Australia In Vitro Fertilisation Service Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The Australia In Vitro Fertilisation Service Market size was valued at USD 540.28 Mn. in 2024 and the total Australia In Vitro Fertilisation Service revenue is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 733.74 Mn. in 2032.

Format : PDF | Report ID : SMR_1680

Australia In Vitro Fertilisation Service Market Overview

In IVF, eggs and sperm are manually combined in a lab dish, fostering embryo development. This method, pivotal in reproductive technology, offers hope for pregnancy. The research scrutinizes Australia's IVF market, delving into dynamics, competition, innovations, and trends, offering comprehensive insights for stakeholders navigating this vital sector. The Australian in Vitro Fertilisation (IVF) Service Market is shaped by rising maternal age, driven by factors like education, career pursuits, and changing family dynamics. Increasing awareness and acceptance of IVF, aided by technological advancements and government funding through Medicare, fuel demand. Diverse fertility treatments further enhance options for couples seeking conception assistance.

The report meticulously analyzes the Australia In Vitro Fertilisation Service Market, spotlighting its evolution, trends, and innovations. It dissects the market's current landscape, dimensions, and growth patterns while identifying pivotal growth factors and opportunities. STELLAR's comprehensive examination offers insights crucial for navigating this dynamic sector's trajectory.

To get more Insights: Request Free Sample Report

In IVF, eggs and sperm are manually combined in a lab dish, fostering embryo development. This method, pivotal in reproductive technology, offers hope for pregnancy. The research scrutinizes Australia's IVF market, delving into dynamics, competition, innovations, and trends, offering comprehensive insights for stakeholders navigating this vital sector. The Australian in Vitro Fertilisation (IVF) Service Market is shaped by rising maternal age, driven by factors like education, career pursuits, and changing family dynamics. Increasing awareness and acceptance of IVF, aided by technological advancements and government funding through Medicare, fuel demand. Diverse fertility treatments further enhance options for couples seeking conception assistance.

The report meticulously analyzes the Australia In Vitro Fertilisation Service Market, spotlighting its evolution, trends, and innovations. It dissects the market's current landscape, dimensions, and growth patterns while identifying pivotal growth factors and opportunities. STELLAR's comprehensive examination offers insights crucial for navigating this dynamic sector's trajectory.

The Australia In Vitro Fertilisation Service Market booms thanks to a significant delay in childbirth among women. Prioritizing education or career advancement often leads to difficulties in natural conception later. IVF emerges as a crucial solution, offering hope for those navigating delayed family planning, and bridging the gap between readiness and conception. The Australia In Vitro Fertilisation Service Market experiences a surge as more women postpone childbirth. This trend increases the clientele seeking assistance, particularly from fertility clinics witnessing heightened demand. With increasing numbers delaying family planning, IVF emerges as a vital resource in fulfilling parenthood aspirations amidst evolving societal norms.

Additionally, the Australia In Vitro Fertilisation Service Market is driven by the rising age of first-time mothers, amplifying the pool of potential patients seeking fertility assistance. As more individuals delay parenthood, the demand for IVF rises, highlighting its pivotal role in enabling conception amidst shifting demographics and societal norms.

Australia In Vitro Fertilisation Service Market Segment Analysis

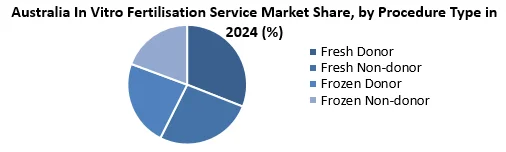

Based on Procedure Type, the Frozen Non-donor segment held the largest market share of about 65% in the Australia In Vitro Fertilisation Service Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 3.9% during the forecast period. Australia's IVF Services Market dominates with advanced tech and smart device integration, fostering rapid growth and connectivity adoption.

In the Australia In Vitro Fertilisation Service Market, higher success rates are pivotal. Fresh embryo transfers from a woman's eggs typically yield superior outcomes compared to frozen embryos or donor eggs. This distinction underscores a vital consideration for couples pursuing IVF and aiming to optimize their prospects of achieving pregnancy. In the market patient preference plays a crucial role couples aspiring to conceive with their genetic material often prioritize fresh cycles. This inclination reflects their desire to maximize their chances of success and emphasizes the significance of personal choice in navigating fertility treatment options.

In the Australia In Vitro Fertilisation Service Market, increased demand is run by high success rates and a preference for fresh cycles. Fertility clinics focus on catering to this segment and are driven by technological advancements. Ongoing research improves egg retrieval and embryo culture methods, particularly augmenting the efficacy of fresh cycles and thereby shaping the landscape of assisted reproductive technology. In the market, the debate between fresh and thawed cycles persists and fresh cycles remain prevalent, thawed cycles gain ground due to their convenience and cost-effectiveness. The success rates significantly influence patient choices. Despite alternatives like donor egg IVF for egg quality issues, the preference for genetic material keeps fresh cycles predominant.

Additionally, Fresh IVF cycles (non-donor) stand as the cornerstone of the Australia In Vitro Fertilisation Service Market, buoyed by high success rates and patient preference. Their pivotal role in market growth remains indisputable and advancements in thawed cycles and alternatives such as donor eggs introduce complexity to market dynamics, shaping the landscape further.

|

Australia In Vitro Fertilisation Service Market Scope |

|

|

Market Size in 2024 |

USD 540.28 Million |

|

Market Size in 2032 |

USD 733.74 Million |

|

CAGR (2025-2032) |

3.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Procedure Type

|

|

By End-User

|

|

Leading Key Players in the Australia In Vitro Fertilisation Service Market

- Max Healthcare

- Bloom In Vitro Fertilization (IVF)

- CCRM Fertility.

- OXFORD FERTILITY Create Health (Create Fertility)

- Medicover

- Aevitas Fertility Clinic

- BioART Fertility Clinic

- Prelude Fertility, Inc.

Frequently Asked Questions

High costs associated with IVF procedures are expected to be the major restraining factors for the Australia In Vitro Fertilisation Service Market growth.

The Australia In Vitro Fertilisation Service Market size was valued at USD 540.28 Million in 2024 and the total Australia In Vitro Fertilisation (IVF) Service revenue is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 733.74 Million By 2032.

1. Australia In Vitro Fertilisation Service Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Impact of Artificial Intelligence (AI) On the Australia In Vitro Fertilisation Service Market.

2.1 Embryo Selection and Grading

2.2 Sperm Selection and Motility Analysis

2.3 Automation and Streamlining of Processes

3. Australia In Vitro Fertilisation Service Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the Australia In Vitro Fertilisation (IVF) Service Industry

4. Australia In Vitro Fertilisation Service Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 Australia In Vitro Fertilisation Service Market Size and Forecast, by Procedure Type (2024-2032)

4.1.1 Fresh Donor

4.1.2 Fresh Non-donor

4.1.3 Frozen Donor

4.1.4 Frozen Non-donor

4.2 Australia In Vitro Fertilisation Service Market Size and Forecast, End-User (2024-2032)

4.2.1 Fertility Clinics

4.2.2 Surgical Centers

4.2.3 Hospitals

4.2.4 Clinical Research Institutes

5. Australia In Vitro Fertilisation Service Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading Australia In Vitro Fertilisation (IVF) Service Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 Max Healthcare

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Bloom In Vitro Fertilization (IVF)

6.3 CCRM Fertility.

6.4 OXFORD FERTILITY Create Health (Create Fertility)

6.5 Medicover

6.6 Aevitas Fertility Clinic

6.7 BioART Fertility Clinic

6.8 Prelude Fertility, Inc.

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. Australia In Vitro Fertilisation Service Market: Research Methodology