Brazil Coffee Market: Industry Analysis and Forecast (2024-2030)

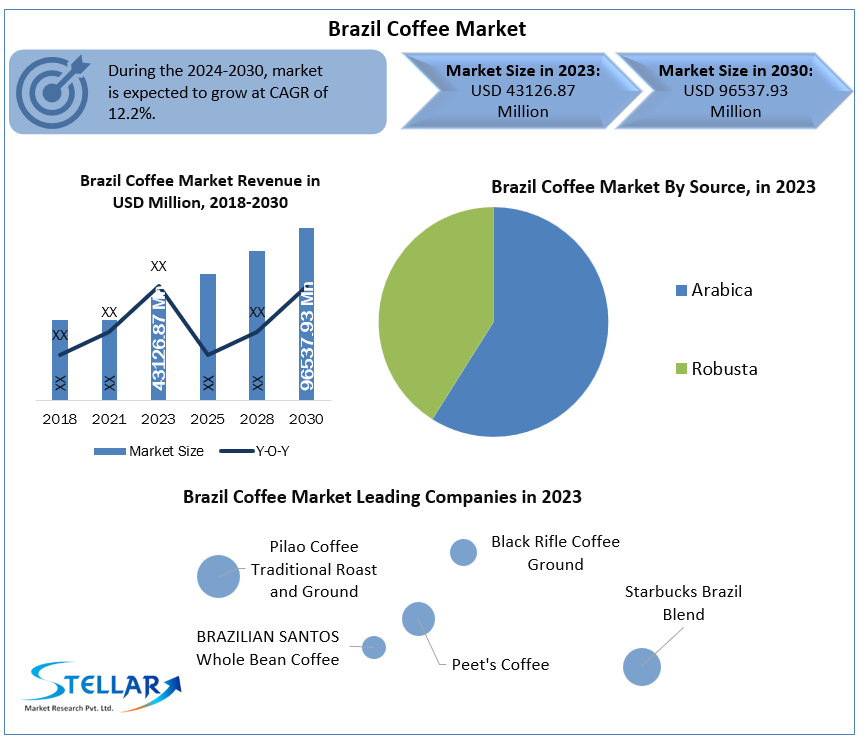

Brazil Coffee Market size was valued at US$ 43126.87 Mn. in 2023. Coffee will encourage a great deal of transformation in Beverage Sector in Brazil.

Format : PDF | Report ID : SMR_86

Brazil Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product

To get more Insights: Request Free Sample Report

Brazil Coffee Market Dynamics:

Brazil produces 35% of the world's coffee, but only Santos is considered important in the specialty coffee industry. Rio is also famous for its medicinal taste and is often used in New Orleans coffees with the addition of chicory. Brazilian coffee is usually produced dry. Bourbon Santos is Brazil's finest coffee, and the beans in the Arabica’s that produce this coffee are very small and curly during the first three or four years of production. As the tree ages, the kernels get larger and decrease in quality. They were then called Santos flat beans. Bandeirante is a popular Brazilian coffee grown in an area commonly found in the United States.

Coffee flows through the nation's veins, Brazilians have traditionally been more conflicted about specialty concepts such as single-origin, roast configuration, and brewing, which have become so common in the United States, Europe, and Asia. This has steadily changed, much of Brazil's coffee crop is destined for the commodity market, today the national specialty coffee movement is on the rise.

"Coffee is Brazil and Brazil is coffee" both in terms of production and consumption. 97 % percent of the population drinks coffee in Brazil. This consumption is more major than any other region and is driving the demand for coffee in the Brazil market.

The majority of coffee consumption in Brazil is still done in-house, Specialty coffees drive a trend towards quality, especially in cities where culture is established. The increase in the number of coffee drinkers in cafes is essentially related to the wave of specialty coffees in Brazil. These factors are driving the growth of the coffee market in this region.

Brazilian specialty coffee chain Surplice Cafés now has 20 stores around the country. Starting the business when specialty coffee was virtually unknown in Brazil. Today, that specialty and premium coffee was increasingly attracting the public.

In 2021, Nestlé has launched about 3 new products to meet the growing demand for roasted coffee beans in Brazil. To meet the emerging demand of consumers, nestle is continuously developing new strategies and introducing new products in Brazil market.

Brazil does not allow the import of chickpeas from other producing countries. All can source from six different regions in Brazil. This factor is driving the growth of the coffee market.

Healthy consumption is the main trend attracting Brazilian consumers. RTD coffee is also one of the functional drinks available with proven health benefits. Various RTD coffees are marketed to serve a wide range of consumers across Brazil. Threatened by health concerns, consumers are increasingly aware of the available functional drinks. RTD coffee combined with energy drinks is the most popular product on the Brazilian market. These factors are driving the growth of coffee in the market.

The objective of the report is to present a comprehensive analysis of the Brazil Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Brazil Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Brazil Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Brazil Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Brazil Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Brazil Coffee market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Brazil Coffee market. The report also analyses if the Brazil Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Brazil Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Brazil Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the Brazil Coffee market is aided by legal factors.

Brazil Coffee Market Scope:

|

Brazil Coffee Market |

|

|

Market Size in 2023 |

USD 43126.87 Mn. |

|

Market Size in 2030 |

USD 96537.93 Mn. |

|

CAGR (2024-2030) |

12.2% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

KEY PLAYERS:

- Golden Bean Trade

- Pilao Coffee Traditional Roast and Ground

- BRAZILIAN SANTOS Whole Bean Coffee

- Black Rifle Coffee Ground

- Starbucks Brazil Blend

- Peet's Coffee

Frequently Asked Questions

1. Brazil Coffee Market: Research Methodology

2. Brazil Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Brazil Coffee Market: Dynamics

3.1. Brazil Coffee Market Trends

3.2. Brazil Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Brazil Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2030)

4.1. Brazil Coffee Market Size and Forecast, by Source (2024-2030)

4.1.1. Arabica

4.1.2. Robusta

4.2. Brazil Coffee Market Size and Forecast, by Type (2024-2030)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Brazil Coffee Market Size and Forecast, by Process (2024-2030)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Brazil Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2023)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Golden Bean Trade

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Pilao Coffee Traditional Roast and Ground

6.3. BRAZILIAN SANTOS Whole Bean Coffee

6.4. Black Rifle Coffee Ground

6.5. Starbucks Brazil Blend

6.6. Peet's Coffee

7. Key Findings

8. Industry Recommendations