Bleisure Travel Market - Global Industry Analysis and Forecast (2025-2032)

The Bleisure Travel Market size was valued at USD 582.28 Bn. in 2024 and the total Global Bleisure Travel revenue is expected to grow at a CAGR of 9.2% from 2025 to 2032, reaching nearly USD 1177.38 Bn. by 2032.

Format : PDF | Report ID : SMR_1733

Bleisure Travel Market Overview

The SMR report offers comprehensive analysis of Bleisure Travel Market including the profit margins of key players, highlighting regional and segmental variations. Trend analysis examines market growth drivers and evolving consumer preferences. Detailed revenue and sales analysis provides a comprehensive understanding of market performance and growth opportunities. Exploring the impact on job creation, employment numbers, and wage structures, the report evaluates the influence of Bleisure travel on employees. Profit analysis assesses the financial health of key players and offers strategies for enhancing profitability. The comprehensive SMR analysis provides valuable insights into the Bleisure travel market dynamics and trends.

Investment opportunities in the Bleisure travel market include technology integration with mobile apps for itinerary management and virtual reality experiences. Customized services provide to individual preferences, while wellness-focused packages attract health-conscious travellers. Destination development increases leisure attractions in business hubs, stimulating Bleisure travel and local economies. Corporate partnerships offer Bleisure-friendly policies, tapping into the corporate travel market. Marketing efforts highlighting Bleisure benefits attract more travelers. These investments enhance the Bleisure experience, providing to diverse preferences and driving growth in the increasing travel sector.

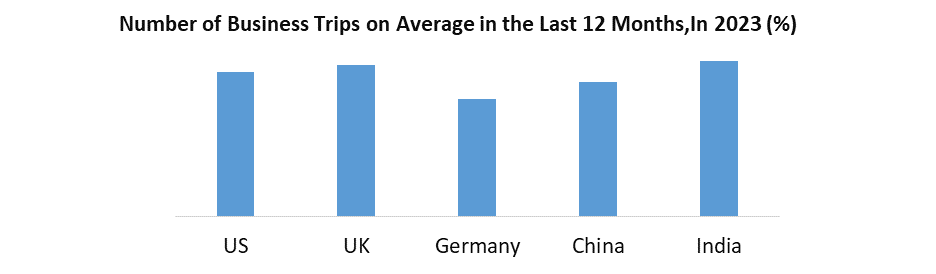

- Travel habits reveal a major focus on leisure, with business trips accounting for 30% or less of total travel. An impressive 83% of respondents utilize business trip time for city exploration. Six out of 10 travellers dedicate at least 10 days annually to business trips, with some extending stays to over 60 days. The data underscores the growing integration of leisure activities into business travel, reflecting a shift towards a more balanced approach to travel. As professionals increasingly blend work with leisure, the Bleisure travel trend continues to gain momentum, shaping the landscape of modern travel experiences.

To get more Insights: Request Free Sample Report

Bleisure Travel Market Dynamics

Work-Life Balance and the Rise of Bleisure Travel

The market of leisure travel is being driven by the increasing importance of work-life balance. To prevent burnout and improve well-being, modern professionals place a high value on leading balanced lives. Conventional work travel has traditionally involved extended time away from home, which has resulted in fatigue and discontent. Bleisure travel arises as a response, combining leisure activities with work obligations in one trip with ease. By improving travel experiences and encouraging rest and renewal, this strategy satisfies the changing demands of modern tourists.

- According to an SMR Analysis, 90% of leisure travelers reported higher life satisfaction compared to 75% of traditional business travelers. It highlights the positive impact of leisure travel on employee happiness.

Corporate Policy Hurdles for Bleisure Travel

Corporate policies often pose significant hurdles to the rising trend of leisure travel. Many companies enforce strict regulations on travel expenses, duration, and approval procedures, limiting employees' ability to extend trips for leisure purposes. The uncertainty and hesitation among employees deter potential leisure travelers, thereby constraining market growth. SMR 2023 survey revealed that only 30% of companies had established formal bleisure travel policies, indicating a widespread lag in adapting to the growing. In 2023, 40% of business travelers refrain from requesting bleisure extensions due to concerns about company policies it underscores employee hesitation stemming from unclear and restrictive policies.

- 83% of business travelers seize the opportunity to explore destinations during work trips. A majority of 60% have embraced leisure travel, often extending trips by two days (30%). Nearly half 46% regularly add personal days to business travel. Over half of 54% bring along companions, and 96% believe bleisure enriches cultural understanding. The desire for global exploration and cultural immersion drives bleisure trips. Most 73% view bleisure as beneficial to employee well-being, and 78% agree it enhances work assignments. Six out of 10 are more inclined towards bleisure today. Significantly, 94% of younger travellers express a high likelihood of engaging in bleisure over the next five years. However, company policies on bleisure are rare, with less than 14% having them in place.

Bleisure Travel Market Segment Analysis

By Age Group, Millennial emerge as the dominant segment in the Bleisure travel market, claiming a substantial 43% share in 2024. Their inclination towards unique travel experiences significantly impacts various aspects of the industry. Millennials' preference for experiential travel not only drives revenue for travel agencies, airlines, and hospitality providers offering Bleisure packages but also potentially increases the profit margins, particularly for businesses providing to their preferences such as boutique hotels and adventure activities. Also, the growing demand for Bleisure travel among Millennials creates job opportunities within the travel industry, influencing employment numbers and potentially wage structures.

The trend is expected to continue, with a projected (CAGR) of XX% from 2025 to 2032, indicating a sustained positive impact on the market. As Millennials continue to prioritize travel experiences that blend business with leisure, their significant presence in the Bleisure travel market is poised to drive growth and innovation in the industry.

Bleisure Travel Market Regional Analysis

North America commands a significant presence in the Bleisure Travel market, holding a robust XX% share in 2024. Projections indicate a promising growth trajectory, with the North American market expected to increase at a (CAGR) of XX% between 2025 and 2032. The surge in remote work culture empowers professionals with greater flexibility to combine business with leisure, thereby driving market growth. For Bleisure travel, specific service costs including flights, hotels, and activities vary widely and are often intertwined with business expenses. Travel agencies and service providers offering Bleisure packages to be expected adore higher profit margins thanks to the extended stays and increased activity bookings.

Core costs include transportation, accommodation, and activities, negotiated with airlines, hotels, and local businesses. While there aren't direct government initiatives for Bleisure travel, policies promoting tourism and flexible work arrangements indirectly support its growth. Government initiatives aimed at developing travel and flexible work arrangements is expected to indirectly increase the Bleisure market. While specific data on country dominance within North America is unusual, several factors is expected to influence on the Bleisure market. Major business hubs such as New York, Toronto, Los Angeles, and San Francisco are likely to witness increased Bleisure travel due to high business activity. Also, leisure destinations like Florida, California, and Hawaii attract travellers seeking to combine work with leisure pursuits.

Bleisure Travel Market Competitive Landscape

Numerous companies are progressing Bleisure-specific services to meet the rising demand for integrated business and leisure travel experiences. These services include tailored itinerary creation, allowing for a mix of business meetings and leisure activities. Flexible booking options enable travelers to extend business trips for personal time seamlessly. Also, travel service providers are integrating wellness activities and relaxation options into business travel packages to enhance traveler experience. Additionally, mobile apps are being developed to streamline Bleisure travel logistics and expenses management.

These new offerings aim to simplify Bleisure travel, making it more enticing for both businesses and employees. They have the potential to increase Bleisure travel adoption rates by addressing logistical challenges and providing seamless experiences. Also, by promoting work-life balance and employee satisfaction, these services can enhance overall well-being. Additionally, premium Bleisure packages is expected to generate higher revenue for travel service providers, tapping into the growing demand for integrated business and leisure travel solutions.

- Expedia Group initiated the Open World Accelerator program in September 2022 to strengthen the technological aspects of the tourism sector.

- BCD Travel and Amadeus teamed up in February 2023 to launch a number of projects pertaining to travel possibilities, including leisure travel.

- BCD Travel and Sabre teamed together in October 2022 to support the development and innovation of leisure travel.

|

Bleisure Travel Market Scope |

|

|

Market Size in 2024 |

USD 582.28 Bn. |

|

Market Size in 2032 |

USD 1177.38 Bn. |

|

CAGR (2025-2032) |

9.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Age Group Millennial Generation X Others |

|

By Industries Government Corporate |

|

|

By Employee Executives Middle Management Entry level Employee |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Bleisure Travel Market

- Travelbank.

- Airbnb, Inc.

- Wexas Travel

- Expedia Group Inc.

- TravelPerk S.L.U.

- Flight Centre Travel Group Limited

- Fareportal, BCD Group, Booking Holdings, Inc.

- Cvent Inc.

- Bleisuretravelcompany

- Paxes

- travel and leisure

- fcmtravel

- Amadeus

- Jrpass

- Corporatetraveller

- dutyofcareawards

Frequently Asked Questions

Incorporating leisure time into business trips allows travelers to experience new destinations, reduce stress, enhance work-life balance, boost productivity, and improve overall well-being. It also provides opportunities for networking and cultural enrichment.

Employers may face challenges related to managing travel expenses, ensuring compliance with company policies, and addressing liability and insurance issues. It's essential for employers to establish clear guidelines and communication channels regarding bleisure travel.

The Market size was valued at USD 582.28 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 9.2% from 2025 to 2032, reaching nearly USD 1177.38 Billion.

The segments covered in the market report are by Age Group, Industries and Employee.

1. Bleisure Travel Market: Research Methodology

2. Bleisure Travel Market: Executive Summary

3. Bleisure Travel Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Bleisure Travel Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Bleisure Travel Market Size and Forecast by Segments (by Value Units)

6.1. Bleisure Travel Market Size and Forecast, by Age Group (2024-2032)

6.1.1. Millennial

6.1.2. Generation X

6.1.3. Others

6.2. Bleisure Travel Market Size and Forecast, by Industries (2024-2032)

6.2.1. Government

6.2.2. Corporate

6.3. Bleisure Travel Market Size and Forecast, by Employee (2024-2032)

6.3.1. Executives

6.3.2. Middle Management

6.3.3. Entry level Employee

6.4. Bleisure Travel Market Size and Forecast, by Region (2024-2032)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Bleisure Travel Market Size and Forecast (by Value Units)

7.1. North America Bleisure Travel Market Size and Forecast, by Age Group (2024-2032)

7.1.1. Millennial

7.1.2. Generation X

7.1.3. Others

7.2. North America Bleisure Travel Market Size and Forecast, by Industries (2024-2032)

7.2.1. Government

7.2.2. Corporate

7.3. North America Bleisure Travel Market Size and Forecast, by Employee (2024-2032)

7.3.1. Executives

7.3.2. Middle Management

7.3.3. Entry level Employee

7.4. North America Bleisure Travel Market Size and Forecast, by Country (2024-2032)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Bleisure Travel Market Size and Forecast (by Value Units)

8.1. North America Bleisure Travel Market Size and Forecast, by Age Group (2024-2032)

8.1.1. Millennial

8.1.2. Generation X

8.1.3. Others

8.2. North America Bleisure Travel Market Size and Forecast, by Industries (2024-2032)

8.2.1. Government

8.2.2. Corporate

8.3. North America Bleisure Travel Market Size and Forecast, by Employee (2024-2032)

8.3.1. Executives

8.3.2. Middle Management

8.3.3. Entry level Employee

8.4. Europe Bleisure Travel Market Size and Forecast, by Country (2024-2032)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Bleisure Travel Market Size and Forecast (by Value Units)

9.1. Asia Pacific Bleisure Travel Market Size and Forecast, by Age Group (2024-2032)

9.1.1. Millennial

9.1.2. Generation X

9.1.3. Others

9.2. Asia Pacific Bleisure Travel Market Size and Forecast, by Industries (2024-2032)

9.2.1. Government

9.2.2. Corporate

9.3. Asia Pacific Bleisure Travel Market Size and Forecast, by Employee (2024-2032)

9.3.1. Executives

9.3.2. Middle Management

9.3.3. Entry level Employee

9.4. Asia Pacific Bleisure Travel Market Size and Forecast, by Country (2024-2032)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Bleisure Travel Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Bleisure Travel Market Size and Forecast, by Age Group (2024-2032)

10.1.1. Millennial

10.1.2. Generation X

10.1.3. Others

10.2. Middle East and Africa Bleisure Travel Market Size and Forecast, by Industries (2024-2032)

10.2.1. Government

10.2.2. Corporate

10.3. Middle East and Africa Bleisure Travel Market Size and Forecast, by Employee (2024-2032)

10.3.1. Executives

10.3.2. Middle Management

10.3.3. Entry level Employee

10.4. Middle East and Africa Bleisure Travel Market Size and Forecast, by Country (2024-2032)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Starch-based bio plastics Market Size and Forecast (by Value Units)

11.1. South America Bleisure Travel Market Size and Forecast, by Age Group (2024-2032)

11.1.1. Millennial

11.1.2. Generation X

11.1.3. Others

11.2. South America Bleisure Travel Market Size and Forecast, by Industries (2024-2032)

11.2.1. Government

11.2.2. Corporate

11.3. South America Bleisure Travel Market Size and Forecast, by Employee (2024-2032)

11.3.1. Executives

11.3.2. Middle Management

11.3.3. Entry level Employee

11.4. South America Bleisure Travel Market Size and Forecast, by Country (2024-2032)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Travelator, Inc.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Airbnb, Inc.

12.3. Wexas Travel

12.4. Expedia Group Inc.

12.5. TravelPerk S.L.U.

12.6. Flight Centre Travel Group Limited

12.7. Fareportal, BCD Group, Booking Holdings, Inc.

12.8. Cvent Inc.

12.9. Bleisuretravelcompany

12.10. Paxes

12.11. travel and leisure

12.12. fcmtravel

12.13. Amadeus

12.14. Jrpass

12.15. Corporatetraveller

12.16. Dutyofcareawards

13. Key Findings

14. Industry Recommendation