Asia Pacific Crude Steel Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

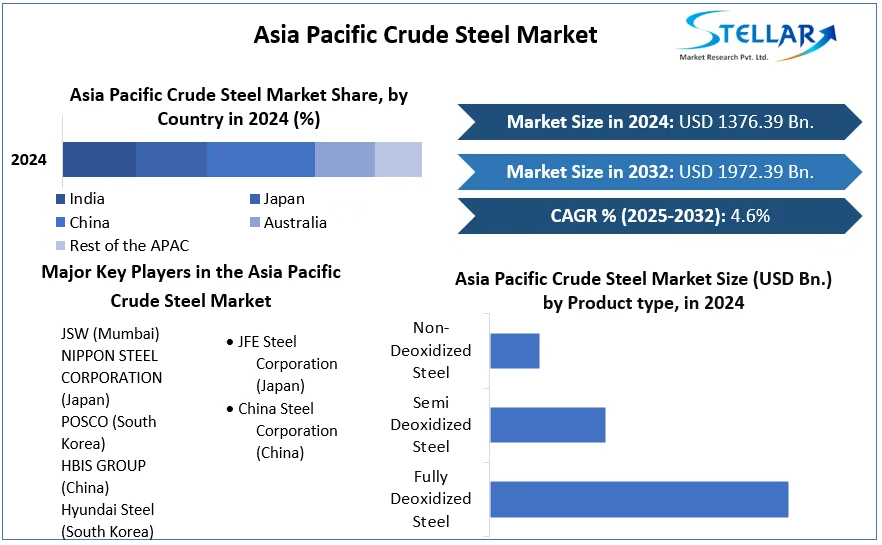

Asia Pacific Crude Steel Market was valued at USD 1376.39 billion in 2024. The Asia Pacific Crude Steel Market size is estimated to grow at a CAGR of 4.6 % over the forecast period.

Format : PDF | Report ID : SMR_991

Asia Pacific Crude Steel Market Definition:

Establishments that manufacture steel shapes and produce pipe and tubes are excluded from the crude steel market. This is significantly used in the construction of train tracks, buildings, and nuclear infrastructure, as well as domestic appliances. Steelmakers are gradually shifting away from blast furnaces towards the Electric Arc Furnace (EAF). In comparison to a blast furnace, EAF requires far less investment, contains fewer chemical processes, and is more efficient. When compared to steel made from ores, the use of EAF enables steelmakers to produce steel from 99 % scrap metal feedstock, reducing the overall energy consumed in the process.

Further, the Asia Pacific Crude Steel market is segmented by product type, distribution channel, and geography. On the basis of product type, the Asia Pacific Crude Steel market is segmented under Fully Deoxidized steel, Semi deoxidized steel, and Non deoxidized steel. Based on the Application, the market is segmented under the channels of Construction, Transportation, Automotive and Others. By geography, the market covers the major countries in Asia Pacific i.e., India, China, Japan, Australia and Rest of Asia Pacific For each segment, the market sizing and forecasts have been done on the basis of value (in USD Million/Billion).

To get more Insights: Request Free Sample Report

Asia Pacific Crude Steel COVID 19 Insights:

China's supply chain and logistical issues have been worsened by the lockdowns in COVID-19-affected cities and regions: transportation has been disrupted, workers have been isolated, and building activities have been halted or reduced.

Asia Pacific Crude Steel Market Dynamics:

Steel and its alloys are one of the most often used metals in the construction sector, accounting for more than 46% of total demand. Steel is utilized in and construction because of its superior properties, such as durability and ductility, which allow buildings to operate safely. Increased use of high-speed trains in countries such as China, Japan, and India has led to the construction of special rail lines, which has resulted in increased carbon steel consumption, increasing crude steel demand over the forecast period.

In countries such as India, China, and South Korea, the crude steel market has grown rapidly, with China accounting for over 50 % of consumption. Civil engineering activities such as school construction, residential and commercial construction, rail lines, and other civil engineering works are driving Japan's crude steel market growth. Steel demand in nations like India and China is approximately 55 % higher than in Germany and the United Kingdom. Due to Investment, India's construction sector is expected to grow at a strong CAGR of over 5.5%. (Foreign Directed Investment). By 2021, India and China are expected to account for approximately 45% of the building sector.

Market Trends

The automotive market is developing in ASEAN countries such as Malaysia, Thailand, Indonesia, and Vietnam, driving up crude steel demand. Advanced High Strength Steel (AHSS) is now used in nearly every new vehicle because it allows for more flexible and innovative designs due to features like ultra-high strength and improved bending ability. Around 60% of new car body constructions are made of AHSS.

The aerospace materials market has become more diversified, resulting in increased demand for steel alloys in the manufacture of aircraft for both commercial and military use. The governments of India and China have put a priority on growing their defense budgets, resulting in increased use of steel products, which has boosted demand for crude steel Market.

Capital Goods: The capital goods sector accounts for 15% of steel consumption and is expected to grow 16-17 %in tonnage and market share by FY2025-26.

Automotive Sector: The automotive sector contributes for around 12% of India's steel demand. By 2026, it is expected to have grown to a scale of US$ 270-310 billion. Steel demand from the market is expected to be strong.

Infrastructure sector: The infrastructure sector consumes 10% of all steel and is expected to grow by 12.5 % by FY2025-26. Long steel products will be in more demand in the next years as infrastructure investments increase.

Railways: steel demand will be driven by the laying of tracks and the construction of foot over bridges, rail coaches, and railway stations.

Currently, there is a supply shortage.

Since 2020, the steel market is experiencing a supply excess, owing to a drop in demand from the nation's biggest customer, China. China's slow economic growth has an impact on the overall stainless steel sector and, as a result, pricing.

Profit Margin Decrease

Steel suppliers have had decreased margins for the past 12–18 months due to falling prices. Suppliers are also susceptible to commodity price fluctuations, which they will be unable to offset due to the shorter duration of contracts.

Asia Pacific Crude Steel Market Segment Analysis:

By Product, Semi-killed steel is a form of iron and carbon metal alloy that has been partially deoxidized during solidification with minimal gas emission. On a molecular level, semi-killed steel has a high degree of uniformity. It also has low gas porosity, which makes it ideal for heat treatment. In general, semi-killed steel releases more gas than killed steel.

Killed steel is used in a variety of applications, including forging, carburizing, and heat treatment. Semi-killed steels are steels that have been partially deoxidized and exhibit characteristics similar to rimmed and killed steels.

By Application,

Building & Infrastructure

Buildings and infrastructure, such as bridges, consume more than half of the steel produced each year. Reinforcing bars (46%), sheet goods, such as those used in roofing, internal walls, and ceilings (35 %), and structural sections account for the majority of steel utilized in this market (27% ). Steel is also utilized in buildings for HVAC systems and elements like stairs, rails, and storage, in addition to structural functions.

Automotive

A car is made up of over 3,000 pounds (950 kilograms) steel on average. A third of it goes into the body construction and exterior, which includes the doors. The drive train accounts for another 23%, while the suspension accounts for 14%. About 65% of a modern car's body structures are comprised of advanced high-strength steels, which are created utilizing complicated methods and are lighter in weight than traditional steels.

Mechanical Equipment

Bulldozers, tractors, machinery that makes vehicle parts, cranes, and hand tools such as hammers and shovel are among the second-largest uses of steel. Rolling mills are also included, which are used to shape steel into various shapes and thicknesses.

Asia Pacific Crude Steel Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Crude Steel Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Crude Steel Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Crude Steel Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Crude Steel Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Crude Steel market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Crude Steel market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia Pacific Crude Steel Market. The report also analyses if the Asia Pacific Crude Steel Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Crude Steel Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Crude Steel Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Crude Steel Market is aided by legal factors.

Asia Pacific Crude Steel Market Scope:

|

Asia Pacific Crude Steel Market |

|

|

Market Size in 2024 |

USD 1376.39 Bn. |

|

Market Size in 2032 |

USD 1972.39 Bn. |

|

CAGR (2025-2032) |

4.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product type

|

|

By Application

|

|

|

Country Scope |

|

Asia Pacific Crude Steel Market Key Players:

- JSW (Mumbai)

- NIPPON STEEL CORPORATION (Japan)

- POSCO (South Korea)

- HBIS GROUP (China)

- Hyundai Steel (South Korea)

- JFE Steel Corporation (Japan)

- China Steel Corporation (China)

Frequently Asked Questions

The market size of the Asia Pacific Crude Steel Market by 2032 is expected to reach USD 1972.39 Billion.

The forecast period for the Asia Pacific Crude Steel Market is 2025-2032.

The market size of the Asia Pacific Crude Steel Market in 2024 was valued at USD 1376.39 Billion.

Asia Pacific region held the highest share in 2024.

1. Asia Pacific Crude Steel Market: Research Methodology

2. Asia Pacific Crude Steel Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Crude Steel Market: Dynamics

3.1. Asia Pacific Crude Steel Market Trends

3.2. Asia Pacific Crude Steel Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Trade Analysis

3.5.1. Imports Scenario

3.5.2. Exports Scenario

3.6. Value Chain Analysis

3.7. Technology Roadmap

3.8. Regulatory Landscape

3.9. Analysis of Government Schemes and Initiatives for Asia Pacific Crude Steel Industry

4. Asia Pacific Crude Steel Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2032)

4.1. Asia Pacific Crude Steel Market Size and Forecast, by Product Type (2024-2032)

4.1.1. Fully Deoxidized Steel

4.1.2. Semi Deoxidized Steel

4.1.3. Non-Deoxidized Steel

4.2. Asia Pacific Crude Steel Market Size and Forecast, by Application (2024-2032)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Transportation

4.2.4. Energy

4.2.5. Packaging

4.2.6. Tools and Machinery

4.2.7. Consumer Appliance

4.2.8. Metal Products

4.3. Asia Pacific Crude Steel Market Size and Forecast, by Country (2024-2032)

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. South Korea

4.3.5. Australia

4.3.6. ASEAN

4.3.7. Rest of APAC

5. Asia Pacific Crude Steel Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. JSW (Mumbai)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. NIPPON STEEL CORPORATION (Japan)

6.3. POSCO (South Korea)

6.4. HBIS GROUP (China)

6.5. Hyundai Steel (South Korea)

6.6. JFE Steel Corporation (Japan)

6.7. China Steel Corporation (China)

7. Key Findings

8. Industry Recommendations