Bulgaria Cement market: Industry Analysis and Forecast (2024-2030) by Type, Application and Region

Bulgaria Cement Market size was valued at US$ 65.59 Mn. in 2023. Bulgaria Cement will encourage a great deal of transformation in Construction Market.

Format : PDF | Report ID : SMR_652

Bulgaria Cement Market Overview:

Cement is a widely utilised binding material in the building sector all over the world. It has a grey tint and is made by grinding a clay and limestone mixture. It's mixed with water to make a hard mass that works as a masonry glue. It is generally divided into two types, hydraulic and non-hydraulic, based on the cement's ability to set in the presence of water. While hydraulic cement sets as a result of a chemical interaction between water and the dry materials, non-hydraulic cement reacts with carbon dioxide in the atmosphere to provide the best chemical resistance.

To get more Insights: Request Free Sample Report

Cement is a binding agent with qualities that aid in retaining or connecting other materials together. Chalks, shells, calcium silicate, and limestone, among other elements, are commonly employed in fine powders of inorganic materials. Cement manufacture is the process of combining the essential elements in a rotary kiln. This process takes place at a temperature of 1450 degrees Celsius. Clinker is produced as a result of this process. This is an intermediate that is processed to produce cement powder. These powders are classified as hydraulic or non-hydraulic. Hydraulic cement dominates the worldwide cement market in terms of overall output.

Bulgaria Cement Market Dynamics:

Bulgaria shipped US$25.7 million worth of cement in 2020, making it the world's 65th largest cement exporter. Cement was Bulgaria's 232nd most exported product in the same year. Romania (US$14.6 million), North Macedonia (US$7.77 million), Greece (US$2.26 million), Ukraine (US$697 thousand), and Serbia (US$160 thousand) are the top destinations for Bulgarian cement exports.

Romania (US$4.06 million), Greece (US$613 thousand), and North Macedonia (US$455 thousand) were the fastest increasing export destinations for Bulgarian cement during 2019 and 2020.

Bulgaria imported US$33.8 million worth of cement in 2020, making it the world's 80th largest cement importer. Cement was the 218th most imported product in Bulgaria in the same year. Cement is mostly imported from Turkey (US$25.2 million), Greece (US$3.81 million), Romania (US$2.14 million), Tunisia (US$1.82 million), and North Macedonia (US$522 thousand).

Turkey (US$6.48 million), Greece (US$2.95 million), and Tunisia (US$513 thousand) were Bulgaria's fastest rising cement import markets during 2019 and 2020.

A huge increase in construction activities is driving the market. This can be attributed to increased population, rising nuclear family habits, and rising demand for residential space. Aside from that, the development of large-scale infrastructure projects is a major driver of growth. Growing environmental concerns, as well as technological breakthroughs in the manufacturing process, are propelling the market forward. For example, since using thermal energy in cement making reduces carbon emissions, it is widely used by manufacturers in a variety of end-use industries. Furthermore, a greater emphasis on sustainable development has shifted preferences toward green construction. This, together with the growing demand for green buildings, is boosting sales of sustainable and green cement, which reduces CO2 emissions generated during manufacture. Consumer's increased purchasing power and rapid industrialization are projected to contribute to the market's good outlook.

Bulgaria Cement Market Segment Analysis:

By Type, Bulgaria Cement Market is segmented into Portland, Blended and Others on the basis of type. The Portland cement market has the biggest market share. This sort of cement is frequently used in general construction. In addition, Portland cement is classified as having strong sulphate resistance, low heat of hydration, high early strength, general-purpose, and moderate sulphate resistance.

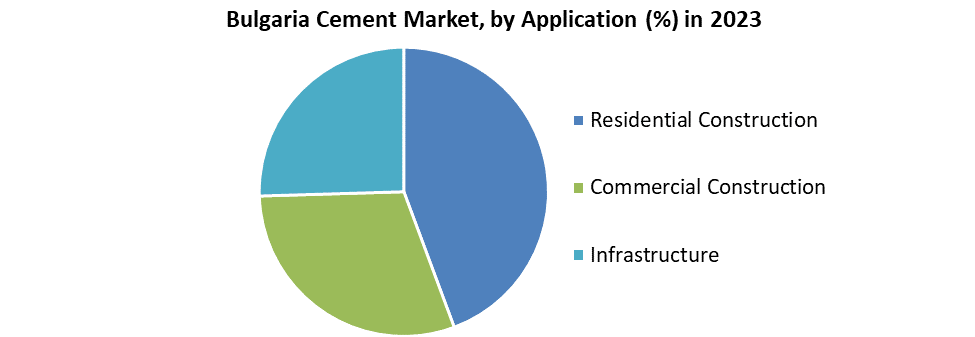

By Application, Bulgaria Cement Market is segmented into Residential Construction, Commercial Construction and Infrastructure on the basis of application. The commercial construction business has the biggest market share in the Bulgaria and controls the whole market. Increased urbanisation is causing cities to grow steadily, which is expected to add to the segment's growth. Apart from that, the element is expected to boost residential construction significantly.

Latest Trend:

Bulgaria's Devnya Cement, a subsidiary of Germany's Heidelberg Cement Group, invested 5 million euro (US$6.1 million) in two initiatives to increase the use of alternative fuels at its Varna facility in 2020-2021.

The projects call for updates to existing equipment as well as the installation of new equipment to enable for the use of other fuels such as automotive tyres and industrial waste in addition to refuse-derived fuel (RDF).

Devnya Cement constructed a clinker and dry cement manufacturing line worth 325 million levs (US$201.7 million/166.2 million euro) at its factory in 2015.

The objective of the report is to present a complete picture of Bulgaria Cement market. Data from past years is compiled to anticipate the future prospects of this market. Porter's five forces help to identify where power lies in a business situation. This is useful both in understanding the strength of an organisation's current competitive position, and the strength of a position that an organisation may look to move into. The report helps in identifying competitive rivalry currently running in the Bulgaria Cement market. It also helps to understand bargaining power of suppliers and consumers.

The report also presents PESTLE analysis which helps to gain a macro picture of Bulgaria Cement market. Political factors helps to identify the influence of government over Bulgaria Cement market. Economic factors a have direct impact on a company’s long-term prospects in a market. The economic environment may affect how a company dealing in Cement price their products or influence the supply and demand model. Social factors, such as demographics and culture can impact the Bulgaria Cement market by influencing peak buying periods, purchasing habits, and lifestyle choices. Technological factors may have a direct or an indirect influence on an industry. The legal and regulatory environment can affect the policies and procedures of an industry, and can control employment, safety and regulations. Environmental factors include all those relating to the physical environment and to general environmental protection requirements.

Bulgaria Cement Market Scope:

|

Bulgaria Cement Market |

Segmentation |

||

|

Market Indicators: |

Details |

By Type |

|

|

Historical Data: |

2018-2022 |

By Application |

|

|

Forecast Period: |

2024-2030 |

||

|

Base Year: |

2023 |

||

|

CAGR: |

5 % |

||

|

Market Size in 2023: |

US$ 65.59 Mn. |

||

|

Market size in 2030: |

US$ 92.30 Mn. |

||

Bulgaria Cement Market Key Players:

- Devnya Cement

- Vulkan Cement

- Holcim

- Zlatna Panega

- Technogips Pro

- Esteta Interiori

- Technocim

- Agromah

- Alfaton Marble

- Trud JSC

- Bulkam Decor

Frequently Asked Questions

Devnya Cement, Vulkan Cement, Holcim, Zlatna Panega, Technogips Pro, Esteta Interiori, Technocim, Agromah, Alfaton Marble, Trud JSC and Bulkam Décor are the key players in the Bulgaria Cement market.

Portland is dominating the Bulgaria Cement Market.

The segments covered in the Bulgaria Cement Market report are based on type, application and region.

The forecast period for the Bulgaria Cement Market is 2023-2030

- Scope of the Report

- Research Methodology

- Research Process

- Bulgaria Cement Market: Target Audience

- Bulgaria Cement Market: Primary Research (As per Client Requirement)

- Bulgaria Cement Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Stellar Competition matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Bulgaria Cement Market Segmentation

- Bulgaria Cement Market, by Type (2023-2030)

- Portland

- Blended

- Others

- Bulgaria Cement Market, by Application (2023-2030)

- Residential Construction

- Commercial Construction

- Infrastructure

- Bulgaria Cement Market, by Type (2023-2030)

- Company Profiles

- Key Players

- Devnya Cement

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Vulkan Cement

- Holcim

- Zlatna Panega

- Technogips Pro

- Esteta Interiori

- Technocim

- Agromah

- Alfaton Marble

- Trud JSC

- Bulkam Decor

- Devnya Cement

- Key Players

- Key Findings

- Recommendations