Asia Pacific Nail Salon Market: Industry Analysis and Forecast (2024-2032)

Asia Pacific Nail Salon Market size was valued at USD 2749.4 million in 2024 and the market is expected to grow at a CAGR of 9.3% from 2025 to 2032, reaching nearly USD 5600.14 Million by 2032.

Format : PDF | Report ID : SMR_2885

Asia Pacific Nail Salon Market Overview:

A nail salon is a beauty shop where professionals offer services to take care and decorating of nails. Nail Salon includes cleaning, shaping, painting and design or adding artificial nails.

In 2024, Asia Pacific Nail Salon Market is fueling with growing social media effects and fashion trends, especially among children of 19–40-year-olds, furthering the demand for creative nail art. In India, Indonesia and Philippines, Tier 2 and 3 cities are also strong, where India alone saw 45% as an increase in beauty market from these areas, below 20% despite the branded salon appearance.

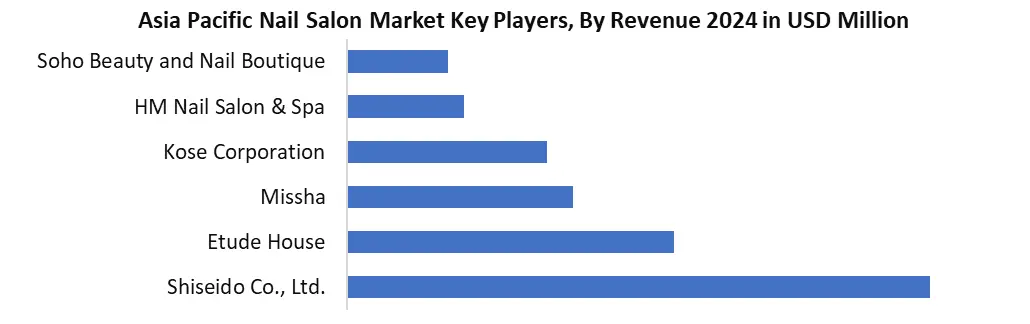

China leads the Market with 25% increase in monthly salon visits, which is operated by digital booking and a consumer base, where women form 70%. Etude House has placed 11.2% of South Korean youth nail polish sales and increased 22% y-o-y in Southeast Asia, while Shiseido with Japan's premium segment 8.6%, with 17%increase in salon product sales in Japan and China. in the Asia Pacific Nail Salon Market Key players are Etude House (South Korea), Shiseido Co., Limited (Japan).

To get more Insights: Request Free Sample Report

Asia Pacific Nail Salon Market Dynamics:

Influence of Social Media & Fashion Trends to Drive Market Growth

In 2024, Asia Pacific Nail Salon Market is greatly influenced by the growing influence of social media and developing fashion trends. Platforms such as Instagram have become important in popularizing complex nail art design and styles, which has increased consumer interest in nail salon services. This boom is particularly clear between groups in the age group of 19 to 40, which are more inclined to experiment with innovative nail designs and colors align with dynamic fashion trends performed online. Coming in contact with diverse nail art through social media has not only increased consumer awareness, but has also operated a salon to offer a wide array of services to meet the increasing demand for personal and trendy nail aesthetics.

Proliferation of Unlicensed Nail Salons Serves to Restrain the Asia Pacific Nail Salon Market

Due to the presence of unlicensed and irregular nail salon, especially in countries such as Vietnam which has become known for unlicensed nail salons, by December 2023 Vietnam had a total of 11,752 establishments providing beauty services, only 598 of which had been licensed for operation even in Ho Chi Minh City, with 7,087 establishments providing beauty services, it was only 598 who were licensed, meaning about 91.6% of establishments are working unlicensed. The existence of this many unlicensed salons can take away from consumer trust and creates health risks pertaining to not complying with hygiene and safety standards. This goes beyond consumer confidence, it offers an uneven sports ground for licensed salons who do play by the rules.

Expansion into Tier 2 & Tier 3 Cities Creates a Growth Opportunity

Asia Pacific Nail Salon sees strong growth ability through expansion in market Tier 2 and Tier 3 cities, especially in emerging economies such as India, Indonesia and the Philippines. With increasing urbanization and increasing disposable income in these areas, the demand for organized beauty services including nail salons is accelerating. In India alone, Tier 2 and 3 cities contributed more than 45% of the total beauty and individual care market growth in 2024. Nevertheless, the penetration of branded or professional nail salon in these areas is below 20%, indicating a huge unused market. In association with relatively low competition, changing lifestyle patterns and growing awareness, salon offers an important opportunity for chains and entrepreneurs to operate beyond the metropolitan hub.

Asia Pacific Nail Salon Market Segment Analysis:

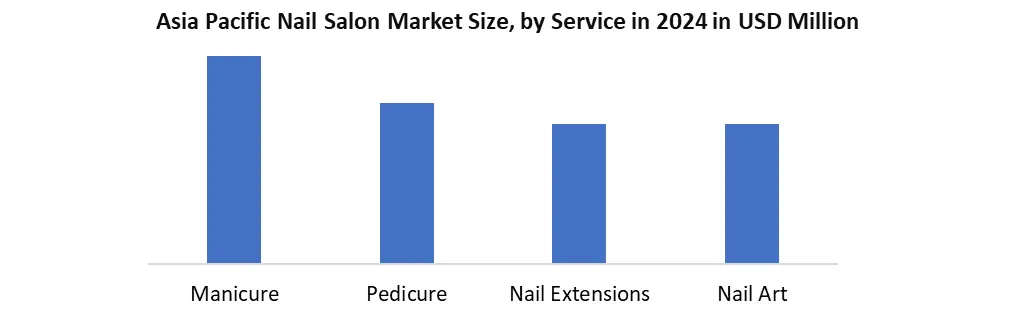

Based on Service Segment, the market is segmented into Manicure, Pedicure, Nail Extensions, Nail Art. Manicure Dominates the Asia Pacific Nail Salon market in 2024 and is expected to hold the largest market share over the forecast period.

Manicure services continue to dominate in the Asia Pacific Nail Salon Market, accounting for high market share. Manicure services can be viewed as number one due to popularity, service considered as a grooming essential for consumers and nail maintenance for health and cosmetic reasons, and that appeals to consumers. Manicure services are also fairly easy and accessible for all consumers based on strength, time, and expectations. Due to social media and current trends in fashion, consumer expectations for their aesthetics of their nails puts pressure on the demand and service point ability of the manicure as a service.

Based on Location Type Segment, the market is segmented into Standalone Salons, Salon Chains, Spa and Wellness Centres. Standalone Salons Dominates the Asia Pacific Nail Salon market in 2024 and is expected to hold the largest market share over the forecast period.

The standalone salon is major segments in the most area. These are small -to -moderately -owned salon branded chains and integrated spa centres. They typically make 60–70% of the total outlets in countries such as India, Indonesia and Thailand, where beauty services are highly localized and cost-sensitive. This gives them an advantage in terms of broader access, low setup costs and deepest access to neighbourhood customers. This dominance by volume and geographical coverage makes the Standalone Salon the biggest location type segment in the Asia Pacific market.

Asia Pacific Nail Salon Market Regional Insight:

China Dominates the Asia Pacific Nail Salon Market in 2024 and is expected to hold the Largest Share during the Forecast Period

In 2024, China is responsible for the biggest stake due to its rapid urbanization, strong digital infrastructure and increasing demand for individual grooming services. A major driver of this growth is the growing popularity of online salon booking platforms, causing an increase in monthly nail salon trips in top level cities by 25%. Also, the expanded female workforce and rising disposable income have contributed significantly, in which women have represented about 70% of the total consumer base for nail services. Increasing preference for advanced treatments such as gel overlay and nail extensions has also deployed China as the fastest growing market in terms of service and consumer refinement, which strengthens its leadership in the region.

Asia Pacific Nail Salon Market Competitive Landscape:

Etude House (South Korea) and Shiseido Co., Ltd. (Japan) Asia Pacific Nail Salon has two major players in the market, each targeting different consumer segments. Etude House, known for its trendy and inexpensive nail products, was about 11.2% of the sale of nail polish among children aged 18–30 in South Korea in 2024. Its "Play Nail" series, offering more than 150 vibrant colours, has obtained significant traction in Southeast Asia, growing with a sale of 22% year-year.

In contrast, Shiseido captured the premium segment in 2024 with brands such as Commanding, high market share in Japan's professional nail care category. An allocation of more than 25% of your cosmetic innovation budget, supported by a strong R&D Foundation, invades long-term home formation and salon-grad performance. The company saw a 17% increase in sales of regional salon products from 2023 to 2024, inspired by its strong presence in the salon in Japan and China.

Asia Pacific Nail Salon Market Key Development

- In June 2023- Essie (L'Oréal Group) launched its ‘love by Essie’ Vegan Nail Polish line in India and Southeast Asia. The range includes 17 plant-based shade in environmentally friendly packaging and targets the growing demand for permanent beauty products among urban millennium consumers. The launch has also been linked to the field with wide ESG goals of L'Oréal.

- In May 2024- Sally Hansen (Cotty) released a limited-edition colour therapy collection in Australia and Japan in collaboration with Love Shack Fancy. Pastel shades and floral packaging characteristic, the purpose of the collection is to promote retail visibility and attract young consumers through cross-brand appeal and seasonal product placement during spring/summer campaigns.

- In August 2024- Orly (distributed by Sprint Asia) launched its "breathable treatment + colour" and "Gelfx builder in a bottle" in products in a bottle. The dual launch targeted both the DIY Nail Care Segment and Professional Salon, including nationwide roadshow and retail promotion brand Reach and Salon.

- In Nov 2024- Orley rolled its GELFX builder more widely in a bottle system in Southeast Asia. Soak-off sculpting gel allowed rapid application for nail extensions and supported Orley strategy to strengthen its professional user base, with salon training programs.

- In March 2025- Orly introduced her spring 2025 nail collection in Asia Pacific, including trendy finish such as Confetti Shimmer and rubberized base coat. This launch was designed to change the consumer taste for expressive nail art and helped the brand to maintain seasonal speed in styling markets such as Japan and South Korea.

Asia Pacific Nail Salon Market Scope:

|

Asia Pacific Nail Salon Market Scope |

|

|

Market Size in 2024 |

USD 2749.4 million. |

|

Market Size in 2032 |

USD 5600.14million. |

|

CAGR (2025-2032) |

9.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments

|

By Age Group

|

|

By Service

|

|

|

By End User

|

|

|

By Location Type

|

|

|

Regional Scope

|

Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN (Indonesia, Vietnam, Laos, Brunei, Thailand, Myanmar, Philippines, Cambodia, Singapore, Malaysia) Rest of APAC |

Asia Pacific Nail Salon Market Key Players:

Japan

- Shiseido Co., Ltd. (Japan)

- Canmake (Japan)

- Majolica Majorca (Japan)

South Korea

- Etude House (South Korea)

- Tony Moly (South Korea)

- Missha (South Korea)

- Innisfree (South Korea)

- Nature Republic (South Korea)

- Dashing Diva (South Korea)

- Bandi (South Korea)

China

- Venalisa (China)

- Clou Beaute (China)

India

- House of Makeup (India)

- Faces Canada (India)

- Bharat & Dorris (India)

Australia

- Bio Sculpture Gel (Australia)

Frequently Asked Questions

Nail art is now a core service, with demand rising over 30% year-on-year, transforming salons from basic grooming spaces to style destinations.

Absolutely—Tier 2 and Tier 3 cities in India and Indonesia contributed 45%+ of beauty market growth in 2023, yet still have <20% organized salon penetration small cities are growing rapidly.

Digital bookings surged visits by 25% in cities like Shanghai and Seoul, making app-based appointments and AI-based nail style previews a growing norm are shaping the nail salon experience in Asia pacific.

1. Asia Pacific Nail Salon Market: Research Methodology

2. Asia Pacific Nail Salon Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Nail Salon Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2023)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Nail Salon Import Export Analysis

3.6. Mergers and Acquisitions Details

4. Asia Pacific Nail Salon Market: Dynamics

4.1. Wire and Cables Market Trends

4.2. Wire and Cables Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Nail Salon Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

5.1. Asia Pacific Nail Salon Market Size and Forecast, By Age Group (2023-2030)

5.1.1. Below 18 Year

5.1.2. 19 to 26 Year

5.1.3. 27 to 40 Year

5.1.4. Above 40 years

5.2. Asia Pacific Nail Salon Market Size and Forecast, By Service (2023-2030)

5.2.1. Manicure

5.2.2. Pedicure

5.2.3. Nail Extensions

5.2.4. Nail Art

5.3. Asia Pacific Nail Salon Market Size and Forecast, By End-user (2023-2030)

5.3.1. Women

5.3.2. Men

5.4. Asia Pacific Nail Salon Market Size and Forecast, By Location Type (2023-2030)

5.4.1. Standalone Salons

5.4.2. Salon Chains

5.4.3. Spa and Wellness Centres

5.5. Asia Pacific Asia Pacific Nail Salon Market Size and Forecast, by Country (2023-2030)

5.5.1. China

5.5.2. S Korea

5.5.3. Japan

5.5.4. India

5.5.5. Australia

5.5.6. ASEAN

5.5.6.1. Indonesia

5.5.6.2. Vietnam

5.5.6.3. Laos

5.5.6.4. Brunei

5.5.6.5. Thailand

5.5.6.6. Myanmar

5.5.6.7. Philippines

5.5.6.8. Cambodia

5.5.6.9. Singapore

5.5.6.10. Malaysia.

5.5.7. New Zealand

5.5.8. Taiwan

5.5.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Shiseido Co., Ltd. (Japan)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Canmake (Japan)

6.3. Majolica Majorca (Japan)

6.4. Etude House (South Korea)

6.5. Tony Moly (South Korea)

6.6. Missha (South Korea)

6.7. Innisfree (South Korea)

6.8. Nature Republic (South Korea)

6.9. Dashing Diva (South Korea)

6.10. Bandi (South Korea)

6.11. Venalisa (China)

6.12. Clou Beaute (China)

6.13. House of Makeup (India)

6.14. Faces Canada (India)

6.15. Bharat & Dorris (India)

6.16. Bio Sculpture Gel (Australia)

7. Key Findings

8. Analyst Recommendations