Asia-Pacific Bio Butanol Market- Industry Analysis Trends, Statistics, Dynamics, Segmentation and Forecast (2025-2032)

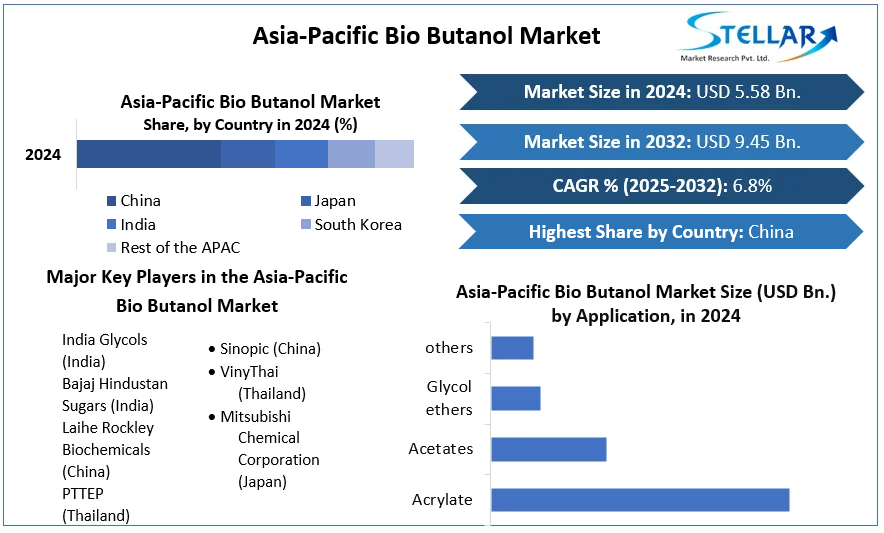

Asia-Pacific Bio Butanol Market was valued at USD 5.58 billion in 2024. The Asia-Pacific Bio Butanol Market size is estimated to grow at a CAGR of 6.8 % over the forecast period.

Format : PDF | Report ID : SMR_1212

Asia-Pacific Bio Butanol Market Definition:

Biobutanol or bio-primarily based butanol gas is a second-era alcoholic gas with a better electricity density and decrease volatility as compared to ethanol, even as it's also used as one of the crucial Raw materials for the production of glycol ethers. In addition, biobutanol is majorly used as a plasticizer to enhance plastic fabric chemical intermediate for butyl esters or butyl ethers. On the basis of the raw material, the market is segmented into cereals, sugarcane, sugar beet, wood, corn, and others. On the basis of the application, the market is segmented into acrylate, acetates, glycol ethers, biofuel, and others. Based on the end-user the market is segmented into transportation, construction, medical, and power generation. By geography, the market covers the major countries in the Asia Pacific i.e., India, China, Japan, Australia, and the Rest of Asia Pacific for each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion).

To get more Insights: Request Free Sample Report

Asia Pacific Bio Butanol COVID 19 Insights:

The COVID19 pandemic in 2021 has negatively impacted the market as manufacturing plants are closed and temporarily closed. In addition, renewable ethanol producers have been actively involved in pandemic containment efforts internationally. Even as they continue to supply the fuel ethanol they need, refineries are shifting some of their production from biofuels to ethyl alcohol for use as sanitizers and hand sanitizers, and manufacturers are working with governments to ensure increased output and maintain supply chains. Due to the epidemic, residential and commercial building has come to a standstill.

Asia-Pacific Bio Butanol Market Dynamics:

Rising demand for alternative fuels and renewable energy as a result of the negative environmental impacts of synthetic fuels, particularly global warming, is expected to drive bio-butanol development during the next seven years. It is also used as a precursor in the production of acetates, arylates, glycol ethers, and solvents. Bio-butanol is an important raw element in the manufacture of paints, coatings, plasticizers, and adhesives. In practically all applications it is utilized as a direct replacement for petroleum-based butanol. With its potential to be utilized as an addition, it is in high demand in the pharmaceutical business. It is can be combined with gasoline to make biofuels, which is expected to be one of its most popular commercial uses in the near future. Demand for green paints and coating is expected to increase throughout the forecast period. Depletion of petroleum supplies, along with variable oil prices, prices has contributed to its growing demand.

The impact of solvent-based systems on human health and the environment is one of the major issues in the market. Acute health risks associated with solvent-using systems include headache, dizziness, and light-headedness, which may escalate to loss of consciousness and convulsions.

Some other side effects of working with this system include nasopharyngeal irritation. Volatile organic compounds introduced into paint systems are hazardous to the environment and human health. During the drying process, industrial paints release volatile organic compounds. Volatile organic compounds have an adverse effect on the body roster and this can also put pressure on vital organs such as the heart and lungs. Perception of the side effects of biobutanol products may influence the growth of the biobutanol market.

Recent trends in Asia Pacific Bio Butanol Market:

In September 2021, Gevo Inc. completed the acquisitions of the Butamax patent estate. This adds fundamental patents to its portfolio to produce renewable isobutanol and derivatives of renewable fuel products. The Butamax patents estate acquisitions is expected to increase Gevo’s intellectual property value, now that Gevo owns the Butamax Patents.

Asia-Pacific Bio Butanol Market Segment Analysis:

By Raw Material: the market is segmented into cereals, sugarcane, sugar beet, wood, corn, and others. Among these cereals segments holds the highest market share. The cereals are the major raw material in processing biobutanol with the increase in demand for raw materials of bio-butanol the increased cereals production will help the market growth for bio-butanol.

By Application- the market is segmented into acrylate, acetates, glycol ethers, biofuel, and others. Acrylates dominate the market studied and are expected to maintain their position over the forecast period. Biobutanol is used as an intermediate in the production of butyl acrylate, which is then used in the manufacture of paints and coatings, adhesives, and textiles, among others. Increased demand for these products from various end-user industries is likely to drive demand at all stages of the value chain, thereby driving the growth of the studied market. In the Asia-Pacific region, China accounts for the largest market share in bio-butanol consumption. The country is the largest producer of paints and coating in the Asia-Pacific region, with an estimated coating production of more than 15v million metric tons, which is expected to increase significantly in the near future.

By End User- the market is segmented into transportation, construction, medical, and power generation. Due to an increase in the international middle-class spending and as a transport fuel in automotive applications compared to other applications. A very large part of other applications. A very large part of bio-butanol is used for blending in gasoline hence there is a great demand in fuel for them. So, with the increase in the number of fuel vehicles around the world, the bio-butanol market is also growing.

Asia-Pacific Bio Butanol Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia-Pacific Bio Butanol Market to the stakeholders in the industry. The report provides trends that are most dominant in the Bio Butanol Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia-Pacific Bio Butanol Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia-Pacific Bio Butanol Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia-Pacific Bio Butanol Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia-Pacific Bio Butanol Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia-Pacific Bio Butanol Market. The report also analyses if the Asia-Pacific Bio Butanol Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia-Pacific Bio Butanol Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia-Pacific Bio Butanol Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia-Pacific Bio Butanol Market is aided by legal factors.

Asia-Pacific Bio Butanol Market Scope:

|

Asia-Pacific Bio Butanol Market |

|

|

Market Size in 2024 |

USD 5.58 Bn. |

|

Market Size in 2032 |

USD 9.45 Bn. |

|

CAGR (2025-2032) |

6.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Raw Materials

|

|

By application

|

|

|

By end-users

|

|

|

Country Scope |

|

Asia-Pacific Bio Butanol Market Key Players:

- India Glycols (India)

- Bajaj Hindustan Sugars (India)

- Laihe Rockley Biochemicals (China)

- PTTEP (Thailand)

- Sinopic (China)

- VinyThai (Thailand)

- Mitsubishi Chemical Corporation (Japan)

Frequently Asked Questions

The market size of the Asia-Pacific Bio Butanol Market by 2032 is expected to reach USD 9.45 Billion.

The forecast period for the Asia-Pacific Bio Butanol Market is 2025-2032.

The market size of the Asia-Pacific Bio Butanol Market in 2024 was valued at USD 5.58 Billion.

1. Asia-Pacific Bio Butanol Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia-Pacific Bio Butanol Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia-Pacific Bio Butanol Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Asia-Pacific Bio Butanol Market: Dynamics

4.1. Asia-Pacific Bio Butanol Market Trends

4.2. Asia-Pacific Bio Butanol Market Drivers

4.3. Asia-Pacific Bio Butanol Market Restraints

4.4. Asia-Pacific Bio Butanol Market Opportunities

4.5. Asia-Pacific Bio Butanol Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Technological Roadmap

4.10. Regulatory Landscape

5. Asia-Pacific Bio Butanol Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032)

5.1. Asia-Pacific Bio Butanol Market Size and Forecast, by Raw Materials (2024-2032)

5.1.1. Cereals

5.1.2. Sugar cane

5.1.3. Sugar beet

5.1.4. Wood

5.1.5. Corn

5.2. Asia-Pacific Bio Butanol Market Size and Forecast, by Application (2024-2032)

5.2.1. Acrylate

5.2.2. Acetates

5.2.3. Glycol ethers

5.2.4. others

5.3. Asia-Pacific Bio Butanol Market Size and Forecast, by End-Users (2024-2032)

5.3.1. Transportation

5.3.2. Constructions

5.3.3. Medicals

5.3.4. Power Generations

5.4. Asia-Pacific Bio Butanol Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. India

5.4.3. Japan

5.4.4. South Korea

5.4.5. Australia

5.4.6. ASEAN

5.4.7. Rest of APAC

6. Company Profile: Key Players

6.1. India Glycols (India)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bajaj Hindustan Sugars (India)

6.3. Laihe Rockley Biochemicals (China)

6.4. PTTEP (Thailand)

6.5. Sinopic (China)

6.6. VinyThai (Thailand)

6.7. Mitsubishi Chemical Corporation (Japan)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook