Europe Industrial Sensors Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

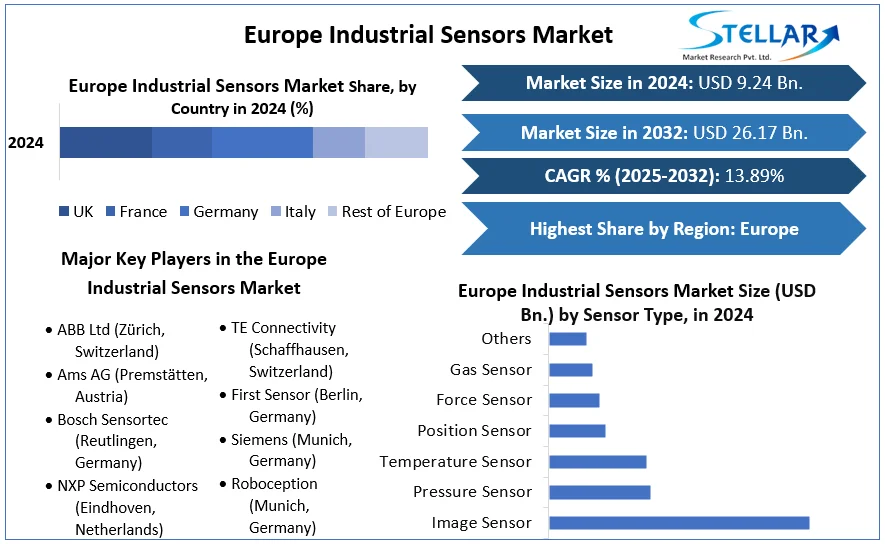

Europe Industrial Sensors Market size was valued at USD 9.24 Bn. in 2024 and the total Europe Industrial Sensors Market size is expected to grow at a CAGR of 13.89% from 2025 to 2032, reaching nearly USD 26.17 Bn. by 2032.

Format : PDF | Report ID : SMR_2341

Europe Industrial Sensors Market Overview:

The industrial sensors are utilized for measuring physical variables like Level, Temperature, Flow, Pressure, Speed, and Position. There is a notable growth in the Europe industrial sensors market owing to the rising use of industrial automation and the need for real-time data in manufacturing processes. Moving to smart factories is important because sensors play a key role in taking measurements in the real world and converting them into digital data, which is then sent to connected devices and management systems through the Internet of Things (IoT).

In the automotive industry, manufacturers are switching out conventional optical systems and potentiometers with non-contact 3D magnetic sensors to improve performance and reliability in position sensing. Companies such as Bosch, Siemens, and Honeywell are constantly advancing sensor technologies for diverse industrial applications, including monitoring machine conditions in SMART factories and meeting environmental regulations.

Revolution in the oil and gas, chemical, mining, energy, and power industries is especially noticeable. By monitoring variables such as temperature, pressure, and fluid levels, sensors installed in drilling equipment for the oil and gas industry improve efficiency and safety. For better safety and upkeep, leading companies like ABB and Schneider Electric are developing cutting-edge sensors to manage pipeline conditions, monitor flow rates, and find leaks.

To get more Insights: Request Free Sample Report

Europe Industrial Sensors Market Dynamics:

Industry 4.0 and IoT to boost Europe Industrial Sensors Market Growth

Industrial Internet of Things (IIoT) devices are finding new applications thanks to the incorporation of higher computing power in sensor nodes, sophisticated microcontrollers, and wired and wireless communication options to cloud servers. Applications include human presence detection, vibration analysis of spinning machinery, factory automation, warehouse inventory management, industrial robotics, and process sensing. Additionally, Industrial Sensors have been growing because of the increasing visibility of equipment issues brought about by predictive maintenance and asset management systems.

Europe government is taking the lead in growing processes and discrete industries through a range of investment-backed strategies and initiatives. By encouraging the use of communication and industrial automation technology, these initiatives are supporting the structural growth of the Industrial Sensors industries. In terms of digital integration, Switzerland leads the world in both connectivity and digital integration, whereas Germany and Austria lag somewhat behind the EU average. Recent developments are opening up new avenues for data analysis and actionable insight extraction, resulting in more responsive and agile manufacturing. One example of the development of smart sensors combines advanced sensing capabilities with increased processing capacity.

Europe Industrial Sensors Market Segment Analysis:

By end-use industry, the Automotive industry segment held XX % share in 2024 for the Europe Industrial Sensors Market. The European Industrial sensor industry is growing owing to the increasing demand from automobile manufacturers to switch out traditional position-sensing methods like optical systems and potentiometers with non-contact 3D magnetic sensors. This change boosts accuracy and dependability in position detection.

Manufacturers use 3D magnetic sensing to optimize form factors across the vehicle, including position sensors for the moving parts of the gearbox, pedals, and gear shifters. For example, 3D gesture sensing is being developed by STMicroelectronics, enhance driver concentration and remove the need for manual control of features like infotainment and lighting in cars. Therefore, the increased use of cutting-edge technology is a trend that is helping the Industrial sensors market grow.

The Europe industrial sensors market for technologically advanced automotive sensors is expected to grow, especially regarding autonomous vehicles. The major driving factor for the Industrial Sensors industry is the increasing demand for real-time data analysis and proactive maintenance, which would enable manufacturers to obtain better visibility of the manufacturing plant and, therefore, enhance efficiency.

The possible applications for several sensor types are also fuelled by several government regulations and initiatives to promote the use of electric vehicles. For instance, in June 2022, the European Parliament voted to support the 2035 sales ban on diesel and gasoline vehicles. Battery electric vehicle share is expected to surpass 70% by 2030 and reach almost 30% of the European market by 2025. Owing to these factors, pressure, temperature, inertia, and other sensors are likely be required in the automotive industry.

Several European countries like Germany and Sweden are raising their automotive safety regulations. Europe is projected to experience the highest growth rate in the pressure sensor market for automotive brake applications during the forecasted period.

Europe Industrial Sensors Market Regional Insight:

Germany held the largest share in 2024 of the Europe Industrial Sensors Market. The Industrial Sensors market in Germany is being influenced by the increase in automation and IoT technologies in manufacturing, the demand for real-time data monitoring and analysis, and the emphasis on predictive maintenance and process optimization.

Germany Industrial Sensors sectors, including automotive and manufacturing, utilize various sensors to improve efficiency, quality assurance, and overall productivity. The Germany automotive industry heavily utilizes sensors for tasks like collision prevention, adaptive cruise control, and self-driving technology. The need for specific sensors in Germany, such as temperature, pressure, and vibration monitors, has consistently increased. These sensors meet the unique requirements of sectors like pharmaceuticals, chemicals, and energy.

- For Instance, SICK AG, a German sensor manufacturer, has a global footprint and significantly contributes to the country's industrial sensors market. Specializing in factory and logistics automation sensor solutions, SICK's products enhance the precision a nd reliability of industrial processes. The company's emphasis on sustainability and resource efficiency resonates with Germany's commitment to environmental responsibility.

Europe Industrial Sensors Market Competitive Landscape:

- January 2023, Elliptic Labs, a global company specializing in AI software and a top player in AI Virtual Smart Sensors, has introduced its AI Virtual Distance Sensor. The sensor is completely software-based and enables devices to constantly measure the distance between each other, providing relative location detection.

- September 2022 - SMP Europe introduced a new series of NOx sensors. The 25 different numbers represent a wide variety of well-known European car makers. The introduction of these new sensors additionally solidifies SMP Europe's standing as a top player in Engine Management and Emissions components. NOx sensors will provide a valuable enhancement to a range that already offers a variety of top-quality components for replacing commonly failed parts in the aftermarket.

Europe Industrial Sensors Market Scope:

|

Europe Industrial Sensors Market |

|

|

Market Size in 2024 |

USD 9.24 billion. |

|

Market Size in 2032 |

USD 26.17 billion. |

|

CAGR (2025-2032) |

13.89 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Sensor Type

|

|

By End Use Industry

|

|

|

Regional Scope |

Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe. |

Europe Industrial Sensors Market Key Players:

1. ABB Ltd (Zürich, Switzerland)

2. Ams AG (Premstätten, Austria)

3. Bosch Sensortec (Reutlingen, Germany)

4. NXP Semiconductors (Eindhoven, Netherlands)

5. Safran Colibrys SA (Yverdon-les-Bains, Switzerland)

6. Siemens (Munich, Germany)

7. STMicroelectronics (Geneva, Switzerland)

8. TE Connectivity (Schaffhausen, Switzerland)

9. First Sensor (Berlin, Germany)

10. Siemens (Munich, Germany)

11. Roboception (Munich, Germany)

12. Others

For Global Scenario:

Frequently Asked Questions

The Market size was valued at USD 9.24 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 13.89 % from 2025 to 2032, reaching nearly USD 26.17 Billion.

The segments covered are sensor Type, and End Use industry.

1. Europe Industrial Sensors Market: Research Methodology

2. Europe Industrial Sensors Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Europe Industrial Sensors Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Europe Industrial Sensors Market: Dynamics

4.1. OLED Market Trends

4.2. OLED Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Europe Industrial Sensors Market Size and Forecast by Segmentation (Value in USD Million and Volume in Units) (2024-2032)

5.1. Europe Industrial Sensors Market Size and Forecast, By Sensors Type (2024-2032)

5.1.1. Image Sensor

5.1.2. Pressure Sensor

5.1.3. Temperature Sensor

5.1.4. Position Sensor

5.1.5. Force Sensor

5.1.6. Gas Sensor

5.1.7. Others

5.2. Europe Industrial Sensors Market Size and Forecast, By End Use Industry (2023 2030)

5.2.1. Manufacturing

5.2.2. Automotive

5.2.3. Oil & Gas

5.2.4. Chemical

5.2.5. Pharmaceutical

5.2.6. Energy & Power

5.2.7. Mining

5.2.8. Others

5.3. Europe Industrial Sensors Market Size and Forecast, by Country (2024-2032)

5.3.1. UK

5.3.2. France

5.3.3. Germany

5.3.4. Italy

5.3.5. Spain

5.3.6. Sweden

5.3.7. Russia

5.3.8. Rest of Europe

6. Company Profile: Key Players

6.1. ABB Ltd (Zürich, Switzerland)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Ams AG (Premstätten, Austria)

6.3. Bosch Sensortec (Reutlingen, Germany)

6.4. NXP Semiconductors (Eindhoven, Netherlands)

6.5. Safran Colibrys SA (Yverdon-les-Bains, Switzerland)

6.6. Siemens (Munich, Germany)

6.7. STMicroelectronics (Geneva, Switzerland)

6.8. TE Connectivity (Schaffhausen, Switzerland)

6.9. First Sensor (Berlin, Germany)

6.10. Siemens (Munich, Germany)

6.11. Roboception (Munich, Germany)

6.12. Others

7. Key Findings

8. Industry Recommendations