Asia Pacific Oral Care Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

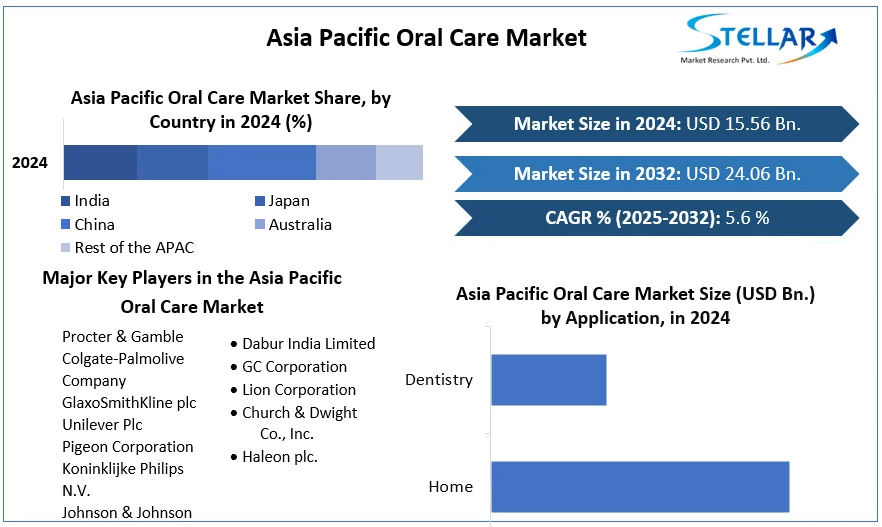

Asia Pacific Oral Care Market size was valued at USD 15.56 Bn. in 2024 and is expected to reach USD 24.06 Bn. by 2032, at a CAGR of 5.6%.

Format : PDF | Report ID : SMR_2289

Asia Pacific Oral Care Market Overview

The Asia Pacific Oral Care market within the Personal Care sector encompasses products used in daily mouth care routines, including toothpaste, mouthwashes, manual toothbrushes, and dental floss. 90% of Indian adults experience dental diseases and cavities. 70% of Indian children face dental issues. Excluded from this category are electric toothbrushes and oral health services. The Asia Pacific Oral Care industry growth is driven by several key factors: increasing consumer awareness and concern about dental health, leading to higher spending on premium oral care products; rising prevalence of oral diseases and dental issues such as tooth decay, gingivitis, and tooth sensitivity, especially among children, which is boosting demand for preventive oral care products, growing disposable incomes and willingness to spend on dental care, particularly for targeted solutions tailored to Asian consumers' needs.

Toothpaste remains the dominant product segment, driven by the fundamental need for dental cleaning; the large and densely populated countries of China and India are major contributors to the region's oral care market growth; long-term growth will be supported by trends like modern parenting, increased access to childcare products, consumer awareness campaigns, and government initiatives to promote children's health, key industry events like the China Dental Show showcase the latest innovations and services across the oral health value chain, further propelling market development.

To get more Insights: Request Free Sample Report

Asia Pacific Oral Care Market Dynamics

Growing Demand for Oral Care Products in Asia-Pacific

The Asia Pacific Oral care Market is experiencing a surge in demand for oral care products due to various factors. One of the primary drivers is the growing prevalence of dental issues, such as tooth decay, breastfeeding caries, and tooth sensitivity. According to research by the World Health Organization (WHO), early childhood caries has a prevalence range of 60 to 90% in the region. Alongside the rise in dental problems, there is an increasing awareness among consumers about the importance of oral hygiene and preventive measures. This heightened awareness has led to a significant increase in expenditure on personal care products, particularly high-end and premium offerings. The dense population of countries like China and India, coupled with rising household incomes, has further boosted consumer demand for oral care products.

Government initiatives to improve children's health and well-being, as well as modern parenting trends, have also contributed to the growing demand for oral care products. Advancements in the development of novel oral care products, such as electric toothbrushes and herbal care solutions, have also played a role in market expansion. The COVID-19 pandemic has had a notable impact on the demand for oral care products in the Asia-Pacific region. As people have become more conscious of personal hygiene, the demand for these products has increased significantly. Manufacturers have responded to this surge in demand by expanding their production capacity to meet the needs of consumers across the region.

Asia Pacific Oral Care Market Segmentation

By Product Type, The Asia Pacific oral care market is segmented into toothpaste, toothbrushes, mouthwash, and dental accessories. Until 2022, the toothpaste segment accounted for the largest market share. However, the mouthwash segment is expected to experience the fastest growth through 2028 due to growing awareness of its convenient and effective attributes, as well as recommendations from dentists.

In the Asia Pacific region, the oral care market is distributed through hypermarkets and supermarkets, convenience stores, retail pharmacies, dental dispensaries, and online channels. Hypermarkets and supermarkets registered the fastest growth until 2022, but the online segment is anticipated to witness high growth during the forecast period due to the booming e-commerce industry in the region. Demand for advanced toothbrush products, such as electric and battery-powered models, is increasing. These products offer additional benefits like total deep cleaning, whitening, tongue cleaning, and massaging, contributing to better oral health for users.

China Drives Advancements in Asia Pacific Oral Care Market Trends

The continuously growing population and rising household income levels have enhanced consumer purchasing power, leading to a steady increase in demand for oral care products in China. The Asia Pacific Oral Care Market for high-end products has grown due to rising concerns about dental health and increased spending on personal care. Awareness about oral hygiene and dentist recommendations have also contributed to market growth. Additionally, the growing prevalence of oral diseases, such as gingivitis, dental plaque, and bleeding gums, has driven demand for various oral care products.

With improving living standards and a greater emphasis on oral care, toothpaste has become a crucial daily necessity. Investments in high-end Chinese medicine toothpaste products offer promising opportunities for research and development. Companies are increasingly focusing on brand awareness through social media platforms like Zhihu, Weibo, Xiaohongshu, and WeChat, which are crucial for Chinese consumers.

The report aims to provide industry stakeholders with a thorough study of the Asia Pacific oral care Market. The research presents the industry& historical and present state with projected market size and trends, analyzing complex data in an easy-to-read manner. The research includes PORTER and PESTLE analyses along with the possible effects of market microeconomic factors. Analyzing both internal and external elements that could have a good or negative impact on the firm will provide decision-makers with a clear picture of the industry& future. By understanding the market segments and projecting the size of the Asia Pacific oral care market, the reports also help understand the market dynamics and structure.

Asia-Pacific Oral Care Market Scope

|

Asia-Pacific Oral Care Market |

|

|

Market Size in 2024 |

USD 15.56 Bn. |

|

Market Size in 2032 |

USD 24.06 Bn. |

|

CAGR (2025-2032) |

5.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Market Segments |

By Product Toothbrush Toothpaste Mouthwash Denture products |

|

By Application Home Dentistry |

|

|

By Distribution Channel Supermarkets and hypermarkets Retail Pharmacies Online Distribution |

|

|

Country Scope |

China, India, Japan, South Korea, Vietnam, Taiwan, Australia, ASEAN, Rest of APAC |

Asia-Pacific Oral Care Market Key Players-

- Procter & Gamble

- Colgate-Palmolive Company

- GlaxoSmithKline plc

- Unilever Plc

- Pigeon Corporation

- Koninklijke Philips N.V.

- Johnson & Johnson

- Dabur India Limited

- GC Corporation

- Lion Corporation

- Church & Dwight Co., Inc.

- Haleon plc.

For Global Scenario:

Frequently Asked Questions

China is expected to dominate the Asia-Pacific Oral Care Market during the forecast period.

The Asia-Pacific Oral Care Market size is expected to reach USD 24.06 Billion by 2032.

The top players in the Asia-Pacific Oral Care Market are Colgate-Palmolive Company, Procter & Gamble, Dabar India, Johnson & Johnson, Inc. Unilever, Church & Dwight Co., Inc. Henkel AG & Co. KG aA

The segments covered in the Asia-Pacific Oral Care Market report are based on Product, Distribution Channel and Application, and region.

1. Asia Pacific Oral Care Market: Research Methodology

2. Asia-Pacific Oral Care Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Oral Care Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Asia Pacific Oral Care Market: Dynamics

4.1. Oral Care Market Trends

4.2. Oral Care Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Asia-Pacific Oral Care Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Asia-Pacific Oral Care Market Size and Forecast, By Component (2024-2032)

5.1.1. Toothbrush

5.1.2. Toothpaste

5.1.3. Mouthwash

5.1.4. Denture Products

5.2. Asia-Pacific Oral Care Market Size and Forecast, By Water Depth (2024-2032)

5.2.1. Home

5.2.2. Dentistry

5.3. Asia Pacific Oral Care Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Supermarkets and hypermarkets

5.3.2. Retail Pharmacies

5.3.3. Online Distribution.

5.4. Asia-Pacific Oral Care Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. ASEAN

5.4.6.1. Indonesia

5.4.6.2. Vietnam

5.4.6.3. Laos

5.4.6.4. Brunei

5.4.6.5. Thailand

5.4.6.6. Myanmar

5.4.6.7. Philippines

5.4.6.8. Cambodia

5.4.6.9. Singapore

5.4.6.10. Malaysia

5.4.7. New Zealand

5.4.8. Taiwan

5.4.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Procter & Gamble

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Colgate-Palmolive Company

6.3. GlaxoSmithKline plc

6.4. Unilever Plc

6.5. Pigeon Corporation

6.6. Koninklijke Philips N.V.

6.7. Johnson & Johnson

6.8. Dabur India Limited

6.9. GC Corporation

6.10. Lion Corporation

6.11. Church & Dwight Co., Inc.

6.12. Haleon plc

7. Key Findings

8. Industry Recommendations