Agricultural Films Market Global Industry Analysis and Forecast (2026-2032) by Component, Water Depth and Region

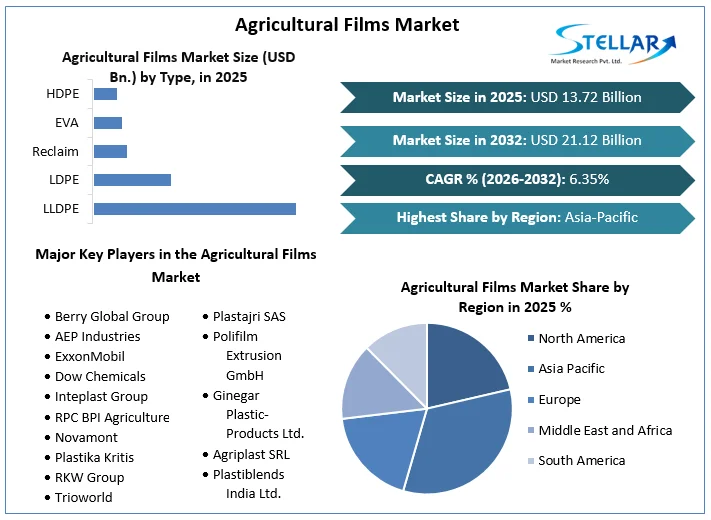

Global Agricultural Films Market size was valued at USD 13.72 Bn. in 2025 and is expected to reach USD 21.12 Bn. by 2032, at a CAGR of 6.35%.

Format : PDF | Report ID : SMR_2217

Agricultural Films Market Overview

The agricultural films market encompasses polyethylene-based films used in farming for mulching, greenhouse covering, and silage preservation. These films enhance crop growth by controlling weeds, regulating soil temperature, conserving moisture, and protecting crops from pests and adverse weather conditions. They are integral to modern agricultural practices, promoting efficiency and sustainability in crop production globally. The agricultural films market is expanding rapidly, owing to a number of major trends and breakthroughs.

Biodegradable films are developing as a crucial motivator for meeting global environmental and regulatory demands. This movement is aided by advances in technology and manufacturing processes, which improve the performance and cost-effectiveness of biodegradable alternatives. Nano greenhouses, which employ nanomaterial-coated sheets, are also transforming agriculture by improving crop-growing conditions while minimizing environmental effects.

Asia-Pacific dominates the market due to significant greenhouse vegetable cultivation and growing use of protected agricultural practices, particularly in China. Europe follows, with strong growth driven by increased usage of biodegradable products. North America has moderate development, but South America, the Middle East, and Africa are expected to increase due to increasing infrastructure and rising consumer demand for the agricultural films market. Overall, the market is competitive, with leading companies working on innovation and sustainability to preserve their global leadership in agricultural films market.

To get more Insights: Request Free Sample Report

Agricultural Films Market Trend

Biodegradable films serve as a catalyst for the growth and sustainability of the agricultural films market

The increasing demand for biodegradable agricultural films is expected to have a substantial impact on agricultural films market growth due to several significant drivers. For instance, increased environmental awareness and strict regulations throughout the world are driving agricultural businesses toward more sustainable techniques, with biodegradable choices taking dominance over traditional plastic. In addition, consumers and farmers are increasingly selecting eco-friendly goods with limited environmental effects throughout their lives. Furthermore, biodegradable films address issues about soil contamination and marine pollution, which are critical in delicate agricultural environments.

Additionally, developments in technology and production techniques are improving biodegradable films' performance and cost-competitiveness, making them accessible to a wider agricultural films market. As sustainability continues to influence consumer and regulatory choices, biodegradable agricultural films are expected to acquire a larger share of the market, boosting overall growth and innovation in agricultural films market solutions.

Agricultural Films Market Dynamics

Nano greenhouses drive demand for advanced agricultural films, transforming technology and expanding the market

Nano greenhouses are a significant innovation in agricultural technology that has the potential to improve the agricultural films market in multiple aspects. These greenhouses use sheets coated with nanomaterial’s to precisely regulate temperature, humidity, and light transmission. Nano films increase crop yields and quality by generating ideal growth conditions, boosting demand for specialized agricultural films.

Furthermore, nanotechnology improves the films' capacity to protect crops from pests, UV radiation, and harsh weather conditions, extending their life and limiting the need for substitutes. This efficiency appeals not just too environmentally aware farmers, but it also promotes sustainable farming practices by using less water and fertilizer. As Nano greenhouses rise in popularity, demand for improved agricultural films that incorporate nanotechnology is expected to rise, boosting the global agricultural films market. This technical advancement encourages additional research and development, establishing nano-enhanced films as a critical component in the future of agriculture.

Furthermore, polycarbonate NANO boosts vegetable growing productivity from 30% to 48% while also speeding up crop maturation by 3–4 weeks. The increasing usage of agricultural films as greenhouse covers is expected to drive agricultural films market expansion.

For instance,

- In 2024, DuPont introduced a new line of smart agricultural films that use nanomaterial’s to monitor and regulate environmental factors in real-time, optimizing crop growth conditions.

- In 2024, Mitsui Chemicals acquired a stake in a start-up specializing in nanotechnology for agricultural films, signaling their strategic focus on technological advancements in the sector.

- In 2022, Novamont collaborated with Syngenta to develop biodegradable mulch films using Mater-Bi bio plastic, focusing on sustainable agriculture practices.

- In 2022, Plastika Kritis S.A. launched anti-UV agricultural films designed to improve durability and performance across various climates.

Volatile raw material costs and sustainability investments offer challenges for the growth of the agricultural films market

The agricultural films market has been significantly impacted by variable raw material prices and the need to invest in sustainable technology. Unpredictable costs for materials used in agricultural films production have stressed manufacturers' cost structures, making it difficult to maintain competitive pricing. Likewise, regulatory expectations for environmentally friendly products have increased, necessitating costly changes and advances in agricultural films manufacturing techniques.

These issues have cumulatively slowed market expansion by raising manufacturing costs and potentially restricting consumer affordability. Furthermore, producers must manage these hurdles while seeking to fulfil increased consumer sustainability expectations, adding to the complexity of market dynamics. To address these constraints, significant investments in technology and operational efficiency must be made to combine cost management with the development of ecologically appropriate solutions, which is critical for the future of the agricultural films market.

Agricultural Films Market Segment Analysis

Based on Type, LLDPE dominates the agricultural films industry among the segments LDP, reclaim, EVA, HDPE, and others due to its versatility and benefits, like being readily available, inexpensive, highly impact-resistant, and easy to work with, making it appropriate for a wide range of agricultural uses. LLDPE films protect crops from weather elements, pests, and UV radiation while preserving ideal growth conditions. The production process involves the polymerization of ethylene and alpha-olefins, resulting in a polymer with tailored properties suitable for agricultural film applications.

The supply chain for LLDPE includes raw material suppliers, polymer producers, and converters who manufacture and distribute agricultural films to end-users. These characteristics not only satisfy but also surpass the demands of current farming methods, resulting in broad acceptance and LLDPE's largest Agricultural Films Market share in agricultural films in 2025, which will continue in the forecast period.

The products manufactured using HDPE and EVA are used in agricultural applications where rigidity is desired. HDPE products are mostly used in mulching and fumigation applications. Reclaims are recycled materials and have excellent tensile strength. However, the prices of these products are not competitive as compared to other conventional polymers. Other agricultural films manufactured from PVC and EVOH have low market penetration owing to non-competitive prices and the low durability of finished products coupled with their non-biodegradable nature.

For instance,

- In 2022, BioBag International launched biodegradable LDPE agricultural films made from renewable sources, aiming to address sustainability concerns.

- In 2022, BASF collaborated with a start-up to develop ethylene vinyl acetate (EVA) films with improved barrier properties for agricultural applications.

- In 2021, Dow scientists partnered with the manufacturer to develop innovative silage wrap. This wrap helps maintain the nutritional value of forage plants.

Based on Applications, mulch films held the largest market share of agricultural films market, in terms of value, in 2025. They are an efficient device that effectively controls weeds, conserves soil moisture, and regulates soil temperature. They also have the capacity to manage soil water retention, promoting perfect conditions for agricultural film growth. Their employment includes insect management, erosion control, and labour cost reduction, making them vital in current farming operations. Mulch films have established themselves as the preferred option of farmers globally by increasing crop yields, improving quality, and supporting sustainable agricultural practices, resulting in a major portion of the agricultural film market. Mulch films are utilized in arid places where crop survival is critical.

Growing greenhouse agriculture in Asia, the Middle East, and Western Europe is expected to have a beneficial effect on agricultural films market growth. Factors such as increased demand for floriculture and horticulture, as well as unpredictable meteorological circumstances, are expected to dominate greenhouse segment market growth. Furthermore, the product's use in greenhouses helps to improve productivity and plant culture.

Furthermore, agricultural films used in silage applications increase the nutritional value of animal feed and enhance milk production. Rising product demand for the fermentation of animal fodder obtained from forage plants is anticipated to drive the agricultural films market in the forecast period.

For instance,

- In 2023, Plastika Kritis and Wageningen University collaborated on research to develop smart mulch films incorporating IoT sensors for real-time monitoring of soil moisture and nutrient levels.

- In 2021, BASF and Netafim collaborated to develop irrigation and crop management solutions integrated with mulch films to optimize water and nutrient use efficiency.

- In 2021, Covestro and Bayer partnered to develop sustainable greenhouse films using polycarbonate-based materials for improved thermal insulation and light transmission.

- In 2024, Mitsubishi Chemical developed high-barrier silage films with enhanced oxygen barrier properties and tear resistance for prolonged feed preservation.

Agricultural Films Market Regional Insights

The Asia-Pacific agricultural films market held largest market share in 2025 as this region accounts for about 50% of the global greenhouse vegetable growing area. Large areas dedicated to greenhouse vegetables, an increasing focus on high-value and export-oriented fruit and vegetable farming, and a growing agriculture business are all significant drivers propelling the region's agricultural films market.

Consumers' increasing attention toward biodegradable films as they become more environmentally sensitive is another important driver of market expansion. Furthermore, farmers in Asia-Pacific, specifically in China, are using protected agricultural methods to increase crop output and quality. Almost 3.3 million hectares of cropland in China are under protected cultivation. China is the major consumer of these films in Asia Pacific due to the high food demand from the ever-growing population.

North America agricultural films market is expected to show moderate growth during the forecast period as many production facilities are transferred to developing countries. Additionally, the increasing preference of consumers for plant-based food is propelling market growth. The agricultural films market in Europe is projected to register a comparatively higher CAGR during the forecast period. Increasing consumption of biodegradable materials in the region is anticipated to drive the market. South America and the Middle East & Africa agricultural films markets are currently at their developing stage. However, developing infrastructure in these regions and growing consumer demand for organic food are projected to create a healthy environment for agricultural films market.

For instance,

- In February 2024, Berry Global Group, Inc. has opened the new 12,000 square feet Circular Innovation and Training Center in Tulsa, Oklahoma.

- In March 2024, Kuraray Co., Ltd. invested in the production plant of the product EVAL EVOH in Singapore to expand the business and contribute to the natural and living environment improvements.

- In April 2023, BASF increased capacities of its ecovio to support the customers in Asia-Pacific region. The high-quality biopolymer Ecovio is biodegraded by microorganisms in industrial and home composting conditions as well as in agricultural soil.

- In October 2022, Under the Polydress TWISTA brand, RKW offers three different silage combination films. Polydress TWISTA Barrier is a combination of a special underlay film with a high oxygen barrier for excellent silage quality.

- In October 2020, Dow Inc. introduced its first recycled plastic resin for shrink film applications in North America. The recycled plastic resin had been designed specifically for retail and logistic shrink film applications.

Competitive Landscape of Agricultural Films Market

The global agricultural films market is highly competitive, characterized by a diverse range of players competing on the basis of product innovation, quality, and sustainability. Leading companies like Berry Global Inc., DowDuPont, and BASF SE dominate with extensive product portfolios that include mulch films, greenhouse films, and silage films. These companies leverage their strong R&D capabilities to introduce films with enhanced properties such as UV resistance, biodegradability, and moisture retention, catering to diverse agricultural needs worldwide.

Regional players such as RKW Group in Europe and Grupo Armando Alvarez in South America strengthen market competition by focusing on localized manufacturing and distribution networks. Emerging players from Asia-Pacific like Ginegar Plastic Products Ltd. and Polifilm Extrusion GmbH are also gaining prominence through strategic expansions and technological advancements.

Agricultural Films Market Scope

|

Agricultural Films Market |

|

|

Market Size in 2025 |

USD 13.72 Bn. |

|

Market Size in 2032 |

USD 21.12 Bn. |

|

CAGR (2026-2032) |

6.35 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Agricultural Films Market Segments |

By Type LLDPE LDPE Reclaim EVA HDPE Others |

|

By Application Greenhouse Films Mulch Films Silage Films |

|

|

Regional Scope |

North America – United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa – South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Agricultural Films Market Key players

North America

- Berry Global Group

- AEP Industries

- ExxonMobil

- Dow Chemicals

- Inteplast Group

- RPC BPI Agriculture

- Novamont

- Plastika Kritis

Europe

- RKW Group

- Trioworld

- Barbier Group

- Grupo Armando Alvarez

- Plastajri SAS

Asia Pacific

- Polifilm Extrusion GmbH

- Ginegar Plastic-Products Ltd.

- Agriplast SRL

- Plastiblends India Ltd.

Middle East and Africa (MEA)

- Saudi Basic Industries Corporation (SABIC)

- Henan Yinfeng Plastic Co. Ltd.

- Al-Pack Enterprises Ltd

South America

- Plastar SA

- Impero Polyfilms

- Agrofilmes

- Braskm SA

Frequently Asked Questions

Asia Pacific is expected to dominate the Agricultural Films Market during the forecast period.

The Agricultural Films Market size is expected to reach USD 21.12 Billion by 2032.

The major top players in the Global Agricultural Films Market are Berry Global Group, Dow Chemicals, Plastika Kritis, BASF SE, and Novamont.

The agricultural films market, which includes greenhouse, mulch, and silage films, has strong worldwide trade dynamics driven by technical improvements and sustainability trends.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Agricultural Films Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Agricultural Films Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. Production Overview

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2025)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

3.5. Agricultural Films Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Agricultural Films Market: Dynamics

4.1. Agricultural Films Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Agricultural Films Market Drivers

4.3. Agricultural Films Market Restraints

4.4. Agricultural Films Market Opportunities

4.5. Agricultural Films Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Smart films

4.8.2. ProTechnology in agricultural films

4.8.3. Multi-layer plastic films

4.8.4. Additive And Pigment Technology

4.8.4.1. Smart Aluminum

4.8.4.2. Thermal Additives

4.8.4.3. Anti-fog/Anti-drip Technology

4.8.5. Technological Roadmap

4.9. Value Chain Analysis and Supply Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Regulatory Landscape

4.11.1. Market Regulation by Region

4.11.1.1. North America

4.11.1.2. Europe

4.11.1.3. Asia Pacific

4.11.1.4. Middle East and Africa

4.11.1.5. South America

4.11.2. Impact of Regulations on Market Dynamics

4.11.3. Government Schemes and Initiatives

5. Agricultural Films Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

5.1. Agricultural Films Market Size and Forecast, by Type (2025-2032)

5.1.1. LLDPE

5.1.2. LDPE

5.1.3. Reclaim

5.1.4. EVA

5.1.5. HDPE

5.1.6. Others

5.2. Agricultural Films Market Size and Forecast, by Application (2025-2032)

5.2.1. Greenhouse Films

5.2.2. Mulch Films

5.2.3. Silage Films

5.3. Agricultural Films Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Agricultural Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

6.1. North America Agricultural Films Market Size and Forecast, by Type (2025-2032)

6.1.1. LLDPE

6.1.2. LDPE

6.1.3. Reclaim

6.1.4. EVA

6.1.5. HDPE

6.1.6. Others

6.2. North America Agricultural Films Market Size and Forecast, by Application (2025-2032)

6.2.1. Greenhouse Films

6.2.2. Mulch Films

6.2.3. Silage Films

6.3. North America Agricultural Films Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Agricultural Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

7.1. Europe Agricultural Films Market Size and Forecast, by Type (2025-2032)

7.2. Europe Agricultural Films Market Size and Forecast, by Application (2025-2032)

7.3. Europe Agricultural Films Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Russia

7.3.8. Rest of Europe

8. Asia Pacific Agricultural Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

8.1. Asia Pacific Agricultural Films Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Agricultural Films Market Size and Forecast, by Application (2025-2032)

8.3. Asia Pacific Agricultural Films Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. India

8.3.3. Japan

8.3.4. South Korea

8.3.5. Australia

8.3.6. ASEAN

8.3.7. Rest of Asia Pacific

9. Middle East and Africa Agricultural Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

9.1. Middle East and Africa Agricultural Films Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Agricultural Films Market Size and Forecast, by Application (2025-2032)

9.3. Middle East and Africa Agricultural Films Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Rest of the Middle East and Africa

10. South America Agricultural Films Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Kilotons) (2025-2032)

10.1. South America Agricultural Films Market Size and Forecast, by Type (2025-2032)

10.2. South America Agricultural Films Market Size and Forecast, by Application (2025-2032)

10.3. South America Agricultural Films Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Berry Global Group

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. AEP Industries

11.3. ExxonMobil

11.4. Dow Chemicals

11.5. Inteplast Group

11.6. RPC BPI Agriculture

11.7. Novamont

11.8. Plastika Kritis

11.9. RKW Group

11.10. Trioworld

11.11. Barbier Group

11.12. Grupo Armando Alvarez

11.13. Plastajri SAS

11.14. Polifilm Extrusion GmbH

11.15. Ginegar Plastic-Products Ltd.

11.16. Agriplast SRL

11.17. Plastiblends India Ltd.

11.18. Saudi Basic Industries Corporation (SABIC)

11.19. Henan Yinfeng Plastic Co. Ltd.

11.20. Al-Pack Enterprises Ltd

11.21. Plastar SA

11.22. Impero Polyfilms

11.23. Agrofilmes

11.24. Braskm SA

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook