Asia Pacific Lab Grown Diamond Market: Size, Share, Luxury Trends, Growth Opportunities and Forecast (2024-2032)

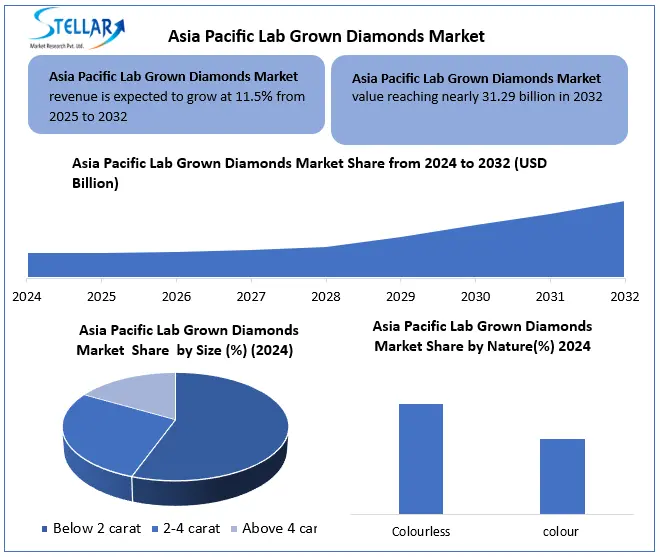

Asia Pacific Lab Grown Diamond Market was valued at USD 13.1 Billion in 2024. Revenue is expected to grow CAGR of 11.5% from 2025 to 2032, reaching nearly USD 31.29 Billion.

Format : PDF | Report ID : SMR_2864

Asia Pacific Lab Grown Diamond Market Overview

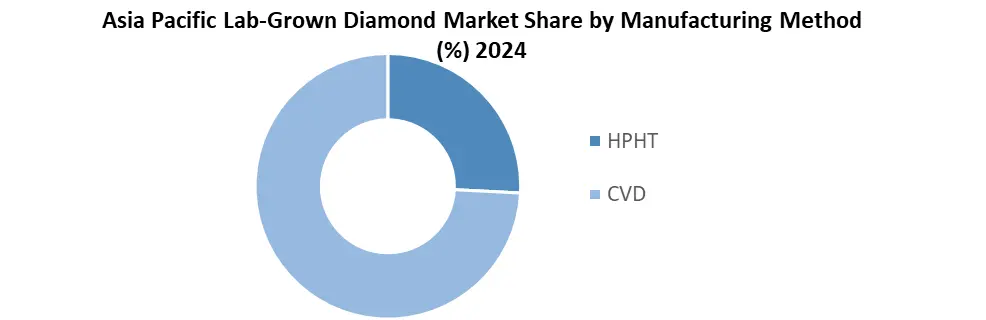

Lab-created diamonds are the same in appearance, chemical structure and physical properties as genuine diamonds. Unlike natural diamonds which take many years to develop, a lab-grown diamond is produced in a few months. Since laboratories produce diamonds, sales of these diamonds in Asia are steadily growing. One way to make grown diamonds involves the use of techniques like high pressure and high temperature (HPHT) and chemical vapor deposition (CVD).

The Asia-Pacific market for lab-grown diamonds is lively, vigorous and represents the various cultures, economic advancements and preferences of the area. In the Asia-Pacific region which stretches over China, India, Japan, South Korea and Australia, traditional techniques are used for jewellery making, while in some places, luxury trends are growing rapidly. The rise of technology for lab-grown diamonds, online shopping and shifting customer habits have helped the CVD method gain ground in Asia pacific, together with continuing business from traditional local stores. Asia-Pacific countries’ rising economic growth and higher disposable earnings have created a bigger middle class with more money to spend. More internet use and popularity of online shopping sites are making diamond jewellery products more reachable to people in Asia pacific which has resulted in more sales.

To get more Insights: Request Free Sample Report

Asia Pacific Lab Grown Diamond Market Dynamics:

Growing as Ethical and Environmental Concerns Continue to Drive Consumer Choices in Lab-Grown Diamonds Market

In Asia pacific there are seems the growth in ethical and environmental concerns People are becoming more conscious of the environmental and ethical issues in mining, so the market for lab grown diamonds is growing. Careful consumers these days prefer lab-grown diamonds because they are more aware of the effects of mining on the environment. Diamonds produced in labs are conflict-free and environmentally friendly which makes them popular as people shift to buying ethical jewellery. Being aware of these issues makes the lab grown diamonds market attractive to more people.

Emerging Role and Advanced Electronics Create Opportunities in Lab-Grown Market.

Lab-Grown Diamonds Market is becoming essential in the worlds of quantum computing and advanced electronics, allowing companies to gain new profits. Because they contain NV centres, these materials are suitable for advanced sensing, secure networks, and quick computing. Laboratories are testing synthetic diamonds for use in computers, heat control systems, and shields against radiation, inspiring progress for defence, the internet, and the auto industries. Leading tech firms and academic institutions are putting money into diamond-based semiconductors, relying on their excellent thermal and electrical isolation capabilities.

Asia Pacific Lab Grown Diamond Market Segment Analysis:

Based on Manufacturing Method Lab-Grown Diamonds Market is segmented into pressure high-temperature (HPHT) and Carbon vapor deposition (CVD) Among them, Carbon vapor deposition (CVD) is expected to dominate the market in 2024.iamond growth is based on a chemical process very different from natural diamond formation. This technique involves a reactor in which hydrogen and hydrocarbon (typically methane) gases flow over one or more diamond substrates. Microwaves are used to activate a plasma, triggering a series of reactions necessary to deposit diamond material on the seeds. Hydrogen, accounting for 90–99% of the gas mixture, suppresses the growth of graphite or non-diamond carbon, which would hinder high-quality diamond formation.

Based on the Nature Method Lab-Grown Diamonds Market is segmented into colour and colourless. Among them, colourless is expected to dominate the market in 2024. Lab-grown, colourless diamonds, including wedding and engagement rings, are quite popular in jewellery. They are also frequently utilized in creating jewellery, including pendants, nose pins, bracelets, and necklaces. These diamonds can also be embedded into belts, watches, tiaras, phone cases, and other accessories.

Based on By Size Lab-Grown Diamonds Market is segmented into below 2 carat,2-4 carat, above 4 carat. Among them, below 2 carats is expected to dominate the market in 2024.Most of the lab grown diamonds that are available in the market for jewellery production and industrial tools production are below 2 carats. 1 to 2 carat diamonds are highly popular for making engagement and wedding rings and are expected to gain popularity in the future.

Based on Application Lab-Grown Diamonds Market is segmented into Fashion and industrial. Among them, fashion is expected to dominate the market in 2024. Most of the bigger and better-quality lab grown diamonds are used for manufacturing different Manufacturing Method of jewellery pieces. Diamonds for industrial use are high in volume but the total cost associated with industrial use diamonds is very less compared to fashion diamonds.

Asia Pacific Lab Grown Diamond Market Regional Insight:

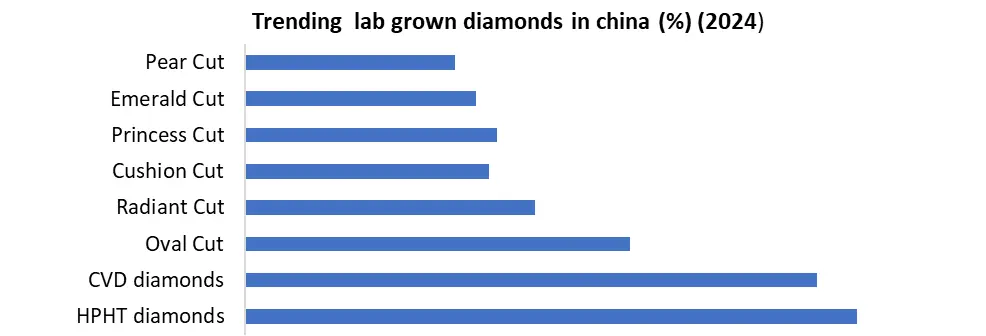

Pioneering Technology and Extensive Infrastructure Create China Dominated Asia Pacific Lab Grown Diamond Market

Decades of research using High-Pressure High-Temperature (HPHT) methods have allowed China to produce oil and gas on a large scale. Chinese firms are capable of producing lab-grown diamonds of high quality since they use advanced technologies, enjoy government aid and have lower running costs. Many huge companies with great production capacity are found in diamond-producing areas such as in Henan province. Having a prosperous home market, high internal consumer interest, and strong export capacity has ensured China’s essential role in world lab-grown diamonds.

Asia Pacific Lab Grown Diamond Market Competitive Landscape:

The lab-grown diamond industry in the Asia Pacific region is lively and very competitive, led mainly by China and India. China is the biggest producer and exporter of diamonds, largely using HPHT technology for both industrial and gemstones. This area is mainly influenced by companies such as Henan Huanghe Whirlwind Co., Ltd. and Zhengzhou Sino-Crystal Diamond Co., Ltd. India is fast growing as a major global center for CVD technology, stands out in diamond cutting and polishing and looks set to expand its share in the market. Mini Diamonds, Limelight Diamonds and Bhanderi Lab Grown Diamonds are increasing how much they sell and produce, assisted by government backing and a large local customer base. To make the best and largest diamonds, CVD companies are always investing in new technological equipment. Many manufacturers are emphasizing lower costs to stay ahead as prices in the market are falling. Here, stable industrial firms, fresh new gem jewelry sellers and more efforts towards sustainability and ethical practices to attract buyers concerned about the environment are all present.

|

Asia Pacific Lab Grown Diamond Market Scope |

|

|

Market Size in 2024 |

USD 23.1 billion. |

|

Market Size in 2030 |

USD 113.37 billion. |

|

CAGR (2024-2030) |

22 % |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Manufacturing Method HPHT CVD |

|

By Nature Colourless Coloured |

|

|

|

By Size Below 2 carats 2-4 carat Above 4 carats |

|

|

By Application Fashion Industrial |

Asia Pacific Lab Grown Diamond Market Key Players:

China:

- Henan Huanghe Whirlwind Co., Ltd.

- Zhongnan Diamond Co., Ltd.

- SF Diamond

- Henan LiLiang Diamond Co., Ltd.

- Henan Huifeng Diamond Co., Ltd.

- Shenzhen ZKZ Jewelry Co., Ltd.

- Jingri Diamond Industrial Co., Ltd.

- CR GEMS Superabrasives Co., Ltd.

India:

- Mini Diamonds

- Limelight Diamonds

- Shree Ramkrishna Exports

- Mittal Diamonds

- Soham Industrial Diamonds

- ABD Diamonds.

- Anjali Diamonds Pvt Ltd.

- Dhanlaxmi Export.

- Ethereal Green Diamond.

- Bhanderi Lab Grown Diamonds

- Pure Lab Diamonds.

- IIa Technologies

- Maitri Lab-grown Diamonds.

- Fiona Diamonds.

- Vandals

- Anantaa Diamonds.

- GIVA.

Japan:

- EDP Corporation

- PRMAL Inc.

- LaBrilliante LLC.

- Apple Green Diamond Inc.

- CarbonLab Co. Ltd.

- Pure Diamond Co., Ltd.

- Mokumeganeya Co., Ltd.

Frequently Asked Questions

The Market size was valued at USD 23.1 billion in 2024, and the total Market revenue is expected to grow at a CAGR of 22 % from 2025 to 2032, reaching nearly USD 113.37 billion.

The segments covered are Manufacturing Method, Nature, Application, and Size

The Key Players in the market of Asia Pacific Lab-Grown Market are Henan Huanghe Whirlwind Co., Ltd., Zhongnan Diamond Co., Ltd., SF Diamond, Henan LiLiang Diamond Co., Ltd.

1. Asia Pacific Lab Grown Diamond Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Asia Pacific Lab Grown Diamond Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Asia Pacific Lab Grown Diamond Market: Dynamics

3.1. Asia Pacific Lab Grown Diamond Market Trends

3.2. Asia Pacific Lab Grown Diamond Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Asia Pacific Lab Grown Diamond Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Asia Pacific Lab Grown Diamond Market Size and Forecast, By Manufacturing Method (2024-2032)

4.1.1. HPHT

4.1.2. CVD

4.2. Asia Pacific Lab Grown Diamond Market Size and Forecast, By Nature (2024-2032)

4.2.1. Colourless

4.2.2. Coloured

4.3. Asia Pacific Lab Grown Diamond Market Size and Forecast, By Size (2024-2032)

4.3.1. Below 2 carat

4.3.2. 2-4 carat

4.3.3. Above 4 carat

4.4. Asia Pacific Lab Grown Diamond Market Size and Forecast, By Application (2024-2032)

4.4.1. Fashion

4.4.2. Industrial

4.5. Asia Pacific Lab Grown Diamond Market Size and Forecast, By Country (2024-2032)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. Company Profile: Key Players

5.1. Henan Huanghe Whirlwind Co., Ltd.

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Zhongnan Diamond Co., Ltd.

5.3. SF Diamond

5.4. Henan LiLiang Diamond Co., Ltd.

5.5. Henan Huifeng Diamond Co., Ltd.

5.6. Shenzhen ZKZ Jewelry Co., Ltd.

5.7. Jingri Diamond Industrial Co., Ltd.

5.8. CR GEMS Superabrasives Co., Ltd.

5.9. Mini Diamonds

5.10. Limelight Diamonds

5.11. Shree Ramkrishna Exports

5.12. Mittal Diamonds

5.13. Soham Industrial Diamonds

5.14. ABD Diamonds.

5.15. Anjali Diamonds Pvt Ltd.

5.16. Dhanlaxmi Export.

5.17. Ethereal Green Diamond.

5.18. Bhanderi Lab Grown Diamonds

5.19. Pure Lab Diamonds.

5.20. IIa Technologies

5.21. Maitri Lab-grown Diamonds.

5.22. Fiona Diamonds.

5.23. Vandals

5.24. Anantaa Diamonds.

5.25. GIVA.

5.26. EDP Corporation

5.27. PRMAL Inc.

5.28. LaBrilliante LLC.

5.29. Apple Green Diamond Inc.

5.30. CarbonLab Co. Ltd.

5.31. Pure Diamond Co., Ltd.

5.32. Mokumeganeya Co., Ltd.

6. Key Findings

7. Industry Recommendations