Australia Antibody Drug Conjugates Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

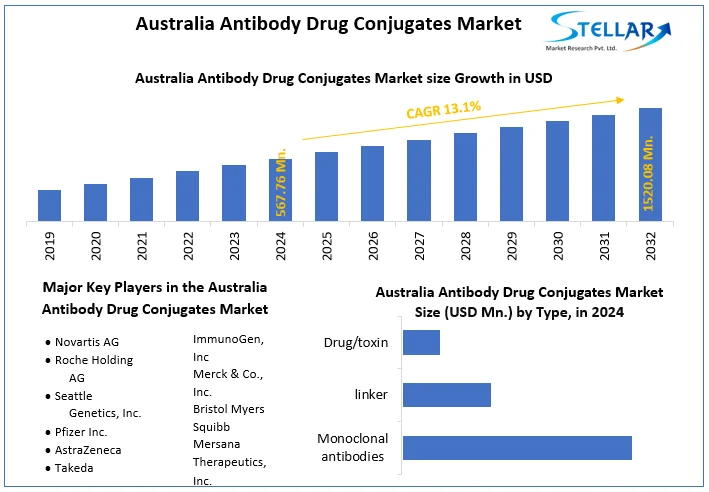

The Australia Antibody Drug Conjugates Market size was valued at USD 567.76 Mn. in 2024 and the total Australia Antibody Drug Conjugates revenue is expected to grow at a CAGR of 13.1% from 2025 to 2032, reaching nearly USD 1520.08 Mn.

Format : PDF | Report ID : SMR_1773

Australia Antibody Drug Conjugates Market Overview-

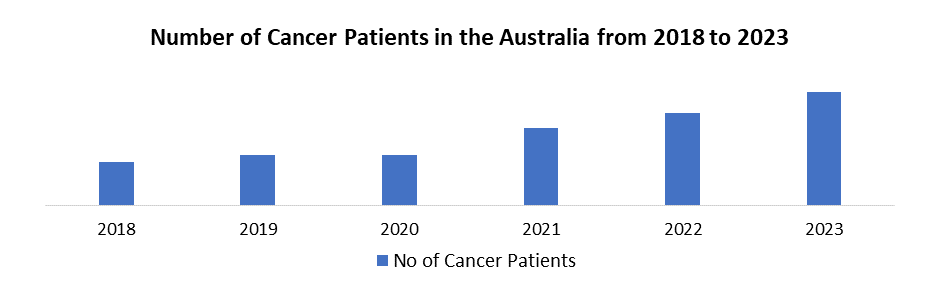

Antibody drug conjugates (ADCs) integrate potent cell-killing drugs with distinct anti-tumor effects and offering a novel therapeutic avenue unlike traditional chemotherapy and they limit systemic toxicity by pinpointing cancerous cells, sparing healthy ones, and enhancing treatment safety. During rising cancer instances, ADCs stand as a formidable tool in oncology's arsenal, marrying monoclonal antibodies with cytotoxic payloads to deliver potent therapy specifically to cancer cells, marking a dynamic frontier in cancer treatment innovation. As Australia battles rising cancer rates and the demand for effective treatments escalates spotlighting the Australia Antibody Drug Conjugates market. In this landscape, Australia's pursuit of innovative cancer treatments underscores a proactive stance in addressing the pressing healthcare challenges.

- Tetra Therapeutics (TTT) is a Perth-based biotech advancing ADC therapies for cancer. Their lead, TPI-2600, targets HER2 and is in Phase 1/2 trials for breast and gastric cancers. Pioneering in Western Australia, they aim to revolutionize cancer treatment with innovative solutions.

This report delves into Australia's Antibody Drug Conjugates market, examining trends, technology, and disruptions. It evaluates market size, growth, regulations, and commercial factors, while analyzing the competitive landscape and historical data. Prompted by economic downturn, it equips stakeholders with vital insights for informed decisions in the dynamic sector, catering to healthcare professionals, policymakers, and pharmaceutical companies.

To get more Insights: Request Free Sample Report

Australia Antibody Drug Conjugates Market Dynamics:

Australia Antibody Drug Conjugates Market Driver:

- Increasing cancer diagnoses drive demand for the Australia Antibody Drug Conjugates market and also research and development. Antibody Drugs Conjugates technology innovations address the urgent need for potent and targeted cancer therapies, pledging improved patient outcomes. Higher healthcare investment bolsters research, manufacturing, and infrastructure, fostering job creation and economic growth. Effective ADCs provide cancer patients with improved treatment options, potentially reducing side effects and enhancing their quality of life.

- Rising cancer rates and the high cost of ADCs raise ethical concerns and intensifying healthcare disparities. The growing demand for Australia Antibody Drug Conjugates industry strains healthcare systems grappling with rising costs and resource limitations. Over-relying on ADCs, neglecting early detection, and prevention may pose challenges. Manufacturing and disposing of complex ADC components raise environmental concerns without responsible management.

- The increasing cancer incidence drives the Australia Antibody Drug Conjugates market, fostering development and treatment optimism. However, ethical, economic, and environmental concerns accompany these advancements, emphasizing the need for responsible development, pricing, and access strategies.

Australia Antibody Drug Conjugates Market Segment Analysis

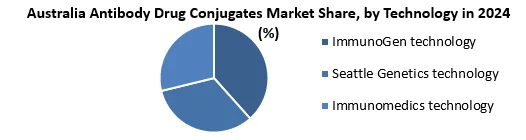

Based on Technology, the ImmunoGen Technology segment held the largest market share of about 30% in the Australia Antibody Drug Conjugates Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 13.2% during the forecast period. It stands out as the dominant segment within the Australia Antibody Drug Conjugates Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Australia Antibody Drug Conjugates ImmunoGen's limited market share actively hampers its broader impact compared to larger players and impeding competition for resources and partnerships. High development costs and time constraints actively impede innovation, disadvantaging smaller companies like ImmunoGen. Safety concerns persist actively due to ADCs' potent payloads and posing a continuous challenge to the balance between efficacy and safety. Rising competition from Seagen and AstraZeneca actively complicates ImmunoGen's differentiation and making partnership acquisition and market share maintenance more challenging.

In the Australia Antibody Drug Conjugates Market Approved Antibody Drug Conjugates like Kayla actively improve efficacy and minimize side effects through ground-breaking linker-payload technology. Novel ADC platforms and advanced linker technologies result from active R&D investments. Enfortumab Vetoing and Kayla actively broaden cancer treatment options in the market. Licensing agreements actively spur ADC tech access and accelerating development and driving the Australia Antibody Drug Conjugates market. Clinically, these active advancements address unmet medical needs and potentially elevating survival rates and patients quality of life, while actively driving research and development in targeted cancer therapy.

The Australia Antibody Drug Conjugates companies excel by leveraging expertise in specific targets or linker technologies for differentiation. Larger firms actively provide crucial resources and broaden their reach through strategic partnerships. Efficiently introducing new, safe, and effective ADCs to the market is ensured by prioritizing clinical development. Continuous technology refinement and collaboration with stakeholders actively address safety concerns to ensure patient well-being.

Australia Antibody Drug Conjugates Market Scope:

|

Australia Antibody Drug Conjugates Market |

|

|

Market Size in 2024 |

USD 567.76 Million |

|

Market Size in 2032 |

USD 1520.08 Million |

|

CAGR (2025-2032) |

13.1 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Application

|

|

By Type

|

|

|

By Product

|

|

|

By Technology

|

|

|

End-User

|

|

Leading Key Players in the Australia Antibody Drug Conjugates Market

- Novartis AG

- Roche Holding AG

- Seattle Genetics, Inc.

- Pfizer Inc.

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- ImmunoGen, Inc

- Merck & Co., Inc.

- Bristol Myers Squibb

- Mersana Therapeutics, Inc.

Frequently Asked Questions

High drug costs and Limited reimbursement are expected to be the major restraining factors for the Australia Antibody Drug Conjugates market growth.

The Australia Antibody Drug Conjugates Market size was valued at USD 567.76 Million in 2024 and the total Australia Antibody Drug Conjugates revenue is expected to grow at a CAGR of 13.1 % from 2025 to 2032, reaching nearly USD 1520.08 Million By 2032.

1. Australia Antibody Drug Conjugates Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Australia Antibody Drug Conjugates Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Australia Antibody Drug Conjugates Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Australia Antibody Drug Conjugates Market: Dynamics

4.1. Australia Antibody Drug Conjugates Market Trends

4.2. Australia Antibody Drug Conjugates Market Drivers

4.3. Australia Antibody Drug Conjugates Market Restraints

4.4. Australia Antibody Drug Conjugates Market Opportunities

4.5. Australia Antibody Drug Conjugates Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Australia Antibody Drug Conjugates Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Australia Antibody Drug Conjugates Market Size and Forecast, by Application (2024-2032)

5.1.1. Blood Cancer

5.1.2. Prostate cancer

5.1.3. kidney cancer

5.1.4. Pancreas cancer

5.1.5. Ovary cancer

5.1.6. Glioblastoma

5.1.7. lung cancer

5.1.8. Colon cancer

5.1.9. Breast cancer

5.1.10. Skin cancer

5.1.11. Solid tumors

5.2. Australia Antibody Drug Conjugates Market Size and Forecast, by Type (2024-2032)

5.2.1. Monoclonal antibodies

5.2.2. linker

5.2.3. Drug/toxin

5.3. Australia Antibody Drug Conjugates Market Size and Forecast, by Product (2024-2032)

5.3.1. Adcetris

5.3.2. Kadcyla

5.4. Australia Antibody Drug Conjugates Market Size and Forecast, by Technology (2024-2032)

5.4.1. ImmunoGen technology

5.4.2. Seattle Genetics technology

5.4.3. Immunomedics technology

5.5. Australia Antibody Drug Conjugates Market Size and Forecast, by End User (2024-2032)

5.5.1. Hospitals

5.5.2. Specialized cancer centers

5.5.3. Academic research institutes

5.5.4. Biotechnology companies

5.5.5. Biopharmaceutical companies

6. Company Profile: Key Players

6.1. Novartis AG

6.1.1. Company Overview

6.1.2. Product Segment

6.1.2.1. Product Name

6.1.2.2. Product Details (Price, Features, etc)

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Roche Holding AG

6.3. Seattle Genetics, Inc.

6.4. Pfizer Inc.

6.5. AstraZeneca

6.6. Takeda Pharmaceutical Company Limited

6.7. ImmunoGen, Inc

6.8. Merck & Co., Inc.

6.9. Bristol Myers Squibb

6.10. Mersana Therapeutics, Inc.

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook