Asia-Pacific Online Gambling Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

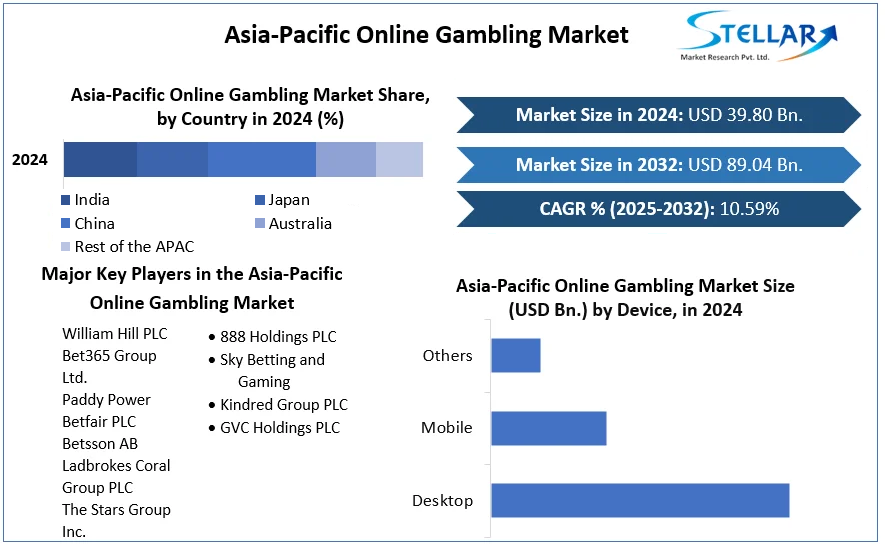

Asia-Pacific Online Gambling Market was valued nearly US$ 39.80 Bn. in 2024. Asia-Pacific Online Gambling Market size is estimated to grow at a CAGR of 10.59% & is expected to reach at US$ 89.04 Bn. by 2032.

Format : PDF | Report ID : SMR_235

Asia-Pacific Online Gambling Market Overview:

The market is majorly driven by rising internet penetration and increasing use of mobile phones by users to play online games from their homes & public places. Factors including simple access to internet gambling, legality & societal acceptance, corporate sponsorships, and celebrity endorsements are also driving market expansion. Market growth is expected to be aided by the increasing availability of low-cost mobile applications around the world.

To get more Insights: Request Free Sample Report

The year 2024 will be recognized as a year that disrupted millions of people's daily lives and had an impact on worldwide enterprises. Borders that are closed, businesses, offices, hotels, and entertainment venues. On the other hand, several firms were able to immediately respond to the epidemic by moving a portion of their operations and services online. Some of them upgraded the services they provided and made them more load-friendly. Before the epidemic, for example, 28% of people did their weekly shopping online. By 2020, this number will have risen to 36%.

Along with the e-commerce industry, the online gaming sector is expected to increase significantly in 2021. People stay at home, become bored, and pass the time by playing online casino games. Furthermore, industry analysts believe that this influence will continue to grow.

Over the course of the last few decades, the gambling & gaming business has seen various changes. These shifts have continued in the modern world, and they have evolved to encompass technological breakthroughs. With the introduction of Bitcoin into casinos last year, Stellar Market Research experts predict that this year will be another exciting one, with new trends likely to redefine and revolutionize entire parts of this massive industry. Below are some of the top gambling & gaming trends for online and real-world casinos in 2022, as well as some of the most important statistics that may have an impact on the whole casino business.

Crypto currency is set to take over the gambling world.

The gambling business will continue to be dominated by crypto currency, with numerous online platforms accepting it this year. Because of the security and anonymity of Bitcoin & other digital currencies, many individuals appreciate and prefer these transactions for deposits, withdrawals, & gaming. Traditional payment methods will continue to be accepted by the largest gambling sites, but crypto currencies are gradually replacing them since many people prefer to be anonymous and untraceable, especially when dealing with something as sensitive as gambling. Furthermore, the enhanced security of crypto helps customers feel safer because identity theft & hacking are reduced. As a result, many gamers have turned to crypto currency as their preferred method of payment, and this trend will continue.

Even in Gaming's Restricted Areas, Access:

Because cryptos introduced anonymity to the gambling world & are virtually untraceable because people do not link their personal information to this digital currency, many players from all over the world have been able to access and play online gambling games in places where it was previously restricted or outlawed. Consider how, as a result of the protection provided by Bitcoin, there has been an increase in online gambling sites in places that have banned physical casinos. For example, despite its rigorous laws, Taiwan is seeing a tremendous increase in the number of online gambling sites that accept bitcoins as a form of payment. Taiwanese players can browse & play at a number of online casinos that take Bitcoin on sites like Online Casino TW. This rising demand will continue to improve in the next years as online casinos gain confidence in promoting and expanding in these locations. Tapping this under-served sector is being given significant priority because of the high volume of probable revenue that may be obtained from these areas.

Rapidly Changing Consumer Behavior

With everyone owning a smartphone, mobile & social gaming have had a significant impact on the online gambling industry. People are increasingly opting to play games on their smartphones. As a result, the number of F2P (free-to-play) game goods has increased over the world. While free-to-play games do not generate direct revenue and are viewed as more of a form of entertainment, revenue can still be generated in other ways. Players frequently spend a little money to upgrade their favorite game in order to gain access to additional features. They are also eager to pay a small fee to improve their gaming experience by purchasing various virtual offerings and game merchandise. This shows that people are willing to spend on amusement, and even something considered as free, is not completely free at all. Because these F2P gamers are potential clients and have strength in numbers, both online and casino operators are working hard to harness this data to their advantage. If they are tapped, income will skyrocket.

Dealing with a Larger Number of Live Dealers

Players prefer online casinos that allow them to view a realistic real-life casino from the comfort of their own homes. They prefer the interaction of a "genuine, live" dealer, which is why they began this gambling habit without having to leave the house. As a result, more online casinos are exploiting this information to obtain a competitive advantage for their websites. Furthermore, they bolster the same angle in the brick-and-mortar casino. For instance, the employment of dynamic, active dealers in games like Blackjack and Baccarat are popular with online casinos, and many real casinos spend their efforts on delivering interesting dealers on the casino floor. Consumers have always been drawn to dealers with a quick wit and charm since the beginning of the casino industry. There's just something about human interaction that makes people want to play more and stay longer. Dealers now appear authentic and engaging online thanks to advances in technology.

VR Gaming Is Getting More Popular

Another clever technology that allows for a more immersive casino experience is virtual reality, or VR. With more VR accessories becoming widely available, the push for VR-based casinos to evolve is on the horizon, and it's only a matter of time before everyone has easy access to these virtual reality casinos from the comfort of their own homes. Net Entertainment, one of the best and most prominent software companies in the gambling industry, recently demonstrated and proven that they are ready to upgrade by demonstrating a virtual reality version of their popular Jack and the Beanstalk slot machine game. There is now a significant call for more VR to be released.

The objective of the report is to present a comprehensive analysis of the Asia-Pacific Online Gambling Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia-Pacific Online Gambling Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia-Pacific Online Gambling Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia-Pacific Online Gambling Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia-Pacific Online Gambling Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia-Pacific Online Gambling Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Asia-Pacific Online Gambling Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia-Pacific Online Gambling Market is aided by legal factors.

Asia-Pacific Online Gambling Market Scope:

|

Asia-Pacific Online Gambling Market |

|

|

Market Size in 2024 |

USD 39.80 Bn. |

|

Market Size in 2032 |

USD 89.04 Bn. |

|

CAGR (2025-2032) |

10.59% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Type

|

|

by Device

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Major Players operating in the Asia-Pacific Online Gambling Market are:

- William Hill PLC

- Bet365 Group Ltd.

- Paddy Power Betfair PLC

- Betsson AB

- Ladbrokes Coral Group PLC

- The Stars Group Inc.

- 888 Holdings PLC

- Sky Betting and Gaming

- Kindred Group PLC

- GVC Holdings PLC

Frequently Asked Questions

Asia Pacific region held the highest share in 2024.

Mobile segment is the dominating end use segment in the market.

William Hill PLC, Bet365 Group Ltd., Paddy Power Betfair PLC, Betsson AB Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC.

The major factors for the growth of the Asia-Pacific Online Gambling market includes high internet penetration and increasing use of mobile phones among individuals for playing online games from their homes and public places.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Asia-Pacific Online Gambling Market: Target Audience

2.3. Asia-Pacific Online Gambling Market: Primary Research (As per Client Requirement)

2.4. Asia-Pacific Online Gambling Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2024-2032(In %)

4.1.1.1. Asia Pacific Market Share Analysis, By Value, 2024-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Asia-Pacific Online Gambling Market Segmentation Analysis, 2024-2032 (Value US$ BN)

4.3.1.1. Asia-Pacific Market Share Analysis, By Type, 2024-2032 (Value US$ BN)

4.3.1.1.1. Sports Betting

4.3.1.1.2. Casinos

4.3.1.1.3. Poker

4.3.1.1.4. Bingo

4.3.1.1.5. Others

4.3.1.2. Asia-Pacific Market Share Analysis, By Device, 2024-2032 (Value US$ BN)

4.3.1.2.1. Desktop

4.3.1.2.2. Mobile

4.3.1.2.3. Others

4.3.1.3. Asia Pacific Market Share Analysis, By Country, 2024-2032 (Value US$ BN)

4.3.1.3.1. China

4.3.1.3.2. India

4.3.1.3.3. Japan

4.3.1.3.4. South Korea

4.3.1.3.5. Australia

4.3.1.3.6. ASEAN

4.3.1.3.7. Rest Of APAC

Chapter 5 Stellar Competition Matrix

5.1. Asia-Pacific Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Type, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Bulk Online Gambling

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. William Hill PLC.

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Bet365 Group Ltd.

6.1.3. Paddy Power Betfair PLC

6.1.4. Betsson AB

6.1.5. Ladbrokes Coral Group PLC

6.1.6. The Stars Group Inc.

6.1.7. 888 Holdings PLC

6.1.8. Sky Betting and Gaming

6.1.9. Kindred Group PLC

6.1.10 GVC Holdings PLC.

6.2. Key Findings

6.3. Recommendations.