Asia Pacific OLED Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

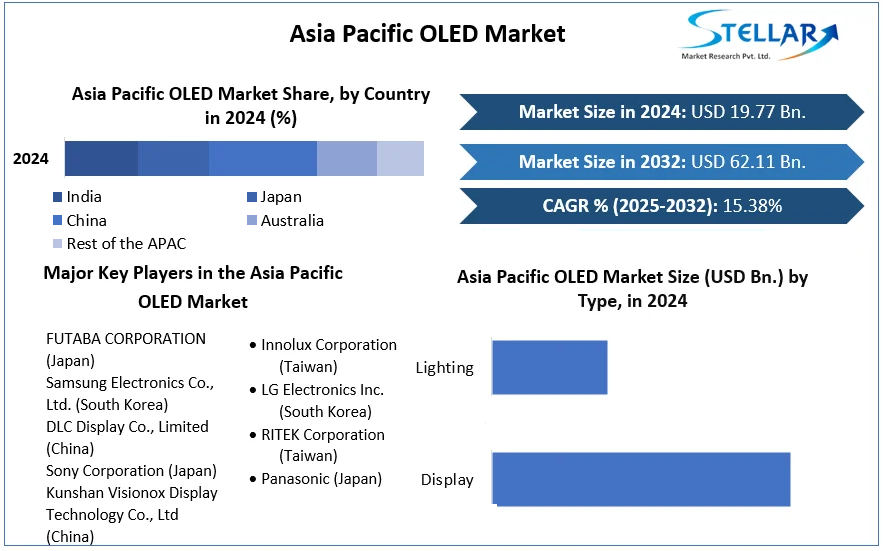

Asia Pacific OLED Market size was valued at USD 19.77 Bn. in 2024 and the total Asia Pacific OLED Market size is expected to grow at a CAGR of 15.38% from 2025 to 2032, reaching nearly USD 62.11 Bn. by 2032.

Format : PDF | Report ID : SMR_2302

Asia Pacific OLED Market Overview:

OLED stands for Organic Light-Emitting Diode, a technology that uses LEDs in which the light is produced by organic molecules. A variety of OLEDs are now available on the market, focusing on both passive and active-matrix technologies, and are being used in multiple industries. The Asia Pacific OLED market is significantly driven by rapid technological advancements and innovation in OLED technology.

There is a significant amount of flexible OLED panels being used at the moment. Rollable and stretchable displays are expected to be the next advancement major in display technology. They are currently being developed and are predicted to enable innovations such as foldable devices. The next generation of OLED displays is expected to focus on foldable panels, creating new shapes for mobile devices. Currently, companies are developing advanced deposition techniques to improve manufacturing efficiency. An example is ink-jet printing, where soluble OLED inks are deposited by big printers.

Chinese companies like Huawei, Honor, Oppo, Vivo, Xiaomi, Transsion, ZTE, and Lenovo MOTO are rapidly advancing in the production of innovative and improved foldable smartphones. The development greatly benefits Chinese flexible OLED manufacturers by enhancing their position in the Asia Pacific OLED market. South Korea provides tax breaks, national initiatives like K-Display 2030, and subsidies to maintain its leadership in the display industry. The Chinese government is heavily investing in OLED technology, supporting private and state-owned businesses through initiatives such as Made in China 2025. Both countries offer grants, subsidies, and tax incentives to promote OLED research and manufacturing.

To get more Insights: Request Free Sample Report

Asia Pacific OLED Market Dynamics:

Rising Demand, Innovation, and Regulations Propel Asia Pacific OLED Market Growth and Competition

A combination of growing consumer demand, industry investments, and technical developments has resulted in a significant increase in the OLED market. Businesses in the sector are focusing on innovation to meet the diverse needs of their customers. And, also increasing OLED market offers and fostering competition. The efficiency and functionality of products are being greatly enhanced by the incorporation of cutting-edge technology like artificial intelligence and the Internet of Things. Consequently, there has been a notable increase in the introduction of new products and improved features in the Asia Pacific OLED market, which is helping to propel the OLED industry's growth.

- Samsung Electronics has taken the top position in the global OLED monitor market by capturing 34.7% of market share based on total revenue and the top position in market share based on sales volume with 28.3% of OLED monitors sold in 2023.

June 4, 2024, Samsung Electronics announced the global launch of its 2024 Odyssey OLED gaming monitor, Smart Monitor and ViewFinity monitor lineups.

Another important aspect affecting the OLED market is the evolving regulatory environment. Governments and regulatory agencies around the globe are introducing fresh policies and regulations to guarantee the safety and conformity of products. These rules aim to safeguard customers and uphold standards within the industry. Firms manage these intricate regulatory demands, often requiring major investments in compliance and certification procedures.

For Instance, the significant investment in OLED technology by the Chinese government, involving both state-owned enterprises and private companies. Significant funds have been set aside for the construction of OLED manufacturing facilities and research and development hubs.

Smart TVs Leverage OLED Technology for Enhanced Lighting and Advanced Internet Capabilities

OLED technology is employed in modern smart TVs to produce effective and impressive lighting panels. A smart TV is a television that is digital and linked to the internet. Essentially, it is a regular TV with internet capabilities and incorporated interactive Web 2.0 features. It is used by users to listen to music, watch videos, browse the internet, and view images. Smart TVs provide access to internet TV, OTT content, on-demand streaming, online interactive media, and other features, in addition to standard TV functions.

South Korea Faces Challenges from China's Growing Display Panel Industry Amidst High OLED Production Costs and Supply Chain Vulnerabilities

South Korea is currently facing significant challenges from China's rapidly increasing display panel industry, despite still being the leader in the OLED panel manufacturing sector. It has produced strong reactions in the country's technology sector. OLED technology requires costly raw materials and intricate manufacturing procedures. Additionally, OLED is in fierce competition with LCD and the up-and-coming MicroLED, which present cost, brightness, and durability advantages. The OLED sector is highly dependent on a small number of key suppliers for essential parts, which exposes it to potential supply chain interruptions.

Asia Pacific OLED Market Segment Analysis:

Based on Type, the Display segment dominated the market and is expected to maintain its dominance through the forecast period (2025 - 2032) with an increasing CAGR of XX%. High demand for OLED displays for smartphones, wearables, laptops, and televisions is likely to drive the Asia Pacific OLED market rapid growth. Almost all OLED displays on the market are produced using an evaporation-based process.

The flexibility of OLED technology, allowing for curved or folded displays, enables innovative device designs that are particularly appealing to consumers. Fast response times are also crucial, especially for AR/VR Technologies and gaming, additional driving adoption in consumer electronics. OLED technology is employed in modern smart TVs to produce effective and impressive lighting panels. Smart TVs offer internet capabilities and interactive features, enhancing the viewing experience.

- World exports most of its OLED Displays to Vietnam, South Korea, and India

|

Top 3 OLED Display Exporter |

|

Country Shipments |

|

Vietnam 40,999 |

|

South Korea 14,428 |

|

China 13,511 |

|

Top 3 OLED Display Importer |

|

Country Shipments |

|

Vietnam 30,646 |

|

South Korea 26,316 |

|

India 12,444 |

Asia Pacific OLED Market Regional Insight:

South Korea has dominated the Asia Pacific OLED Market, which held the largest market share accounting for XX% in 2024. The strong presence of South Korea in the Asia-Pacific OLED market is supported by top companies Samsung Display and LG Display, as well as strong government backing. The automotive industry is emerging as a key growth driver for the OLED market, with technology in heads-up displays (HUDs) and smart mirrors.

In 2024, 35% of new vehicles are estimated to feature some form of HUD, up from 19% in 2020. The consumer electronics sector also continues to fuel demand, with smartwatch shipments forecast to reach 305 million units by 2025, many of which utilize OLED microdisplays.

Samsung Display covering of the market leader in foldable display technology is driving development and maintaining high production yield rates. Since 2024, Chinese OLED makers have been progressively increasing their shipment shares. Chinese flexible Gen6 Fab such as BOE’s B11, ChinaStar’s T4, Visionox’s V2, and V3 are ramping up production of foldable displays, benefiting from improved yield rates and a growing customer base.

The innovations have led to successful designs in new foldable models from Chinese smartphone brands and OEMs like Huawei, Honor, Lenovo MOTO, Oppo, Vivo, Xiaomi, Transsion, and ZTE, while Samsung Galaxy Fold is mainly incorporating the latest foldable technologies from Samsung Display. As Chinese brands and OEMs increase their foldable smartphone device shipments, shipments from Chinese OLED makers are also on the rise.

In the small-sized OLED market for smartwatches, Chinese manufacturers are expected to have captured 64% of the market in the first half of 2024, far outpacing the combined 25% share held by LGD and SDC. Chinese companies have begun to make inroads into the large-sized OLED market, traditionally dominated by South Korean firms. In 2023, South Korea's market share in this segment fell from 100% to 96%, with Chinese manufacturers claiming the remaining 4% in the first quarter of 2024.

Asia Pacific OLED Market Competitive Landscape:

The OLED industry in the Asia-Pacific region encounters strong competition, as leading companies from South Korea, China, Japan, and Taiwan are making notable impacts. The OLED market advancements are being driven by constant innovation, substantial financial investments, and government support. It is expected that the future of the OLED industry in the region will be greatly influenced by new technologies and different sizes and shapes of devices.

One of the major companies in the OLED market is Samsung Display, which is well-known for its skill in producing small- to medium-sized OLED screens for smartphones. Owing to Samsung's leadership in flexible OLED technology, foldable smartphones like the Galaxy Fold and Galaxy Z Flip have been made possible. To enhance display quality, the company is now investigating the Technology of Quantum Dot OLED (QD-OLED) technology.

- In June 2024, Samsung Electronics announced the global launch of its 2024 Odyssey OLED gaming monitor, Smart Monitor, and ViewFinity monitor lineups, reinforcing its dominance in the high-end display market.

LG Display leads in manufacturing big OLED panels, especially for TVs. LG has introduced several innovations, like rollable OLED TVs and transparent OLED displays. The efficiency and brightness of the OLED panels from the company are still being enhanced. LG is increasing its manufacturing capabilities and prioritizing new OLED technologies like OLED.EX, which offers improved efficiency and durability.

BOE Technology is quickly becoming an important competitor in the OLED market, especially in the smartphone sector. BOE is making significant investments in flexible and foldable OLED technologies. The company is currently focused on enhancing the resolution and energy efficiency of its displays. BOE has been increasing its production capabilities and forming collaborations with leading smartphone makers such as Huawei and Apple.

Asia Pacific OLED Market Scope:

|

Asia Pacific OLED Market |

|

|

Market Size in 2024 |

USD 19.77 billion. |

|

Market Size in 2032 |

USD 62.11 billion. |

|

CAGR (2025-2032) |

15.38 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type

|

|

By Technology

|

|

|

By End Use

|

|

|

Regional Scope |

Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN (Indonesia , Vietnam, Laos, Brunei, Thailand, Myanmar, Philippines, Cambodia, Singapore, Malaysia), Rest of APAC |

Asia Pacific OLED Market Key players:

- FUTABA CORPORATION (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- DLC Display Co., Limited (China)

- Sony Corporation (Japan)

- Kunshan Visionox Display Technology Co., Ltd (China)

- SEIKO EPSON CORPORATION (Japan)

- Innolux Corporation (Taiwan)

- LG Electronics Inc. (South Korea)

- RITEK Corporation (Taiwan)

- Panasonic (Japan)

- Others

For Global Scenario:

Frequently Asked Questions

The Market size was valued at USD 19.77 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 15.38 % from 2025 to 2032, reaching nearly USD 62.11 Billion.

The segments covered are Type, Technology, and End Use.

1. Asia Pacific OLED Market: Research Methodology

2. Asia Pacific OLED Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific OLED Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Asia Pacific OLED Market: Dynamics

4.1. OLED Market Trends

4.2. OLED Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Asia Pacific OLED Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Asia Pacific OLED Market Size and Forecast, By Type (2024-2032)

5.1.1. Display

5.1.2. Lighting

5.2. Asia Pacific OLED Market Size and Forecast, By Technology (2024-2032)

5.2.1. Passive-Matrix OLED (PMOLED)

5.2.2. Active-Matrix OLED (AMOLED)

5.2.3. Transparent OLED

5.2.4. Top-Emitting OLED

5.2.5. Foldable OLED

5.2.6. White OLED

5.3. Asia Pacific OLED Market Size and Forecast, By End User (2024-2032)

5.3.1. Consumer Electronics

5.3.2. Automotive

5.3.3. Retail

5.3.4. Aerospace & Defense

5.3.5. Healthcare

5.3.6. Others

5.4. Asia Pacific Asia Pacific Managed Security Service Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. ASEAN

5.4.6.1. Indonesia

5.4.6.2. Vietnam

5.4.6.3. Laos

5.4.6.4. Brunei

5.4.6.5. Thailand

5.4.6.6. Myanmar

5.4.6.7. Philippines

5.4.6.8. Cambodia

5.4.6.9. Singapore

5.4.6.10. Malaysia

5.4.7. New Zealand

5.4.8. Taiwan

5.4.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. FUTABA CORPORATION (Japan)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Samsung Electronics Co., Ltd. (South Korea)

6.3. DLC Display Co., Limited (China)

6.4. Sony Corporation (Japan)

6.5. Kunshan Visionox Display Technology Co., Ltd (China)

6.6. SEIKO EPSON CORPORATION (Japan)

6.7. Innolux Corporation (Taiwan)

6.8. LG Electronics Inc. (South Korea)

6.9. RITEK Corporation (Taiwan)

6.10. Panasonic (Japan)

7. Key Findings

8. Industry Recommendations