North America Additive Manufacturing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

North America Additive Manufacturing Market was valued at USD 7.8 Billion in 2024. The Total North America Additive Manufacturing Market revenue is expected to grow by CAGR 21.4% from 2024 to 2032 and reach USD 30.04 Billion in 2032.

Format : PDF | Report ID : SMR_2723

North America Additive Manufacturing Overview:

Additive manufacturing (AM) is a process of making items by adding material layer by layer to digital 3D model. It uses technology s such as FDM, SLM, or SLA and supports materials such as polymers, metals and composites. Additive manufacturing enables complex designs, reduces waste, and is widely used for aerospace, automotive and medical industries for rapid prototypes and custom parts.

The North America Additive Manufacturing Market is powered by its strong industrial base in aerospace, automotive and healthcare sectors, demanding light, complex components. The aerospace fuel-skilled, benefits from complex parts, while the market opportunity in healthcare focuses on custom transplants and prosthetics. Fused deposition modeling (FDM) dominates due to cost-effectiveness and versatility, rapidly supports prototypes and small batch production. Metals such as titanium and aluminum lead materials were fueled by advanced 3D printing technologies. The aerospace remains the emerging market section, which benefits from high strength, low-exploited parts. The government's initiative and innovation from major players accelerate adoption, despite the challenges such as more costs and IP concerns, ensuring an increase in the market.

In North America, additive manufacturing (AMs) increase production costs in the market, affecting tariff competition on imported raw materials such as metal powder. Import restrictions on additive manufacturing machinery slow down innovation and disrupt supply chains. However, initiatives such as trade agreements such as USMCA and additive manufacturing Forward Program support domestic manufacturing and reduce dependence on imports. Despite global trade stress, strong policy support and industrial abilities help North America maintain their additive manufacturing market leadership.

To get more Insights: Request Free Sample Report

North America Additive Manufacturing Market Dynamics:

Strong Industrial Base to Drive the Additive Manufacturing Market Growth

North America additive manufacturing market is strongly powered by its well-established industrial base, especially in aerospace, automotive and healthcare sectors. These Additive Manufacturing

industries require light, complex and highly adapted components to improve performance, fuel efficiency and patient results. Additive manufacturing enables the production of complex designs that traditional methods cannot easily achieve, supporting rapid prototyping and small-batch production. the aerospace sector, benefit from light parts that reduce fuel consumption and emissions, while automotive companies use additive manufacturing for both functional parts and design innovations. Healthcare applications include custom transplants and prosthetics. This industrial demand is running for investment and adoption of additive manufacturing technologies throughout the region.

Healthcare Sector is a Significant Opportunity Additive Manufacturing Market

The healthcare sector in North America offers an important development opportunities for adorable manufacturing due to the increasing demand for customized medical solutions. Additive manufacturing enables the production of patient-specific implants, prosthetics, surgical apparatus and Additive Manufacturing over time compared to traditional manufacturing methods. This adaptation improves patient results by ensuring better fit, efficiency and comfort. The additive manufacturing supports the rapid prototype for medical research and equipment development, accelerating innovation to drive Additive Manufacturing industry growth in 2024. There is a further demand for aging population and increasing prevalence of chronic diseases. healthcare additive manufacturing is becoming a major adoption of technology, which contributes significantly to additive manufacturing market expansion in the region.

Material Limitations Hindering Additive Manufacturing Growth in North America

North America, the boundaries of materials remain a significant challenge in the additive manufacturing market. While additive manufacturing ?supports a wide range of materials such as metals, polymers and composites, many materials are still low in meeting strict performance requirements for important applications, especially in aerospace, healthcare and automotive sectors. Certification and quality standards for 3D-merged materials are still developing, forming obstacles for their widespread acceptance in security-mating components. Additionally, it is expensive or difficult to process certain advanced materials using current additive manufacturing technologies. It is necessary to control these material boundaries to adopt a comprehensive industry and unlock the full potential of additive manufacturing market.

North America Additive Manufacturing Market Segmentation

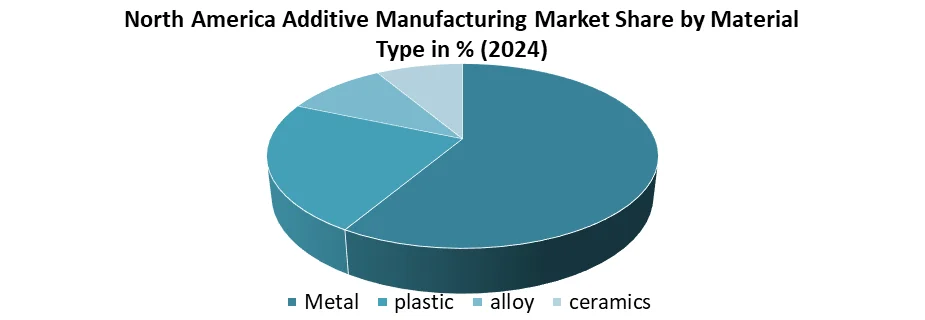

By Material Type, the additive manufacturing market is segmented into metal, plastic, alloys, and ceramics. The metal segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. Its increasing application in high demand trades such as aerospace, automotive and healthcare. Metals such as titanium, aluminium and stainless-steel offer exceptional power, durability and heat resistance required for significant components such as engine parts and medical transplants. Advance in metal 3D printing technologies, including selective laser melting and electron beam melting, have better the quality of production and the quality of the part, encouraging comprehensive adoption. While plastic and ceramic are important for specific uses, metals dominate because they meet the demand for manufacturing mechanical and thermal requirements, which grades in significant North America additive manufacturing market growth.

By Technology, the additive manufacturing market segmented into Stereolithography, Fused Deposition Modelling, Laser Sintering, Binder Jetting Printing, Electron Beam Melting and Others. Fused Deposition Modelling segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. Cost effectiveness, ease of use, and comprehensive material compatibility, specially with thermoplastic. It is commonly adopted in industries from prototypes in customer goods to motor vehicle and functional portions in industrial manufacturing. FDM printers are available in both desktop and trade forms, making technology equally accessible to startups, educational institutions and large scale manufacturers. the print resolution, continuous improvement in the power of speed and material have increased its versatility. While Technology s such as SLM and EBM are important for metal applications, FDM is most commonly used due to its ability, scalability and comprehensive application base.

By Application, the North America additive manufacturing market segmented into Automotive, Healthcare, Aerospace, Consumer Goods, Architecture, and Others. The aerospace segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. Aerospace segment 28% of the regional additive manufacturing market share in 2024.The industry's demand for lightweight, high strength, and complex components that reduce fuel consumption and improve performance. Additive manufacturing market enables the production of intricate shares with minimal material waste, making it ideal for aerospace applications such as engine components, air ducts, brackets, and structural elements.

The sector also benefits from the use of innovative metal 3D printing technologies similar Selective Laser Melting and Electron Beam Melting, which meet strict aerospace quality and safety standards. the need for rapid prototyping and part consolidation supports additive manufacturing adoption. aerospace leads in terms of value contribution and technological integration, especially for mission critical, custom, and low volume parts.

By Country, In the North America Additive Manufacturing market, the United States emerged as a major country in 2024, accounting for more than 75% of the regional market share. This dominance is powered by a well established industrial base, comprehensive R&D investment, and the presence of key players such as GE Additive, Stretti’s and 3D System. U.S. Has led to adopting 3D printing technologies in advanced areas including aerospace, healthcare and automotive, with companies such as Boeing and Lockheed Martin integrate additive manufacturing in their production processes. strong government support through initiatives like America Make has intensified the commercialization of innovation, standardization and adorable manufacturing technologies.

Meanwhile, Canada and Mexico are observing gradual development, which are supported by increasing investment in manufacturing and increasing demand for customized production. MMR report covred the detailed analysis of Additive Manufacturing industry and top Additive Manufacturing company analysis. Also, report provide the detailed analysis of Additive Manufacturing country wise analysis with industrial demand and supply dynamics, changing regulations, row material fluctuations in north American Additive Manufacturing industry, and pricing analysis.

North America Additive Manufacturing Market Competitive Landscape

The 3D System Corporation and Stratasys Ltd. Limited are two prominent players in the additive manufacturing market. The 3D system, is known for pioneering stereolithography (SLA) and focuses heavy on healthcare, aerospace and dental applications, offering metal and polymer 3D printers with software such as 3DXPTs. The USA and Israel leads in Stratasys, FDMs and polygette technologies with dual headquarters and operates industries such as aerospace, education and motor vehicles. It has expanded through acquisitions such as original and co-store additive manufacturing to increase production capabilities. While the 3D system is stronger in medical and metal additive manufacturing, Stratasys excel in multi-coal prototypes and industrial solutions. Both invest heavy in R&D and stability, but face growing competition from new entrances such as HP and desktop metals.

North America Additive Manufacturing Market Key Development

In 5 March 2025, the 3D System Corporation (USA) launched the NextDent LCD 1, a compact dental 3D printer for small dental labs and clinics. The launch marked a strategic expansion of its digital dental portfolio, which provides high precision, in-house printing solutions. Development reinforces the leadership of the 3D system in North America's Dental Additive Manufacturing sector by addressing the increasing demand for accessible and skilled dental 3D printing technology.

In 4 October 2024, Markforged (USA) launched the FX10, an advanced industrial composite 3D printer designed for producing high-strength, end use parts. Specifically engineered for demanding applications, the FX10 targets sectors like aerospace and defence in North America, offering improved speed, reliability, and material performance.

In June 2024, GE Additive (USA) opened a Customer Experience Centre in Cincinnati, Ohio to provide DfAM consulting and training. The centre supports U.S. manufacturers in adopting additive manufacturing technologies more effectively.

|

The North America Additive Manufacturing Market Scope |

|

|

Market Size in 2024 |

USD 7.8 Billion |

|

Market Size in 2032 |

USD 30.4 Billion |

|

CAGR (2025-2032) |

21.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Material Type Metal Plastics Alloy Ceramics |

|

By Technology Stereolithography Fused Deposition Modelling Laser Sintering Binder Jetting Printing Electron Beam Melting Others |

|

|

By Application Automotive Healthcare Aerospace Consumer Goods Architecture Others |

|

|

Regional Scope |

North America- US, Canada, and Mexico |

North America Key players in the Additive Manufacturing Market

North America

- 3D Systems Corporation (USA)

- Stratasys Ltd. (USA)

- HP Inc. (USA)

- Desktop Metal, Inc. (USA)

- Carbon, Inc. (USA)

- Markforged, Inc. (USA)

- Protolabs, Inc. (USA)

- Velo3D, Inc. (USA)

- General Electric Additive (GE Additive) (USA)

- ExOne Company (USA)

- 3DEO, Inc. (USA)

- Essentium, Inc. (USA)

- nTopology (USA)

- Xometry, Inc. (USA)

- Mantle Inc. (USA)

Frequently Asked Questions

Fused Deposition Modelling (FDM) led the market due to its versatility and cost-effectiveness.

The market is projected to grow at a CAGR of 21.4%.

The aerospace sector dominates due to its need for lightweight, high-strength components.

The additive manufacturing Forward Program by the U.S. Department of Defence supports advanced manufacturing adoption.

1. North America Additive Manufacturing Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Additive Manufacturing Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Additive Manufacturing Market: Dynamics

3.1. North America Aesthetic Additive Manufacturing Market Trends

3.2. North America Aesthetic Additive Manufacturing Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Additive Manufacturing Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America Aesthetic Additive Manufacturing Market Size and Forecast, By Material Type (2024-2032)

4.1.1. Metal

4.1.2. Plastics

4.1.3. Alloy

4.1.4. Ceramics

4.2. North America Aesthetic Additive Manufacturing Market Size and Forecast, By Technology (2024-2032)

4.2.1. Stereolithography

4.2.2. Fused Deposition Modelling

4.2.3. Laser sintering

4.2.4. Binder jetting printing

4.2.5. Electron beam melting

4.2.6. others

4.3. North America Aesthetic Additive Manufacturing Market Size and Forecast, By Application (2024-2032)

4.3.1. Automotive

4.3.2. Healthcare

4.3.3. Aerospace

4.3.4. Consumer goods

4.3.5. Architecture

4.3.6. Others

4.4. North America Aesthetic Additive Manufacturing Market Size and Forecast, By Country (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. Company Profile: Key Players

5.1. 3D Systems Corporation

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Development

5.2. Stratasys Ltd.

5.3. HP Inc.

5.4. Desktop Metal, Inc.

5.5. Carbon, Inc.

5.6. Markforged, Inc.

5.7. Protolabs, Inc.

5.8. Velo3D, Inc.

5.9. General Electric Additive (GE Additive)

5.10. ExOne Company

5.11. 3DEO, Inc.

5.12. Essentium, Inc.

5.13. nTopology

5.14. Xometry, Inc.

5.15. Mantle Inc.

6. Key Findings

7. Industry Recommendations