Agriculture Drones Market Global Industry Analysis and Forecast (2026-2032) by Type, Application, Farm Size and Region

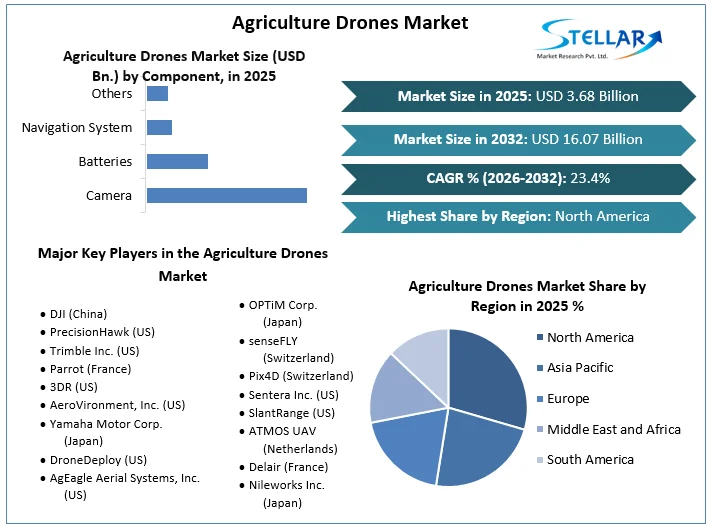

The Agriculture Drones Market size was valued at US$ 3.68 Bn in 2025. The Global Agriculture Drones Market is estimated to grow at a CAGR of 23.4% over the forecast period.

Format : PDF | Report ID : SMR_474

Agriculture Drones Market Definition:

An agricultural drone is an unmanned aerial vehicle that is used in agriculture for yield optimization, crop development and production observing. A drone's mid-air view can aid in the real-time monitoring of crop growth stages, crop health, and soil variances, agreeing for any necessary mitigation. Multispectral instruments may gather data in both the near-infrared and visible continuums of the electromagnetic continuum. The Agriculture Drones Market report's segment analysis is provided on the basis of component, offering, application and region.

Agriculture drones are spray drone improved unmanned aerial vehicles that are used to progress agricultural processes competence, crop yield, and crop growth monitoring. Drone sensors and digital image competencies are also intended to deliver farmers with a more comprehensive view of their land. Additionally, abrupt climate change is adding new layers of complication to the agriculture industry, accumulative the demand for technological solutions like agriculture drones to increase crop output and company efficiency.

To get more Insights: Request Free Sample Report

Agriculture Drones Market Dynamics:

Precision farming is becoming more popular which is fuelling the growth of the market:

Precision farming has several benefits for the agricultural industry. Different technologies are being developed, including global positioning systems and guided vehicles, to the attendant in a new era of precision farming. The agricultural sector's rapid growth, which is already incorporating technology advancements into its agricultural methods, will continue to fuel the market for precision farming and, as a result, agriculture drones. Moreover, a lack of agricultural employment, which fell from 27.8% in 2017 to 26.4% in 2020 as a percentage of the entire population, has led to a greater reliance on precision farming instruments such as agricultural drones which is a major factor for driving the growth of the agriculture drones market.

Wide usage of air traffic management in agriculture drones:

Air traffic management (ATM) is inextricably linked to safe and cost-effective air travel. Currently, several agricultural drone development programmes are rapidly approaching operational status. To avoid mishaps and collisions, appropriate airspace traffic management is required as the number of agricultural drones grows dramatically. The drone traffic management policy framework takes into account situations where a large number of drones are flown near manned aircraft, especially at lower altitudes in the airspace where drones are allowed to operate.

A big opportunity for the Agriculture Drones sector is the reduced cost of human errors:

The consumer can gain a better picture of their fields and collect statistics much faster and more professionally with drones than they could with traditional methods. Farmers will be able to perceive how healthy their plants are, where they might need water or nutrients, and whether pest activity is out of control using drones. Photo capturing technology, planting, irrigation, and data & monitoring solution is the most common solution for drone technology management which is having the major opportunity for the agriculture drones market.

Precision agricultural communication interfaces and protocols should be standardised:

Agriculture drones and other smart agricultural devices interact via a variety of interfaces, technologies, and protocols. Data may be distorted due to the absence of calibration of various communiqué interfaces and procedures.

Agriculture Drones Market Segment Analysis:

By Application, the market is segmented as Precision Agriculture, Livestock Monitoring, Smart Greenhouse, Irrigation, and Precision Fish Farming. The Precision Agriculture segment dominated the Agriculture Drones Market with a 35% share in 2025. Precision farming also known as precision agriculture, is information and technology-based farm management system that identifies, analyses, and manages spatial and temporal variability within fields for maximum productivity and profitability, as well as long-term sustainability and land resource protection. Apart from this, the application of information technology to the assessment of fine-scale animal and physical resource variability to better management techniques for economic, social, and environmental farming is driving the growth of this segment.

However, the Smart Greenhouse segment is expected to grow at a CAGR of 5.6% during the forecast period. The smart greenhouse is a rebellion in agriculture, with sensors, actuators, and observing and control systems that enhance growth conditions and mechanise the growing procedure to create a self-regulating, microclimate suited for plant growth. Smart Greenhouse can be accessed via a dashboard or a tablet application. The greenhouse can also be controlled by voice commands.

By Offering, the market is segmented as Hardware and Software. The Software segment dominated the agriculture drones market with a 74% share in 2025. The large investments made by venture capitalists and investors in start-up companies delivering software and analytics to digitise the information collected by drones are credited to this increase; the investments are mostly targeted at mapping, imaging, and data analytics software. The following are some of the best drone mapping software options such as 3D Mapping Solutions by Drone Deploy, Photogrammetry software Pix4D Mapper, and ReCap Photogrammetry Software by Auto Desk. Owing to this factor this segment is constantly growing.

By Component, the market is segmented as Cameras, Batteries, Navigation systems, and Others. The Camera segment dominated the market with a 45.3% share in 2025. During the forecast period, camera systems are expected to account for the highest proportion of the agriculture drones market. Because the camera system determines the application for which the drone will be utilised, it is an important component of an agriculture drone. The hyperspectral camera, for example, is great for investigating weed encroachment in farms, while the lidar camera is best for revealing farm slopes and sun exposure.

Agriculture Drones Market Regional Insights:

The North America dominated the agriculture drones market with a 47% share in 2025. The use of enhanced technology in agribusiness is at the core of national strategic policy goals in East Asia and Southeast Asia as a result of diminishing Total Factor Productivity (TFP). The goal is to increase food production output by promoting private-sector cooperation and agricultural infrastructure development. The United States was one of the first countries to implement precision farming technologies, which is one of the main reasons for the region's dominant position in the market. Canada's widespread acceptance of modern agricultural technologies is helping to propel the industry forward.

However, the Asia Pacific agriculture drones market is expected to grow at a CAGR of 6.6% during the forecast period. Around this region, the reception of shrewd agribusiness innovation is relied upon to speed up, with developing nations like India, China, and Southeast Asia driving the way. The organization of horticulture drones in APAC is being driven by a quickly developing populace, the accessibility of arable homesteads, and government backing through appropriations.

|

Certified Drone Operators by Country |

||

|

Country |

Operator |

Sources |

|

United Kingdom |

3046 |

Civil Aviation Authority |

|

Ireland |

172 |

IAA |

|

France |

2250 |

IAA |

|

Spain |

2420 |

AESA |

|

Italy |

972 |

ENAC |

The objective of the report is to present a comprehensive analysis of the Global Agriculture Drones Market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Agriculture Drones market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the global market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Agriculture Drones market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Agriculture Drones market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the gobal market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Global Agriculture Drones market. The report also analyses if the Global Agriculture Drones market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Agriculture Drones market. Economic variables aid in the analysis of economic performance drivers that have an impact on the global Agriculture Drones market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the global market is aided by legal factors.

Agriculture Drones Market Scope:

|

Agriculture Drones Market |

|

|

Market Size in 2025 |

USD 3.68 Bn. |

|

Market Size in 2032 |

USD 16.07 Bn. |

|

CAGR (2026-2032) |

23.4% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

by Application

|

|

by Offering

|

|

|

by Component

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Agriculture Drones Market Key Players:

- DJI (China)

- PrecisionHawk (US)

- Trimble Inc. (US)

- Parrot (France)

- 3DR (US)

- AeroVironment, Inc. (US)

- Yamaha Motor Corp. (Japan)

- DroneDeploy (US)

- AgEagle Aerial Systems, Inc. (US)

- OPTiM Corp. (Japan)

- senseFLY (Switzerland)

- Pix4D (Switzerland)

- Sentera Inc. (US)

- SlantRange (US)

- ATMOS UAV (Netherlands)

- Delair (France)

- Nileworks Inc. (Japan)

Frequently Asked Questions

The North American region is expected to hold the highest share in the Agriculture Drones Market.

The market size of the Agriculture Drones Market is expected to be 16.07 Bn by 2032.

The forecast period for the Agriculture Drones Market is 2026-2032

The market size of the Agriculture Drones Market in 2025 was US$ 3.68 Bn.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Agriculture Drones Market: Target Audience

2.3. Global Agriculture Drones Market: Primary Research (As per Client Requirement)

2.4. Global Agriculture Drones Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2025-2032(In %)

4.1.1. North America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.2. Europe Market Share Analysis, By Value, 2025-2032 (In %)

4.1.3. Asia Pacific Market Share Analysis, By Value, 2025-2032 (In %)

4.1.4. South America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.5. Middle East and Africa Market Share Analysis, By Value, 2025-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Agriculture Drones Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.3.1. Global Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.3.1.1. Precision Agriculture

4.3.1.2. Livestock Monitoring

4.3.1.3. Smart Greenhouse

4.3.1.4. Irrigation

4.3.1.5. Precision Fish Farming

4.3.2. Global Market Share Analysis, By Offering, 2025-2032 (Value US$ MN)

4.3.2.1. Hardware

4.3.2.2. Software

4.3.3. Global Market Share Analysis, By Component, 2025-2032 (Value US$ MN)

4.3.3.1. Camera

4.3.3.2. Batteries

4.3.3.3. Navigation System

4.3.3.4. Others

4.4. North America Agriculture Drones Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.4.1. North America Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.4.1.1. Precision Agriculture

4.4.1.2. Livestock Monitoring

4.4.1.3. Smart Greenhouse

4.4.1.4. Irrigation

4.4.1.5. Precision Fish Farming

4.4.2. North America Market Share Analysis, By Offering, 2025-2032 (Value US$ MN)

4.4.2.1. Hardware

4.4.2.2. Software

4.4.3. North America Market Share Analysis, By Component, 2025-2032 (Value US$ MN)

4.4.3.1. Camera

4.4.3.2. Batteries

4.4.3.3. Navigation System

4.4.3.4. Others

4.4.4. North America Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.4.4.1. US

4.4.4.2. Canada

4.4.4.3. Mexico

4.5. Europe Agriculture Drones Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.5.1. Europe Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.5.2. Europe Market Share Analysis, By Offering, 2025-2032 (Value US$ MN)

4.5.3. Europe Market Share Analysis, By Component, 2025-2032 (Value US$ MN)

4.5.4. Europe Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.5.4.1. UK

4.5.4.2. France

4.5.4.3. Germany

4.5.4.4. Italy

4.5.4.5. Spain

4.5.4.6. Sweden

4.5.4.7. Austria

4.5.4.8. Rest Of Europe

4.6. Asia Pacific Agriculture Drones Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.6.1. Asia Pacific Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.6.2. Asia Pacific Market Share Analysis, By Offering, 2025-2032 (Value US$ MN)

4.6.3. Asia Pacific Market Share Analysis, By Component, 2025-2032 (Value US$ MN)

4.6.4. Asia Pacific Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.6.4.1. China

4.6.4.2. India

4.6.4.3. Japan

4.6.4.4. South Korea

4.6.4.5. Australia

4.6.4.6. ASEAN

4.6.4.7. Rest Of APAC

4.7. South America Agriculture Drones Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.7.1. South America Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.7.2. South America Market Share Analysis, By Offering, 2025-2032 (Value US$ MN)

4.7.3. South America Market Share Analysis, By Component, 2025-2032 (Value US$ MN)

4.7.4. South America Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.7.4.1. Brazil

4.7.4.2. Argentina

4.7.4.3. Rest Of South America

4.8. Middle East and Africa Agriculture Drones Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.8.1. Middle East and Africa Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.8.2. Middle East and Africa Market Share Analysis, By Offering, 2025-2032 (Value US$ MN)

4.8.3. Middle East and Africa Market Share Analysis, By Component, 2025-2032 (Value US$ MN)

4.8.4. Middle East and Africa Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.8.4.1. South Africa

4.8.4.2. GCC

4.8.4.3. Egypt

4.8.4.4. Nigeria

4.8.4.5. Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1. Global Stellar Competition Matrix

5.2. North America Stellar Competition Matrix

5.3. Europe Stellar Competition Matrix

5.4. Asia Pacific Stellar Competition Matrix

5.5. South America Stellar Competition Matrix

5.6. Middle East and Africa Stellar Competition Matrix

5.7. Key Players Benchmarking

5.7.1. Key Players Benchmarking By Application, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.8. Mergers and Acquisitions in Industry

5.8.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. DJI (China)

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. PrecisionHawk (US)

6.1.3. Trimble Inc. (US)

6.1.4. Parrot (France)

6.1.5. 3DR (US)

6.1.6. AeroVironment, Inc. (US)

6.1.7. Yamaha Motor Corp. (Japan)

6.1.8. DroneDeploy (US)

6.1.9. AgEagle Aerial Systems, Inc. (US)

6.1.10. OPTiM Corp. (Japan)

6.1.11. senseFLY (Switzerland)

6.1.12. Pix4D (Switzerland)

6.1.13. Sentera Inc. (US)

6.1.14. SlantRange (US)

6.1.15. ATMOS UAV (Netherlands)

6.1.16. Delair (France)

6.1.17. Nileworks Inc. (Japan)

6.2. Key Findings

6.3. Recommendations