BOPP Films Market Industry Analysis and Trends of the Market (2026-2032)

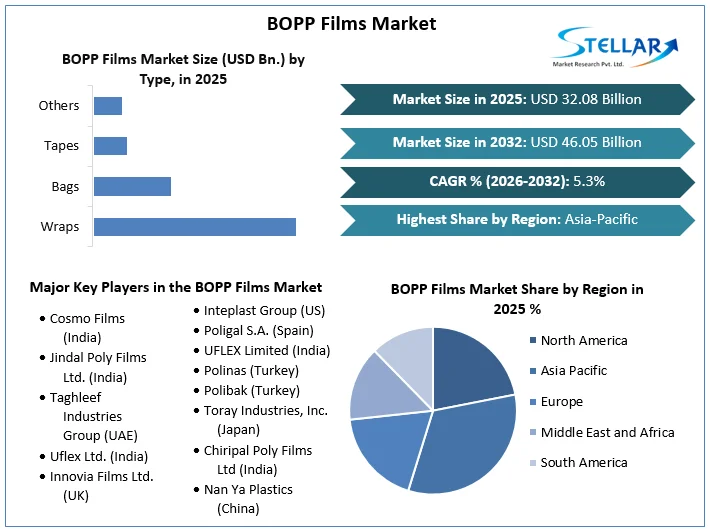

The Global BOPP Films Market size was valued at USD 32.08 Bn. in 2025 and the total Market revenue is expected to grow at a CAGR of 5.3% from 2026 to 2032, reaching nearly USD 46.05 Bn. by 2032.

Format : PDF | Report ID : SMR_2227

BOPP Films Market Overview:

BOPP (Biaxially-Oriented Polypropylene) film is a type of plastic film that has a wide range of applications in the packaging, labelling, and laminating industries. The market refers to the global BOPP films industry which is involved in the manufacturing, distribution, and utilization of BOPP films that have polymer films properties. One of the primary drivers of the BOPP films market is the booming demand for flexible packaging solutions from food & beverage and tobacco industry. The progress in technological advancements continue to drive the innovation in the BOPP films market as manufacturers are investing in R&D to improve film properties such as matte finishes and biodegradability, aligning with the growing demand for sustainable packaging solutions.

The leading manufacturers in the market such as Cosmos, UFLEX, CCL, Treofan are leveraging their capabilities by following sustainability practices to minimize the adverse impact on environment. The key BOPP films manufacturer company UFLEX (India) in Q4 of the year 2024, has witnessed an 8% volume growth across its business segments of which 3% was contributed from the film and packaging business. UFLEX, is aiming to reduce its plastic use at source and replace it with the recyclable content.

The Asia-Pacific BOPP films market dominated the market share in 2025, fueled by industrialization, urbanization, and expanding consumer markets in countries such as China and India. The existence of established manufacturing companies is representing the APAC region as the potential manufacturing region of BOPP films. The food and beverage segment is experiencing high demand for films as a result of expansion in food & beverage sectors across nations and consumer preferences for packaged food products.

With sustainability being the key focus area of the BOPP films market, manufacturers are increasingly adopting recyclable materials and eco-friendly production processes to bring in innovations in the market. However, with the emerging opportunities in the market, the BOPP market has a substantial growth with the market potential reaching USD 46.06 Bn over the forecast period.

To get more Insights: Request Free Sample Report

BOPP Films Market Dynamics:

Growing packaging industry and demand for flexible packaging are driving the BOPP Films market growth:

The BOPP films are used in packaging as they possess excellent barrier properties, clarity, and printability. The expansion of the packaging industry worldwide, which is driven by e-commerce, food & beverage, and consumer goods sectors, is directly influencing the demand for BOPP films in the market. These films are a preferred choice for flexible packaging applications such as pouches, bags, and wraps. The shift towards convenient and lightweight packaging solutions, with consumer preferences for longer shelf life of products and product visibility is boosting the demand for BOPP films.

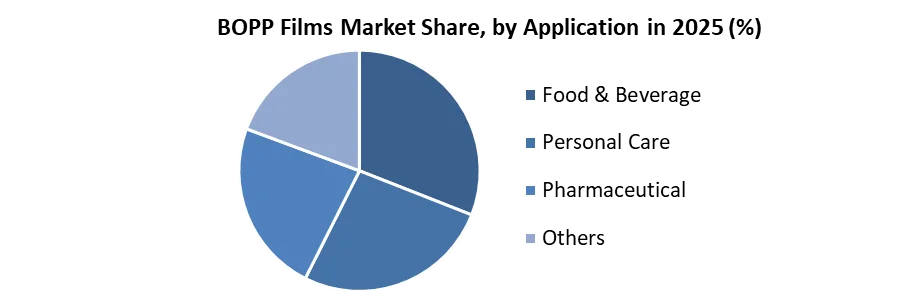

The progress in film manufacturing processes, such as improved barrier coatings and additives, enable BOPP film producers to prepare films with enhanced properties such as moisture resistance, heat seal, and stiffness fulfil the diverse application requirements. The demand from middle-class population is driving the need for packaged goods, which in turn is boosting the BOPP market. The personal care, hygiene products, and pharmaceuticals industries are significant BOPP films consumers.

Smart packaging integrations and innovative designs hold opportunities in the BOPP films market:

As regulatory bodies are emphasizing on environmental sustainability, there is a growing opportunity for BOPP films, in which recyclable films offer opportunities for manufactures by reducing material usage. Thus, manufacturers can capitalize on this trend by promoting the eco-friendly benefits of BOPP films in the market. There are opportunities for BOPP film manufacturers to differentiate their products through innovations such as matte finishes, high barrier films, metallized films, and specialty coatings as these innovations cater to specific market needs and are capable of charging premium pricing for films products. The film production technology has advanced to increase overall product quality and research has continued to create multiple smart solutions in packaging.

As technology continues to fuse with daily lives, customer engagement has become a priority for many companies. Anti-counterfeiting measures and QR code integration have started to become prevalent to increase customer satisfaction. Smart sensors may also be embedded to provide further information about product temperature, and authentication, and suggest similar brands. Smart packaging will enable real-time data collection during production while ensuring consistent quality and minimizing defects in the film. Further, advanced computer simulations will allow manufacturers to tailor film properties to specific applications before production begins by optimizing performance and reducing waste.

Wrinkling defects and inconsistent thickness of films pose challenges for the BOPP films market:

Wrinkling is caused by uneven tension, alignment issues and excessive processing speed disrupts the film's uniformity. This affects the quality and performance of films for packaging process. The irregular edges caused by misaligned slitters, blade dullness, or improper settings results in production halts and reduces the film's usability. The inconsistent or contaminated resin quality appears as a visual defect and reduces the film's visual appearance and functioning integrity.

The external factors like humidity and contaminants impact the BOPP film's quality when it's in processing, thus act as a barrier for the production process of films. For Instance, in the recent weeks, the European market for BOPP has encountered significant challenges, driven by low demand from downstream packaging industries. The region has seen a surplus in BOPP film supply, with market conditions characterized by sufficient stock levels.

BOPP Films Market Segmentation:

Based on type, the bag type of segment holds largest market share over the forecast period, as BOPP film bags, are thick and strong as compared to wraps and tapes. They provide better resistance and durability, which makes them suitable for packing products that require protection during handling and transit of products. The bags and pouches are able to heat-seal or sealed with adhesives, providing secure closure options that prevent tampering and ensure product integrity during dispatchment. This sealing efficiency is higher as compared to wraps or tapes, which requires more manual sealing processes, this in turn incurs high labor costs for businesses.

Based on production process, the tenter type of production process holds the largest market share over the forecast period as it is a high-speed production method suitable for large-scale manufacturing, which meets the demand for BOPP films in various industries including packaging and labelling applications. The tenter process is able to house different additives and coatings during the production process to enhance specific properties of the film. The process meets high-speed production method suitable for manufacturing of large-scale products which drives the demand for BOPP films in various industries including packaging and labelling applications. The process offers economic advantages in terms of production costs and efficiency as compared to the tubular process.

BOPP Films Market, Regional Analysis:

The Asia-Pacific BOPP films market held the largest market share in 2025 as countries such as China, India, Japan and South Korea are experiencing rapid industrialization and urbanization, leading to increased demand for packaged goods in the region. The growth is fueled by the demand for BOPP films in various packaging applications including food, beverages, personal care products, and pharmaceuticals. The food and beverage sector is a major BOPP films consumer in the APAC region influenced by changing dietary habits of the population and increasing preference for convenience in food products for flexible and durable packaging solutions that are provided by BOPP films.

APAC region is witnessing a significant rise in e-commerce activities, especially in countries such as China and India as the films are extensively used in packaging materials for e-commerce products for their ability to protect products during loading and dispatchment process accompanied by different printing designs and ensuring the product freshness. The region of North America is witnessing a significant growth in the market by the presence of expanding retail sector in countries like US and Canada.

Leading Exporters of BOPP Films, By Country, By Shipments, in 2024

Competitive Analysis of BOPP Films Market:

The competitive landscape of the BOPP films market is characterized by competition among key players trying to innovate and expand their product portfolios to capture the market share. Major companies in the market include multinational corporations such as Jindal Poly Films, Taghleef Industries, Treofan Group, Uflex Ltd., and Cosmo Films, among others. The leading BOPP films manufacturer Cosmos Films (India) is currently leveraging its market presence by the introduction of eco-friendly packaging solutions for food products which are made using renewable resources thus promoting reduction in greenhouse gas emissions and control on waste minimization. In 2025, the company has launched White CPP films for food packaging which ensures safety and preservation and offers a unique mix of functionality and aesthetics in the evolving world of packaging.

The central idea of utilizing white CPP is to ensure food safety as its acts as a potential barrier against contaminants and is made using non-reactive material, thus preventing any reactions. The White CPP overall enhances the visual appearance of products thus attracting consumers by giving a neat and professional look. Additionally, Cosmo Films had participated in Drupa 2025, and witnessed great success as its stall stood out as the centre of attraction that attracted visitors and industry professionals to experience the innovations offered by the brand. These key innovations and collaborations should be taken into account by other companies in order to withstand the market share with the recent happenings in the market.

|

BOPP Films Market Scope |

|

|

Market Size in 2024 |

USD 32.08 Bn. |

|

Market Size in 2032 |

USD 46.05 Bn. |

|

CAGR (2026-2032) |

5.3 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

BOPP Films Market Segments: |

By Type Wraps Bags Tapes Others |

|

By Production Process Tubular Tenter |

|

|

By Application Food & Beverage Personal Care Pharmaceutical Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

BOPP Films Market Key Players:

- Cosmo Films (India)

- Jindal Poly Films Ltd. (India)

- Taghleef Industries Group (UAE)

- Uflex Ltd. (India)

- Innovia Films Ltd. (UK)

- CCL Industries (Canada)

- SIBUR Holdings (Russia)

- Zhejiang Kinlead Innovative Materials (China)

- Inteplast Group (US)

- Poligal S.A. (Spain)

- UFLEX Limited (India)

- Polinas (Turkey)

- Polibak (Turkey)

- Toray Industries, Inc. (Japan)

- Chiripal Poly Films Ltd (India)

- Nan Ya Plastics (China)

- Treofan (Germany)

- Mitsui Chemicals (Japan)

Frequently Asked Questions

Cosmos films, JPFL, Taghleef, UFLEX, CCL Industries, Innovia films, Poligal are the key players of the BOPP Films market.

Asia-Pacific is the fastest-growing region in the BOPP films market in 2025.

The Market size was valued at USD 32.08 Bn in 2024 with growing CAGR of 5.3% from 2026 to 2032.

The segments covered in the BOPP Films market report are by type, Production Process and application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. BOPP Films Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global BOPP Films Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. BOPP Films Market: Dynamics

4.1. BOPP Films Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. BOPP Films Market Drivers

4.3. BOPP Films Market Restraints

4.4. BOPP Films Market Opportunities

4.5. BOPP Films Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. BOPP Films Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

5.1. BOPP Films Market Size and Forecast, by Type (2025-2032)

5.1.1. Wraps

5.1.2. Bags

5.1.3. Tapes

5.1.4. Others

5.2. BOPP Films Market Size and Forecast, by Production Process (2025-2032)

5.2.1. Tubular

5.2.2. Tenter

5.3. BOPP Films Market Size and Forecast, by Application (2025-2032)

5.3.1. Food & Beverage

5.3.2. Personal Care

5.3.3. Pharmaceutical

5.3.4. Others

5.4. BOPP Films Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America BOPP Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

6.1. North America BOPP Films Market Size and Forecast, by Type (2025-2032)

6.1.1. Wraps

6.1.2. Bags

6.1.3. Tapes

6.1.4. Others

6.2. North America BOPP Films Market Size and Forecast, by Production Process (2025-2032)

6.2.1. Tubular

6.2.2. Tenter

6.3. North America BOPP Films Market Size and Forecast, by Application (2025-2032)

6.3.1. Food & Beverage

6.3.2. Personal Care

6.3.3. Pharmaceutical

6.3.4. Others

6.4. North America BOPP Films Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe BOPP Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

7.1. Europe BOPP Films Market Size and Forecast, by Type (2025-2032)

7.2. Europe BOPP Films Market Size and Forecast, by Production Process (2025-2032)

7.3. Europe BOPP Films Market Size and Forecast, by Application (2025-2032)

7.4. Europe BOPP Films Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific BOPP Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

8.1. Asia Pacific BOPP Films Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific BOPP Films Market Size and Forecast, by Production Process (2025-2032)

8.3. Asia Pacific BOPP Films Market Size and Forecast, by Application (2025-2032)

8.4. Asia Pacific BOPP Films Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. South Korea

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa BOPP Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

9.1. Middle East and Africa BOPP Films Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa BOPP Films Market Size and Forecast, by Production Process (2025-2032)

9.3. Middle East and Africa BOPP Films Market Size and Forecast, by Application (2025-2032)

9.4. Middle East and Africa BOPP Films Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Rest of the Middle East and Africa

10. South America BOPP Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

10.1. South America BOPP Films Market Size and Forecast, by Type (2025-2032)

10.2. South America BOPP Films Market Size and Forecast, by Production Process (2025-2032)

10.3. South America BOPP Films Market Size and Forecast, by Application (2025-2032)

10.4. South America BOPP Films Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Cosmo Films (India)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Jindal Poly Films Ltd. (India)

11.3. Taghleef Industries Group (UAE)

11.4. Uflex Ltd. (India)

11.5. Innovia Films Ltd. (UK)

11.6. CCL Industries (Canada)

11.7. SIBUR Holdings (Russia)

11.8. Zhejiang Kinlead Innovative Materials (China)

11.9. Inteplast Group (US)

11.10. Poligal S.A. (Spain)

11.11. UFLEX Limited (India)

11.12. Polinas (Turkey)

11.13. Polibak (Turkey)

11.14. Toray Industries, Inc. (Japan)

11.15. Chiripal Poly Films Ltd (India)

11.16. Nan Ya Plastics (China)

11.17. Treofan (Germany)

11.18. Mitsui Chemicals (Japan)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook