Rigid Plastic Packaging Market- Global Industry Analysis and Forecast (2025-2032) by Material, Product and Application

Rigid Plastic Packaging Market size was valued at US$ 226.00 Bn. in 2024 and the total Global Rigid Plastic Packaging Market revenue is expected to grow at a CAGR of 4.9% from 2025 to 2032, reaching nearly USD 331.37 Bn.

Format : PDF | Report ID : SMR_1631

Rigid Plastic Packaging Market Overview

Packaging materials that give items structure and stability and not be bent or forced out of form are referred to as rigid plastic packaging. Materials like cardboard, metal, glass, and rigid plastics are among them. Benefits of rigid packaging include its capacity to preserve contents, provide the image of quality, and exhibit better strength. Bottles and containers, clamshells, thermoformed trays, blister packing, and clamshells are typical forms of rigid plastic packaging. The recyclability of rigid plastic packaging is well-known, as polymers such as polyethylene, polypropylene, and polyethylene terephthalate allow for 100% recycling.

The Rigid Plastic Packaging Market has seen significant growth with an expected CAGR of 4.9%. The Rigid Packaging Market is influenced by several factors like changing consumer lifestyles, an increase in urban population, and growing demand in the Healthcare sector. The Rigid plastic packaging market is driven by some key factors which include a significant rise in disposable income, product presentation and differentiation, and the low cost of rigid plastic packaging. The Rigid Plastic Packaging Market growth is hindered by some major restraining factors such as a Rise in Environmental Concerns, the Introduction of Regulatory Restrictions, and Limited growth in some of the regions. The Rigid Plastic Packaging Market is Segmented into three components which consist- by material, Product, and Application.

The Rigid Plastic Packaging Market is analyzed through Asia-Pacific, North America, South America, Europe, and the Middle East Region. The APAC region is leading the Rigid Plastic Packaging Market with a substantial market share and is estimated to register a CAGR of 3.42% during the forecasting period. The growth in the APAC region is primarily attributed to the rising demand for food and beverage products in nations like India and China. North America holds the second-largest share in the Rigid Plastic Packaging Market because of its well-developed pharmaceutical and medical sectors in countries like the United States and booming industrial sectors in Canada. Whereas, Europe is considered an emerging region because of its continuous innovation and technological advancements in the plastic sector and packaging industry. Meanwhile, is estimated to showcase moderate growth in the market.

Some of the Key players in the Rigid Plastic Packaging Market are Berry Global Inc., Amcor Plc, Takween Advanced Industries, Silgan Holdings Inc., Sonoco Products Company, DS Smith Plc, ALPLA, SABIC, Al Jabri Plastic Factory, Consolidated Container Company, Pactiv Evergreen Inc, Albea Group, Plastipak Holding, Inc, Graham Packaging Company, Huhtamaki, Inc, Mauser Packaging Solutions, Ball Corporation, Sealed Air Corporation, Sealed Air Corporation, RPC Group Plc.

To get more Insights: Request Free Sample Report

Rigid Plastic Packaging Market Dynamics

Rising Disposable Income- An important driver boosting the rigid plastic packaging market is a rise in disposable income. Rigid plastic packaging is in high demand as people tend to spend more on packaged goods when their disposable income increases. This aspect is especially significant in emerging nations like India, China Vietnam, and Australia, where the rigid plastic packaging market is growing due to rising consumer disposable income and urbanization. The market for rigid plastic packaging is projected to see prosperous growth due to the expansion of the e-commerce industry. The market for rigid plastic packaging is influenced by the convenience packaging sector since people with busy schedules need foods that are portable and require less preparation time. Disposable Personal Income in India increased to 272995360 INR Million (3281.825 B USD) in 2022. The maximum level was 206752288 INR Million and the minimum was 91540 INR Million. Also, in China, the Disposable per capita income was recorded at an all-time high of 47,435.000 RMB in 2023.

Product Presentation and Differentiation- Because of its many advantages, rigid plastic packaging is a major element propelling the market's expansion. It offers excellent visual appeal, facilitating successful branding and customer communication. likewise, it guarantees the conservation and safeguarding of food and drinks, prolonging their shelf life and averting infection. On the other hand, businesses use cutting-edge designs, labeling, and printing methods to improve customer appeal and brand visibility. Also, to use less material and save money on shipping, manufacturers are constantly developing lightweight designs that preserve the integrity and strength of packaging. Finally, manufacturers and customers benefit from the simplicity and versatility that rigid plastic packaging offers by choosing from a variety of forms and sizes. These elements support the need for stiff plastic packaging, which is a major force behind the market's expansion.

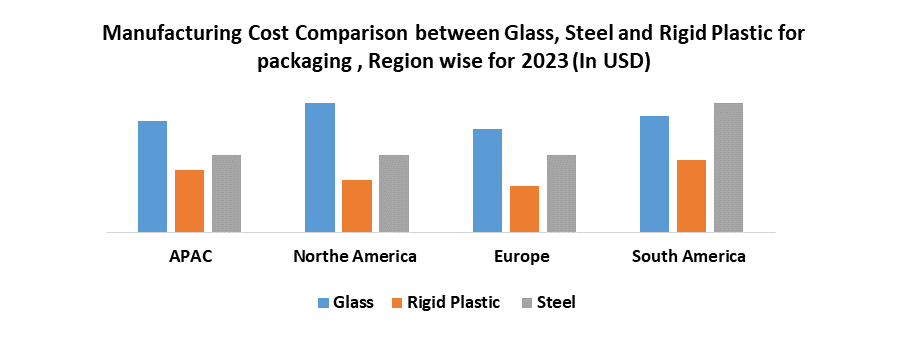

Low Cost of Rigid Plastic Packaging - One of the main factors assisting the rigid plastic packaging industry is its affordability. Rigid plastic packaging is a market leader because of its affordability, and it continue to gain traction in sectors seeking low-cost packaging options. Rigid plastic packaging is a popular option because of its strength and low weight, which lowers transportation costs and guarantees product safety while in route. Also, firms trying to cut costs like it because of its cost advantages over substitute materials. Also, the cost advantage when compared to alternative options like glass and metals, rigid plastic sounds to be a preferred option for the manufacturers who aim at cost cutting.

Environmental Concerns- One of the main factors limiting the growth of the rigid plastic packaging industry is the legislative limitations and outright prohibitions on single-use plastics in many places. The market faces difficulties due to these limitations and bans, which have a substantial effect on the demand for and output of rigid plastic packaging varieties. For instance, the Indian Government imposed a ban on the use of single-use plastic ban, from July 1, 2022, which prohibits the use of earbuds with plastic sticks, plastic sticks for balloons, plastic flags, candy sticks, ice-cream sticks, polystyrene for decoration, and plastic packaging waste.

Similarly, China’s National Development and Reform Commission (NDRC) and the Ministry of Ecology and Environment jointly released a policy document called "Opinions on Further Strengthening the Cleanup of Plastic Pollution" in January 2020, which outlines a five-year roadmap to restrict the use of plastic products such as shopping bags, straws, and utensils by 2020, 2022, and 2025, which includes the ban of Plastic packaging of all sorts. In the United States, many states and cities have imposed a ban and restrictions on single-use plastics including New York, California, and many more. The country is all set to ban the use of single-use plastic on public properties and national parks by 2032.

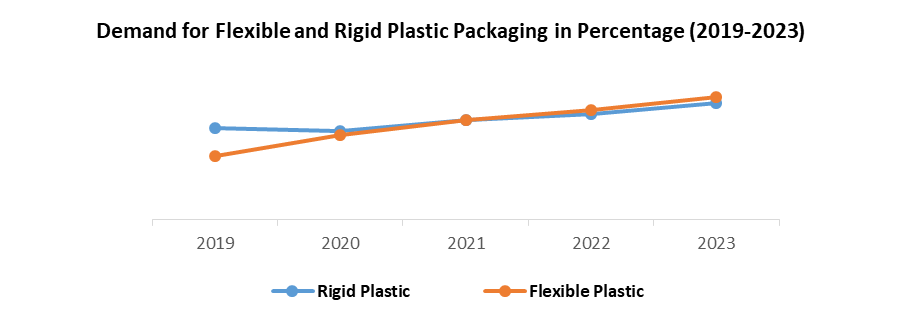

Accelerated Demand for Flexible Packaging- One major issue restricting the growth of the rigid plastic packaging industry is the growing need for flexible packaging. Rigid plastic packaging finds it difficult to compete with flexible packaging's adaptable forms and formats, which hinders its expansion. Rigid pack forms have increasingly lost market share to flexible packaging in a wide range of end-use applications. The versatility of flexible packaging allows it to be used in a wide range of applications, including food and beverage, pharmaceuticals, and personal care products. It is expected that the market for rigid plastic packaging is going to encounter challenges from the growing popularity of flexible packaging.

Rigid Plastic Packaging Market Segmentation

By Material, Polyethylene(PE) specifically is widely used in rigid packaging as it provides durability as well as flexibility. Polypropylene (PP) is known for its resistance to heat and chemicals which is why it is especially used in the packing of food and beverages. Polyethylene Terephthalate (PET) is widely used for packaging containers and bottles as it provides transparency, lightweight, and recyclability which helps it dominate the market with having a significant market share of 62.50% globally. Polystyrene is famous because of its insulation abilities and is widely used in products like electronics and food service.

By Product segmentation comprises Bottles and Jars, Trays and Containers, Caps and Closures as the main products in the Rigid Plastic Packaging Market. The Bottles and Jars dominate the product segment by consisting of 40% of the market share globally and are estimated to play a crucial role in the forecasting period. The success of the Bottles and Jars is mainly attributed to the ability of the bottles and jars to mould into unique shapes and sizes which increases the branding as well as consumer appeal.

By Application, the Rigid Plastic Packaging Market is further segmented into Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Household Products, and Automotive and Industry. Due to the industry's increasing need for jars, bottles, and containers, the food and beverage segment is projected to bring in the most revenue during the estimated period.

Rigid Plastic Packaging Market Competitive Landscape

The vehicle tracking system market is highly competitive, with multiple large-scale and medium-scale key players. Some of the key players dominating the markets are Berry Global Inc., Amcor Plc, Takween Advanced Industries, Silgan Holdings Inc., Sonoco Products Company, DS Smith Plc, ALPLA, SABIC, Al Jabri Plastic Factory, Consolidated Container Company, Pactiv Evergreen Inc. These companies are constantly involved in introducing new strategies such as new product launches, collaborations, business expansion, partnerships, mergers and acquisitions, joint ventures, and others to stay competitive in the market. Some instances include-

Amcor Plc- To advance its efforts in environmentally friendly packaging, Amcor made a calculated investment in PulPac fiber technology. Amcor's dedication to developing environmentally friendly packaging technology is demonstrated by this investment. Phoenix Flexibles, a flexible packaging business in the rapidly expanding Indian market, was acquired by Amcor. With this action, Amcor shows its commitment to sustaining and advancing the growth of the Indian packaging sector.

Takween Advanced Industries- Takween Advanced Industries Co. recently declared a significant SAR 300 million capital increase which is a 64.75% increase. The objective of the capital infusion is to encourage innovation and support the company's expansion plans.

DS Smith Plc- DS Smith Plc has declared that it has invested a total of €13 million in its factories located in Austria. With these investments, Austrian output is expected to rise by 20% and technological developments are accelerated. Also, the company is in talks for a possible all-share combination with Mondi, which is viewed as an exciting opportunity to create an industry leader in the European packaging Market.

|

Rigid Plastic Packaging Market Scope |

|

|

Market Size in 2024 |

USD 226.00 Bn. |

|

Market Size in 2032 |

USD 331.37 Bn. |

|

CAGR (2025-2032) |

4.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Material

|

|

By Product

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe - UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific - China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America - Brazil, Argentina, Rest of South America |

Key Players for the Rigid Plastic Packaging Market

- Berry Global Inc.

- Amcor Plc

- Takween Advanced Industries

- Silgan Holdings Inc.

- Sonoco Products Company

- DS Smith Plc

- ALPLA

- SABIC

- Al Jabri Plastic Factory

- Consolidated Container Company

- Pactiv Evergreen Inc

- Albea Group

- Plastipak Holding, Inc

- Graham Packaging Company

- Huhtamaki, Inc

- Mauser Packaging Solutions

- Ball Corporation

- Sealed Air Corporation

- Sealed Air Corporation

- RPC Group Plc

Frequently Asked Questions

There 3 major products in the Rigid Plastic Packaging Market, namely; Bottles and Jars, Trays and Containers, Caps and Closures.

Include Berry Global Inc., Amcor Plc, Takween Advanced Industries, Silgan Holdings Inc., Sonoco Products Company, DS Smith Plc, ALPLA, SABIC, Al Jabri Plastic Factory, Consolidated Container Company, Pactiv Evergreen Inc.

The Asian Pacific region holds the largest market share in the Rigid Plastic Packaging Market.

4.9% CAGR is the growth rate of the Rigid Plastic Packaging Market.

1. Rigid Plastic Packaging Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Rigid Plastic Packaging Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Rigid Plastic Packaging Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Rigid Plastic Packaging Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Rigid Plastic Packaging Market Size and Forecast by Segments (by Value USD Million and Volume in Tonnes)

5.1. Rigid Plastic Packaging Market Size and Forecast, By Material (2024-2032)

5.1.1. Polyethylene (PE)

5.1.2. Polypropylene (PP)

5.1.3. Polyethylene Terephthalate (PET)

5.1.4. Polystyrene

5.1.5. Polyvinyl Chloride (PVC)

5.1.6. Others

5.2. Rigid Plastic Packaging Market Size and Forecast, By Product (2024-2032)

5.2.1. Bottles and Jars

5.2.2. Trays and Containers

5.2.3. Caps and Closures

5.2.4. Others

5.3. Rigid Plastic Packaging Market Size and Forecast, By Application (2024-2032)

5.3.1. Food and Beverage

5.3.2. Personal Care and Cosmetics

5.3.3. Pharmaceuticals

5.3.4. Household Products

5.3.5. Automotive and Industrial

5.3.6. Others

5.4. Rigid Plastic Packaging Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Rigid Plastic Packaging Market Size and Forecast (by Value USD Million and Volume in Tonnes)

6.1. North America Rigid Plastic Packaging Market Size and Forecast, By Material (2024-2032)

6.1.1. Polyethylene (PE)

6.1.2. Polypropylene (PP)

6.1.3. Polyethylene Terephthalate (PET)

6.1.4. Polystyrene

6.1.5. Polyvinyl Chloride (PVC)

6.1.6. Others

6.2. North America Rigid Plastic Packaging Market Size and Forecast, By Product (2024-2032)

6.2.1. Bottles and Jars

6.2.2. Trays and Containers

6.2.3. Caps and Closures

6.2.4. Others

6.3. North America Rigid Plastic Packaging Market Size and Forecast, By Application (2024-2032)

6.3.1. Food and Beverage

6.3.2. Personal Care and Cosmetics

6.3.3. Pharmaceuticals

6.3.4. Household Products

6.3.5. Automotive and Industrial

6.3.6. Others

6.4. North America Rigid Plastic Packaging Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Rigid Plastic Packaging Market Size and Forecast (by Value USD Million and Volume in Tonnes)

7.1. Europe Rigid Plastic Packaging Market Size and Forecast, By Material (2024-2032)

7.2. Europe Rigid Plastic Packaging Market Size and Forecast, By Product (2024-2032)

7.3. Europe Rigid Plastic Packaging Market Size and Forecast, By Application (2024-2032)

7.4. Europe Rigid Plastic Packaging Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Rigid Plastic Packaging Market Size and Forecast (by Value USD Million and Volume in Tonnes)

8.1. Asia Pacific Rigid Plastic Packaging Market Size and Forecast, By Material (2024-2032)

8.2. Asia Pacific Rigid Plastic Packaging Market Size and Forecast, By Product (2024-2032)

8.3. Asia Pacific Rigid Plastic Packaging Market Size and Forecast, By Application (2024-2032)

8.4. Asia Pacific Rigid Plastic Packaging Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Rigid Plastic Packaging Market Size and Forecast (by Value USD Million and Volume in Tonnes)

9.1. Middle East and Africa Rigid Plastic Packaging Market Size and Forecast, By Material (2024-2032)

9.2. Middle East and Africa Rigid Plastic Packaging Market Size and Forecast, By Product (2024-2032)

9.3. Middle East and Africa Rigid Plastic Packaging Market Size and Forecast, By Application (2024-2032)

9.4. Middle East and Africa Rigid Plastic Packaging Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Rigid Plastic Packaging Market Size and Forecast (by Value USD Million and Volume in Tonnes)

10.1. South America Rigid Plastic Packaging Market Size and Forecast, By Material (2024-2032)

10.2. South America Rigid Plastic Packaging Market Size and Forecast, By Product (2024-2032)

10.3. South America Rigid Plastic Packaging Market Size and Forecast, By Application (2024-2032)

10.4. South America Rigid Plastic Packaging Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Berry Global Inc.

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Amcor Plc

11.3. Takween Advanced Industries

11.4. Silgan Holdings Inc.

11.5. Sonoco Products Company

11.6. DS Smith Plc

11.7. ALPLA

11.8. SABIC

11.9. Al Jabri Plastic Factory

11.10. Consolidated Container Company

11.11. Pactiv Evergreen Inc

11.12. Albea Group

11.13. Plastipak Holding, Inc

11.14. Graham Packaging Company

11.15. Huhtamaki, Inc

11.16. Mauser Packaging Solutions

11.17. Ball Corporation

11.18. Sealed Air Corporation

11.19. Sealed Air Corporation

11.20. RPC Group Plc

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook