Ethiopia Spices Market: Industry Analysis and Forecast (2024-2030)

The Ethiopia Spices Market size was valued at 30221.03 Metric Tons in 2023 and the total Ethiopia Spices Market revenue is expected to grow at a CAGR of 2.9% from 2024 to 2030, reaching nearly 31097.44 Metric Tons.

Format : PDF | Report ID : SMR_1684

Ethiopia Spices Market Overview

The Ethiopian spice market significantly contributes to the country's agricultural sector, with a diverse range of spices being produced and exported. It is a vibrant and diverse sector, exporting various spices, including ginger, pepper (crushed or ground), turmeric, coriander, cumin, fenugreek, cardamom, cinnamon, and clove. Beyond mere culinary ingredients, these aromatic treasures are integral to traditional medicine, perfumes, and daily rituals. About more than 50 varieties on the spice market are witness to the nation's rich history.

- The average land coverage by spices is approximately 222,700 ha and the production is 244,000 tons/annum.

Small farmers, who nurture local treasures such as korarima and black cumin, are at the heart of this market. Key companies such as Nati Coffee and Spices Plc and Shochoch Trading Plc add value in terms of cleaning, packaging, or exports to the world spice market. The market is characterized by smallholder farmers, organic farming practices, and a growing demand for spices in domestic and international markets. The key players in the sector are actively involved in the production, marketing, and export of spices, with the industry offering significant growth opportunities for both producers and consumers.

Simultaneously, yields are reduced by traditional farming methods and quality is negatively affected by insufficient storage and processing facilities. The modernization of agricultural practices and infrastructure is the focus of government initiatives. The Ethiopia Spice Market is not only promising the tantalization of palates around the world but also offering a source of national economic growth through continued investment and innovation.

To get more Insights: Request Free Sample Report

Ethiopia Spices Market Dynamics

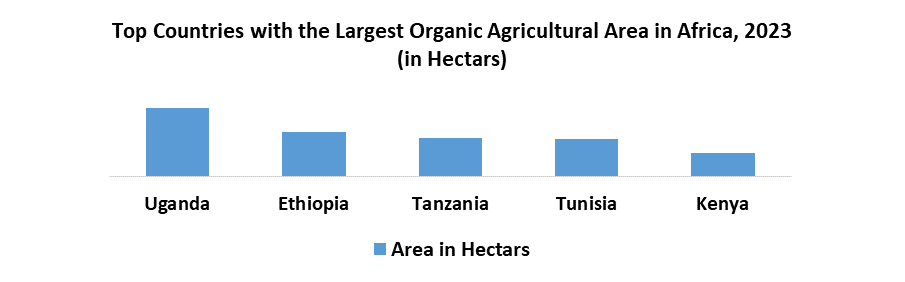

Embracing Organic Farming and Fair Trade for Sustainable Growth

In Ethiopia's vibrant spice market, organic farming and fair trade practices are emerging as key growth drivers, transforming the industry landscape and offering beneficial opportunities for producers and consumers. Organic farming, characterized by natural fertilizers and pest control methods, not only elevates spice quality but also amplifies market value. With a rising consumer emphasis on health and sustainability, the demand for organic spices has surged, carving out a profitable niche within the Ethiopia Spices Market.

Ethiopian spices cultivated through organic methods resonate with discerning consumers, who are increasingly willing to pay a premium for products free from synthetic chemicals and pesticides. Additionally, fair trade practices play a vital role in ensuring unbiased compensation for spice farmers and workers. By guaranteeing fair wages and working conditions, these practices uplift livelihoods within local communities, driving poverty reduction and economic empowerment. This incentivizes existing producers to expand operations and attracts new entrants, fostering sector growth and sustainability in the Spices Market.

Beyond economic benefits, organic farming and fair trade practices represent environmental management and social responsibility. Organic methods promote soil health and biodiversity, mitigating risks of degradation and pollution. Fairtrade principles maintain social justice, fostering inclusive and collaborative market dynamics. In addition, government support through incentives, capacity-building initiatives, and policy reforms further accelerates adoption, creating an enabling environment for transformation and fuelling the Ethiopia Spices Market.

As these practices gain traction, they catalyze complete growth, environmental sustainability, and socio-economic development. Embracing organic farming and fair trade not only enhances Ethiopia's spice exports but also establishes a reliable and fair sector that prioritizes both people and the planet. With consumers increasingly seeking transparency and ethical sourcing, these practices emerge as not just market drivers but also as pillars of responsible and sustainable development in the vibrant Ethiopia Spice Industry.

Ethiopia Spices Market Segment Analysis:

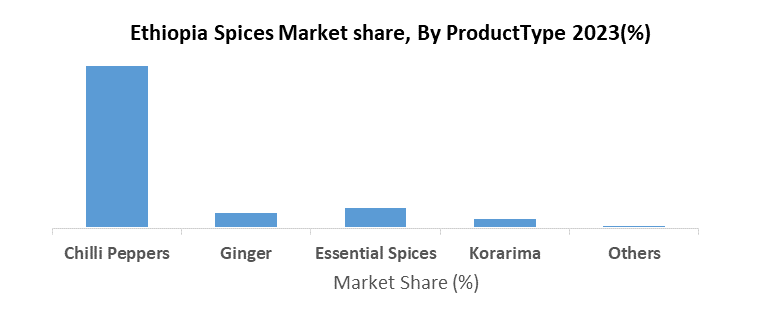

By Product type, the Chilli Peppers segment held the largest market share of about 75% in the Ethiopia Spices Market in 2023. According to the SMR analysis, the segment is expected to grow at a CAGR of 2.9% and stand out as the dominant segment during the forecast period. The region's diverse agroecology and rich culinary heritage have positioned chili peppers as a dominant segment in Ethiopia’s spice market. With over 50 spices cultivated, chili peppers are among the most popular and widely cultivated varieties. Traditionally grown by smallholder farmers as a cash crop, chili peppers flourish in Ethiopia's varied climatic conditions.

The demand for bold, spicy flavors has driven the growth of the chili pepper segment, both locally and globally in the Ethiopia Spices Market. Pepper-based hot sauces, renowned for their versatility and availability, command a significant share of the global hot sauce market. This popularity is attributed to the diverse range of heat levels and flavors offered by chili peppers, catering to a range of consumer preferences.

Ethiopia's culinary landscape boasts a fusion of flavors, with chili peppers playing a pivotal role. Introduced by Portuguese traders in the 16th century, chili peppers revolutionized Ethiopian cuisine, adding depth and complexity to traditional dishes. From the versatile berbere to the fiery "atkilt" chili, Ethiopia offers a diverse selection of chili pepper varieties, ensuring there's something to tempt every palate. The country's optimal climate for chili pepper cultivation further cements its position as a major producer. Ethiopian cuisine's global appeal and the adaptability and flavor profiles of chili peppers drive their dominance in the local spice market. Tradition, culinary adaptability, and favorable growing conditions converge to underscore the enduring success of chili peppers in the Ethiopia Spice Market.

• In 2022, the largest proportion of ginger was exported to Kenya (41.7%), followed by Canada (23.3%), Taiwan (15%), and the United States (13.8%).

Ethiopia Spices Market Scope

|

Ethiopia Spices Market |

|

|

Market Size in 2023 |

30221.03 Metric Tons |

|

Market Size in 2030 |

31097.44 Metric Tons |

|

CAGR (2024-2030) |

2.9% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope

|

By Product Type

|

|

By Form

|

|

|

By Source

|

|

|

By Application

|

|

Ethiopia Spices Market Key Players

- AKBI Spice Company

- Amaarech Premium Ethiopian Spices

- Fasika Spices & Baltina

- Feed Green Ethiopia (SB Manufacturing Plc)

- Brundo Spice Company

Frequently Asked Questions

Supply Chain disruptions and quality control are expected to be the major restraining factors for the market growth.

The Market size was valued at 30221.03 Metric Tons in 2023 and the total Market revenue is expected to grow at a CAGR of 2.9% from 2024 to 2030, reaching nearly 31097.44 Metric Tons.

The segments covered in the market report are By Product Type, form, application, and distribution channel.

1. Ethiopia Spices Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Ethiopia Spices Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Ethiopia Spices Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Revenue (2023)

3.2.6. Profit Margin

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Ethiopia Spices Market: Dynamics

4.1. Ethiopia Spices Market Trends

4.2. Ethiopia Spices Market Drivers

4.1. Ethiopia Spices Market Restraints

4.2. Ethiopia Spices Market Opportunities

4.3. Ethiopia Spices Market Challenges

4.4. PORTER’s Five Forces Analysis

4.5. PESTLE Analysis

4.6. Technological Roadmap

4.7. Value Chain Analysis

4.8. Trade Analysis

4.9. Regulatory Landscape

5. Ethiopia Spices Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2023-2030)

5.1. Ethiopia Spices Market Size and Forecast, by Product Type (2023-2030)

5.1.1. Chilli peppers

5.1.2. Ginger

5.1.3. Essential Spices

5.1.4. Korarima

5.1.5. Others

5.2. Ethiopia Spices Market Size and Forecast, by Form (2023-2030)

5.2.1. Whole

5.2.2. Grounded Powder

5.2.3. Spice Blends

5.3. Ethiopia Spices Market Size and Forecast, by Source (2023-2030)

5.3.1. Yellow split peas

5.3.2. chickpeas

5.3.3. lentils

5.4. Ethiopia Spices Market Size and Forecast, by Application (2023-2030)

5.4.1. Traditional Open-Air Markets

5.4.2. Small Grocery Stores

5.4.3. Supermarkets

5.4.4. Online

6. Company Profile: Key Players

6.1. AKBI Spice Company

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Amaarech Premium Ethiopian Spices

6.3. Fasika Spices & Baltina

6.4. Feed Green Ethiopia (SB Manufacturing Plc)

6.5. Brundo Spice Company

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook