Bread And Baked Food Market - Global Industry Analysis and Forecast (2025-2032)

Bread And Baked Food Market size was valued at USD 160.83 Bn. in 2024 and the total Bread and Baked Food revenue is expected to grow at a CAGR of 5.69% from 2025 to 2032, reaching nearly USD 250.41 Bn. by 2032.

Format : PDF | Report ID : SMR_1748

Bread And Baked Food Market Overview:

The bread and bakery industry are a dynamic sector that supplies food to millions of consumers every day. The focus of the bread and bakery industry is the production and selling of flour and wheat-based products that are baked in an oven. The products include but are not limited to bread, cookies, cakes, pastries and pies. As many people throughout the world eat bread and wheat-based meals at least once per day, the bread and bakery industry has become a staple of consumption in many countries. Every day, the equivalent of over 9 million large loaves of bread is consumed. Breads and bakery products wide sector that has been around for thousands of years.

The report focuses on the Bread and Bakery Products sales, revenue, market share, and industry ranking of main manufacturers. Identification of the major stakeholders in the global Bread and Bakery Products market, and analysis of their competitive landscape and market positioning based on recent developments and segmental revenues. Additionally, the Bread and Baked Food Market report presents the competitive scenario in the market among distributors and manufacturers, encompassing market value assessment and a breakdown of the cost chain structure.

To get more Insights: Request Free Sample Report

Bread And Baked Food Market Dynamics:

Rising Demand for Versatile Bakery Processing Equipment Fuels Bread and Baked Food Market Growth

Focus on Product Innovation and Customization is driving the Bread and Baked Food Market. Manufacturers are increasingly focusing on developing innovative bakery products and offering customized solutions to meet diverse consumer preferences. Required versatile processing equipment capable of handling a variety of ingredients and producing a wide range of bakery items, thereby boosting the demand for specialized equipment. The proliferation of bakery chains, artisanal bakeries, and retail outlets across various regions is creating a significant demand for bakery processing equipment. The establishments require efficient and scalable equipment to cater to the growing demand for freshly baked goods is driving the Bread and Baked Food market growth.

Innovations in Baking and Confectionery Brands

Baking and confectionery brands are innovating to meet the demand for products that are gluten-free, sugar-reduced, and enriched with functional ingredients like protein and fiber. Brands such as MT. Elephant and The Healthy Bakers are prime examples of how to successfully cater to this market. Their products not only taste great but also offer health benefits, appealing to a broad audience seeking guilt-free indulgence. Consumer Engagement trend also reflects a broader shift towards experiences over more consumption. Consumers are not just buying a product they are engaging with the story behind it, the person who made it, and the process that brought it to life. The engagement adds value and meaning to the product, making it more than just a treat but a piece of art.

Bread And Baked Food Market Segment Analysis:

By Type, Biscuits and cookies have always been a versatile sector with a wide variety of tastes and high global demands. Manufacturers are increasingly relying on automated machinery and sophisticated technology to maintain productivity, cater to the requirements of customers, and ensure compliance with increasingly stringent regulations. A major player in the biscuit and cookie arena has committed to company-wide sustainability goals and initiatives, including Mondel?z, which has pledged for 100 percent of its packaging around the globe to be recyclable by 2032. Machinery manufacturers continue to innovate with updated systems and technology, allowing operators within the biscuit and cookie sector to cater to new trends.

Packaging and processing group Syntegon, for example, launched its Distribution Continuous Slide (DCS), a new highly flexible discharge station for round cookies, crackers, and biscuits. Snack production systems manufacturer Reading Bakery Systems (RBS) introduced an advanced Thomas L. Green WCX Wirecut Machine, offering more product flexibility, control, better safety features, and easier sanitation than previous designs.

Bread And Baked Food Market Regional Insight:

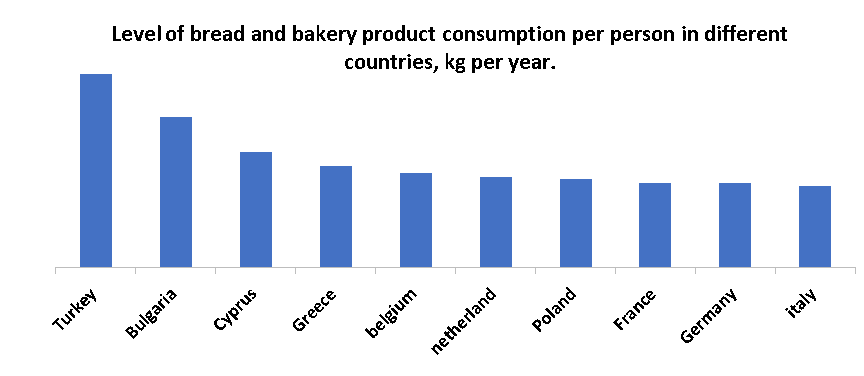

The Europe is fastest growing region in 2024 for the Bread and Baked Food Market. There is a certain dependence on the consumption of bread the higher the standard of living, the less bread people consume, and vice versa. As the income grows, people consume less bread (or buy more expensive bread). The level of bread and bakery products consumption per person in different countries. The most popular bread in Bulgaria is Pitka (an analog of the Russian loaf (caraway)), which for many centuries has been and remains one of the main food products. The Scandinavian countries are distinguished by a low level of bread consumption (32-45 kg per year).

In addition to the amount of bread consumed, bakery traditions have developed in different countries. For example, a small bakery prevails in Turkey, Greece (96.5%), Italy – 85%, France – 65%, Spain – 60%. A large proportion of industrial bakery is typical for Austria, Germany, Great Britain, the Netherlands, and Belgium, approximately 60-85% of bread is baked at industrial enterprises. At the same time, there is a trend towards a decrease in the share of small bakeries and an increase in the share of large industrial bakery plants. The market for frozen bakery products included bread, rolls, pastries, cakes, pizza crusts (the share is approximately 30%), baked goods, donuts, etc.

The products are in demand thanks to the long shelf life (six months), availability, high degree of readiness and quality, environmentally friendly production process and prices. Frozen pizza, for example, is considered a daily meal option in many countries like France, Spain, Germany, Mexico, USA, Russia, and Italy. Frozen food manufacturers are introducing and developing new types of products in demand for the healthy lifestyle category, which include gluten-free and organic.

It is predicted that Europe (Germany, UK, France) thanks to the growing catering industry, including fast food restaurants, and tourism provide the greatest growth in production. The dominant positions in the global. Production of flour also belongs to Brazil, Russia, and Turkey. The world leader in flour exports is Turkey which delivers flour to 110 countries of the world. The industry is developing thanks to the fact that many mill complexes have been built on the coast, which import duty-free grain by sea, with minimal transport costs. At the same time, the state subsidizes the production of a flour ton at 35 USD per ton.

Bread And Baked Food Market Competitive Landscape:

- In January 2023, Sara Lee, makers of bread, buns, rolls, and breakfast products, announced the latest addition to its lineup of products: Sara Lee White Bread Made with Veggies. Baked with the equivalent of one cup of veggies per loaf and fortified with vitamins A, D, and E, the new Sara Lee White Bread Made with Veggies is an effective option for adding some extra goodness to any meal.

- In July 2023, Starbucks had only one certified gluten-free bakery item on its menu, which is surprising when you consider how many of its beverages are, or made, gluten-free in its packaging, with a gluten-free. The Marshmallow Dream Bar comes in its packaging, with a gluten–free certification right on the label.

- In August 2023, Dunkin Donuts has unveiled its autumn offerings, including pumpkin-flavored drinks and seasonal bakery treats, like the pumpkin spice signature latte, nutty treats like the pumpkin spice signature latte, nutty pumpkin coffee, pumpkin cake donuts, munchkin donut hole treats, and pumpkin muffins.

Bread And Baked Food Market Scope:

|

Bread And Baked Food Market |

|

|

Market Size in 2024 |

USD 160.83 Bn. |

|

Market Size in 2032 |

USD 250.41 Bn. |

|

CAGR (2025-2032) |

5.69 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Product Type Bread Breakfast Cereals Biscuits and Cookies Cakes and Pastries Others |

|

By Distribution Channel Supermarkets and Hypermarkets Specialty Stores Online Retail Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Bread And Baked Food Market Key players:

- Grupo Bimbo - Mexico.

- Finsbury Food Group -, United Kingdom.

- Yamazaki Baking Co., Ltd. - Japan.

- Aryzta AG - Switzerland.

- Premier Foods plc - United Kingdom.

- Flowers Foods, Inc. - USA.

- Associated British Foods plc (ABF) - United Kingdom.

- George Weston Limited - Canada.

- Grupo Lala - Mexico

- Franz Family Bakery - USA.

Frequently Asked Questions

Baking and confectionery brands is trend for the Bread and Baked Food market growth.

The Market size was valued at USD 160.83 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of5.5.69% from 2025 to 2032, reaching nearly USD 250.41 Billion.

The segments covered in the market report are by product and Distribution Channel.

1. Bread And Baked Food Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Bread And Baked Food Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Bread And Baked Food Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Bread And Baked Food Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Bread And Baked Food Market Size and Forecast by Segments (by Value USD Million)

5.1. Bread And Baked Food Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Bread

5.1.2. Breakfast Cereals

5.1.3. Biscuits and Cookies

5.1.4. Cakes and Pastries

5.1.5. Others

5.2. Bread And Baked Food Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Supermarkets and Hypermarkets

5.2.2. Specialty Stores

5.2.3. Online Retail

5.2.4. Others

5.3. Bread And Baked Food Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Bread And Baked Food Market Size and Forecast (by Value USD Million)

6.1. North America Bread And Baked Food Market Size and Forecast, By Product Type (2024-2032)

6.1.1. Bread

6.1.2. Breakfast Cereals

6.1.3. Biscuits and Cookies

6.1.4. Cakes and Pastries

6.1.5. Others

6.2. North America Bread And Baked Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.2.1. Supermarkets and Hypermarkets

6.2.2. Specialty Stores

6.2.3. Online Retail

6.2.4. Others

6.3. North America Bread And Baked Food Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Bread And Baked Food Market Size and Forecast (by Value USD Million)

7.1. Europe Bread And Baked Food Market Size and Forecast, By Product Type (2024-2032)

7.2. Europe Bread And Baked Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Europe Bread And Baked Food Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Bread And Baked Food Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Bread And Baked Food Market Size and Forecast, By Product Type (2024-2032)

8.2. Asia Pacific Bread And Baked Food Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Asia Pacific Bread And Baked Food Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Bread And Baked Food Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Bread And Baked Food Market Size and Forecast, By Product Type (2024-2032)

9.2. Middle East and Africa Bread And Baked Food Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. Middle East and Africa Bread And Baked Food Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Bread And Baked Food Market Size and Forecast (by Value USD Million)

10.1. South America Bread And Baked Food Market Size and Forecast, By Product Type (2024-2032)

10.2. South America Bread And Baked Food Market Size and Forecast, By Distribution Channel (2024-2032)

10.3. South America Bread And Baked Food Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Grupo Bimbo - Mexico.

11.1.1. Company Overview

11.1.2. Product Segment

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Finsbury Food Group -, United Kingdom.

11.3. Yamazaki Baking Co., Ltd. - Japan.

11.4. Aryzta AG - Switzerland.

11.5. Premier Foods plc - United Kingdom.

11.6. Flowers Foods, Inc. - USA.

11.7. Associated British Foods plc (ABF) - United Kingdom.

11.8. George Weston Limited - Canada.

11.9. Grupo Lala - Mexico

11.10. Franz Family Bakery - USA.

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook