Flexible Packaging Market Global Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics, Segmentation by Material Type, Product, End User Industry, and Region

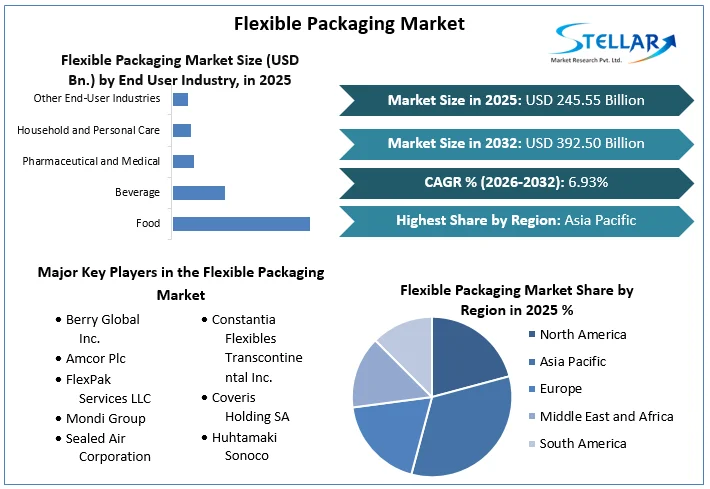

Flexible Packaging Market was valued at US$ 245.55 Bn. in 2025. Global Flexible Packaging Market size is estimated to grow at a CAGR of 6.93 %.

Format : PDF | Report ID : SMR_277

Flexible Packaging Market Overview:

Flexible packaging is available in the various formats like seal and resealable pouches, gusseted bags, stand-up pouches, microwavable pouches, spouted pouches, zipper and vacuum bags. Flexible packaging adds value to food and non-food products. Innovation and advancements in the packaging technology have led to the development of lighter weight packaging. It has a positive sustainability profile. Flexible packaging extends the shelf life of food products. Flexible Packaging Market report's segment analysis is on the basis of material type, product, end use industry and region.

Convenience is one of the key factors contributing to the rise in the popularity of flexible packaging. Current trends in flexible packaging are expected to shape the packaging sector in the near future. Consumer expectations, legal requirements and innovative technologies are driving the packaging sector. High-performance PU adhesives are expected to contribute enhanced sustainability in flexible packaging. Fast-curing, easy-to-use PU lamination adhesives supports manufacturers to accelerate their processes and stay competitive in the fast-paced flexible packaging market.

To get more Insights: Request Free Sample Report

Flexible Packaging Market Dynamics:

Sustainability trends: Flexible Packaging Solutions offer an ecological footprint

Sustainability is a new trend in the flexible packaging market. Many brand owners are seeking sustainable solutions. Flexible packaging offers ecological benefits like it uses less material over other solutions. It helps to save precious resources and energy during production.

Health and food safety trends: Drive demand for Reliable, Safe Materials for Packaging

Food contact materials have stringent legal requirements. With the growing consumer, brand owners are focusing to deploy suitable solution for maximized health and food. The standards and regulations are expected to become even stricter in the future, which drives the demand for packaging for food products. In the future, to offer healthy and safe food deployment and improve the quality, freshness and safety of food products, value chain from raw material suppliers to brand owners need to collaborate to create packaging solutions. The demand growth for healthy and safety food drives the growth of flexible packaging market.

Food industry: Hold the dominant position

Currently, food packaging industry includes the food products like processed fruits and vegetables, snacks, frozen and fresh food, sauce and spice, fish and seafood, meat and poultry, baby food, pet food, etc. Brand owners in the food packaging market are facing intense competition for the food preference of consumers and high-growth sectors in local, national, regional and global flexible packaging market. Food is the largest end-use industry for flexible packaging, which is accounting more than 50% share in flexible packaging. The food industry was an early adopter of flexible packaging and has witnessed continued strong growth because of increase its usages in convenient packaging for ready-to-eat foods, snacks, frozen meals and cake mixes. The processed fruits, vegetables, and baby food are expected to outperform the total food market for flexible packaging.

Global demand for consumer flexible packaging is expected to continue its upward growth trend specially in developing economies across the globe. Additionally, rural-urban migration, population growth and work routines are expected to increase demand for lightweight, on-the-go, ready-to-eat and portable food packaging to save space and time. Convenient packaging is a key factor for buying decisions among consumers. Food producers are concentrating to fulfil consumers’ desire for sustainable consumption and sustainable lifestyle through packaging formats.

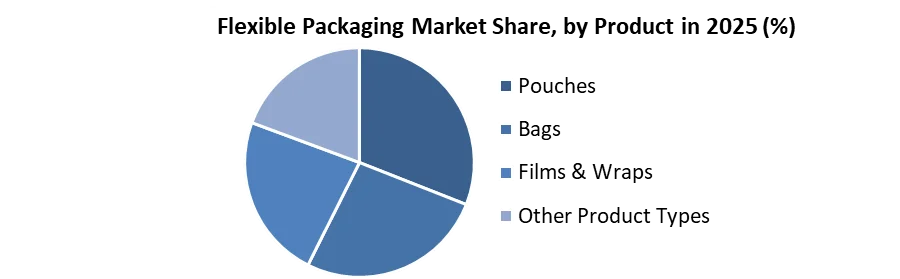

High Adoption of Plastic Pouches: Booming Flexible Packaging Sector

In the flexible packaging market, plastic pouches are expected to contribute more than 25% growth over other types of material. The demand for plastic pouch is driven by their flexibility, ease of use and light weight, and growing popularity of ready-to-eat foods. Advances in pouch characteristics like convenience usages as resealable closures, spouts and tear notche boost the demand for plastic pouch. The usages of machinery in pouch manufacturing technology are increasing line speeds and helps to reduce production cost. It makes pouches more competitive with other form of packaging, like cartons and cans.

Flexible Packaging Market Regional Insights:

Today, Asia is expected to hold the dominant position in the global flexible packaging market, with more than 40% of the global market share. An increase in preference for ready meals and smaller packaging units, rapid urbanization and high penetration of online shopping are some of the prominent factors behind the market growth. Multilayer plastics are projected to contribute more than 70%% of the market for food packaging in the Asia Pacific region. Asian consumers increasingly demanding environmentally friendly products. An innovation at the business model level is expected to increase profitability and stave off competition. Key operating players in the market are expected to form new strategies to tap key opportunities into new markets by providing socially responsible goods without sacrificing convenience.

However, many countries in Southeast Asia have stated their concerns regarding emerging consequences of a growing dependence on flexibles. An increase in incidences of flooding because of clogged drains and chemicals leaking into the surrounding environment are forcing key players to design plastic action plans to create great opportunity for startups to redesign flexible packaging materials.

Flexible Packaging Market Competitive Landscape:

Key players are taking efforts for plastic packaging, which shows that circularity in packaging sustainability is possible without sacrificing food quality or shelf life. For instance, global division of India-based UFlex has developed sustainable solutions that build on the inherent light-weighting efficiency of flexible packaging. Following are the Flexible Packaging Market keyplayers with some of the flexible packaging solutions in 2025.

Valvoline has Launched Bag for Oil- Valvoline Inc., who is a U.S.-based supplier of lubricants and automotive services have introduced gear-oil packaging innovation FlexFill. It aims to make changing synthetic gear oil easier and offer greater flexibility.

ProAmpac has introduced Recyclable Film for Frozen Food Products- ProAmpac has launched ProActive Recyclable R-2000F. It is film part of the ProActive Sustainability product family, which is prequalified for store drop-off recycling.

MULTIVAC's has launched Plastic-Free Packaging for Fresh Fruit and Vegetables- MULTIVAC has introduced full wrap labelling that offers a sustainable solution for plastic-free packaging concepts.

Amcor has introduced Dual Chamber Pouch- Amcor has launched a specialty multi-chamber pouch for drug-device combination products, which protects from light, moisture and oxygen ingress to support shelf life.

The objective of the report is to present a comprehensive analysis of the Flexible Packaging Market to the stakeholders in the industry. The report provides

trends that are most dominant in the Flexible Packaging Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Flexible Packaging Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Flexible Packaging Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Flexible Packaging Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the global market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Flexible Packaging Market. The report also analyses if the Flexible Packaging Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Flexible Packaging Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Flexible Packaging Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Flexible Packaging Market is aided by legal factors.

Flexible Packaging Market Scope:

|

Flexible Packaging Market |

|

|

Market Size in 2025 |

USD 245.55 Bn. |

|

Market Size in 2032 |

USD 392.50 Bn. |

|

CAGR (2026-2032) |

6.93% |

|

Historic Data |

2020-2032 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Material Type

|

|

By Product

|

|

|

By End User Industry

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Flexible Packaging Market

- Berry Global Inc.

- Amcor Plc

- FlexPak Services LLC

- Mondi Group

- Sealed Air Corporation

- Constantia Flexibles Transcontinental Inc.

- Coveris Holding SA

- Huhtamaki Sonoco

Frequently Asked Questions

The Asia Pacific region is expected to hold the highest share in the Flexible Packaging Market.

The market size of the Flexible Packaging Market by 2032 is US$ 392.50 Bn.

The forecast period for the Flexible Packaging Market is 2026-2032.

The market size of the Flexible Packaging Market in 2025 was USD 245.55 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Flexible Packaging Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Flexible Packaging Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

3.5. Flexible Packaging Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Flexible Packaging Market: Dynamics

4.1. Flexible Packaging Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Flexible Packaging Market Drivers

4.3. Flexible Packaging Market Restraints

4.4. Flexible Packaging Market Opportunities

4.5. Flexible Packaging Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Various Printing Methods for Flexible Products

4.8.2. Form Fill Seal Machine for Flexible Packaging

4.8.3. Stretchable Paper for Novel Paper Applications

4.8.4. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

5. Flexible Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

5.1. Flexible Packaging Market Size and Forecast, by Material Type (2025-2032)

5.1.1. Plastic

5.1.2. Paper

5.1.3. Aluminum Foil

5.1.4. Other Material Type

5.2. Flexible Packaging Market Size and Forecast, by Product (2025-2032)

5.2.1. Pouches

5.2.2. Bags

5.2.3. Films & Wraps

5.2.4. Other Product Types

5.3. Flexible Packaging Market Size and Forecast, by End User Industry (2025-2032)

5.3.1. Food

5.3.2. Beverage

5.3.3. Pharmaceutical and Medical

5.3.4. Household and Personal Care

5.3.5. Other End-User Industries

5.4. Flexible Packaging Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Flexible Packaging Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

6.1. North America Flexible Packaging Market Size and Forecast, by Material Type (2025-2032)

6.1.1. Plastic

6.1.2. Paper

6.1.3. Aluminum Foil

6.1.4. Other Material Type

6.2. North America Flexible Packaging Market Size and Forecast, by Product (2025-2032)

6.2.1. Pouches

6.2.2. Bags

6.2.3. Films & Wraps

6.2.4. Other Product Types

6.3. North America Flexible Packaging Market Size and Forecast, by End User Industry (2025-2032)

6.3.1. Food

6.3.2. Beverage

6.3.3. Pharmaceutical and Medical

6.3.4. Household and Personal Care

6.3.5. Other End-User Industries

6.4. North America Flexible Packaging Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Flexible Packaging Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

7.1. Europe Flexible Packaging Market Size and Forecast, by Material Type (2025-2032)

7.2. Europe Flexible Packaging Market Size and Forecast, by Product (2025-2032)

7.3. Europe Flexible Packaging Market Size and Forecast, by End User Industry (2025-2032)

7.4. Europe Flexible Packaging Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Flexible Packaging Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

8.1. Asia Pacific Flexible Packaging Market Size and Forecast, by Material Type (2025-2032)

8.2. Asia Pacific Flexible Packaging Market Size and Forecast, by Product (2025-2032)

8.3. Asia Pacific Flexible Packaging Market Size and Forecast, by End User Industry (2025-2032)

8.4. Asia Pacific Flexible Packaging Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. South Korea

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Flexible Packaging Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

9.1. Middle East and Africa Flexible Packaging Market Size and Forecast, by Material Type (2025-2032)

9.2. Middle East and Africa Flexible Packaging Market Size and Forecast, by Product (2025-2032)

9.3. Middle East and Africa Flexible Packaging Market Size and Forecast, by End User Industry (2025-2032)

9.4. Middle East and Africa Flexible Packaging Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of the Middle East and Africa

10. South America Flexible Packaging Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

10.1. South America Flexible Packaging Market Size and Forecast, by Material Type (2025-2032)

10.2. South America Flexible Packaging Market Size and Forecast, by Product (2025-2032)

10.3. South America Flexible Packaging Market Size and Forecast, by End User Industry (2025-2032)

10.4. South America Flexible Packaging Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Berry Global Inc.

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Amcor Plc

11.3. FlexPak Services LLC

11.4. Mondi Group

11.5. Sealed Air Corporation

11.6. Constantia Flexibles Transcontinental Inc.

11.7. Coveris Holding SA

11.8. Huhtamaki Sonoco

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook