Dietary Fiber Gummies Market -Global Industry Analysis and Forecast (2025-2032) by Product, Form, Source and Application

The Dietary Fiber gummies Market size was valued at US$ 5.40 Bn. in 2025 and the total Global Dietary Fiber gummies revenue is expected to grow at a CAGR of 11.5 % from 2025 to 2032, reaching nearly USD 12.91 Bn. by 2032.

Format : PDF | Report ID : SMR_1660

Dietary Fiber Gummies Market Overview

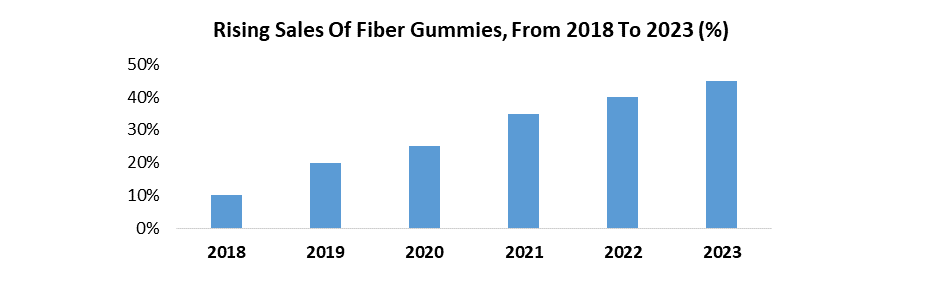

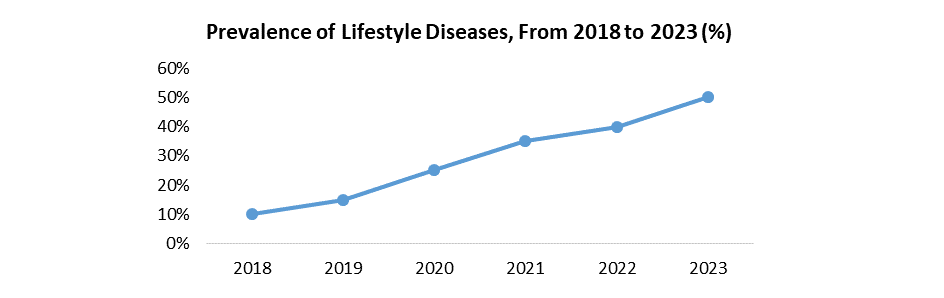

The research report offers the dietary fiber gummies market, including market size, growth rate, and important market segments. The importance of dietary fiber in preserving general health and well-being has been highlighted along with the rising need for easily obtainable supplement options such as gummies. An in-depth examination finds several factors driving the market for dietary fiber gummies to grow. These factors include increased rates of lifestyle diseases, growing consumer health consciousness, developments in formulation technologies, and the growth of distribution networks. Consumers are prioritizing healthier lives, which promotes demand for simple fiber ingestion techniques.

The market of nutritional supplements, such as fiber gummies, which are thought to help with condition management, is driven by lifestyle diseases. In certain areas, rising disposable incomes make it possible to spend on preventive healthcare solutions, such as supplements. The flavor and texture of fiber gummies are improved by manufacturers' ongoing innovation, making them more appealing to a wider range of consumers. Compared to traditional supplements, gummies' handy and pleasurable style appeals to customers looking for a simple way to improve their fiber consumption, which is driving the growth of the market.

Through innovative formulation, spending on research and development to improve the flavor, texture, and usefulness of fiber gummies provides a competitive edge. Niche market demands are met by producing customized fiber gummies that are aimed toward particular populations or health issues. Growth prospects might be found by investigating emerging markets where disposable income and health consciousness are on the rise. Strong distribution networks and an online presence help to leverage the growing trend of online shopping. Sustainability is emphasized as a crucial component of market strategy by incorporating sustainable practices into packaging and product procurement, which supports brand image and corresponds with changing customer preferences.

To get more Insights: Request Free Sample Report

Dietary Fiber Gummies Market Dynamics

Increasing Health Consciousness

Customers are becoming increasingly aware of how important dietary fiber is to maintaining a healthy lifestyle. The information includes the advantages of eating enough fiber, which includes the maintenance of regularity in the digestive system, prevention of constipation, and the development of healthy gut flora. In addition, eating meals high in fiber increases satiety, which supports attempts to regulate hunger and lose weight. Furthermore, soluble fiber has been linked to lower cholesterol, which lowers the risk of heart disease. Additionally, fiber helps control blood sugar levels, which has major benefits for people with diabetes or prediabetes. All things considered, this consciousness highlights the various health advantages of fiber-rich goods and increases demand for them.

Gummies in particular, which are dietary fiber supplements, are seeing rapid development in the market because of consumers' increased health consciousness and the need for easy ways to increase their consumption of fiber. In response to this need, producers are coming up with novel ways to fulfill consumer preferences by releasing high-fiber gummies that come in a variety of flavors, textures, and functional additions like probiotics and vitamins. In addition, the wider availability of fiber gummies in pharmacies, supermarkets, and online stores makes them more accessible to health-conscious consumers, which propels market growth. The convergence of variables highlights the market for dietary fiber gummies' rapid development potential.

Lifestyle Diseases

The rise in lifestyle disorders including obesity, type 2 diabetes, and cardiovascular problems is a result of modern sedentary lives, processed meals, and little exercise. Diets high in calories but low in nutrients and physical inactivity are the main causes of obesity, which increases the risk of chronic illnesses. The three main causes of type 2 diabetes are a sedentary lifestyle, poor diet, and obesity. Unhealthy lifestyle choices lead to cardiovascular problems, which include high blood pressure, increased cholesterol, and artery blockages. These elements highlight the critical necessity for dietary and lifestyle adjustments to counteract the crippling diseases that are becoming more and more common in today's society.

Consumers are actively looking for methods to alter their eating habits as they become more aware of the link between nutrition and disease, which is driving up demand for fiber supplements like gummies. The demand is driven by the benefits of fiber for heart health, blood sugar regulation, and weight management. Supplement usage is expected to increase if manufacturers and medical practitioners inform consumers about the advantages of fiber in managing lifestyle disorders. Additionally, in response to changing customer demands and tastes, the market witness an increase in fiber gummies made with components that specifically target ailments linked to lifestyle disorders, such as improving blood sugar regulation or promoting intestinal health.

Formulation Challenges

Dietary fiber gummies are difficult to make because of issues with taste, texture, and stability. The inherent bitterness of fiber makes it difficult to disguise flavors, and too much of it results in textures that are too mushy or gritty and lose the intended chewiness. Also, fiber modifies the interactions between ingredients, impacting the gummy setting and shelf life. Producing stable, edible gummies requires striking a balance between these variables. As producers work to address issues with taste, texture, and stability, innovation is essential for the dietary fiber gummies industry to develop. Investing in innovative flavoring systems, texturizers, and research gives manufacturers a competitive edge when producing gratifying, high-fiber candies.

Acceptance by customers is essential; poor flavor or texture is expected to discourage repurchases, impeding market growth. In addition, unfavorable opinions resulting from early versions of fiber gummies hinder consumer confidence and make it difficult to persuade skeptics. Maintaining a healthy balance between innovation and customer happiness is crucial for growing the market and fostering favorable opinions about dietary fiber candies.

Dietary Fiber Gummies Market Segment Analysis

By Flavor, the Mixed Berry segment has the highest market share, by 2024, it account for almost 60%. Mixed berry flavor is so popular, that it makes fiber gummies more accessible to newcomers, expanding the pool of prospective customers and promoting market growth. Because of its sweet and fruity flavor profile, mixed berries are a popular option for families who want to encourage their children to eat more fiber in their diet. That is especially true for younger members of the family. The growing size of the market as a whole is greatly aided by this family-oriented market sector. Additionally, the delicious and comfortable flavor of mixed berries promotes client pleasure and encourages recurring purchases. By fostering brand loyalty, this cyclical pattern builds a solid basis for the business's continued growth in the market.

In the fiber gummies market, mixed berry flavor is the industry standard for taste, therefore expectations for flavor are high. To effectively compete, both established players and newcomers strive to emulate its pleasing taste. The popularity of mixed berries encourages producers to experiment with novel flavor pairings, resulting in a constant evolution of flavor profiles and preservation of market vibrancy. Making use of the widespread appeal of mixed berries, producers employ forceful branding and marketing tactics to draw in new clients and position their mixed berry products as the go-to option in the fiber gummy market.

Dietary Fiber Gummies Market Regional Analysis

The market for dietary fiber gummies is dominated by North America, which is expected to account for 34.5% of worldwide sales in 2024. Its supremacy is the product of several reasons. Europe accounts for another sizable portion of the market, driven by rising health consciousness and knowledge of the benefits of fiber. In the meantime, the Asia-Pacific area shows signs of rapid growth, driven by rising disposable incomes and a changing attitude toward supplements as preventative medical tools. The population of North America, aware of the benefits of fiber, drives demand for easy-to-consume forms of intake.

A sizable consumer base seeking dietary support is driven by lifestyle disorders including diabetes and obesity. North America, a center for supplement producers, encourages ongoing innovation in fiber-filled candies. Also, the area is advantaged by a legislative environment that is conducive to the smooth production and marketing of dietary supplements, especially in the US and Canada.

The market is overrun with new fiber gummies that promote improved flavor, texture, and the addition of useful substances. For greater accessibility, distribution spreads to pharmacies, supermarkets, and large internet shops. Campaigns highlighting the benefits and ease of use of fiber gummies raise customer awareness. Precise revenue estimates for 2024 and anticipated growth rates are required for North America. It's also interesting to see how sales increase for fiber gummies in North America compared to other forms of fiber supplements. These observations shed light on the ever-changing market conditions surrounding fiber gummies and highlight their increasing popularity and influence in the area.

The United States is the market leader for dietary fiber gummies in North America thanks to its large population and growing health and wellness industry. Dietary recommendations supporting a suggested daily intake of fiber indirectly support the use of fiber supplements, such as fiber gummies. Regulations improve consumer confidence by guaranteeing the security and truthful labeling of fiber-filled gum products. Research funding on the benefits of fiber not be focused only on fiber gummies, but it could have a good effect on the industry overall. In general, the US dominates because of its significant influence on consumer trends that are health-conscious and the size of its population.

Dietary Fiber Gummies Market Competitive Landscape

Product innovation in the fiber gummies market is driven by major players such as The Hershey Company, Ferrara Candy Company & Perfetti Van Melle, Horbächer Achsensprung GmbH & Co. KG, Nestlé Health Science, and Spectrum Brands Inc. Their investing tactics center on improving texture and flavor by incorporating functional ingredients including vitamins and probiotics, addressing issues with high fiber content, and creating product lines that are geared towards particular markets or health issues like digestive health. In addition, a move toward environmentally friendly packaging reflects customer preferences for eco-friendly operations and directs the market toward more ecologically responsible products.

- Prebiotic Fiber was introduced by Optimum Nutrition in January 2022 to enhance immunity and intestinal health. Each serving has five grams of prebiotic fiber. A variety of nutritional supplements are available from the company Optimum Nutrition, including energy drinks, protein powders, and multivitamins. Professional sportsmen and gymgoers have trusted the brand for more than 30 years. The products made by Optimum Nutrition are intended to promote endurance, aid in recuperation, and aid in muscle growth. A combination of whey protein isolate, whey protein concentrate, and hydrolyzed whey protein is used to make the brand's protein powders, like Gold Standard 100% Whey, which has 24g of protein per serving.

- In September 2021, Garden of Life announced a new line of Dr. Formulated Organic Fiber supplements featuring prebiotic fiber for gut health

- In June 2022, Metamucil launched a new line of fiber thins made with psyllium husk to help consumers add more fiber to their diet. The new things are available in cinnamon spice and chocolate flavors. Metamucil is a fiber supplement.

|

Dietary Fiber Gummies Market Scope |

|

|

Market Size in 2024 |

USD 5.40 bn. |

|

Market Size in 2032 |

USD 12.91 bn. |

|

CAGR (2025-2032) |

11.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Flavor Strawberry Mixed Berry Peach Raspberry |

|

By Application Metabolic Health |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Dietary Fiber Gummies Market Key Players

- Nestlé Health Science

- Horbächer Achsensprung GmbH & Co. KG

- Spectrum Brands Inc

- The Hershey Company

- Church & Dwight Co., Inc

- Smarty Pants Vitamins

- Renew Life Formulas, LLC

- Goli Nutrition Inc

- Balance of Nature

- Bellway

- Smarty Pants Vitamins.

- Fiber Chvoice.

- Nutraingredclients

- Fairway market

- Ingredients

- The Atlantic

- Brookshires

- Nutritionaloutlook

- Davaindia

- Ndxusa

- Miralax

Frequently Asked Questions

R&D investments enhance fiber gummies' taste, texture, and nutrition. Marketing builds awareness, production meets demand, distribution expands reach, and quality control ensures compliance and product integrity.

Growing health awareness boosts demand for fiber gummies. Consumers favour their convenience. Rising digestive issues drive demand for fiber-rich options. Innovations create tasty gummies with high fiber content, appealing to more consumers.

The Market size was valued at USD 5.40 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 11.5 % from 2025 to 2032, reaching nearly USD 12.91 Billion.

The segments covered in the market report are By Flavour and Application.

1. Dietary Fiber Gummies Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Dietary Fiber Gummies Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Dietary Fiber Gummies Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. Total Production (2024)

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2023)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Dietary Fiber Gummies Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Dietary Fiber Gummies Market Size and Forecast by Segments (by Value USD Million and Volume in Kilotons)

5.1. Dietary Fiber Gummies Market Size and Forecast, By Flavor (2024-2032)

5.1.1. Strawberry

5.1.2. Mixed Berry

5.1.3. Peach

5.1.4. Raspberry

5.2. Dietary Fiber Gummies Market Size and Forecast, By Application (2024-2032)

5.2.1. Metabolic Health

5.3. Dietary Fiber Gummies Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Dietary Fiber Gummies Market Size and Forecast (by Value USD Million and Volume in Kilotons)

6.1. North America Dietary Fiber Gummies Market Size and Forecast, By Flavor (2024-2032)

6.1.1. Strawberry

6.1.2. Mixed Berry

6.1.3. Peach

6.1.4. Raspberry

6.2. North America Dietary Fiber Gummies Market Size and Forecast, By Application (2024-2032)

6.2.1. Metabolic Health

6.3. North America Dietary Fiber Gummies Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Dietary Fiber Gummies Market Size and Forecast (by Value USD Million and Volume in Kilotons)

7.1. Europe Dietary Fiber Gummies Market Size and Forecast, By Flavor (2024-2032)

7.2. Europe Dietary Fiber Gummies Market Size and Forecast, By Application (2024-2032)

7.3. Europe Dietary Fiber Gummies Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Dietary Fiber Gummies Market Size and Forecast (by Value USD Million and Volume in Kilotons)

8.1. Asia Pacific Dietary Fiber Gummies Market Size and Forecast, By Flavor (2024-2032)

8.2. Asia Pacific Dietary Fiber Gummies Market Size and Forecast, By Application (2024-2032)

8.3. Asia Pacific Dietary Fiber Gummies Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Dietary Fiber Gummies Market Size and Forecast (by Value USD Million and Volume in Kilotons)

9.1. Middle East and Africa Dietary Fiber Gummies Market Size and Forecast, By Flavor (2024-2032)

9.2. Middle East and Africa Dietary Fiber Gummies Market Size and Forecast, By Application (2024-2032)

9.3. Middle East and Africa Dietary Fiber Gummies Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Dietary Fiber Gummies Market Size and Forecast (by Value USD Million and Volume in Kilotons)

10.1. South America Dietary Fiber Gummies Market Size and Forecast, By Flavor (2024-2032)

10.2. South America Dietary Fiber Gummies Market Size and Forecast, By Application (2024-2032)

10.3. South America Dietary Fiber Gummies Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Nestlé Health Science

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Horbächer Achsensprung GmbH & Co. KG

11.3. Spectrum Brands Inc

11.4. The Hershey Company

11.5. Church & Dwight Co., Inc

11.6. Smarty Pants Vitamins

11.7. Renew Life Formulas, LLC

11.8. Goli Nutrition Inc

11.9. Balance of Nature

11.10. Bellway

11.11. Smarty Pants Vitamins.

11.12. Fiber Chvoice.

11.13. Nutraingredclients

11.14. Fairway market

11.15. Ingredients

11.16. The Atlantic

11.17. Brookshires

11.18. Nutritionaloutlook

11.19. Davaindia

11.20. Ndxusa

11.21. Miralax

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook