe.

Europe IVF Services Market Regional Analysis

Germany holds the highest number market share with a growing CAGR and is expected to maintain its dominance during the forecast period. Fertility rates in Europe are among the lowest in the world, which is attributed to both biological and lifestyle factors. Cost and reimbursement of fertility treatments vary across Europe, although its citizens enjoy wide access to fertility care. The evolution of and increased access to fertility treatments have resulted in a substantial increase in the number of babies born via in vitro fertilization (IVF)

In Poland, the legitimacy and acceptability of in vitro fertilization (IVF) are still debated in the public and political realms, with NaProTechnology being the recommended publicly funded method of infertility treatment. France has witnessed an almost uninterrupted decline in births, with another 6.6% drop in 2023 compared to 2022. Denmark, a country with generous national fertility benefits, is home to the greatest proportion of babies born through assisted reproduction.

Europe IVF Services Market Competitive Landscape

In September 2023, Merck, a leading science and technology company, launched a comprehensive Fertility Benefit program that offers employees financial support for fertility treatments. The program had launched in eight markets: Germany, the United Kingdom, Switzerland, China, India, Taiwan, Brazil, and Mexico. A range of services, such as fertility tests, in vitro fertilization treatments, and hormonal treatments are covered in the program.

In June 2023, Irvine Scientific Offers Extended Capabilities of Presagen’s Life Whisperer Platform to aid with Clinical Decision-making in IVF. A global leader in the innovation and manufacture of cell culture solutions for the Life Science and Medical markets, announced the addition of the Life Whisperer Genetics module to its Life Whisperer software package, enabling non-invasive evaluation of embryo genetic integrity during in vitro fertilization (IVF).

|

Europe IVF Services Market Scope |

|

|

Market Size in 2024 |

USD 1.30 Bn. |

|

Market Size in 2032 |

USD 3.55 Bn. |

|

CAGR (2025-2032) |

13.35% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

Country Scope |

By Cycle Type

|

|

By End User

|

|

|

|

Europe In Vitro Fertility Services Market Key Players

- Merck KGaA (Germany)

- Cook Medical (Ireland)

- Irvine Scientific (United Kingdom)

- Vitrolife AB (Sweden)

- Institut Marquès (Spain)

- IVI-RMA Global (Spain)

- Bourn Hall Clinic (United Kingdom)

- Care Fertility (United Kingdom)

- Groupe Clinique Belledonne (France)

- Fertility Center Berlin (Germany)

- ReproMed Ireland (Ireland)

- Unita (Italy)

- EUGIN Group (Spain)

- Fertility Partnership (United Kingdom)

Frequently Asked Questions

High Costs are expected to be the major restraining factors for the market growth.

Germany is expected to lead the European in Vitro Fertility Services market during the forecast period.

The Market size was valued at USD 1.30 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 13.35% from 2025 to 2032, reaching nearly USD 3.55 Billion.

The segments covered in the market report are By Cycle Type, and End User.

1. Europe In Vitro Fertilization Services Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe In Vitro Fertilization Services Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Europe In Vitro Fertilization Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Europe In Vitro Fertilization Services Market: Dynamics

4.1. Europe In Vitro Fertilization Services Market Trends

4.2. Europe In Vitro Fertilization Services Market Drivers

4.3. Europe In Vitro Fertilization Services Market Restraints

4.4. Europe In Vitro Fertilization Services Market Opportunities

4.5. Europe In Vitro Fertilization Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Europe In Vitro Fertilization Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Europe In Vitro Fertilization Services Market Size and Forecast, by Cycle Type (2024-2032)

5.1.1. Fresh Cycle

5.1.2. Thawed IVF Cycle

5.1.3. Donor Egg IVF Cycles

5.2. Europe In Vitro Fertilization Services Market Size and Forecast, by End User (2024-2032)

5.2.1. Fertility Clinics

5.2.2. Hospitals

5.2.3. Surgical Centers

5.2.4. Clinical Research Institutes

5.3. Europe In Vitro Fertilization Services Market Size and Forecast, by Country (2024-2032)

5.3.1. Germany

5.3.2. United Kingdom

5.3.3. Spain

5.3.4. France

5.3.5. Italy

5.3.6. Belgium

5.3.7. Sweden

5.3.8. Poland

5.3.9. Russia

6. Company Profile: Key Players

6.1. Merck KGaA (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Cook Medical (Ireland)

6.3. Irvine Scientific (United Kingdom)

6.4. Vitrolife AB (Sweden)

6.5. Institut Marquès (Spain)

6.6. IVI-RMA Global (Spain)

6.7. Bourn Hall Clinic (United Kingdom)

6.8. Care Fertility (United Kingdom)

6.9. Groupe Clinique Belledonne (France)

6.10. Fertility Center Berlin (Germany)

6.11. ReproMed Ireland (Ireland)

6.12. Unita (Italy)

6.13. EUGIN Group (Spain)

6.14. Fertility Partnership (United Kingdom)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook