Asia Pacific Commercial Vehicle Rental and Leasing Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities, and Forecast (2025-2032)

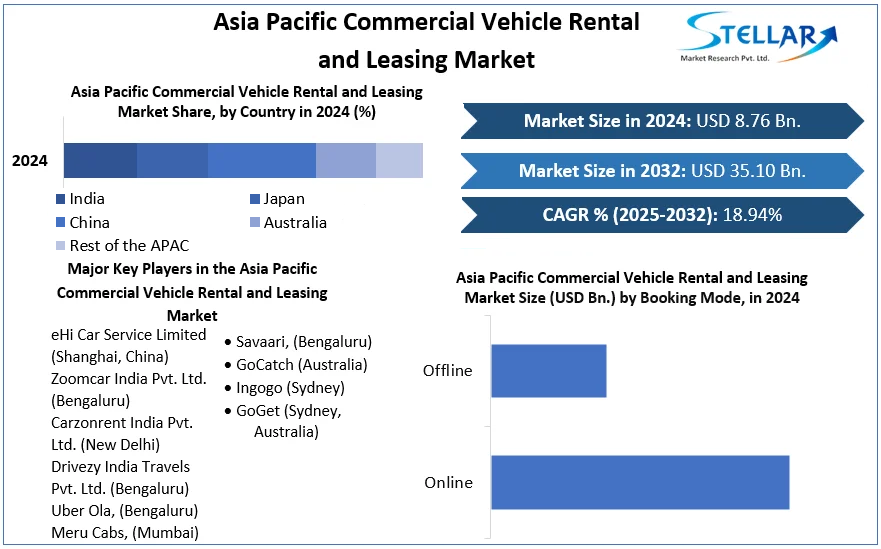

Asia Pacific Commercial Vehicle Rental and Leasing Market were valued at USD 8.76 billion in 2024. Asia Pacific Commercial Vehicle Rental and Leasing Market size is estimated to grow at a CAGR of 18.94% over the forecast period.

Format : PDF | Report ID : SMR_752

Asia Pacific Commercial Vehicle Rental and Leasing Market Definition:

Rental trucks and equipment, as well as other services, are part of the Asia Pacific Commercial Vehicle Rental and Leasing business. These businesses typically run a retail store or a facility that rents and leases automotive equipment. Short-term rental and long-term lease services are offered by some car companies, while others offer both.

On the basis of innovative technology and a growing consumer base in developing nations like China, Indonesia, and India, the Asia Pacific Commercial Vehicle Rental and Leasing industry has been rapidly growing over the last several years. In many countries in the Asia Pacific, the commercial vehicle rental and leasing sector is growing in popularity, but local enterprises still hold the largest market share.

Further, the Asia Pacific Commercial Vehicle Rental and Leasing market is segmented by Booking Type, Vehicle Type, and geography. On the basis of Booking Type, the Asia Pacific Commercial Vehicle Rental and Leasing market is segmented under Online & Offline mode. Based on the Vehicle Type, the market is segmented under the Light Commercial Vehicle, Car, and Medium/Heavy Commercial Vehicle. By geography, the market covers the major countries in the Asia Pacific, i.e., India, China, Japan, Australia, and the Rest of Asia Pacific. For each segment, the market sizing and forecasts have been done on the basis of value in Billion.

To get more Insights: Request Free Sample Report

Asia Pacific Commercial Vehicle Rental and Leasing Market Dynamics:

Market Drivers:

Increased Concern and Awareness of Lower Emissions:

An increase in Commercial vehicle rental and leasing alternatives has mostly resulted from increased concern and understanding about lower emissions. Also, vehicle rental allows for enhanced mobility without the worry of incurring the fees associated with owning a car. These services are available on websites and other online platforms, which has helped the vehicle rental market's growth.

Increase in the Number of Foreign Tourists:

Asia-Pacific is the most popular tourist destination for both domestic and international tourism, with 343 million visitors expected in 2024. Customers in emerging economies like China and India have more disposable income, allowing them to spend on travel. During the forecast period, outstation rentals and SUV rentals are expected to grow significantly. The rising client base for the vehicle rental sector owing to fast urbanization has greatly strengthened the growth of the Asia Pacific Commercial Vehicle Rental and Leasing business, which is a primary driver in the Asia Pacific car rental market.

Market Restraints:

Inconsistent and weak regulatory frameworks are an issue in Australia's commercial vehicle rental and leasing business. The car rental sector is governed by eight different regulatory and tax frameworks in eight different states and territories. Only Tasmania has standards, especially for the rental automobile business among these jurisdictions. However, in India, one of the primary reasons limiting industry growth is the lower cost of public transportation compared to taxi renting.

Asia Pacific Region Outlook:

The Shift Towards Vehicle Outsourcing in Asia Pacific's Leasing Market:

Japan: The Japanese leasing market is strong and growing, with operational leasing driving growth in both corporate and private customer sectors. In 2019, new contracts accounted for more than 1/3 of the leasing market share in the APAC region, indicating that the Japanese leasing market is well-established. Even though the concept of a business automobile as a perk is not as popular in Japan as it is in Europe, growth is being driven by factors such as new fleet acquisition and renewals among corporate firms, as well as new private lease registration. The top three players control over two-thirds of all active leasing contracts; Toyota, ORIX, and SMAS control nearly two-thirds of all active leasing contracts. Domestic enterprises are also asserting their influence, backed by nationalistic consumerism.

Purchase subsidies and preferential tax treatment are expected to boost the usage of electric and hybrid vehicles in the forecasted period. Simultaneously, as the industry matures over the next five years, leasing businesses will need to gradually move their business focus to emerge customer categories, such as SMEs, while enhancing their operational capabilities.

South Korea: Favorable rules have helped in the development of a mature leasing sector, even as shifting customer needs have driven leasing companies to grow into full-service mobility providers. South Korea has a well-developed leasing sector that works similarly to its Japanese counterpart. Due to favorable legislation and the resulting reduction in fleet management responsibilities, operational leasing is the most favored finance option. Meanwhile, local leasing service providers such as Hyundai Capital, Lotte Rental, and SK Networks account for over 80% of contracts, indicating that they have a greater understanding of customer needs and local policies. Consumer demand has driven leasing companies to develop end-to-end options such as car-sharing and ride-hailing, which were formerly limited to pure leasing.

Australia: In 2020, corporate leasing dominated the Australian leasing market, but the steady increase of private leases or novated leases has quietly shifted leasing businesses' emphasis to individuals. Trends like corporate fleet downsizing, fleet efficiency, and the growth of novated leasing are affecting the leasing business in Australia. Consumers prefer novated lease contracts to perk vehicles because they offer flexibility as well as cost and tax advantages. Local leasing companies such as SG Fleet and CustomFleet have established a solid presence and account for more than half of the market share, based on years of experience. Also, their telemetry services contribute to increased fleet savings and customer satisfaction.

New trends like car sharing are also assisting businesses in lowering mobility costs and better utilizing their underutilized vehicle fleets. As a result, firms will be able to concentrate on their core operations. As a result, leasing businesses must focus on providing similar solutions, as both corporate and individual customers place a higher value on the whole cost of asset ownership. In addition, leasing companies can use digital marketing tactics to boost lead generation and partner with distributors to broaden their market reach.

China: Due to car plate purchase restrictions in Tier I cities, cheap installment rates, and greater flexibility in terms of leasing contract options, private leasing is more common than company automobile leasing in China.

The leasing sector in China is still in its early phases of growth. Although private leasing registers more yearly contracts than corporate leasing, its penetration rate of only 1.4 percent (of retail registrations) is significantly lower than corporate leasing's 16.0 percent (of total true fleet registrations). High vehicle taxes, car plate purchase limits, increased flexibility, and central government initiatives to encourage provincial governments to establish rules linked to operational leasing are all contributing to the increase in new leasing registrations. But, the market is constrained by a strong desire for innovative mobility solutions like car-sharing and ride-hailing, as well as a preference for vehicle acquisition — a trend reinforced by increased disposable incomes.

In comparison to competitive corporate mobility providers like DiDi and Shouqi, leasing businesses' competence in digital solutions is weak, and their service area is also limited to only 200 cities, less than half of what vehicle hailing companies cover. As a result, leasing firms should spend on improving their digital skills, sales, and marketing strategies, consistently invent new services and focus more on indirect sales channels to leverage demand from tier I and tier-II cities to be competitive in the long run.

India: Vehicle leasing is still a developing business, but it is likely to increase steadily over the next five years as consumers become more aware of the advantages of leasing. Since private leasing as a business model has just been available for the past two years, the leasing sector in India is dominated by corporate leasing. Corporate leasing penetration in genuine fleets, on the other hand, is only 9.0 percent. While the advent of GST had an adverse impact on new registrations, leasing businesses' continued efforts to educate clients and establish appropriate business models have revived growth. Because people are becoming more aware of the benefits of corporate leasing, it is becoming a major growth area, while brand value is an important decision-making factor that drives consumer behavior.

ALD Automotive, LeasePlan, and Sundaram Finance, the top three players, control more than half of the market. While manufacturers are increasingly introducing private leasing options to combat declining new car sales, the most important factor influencing the growth is pricing. As a result, all leasing service providers must adopt attractive pricing strategies to improve their future prospects. Recognizing key customer categories and educating them on the primary aspects of leasing will also be critical to the company's growth.

Asia Pacific Commercial Vehicle Rental and Leasing Market Segment Analysis:

By Booking Mode, The convenience of renting a vehicle through online booking has become the most popular choice of customers in recent years, thanks to the increasing trend in technology. Because it has features that allow you to track the operation, performance, and maintenance of a rental vehicle in real-time, these capabilities were invaluable to drivers and fleet managers, allowing them to more effectively identify risks and make timely modifications to their rental services.

In January 2021, DiDi introduced its financial services hub in its main China app, offering a broad range of insurance, wealth management, and payment services to riders, drivers, and car owners across its ride-hailing and auto-solutions companies. Didi Chuxing had provided over 550 million consumers with a full spectrum of app-based transportation options by 2021.

Asia Pacific Commercial Vehicle Rental and Leasing Market Regional Insights:

Geographically, China dominates the Asia Pacific Commercial vehicle rental & leasing market with a market share of more than 27% and a revenue share of more than USD 4 billion in 2023. India and the Philippines are the region's fastest-growing markets, with CAGRs of more than 6.9% and 6.6 %, respectively. The Indian car rental market is expected to pick up speed in the near future, as major players in the country intend to increase their businesses in tier I/II cities.

Because of the increasing populations in India and China, Asia Pacific is expected to hold the highest share in the next years. The market in the Asia Pacific will benefit from the growing automobile industry. Also, people's increasing disposable income will have an impact on the region's market growth.

Asia Pacific Commercial Vehicle Rental and Leasing Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Commercial Vehicle Rental and Leasing market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Commercial Vehicle Rental and Leasing market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Commercial Vehicle Rental and Leasing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Commercial Vehicle Rental and Leasing market report is to help understand which market segments and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Commercial Vehicle Rental and Leasing market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Commercial Vehicle Rental and Leasing market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia Pacific Commercial Vehicle Rental and Leasing market. The report also analyses if the Asia Pacific Commercial Vehicle Rental and Leasing market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, and if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Commercial Vehicle Rental and Leasing market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Commercial Vehicle Rental and Leasing market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Commercial Vehicle Rental and Leasing market is aided by legal factors.

Asia Pacific Commercial Vehicle Rental and Leasing Market Scope:

|

Asia Pacific Commercial Vehicle Rental and Leasing Market |

|

|

Market Size in 2024 |

USD 8.76 Bn. |

|

Market Size in 2032 |

USD 35.10 Bn |

|

CAGR (2025-2032) |

18.94 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

by Booking Mode

|

Asia Pacific Commercial Vehicle Rental and Leasing Market Key Players:

- eHi Car Service Limited (Shanghai, China)

- Zoomcar India Pvt. Ltd. (Bengaluru)

- Carzonrent India Pvt. Ltd. (New Delhi)

- Drivezy India Travels Pvt. Ltd. (Bengaluru)

- Uber Ola, (Bengaluru)

- Meru Cabs, (Mumbai)

- Savaari, (Bengaluru)

- GoCatch (Australia)

- Ingogo (Sydney)

- GoGet (Sydney, Australia)

Frequently Asked Questions

China region is expected to hold the highest share in the Asia Pacific Commercial Vehicle Rental and Leasing Market.

The forecast period for the Asia Pacific Commercial Vehicle Rental and Leasing Market is 2025-2032.

1. Asia Pacific Commercial Vehicle Rental and Leasing Market: Research Methodology

2. Asia Pacific Commercial Vehicle Rental and Leasing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Commercial Vehicle Rental and Leasing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Business Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Asia Pacific Commercial Vehicle Rental and Leasing Market: Dynamics

4.1. Asia Pacific Commercial Vehicle Rental and Leasing Market Trends

4.2. Asia Pacific Commercial Vehicle Rental and Leasing Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Commercial Vehicle Rental and Leasing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific Commercial Vehicle Rental and Leasing Market Size and Forecast, by Booking Mode (2024-2032)

5.1.1. Online

5.1.2. Offline

5.2. Asia Pacific Commercial Vehicle Rental and Leasing Market Size and Forecast, by Country (2024-2032)

5.2.1. China

5.2.2. India

5.2.3. Japan

5.2.4. South Korea

5.2.5. Australia

5.2.6. ASEAN

5.2.7. Rest of APAC

6. Company Profile: Key Players

6.1. Carzonrent India Pvt. Ltd. (New Delhi)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. eHi Car Service Limited (Shanghai, China)

6.3. Zoomcar India Pvt. Ltd. (Bengaluru)

6.4. Savaari, (Bengaluru)

6.5. GoGet (Sydney, Australia)

6.6. Ingogo (Sydney)

6.7. Uber Ola, (Bengaluru)

6.8. Meru Cabs, (Mumbai)

6.9. GoCatch (Australia)

6.10. Drivezy India Travels Pvt. Ltd. (Bengaluru)

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook