Wide-body Aircraft MRO Market-Global Industry Analysis and Forecast (2026-2032)

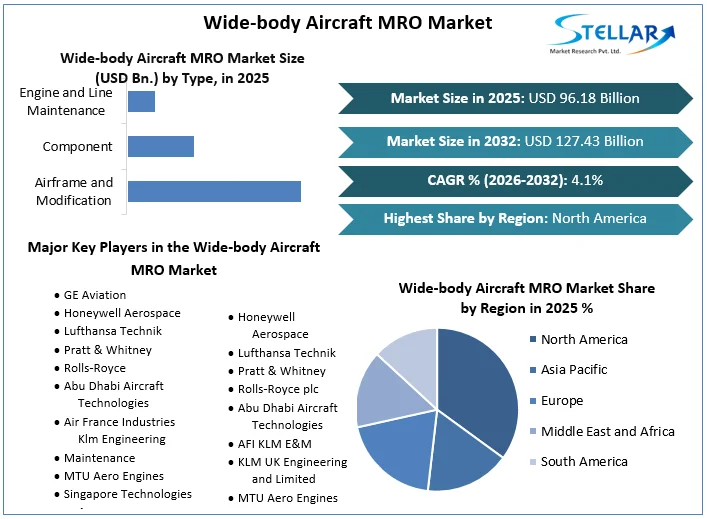

Wide-body Aircraft MRO Market size was valued at USD 96.18 Bn. in 2025 and the Wide-body Aircraft MRO revenue is expected to grow at a CAGR of 4.10% from 2026 to 2032, reaching nearly USD 127.43 Bn. by 2032.

Format : PDF | Report ID : SMR_2033

Wide-body Aircraft MRO Market Overview:

The Wide-body Aircraft MRO market provides market size, share, scope, growth, and potential of the industry. It offers valuable in application to help businesses identify opportunities and potential risks within the market. Also the global Wide-body Aircraft MRO market research reports provide detailed analysis of market conditions, trends, challenges, and recommendations for stakeholders in the industry.

Wide Body aircraft generally involve two or four engines and are also called as twin-aisle aircraft. Wide Body jet engines have experienced an incredible transformation over the past several years with the development of turbofan engines and application of strategies that encourage fuel economy. The typical fuselage diameter is of 5 to 6 m that is 16 to 20 ft. In the typical Wide Body economy cabin, the passengers are settled seven to ten abreast, tolerating a total capacity of 200 to 850 passengers.

The largest Wide Body aircraft are over 6 m that is 20 ft. wide and adjust up to eleven passengers abreast in high-density configurations. Major factors that are expected to boost the increase of the huge body plane market within the forecast length are the rapid urbanization. In addition, the worldwide trade between the international locations and the recognition of IoT clever sensors and records analytics for advanced effectiveness and much less downtime is similarly predicted to propel the increase of the huge body plane marketplace.

To get more Insights: Request Free Sample Report

Wide-body Aircraft MRO Market Dynamics:

Adapting to Changing Market Forces and Technological Innovations Driving Global Wide-body Aircraft MRO Market Growth

Demand for aftermarket services and capacity growth are being driven by rising air travel demand and decreasing fuel prices. The fleet renewal process is being delayed by the low price of gasoline, which is prolonging the requirement to maintain ageing. The loosening of regulations on foreign ownership for airlines and their affiliates is pushing airlines to contract out "captive" maintenance tasks. Continuous Innovation in MRO operations is fueled by ongoing investments in research and development, with an emphasis on better repair methods, predictive maintenance, and the integration of digital technologies like artificial intelligence and data analytics. Collaborations with OEMs, airlines, and other MRO companies facilitate knowledge sharing, increase service options, and strengthen a company's worldwide footprint.

Challenges Facing the Wide-body Aircraft MRO Market

Technology factors impacting maintenance needs

Challenging elements influencing the wide-body plane MRO region encompass technical know-how, reliability, turnaround time, cost-effectiveness, geographical reach, and consumer pride. Businesses excelling in supplying, fee-effective, and timely MRO offerings whilst minimizing plane downtime tend to have an aggressive gain. As new aircraft are introduced, improvements to on-wing time are delivering longer maintenance windows, reducing overall maintenance needs. The shift to advanced materials, namely composites, mean new strategies, techniques and schedules are needed compared to the more mature metallic MRO processes.

Wide-body Aircraft MRO Market Segment Analysis:

By Type, the huge-body plane MRO marketplace section is multifaceted, comprising numerous forms of protection, repair, and overhaul (MRO) offerings tailored to satisfy the diverse needs of operators. Those services generally encompass line renovation, heavy upkeep, engine maintenance, issue repair, and modification services. Line maintenance entails ordinary assessments and minor upkeep conducted frequently to make sure the continuing airworthiness of aircraft between flights. Heavy renovation, however, encompasses greater large inspections, overhauls, and repairs conducted at designated upkeep centers to address structural and gadget-associated problems.

Wide-body Aircraft MRO Market Regional Insight:

In North America, mounted MRO hubs and a dense network of small extensive-body aircraft operations pressure steady demand for upkeep offerings, supported through stringent safety requirements. Europe, with its state-of-the-art MRO infrastructure and emphasis on sustainable practices, gives a strong market for small huge-body aircraft maintenance. Within the Asia-Pacific place, burgeoning air journey call for and expanding fleets of small extensive-body plane present beneficial possibilities for MRO carriers, specifically in rising markets. Conversely, areas like the center East and Latin the United States are experiencing increase in small extensive-frame plane operations, fueled through investments in aviation infrastructure and protection tasks.

Wide-body Aircraft MRO Market Competitive Landscape:

- In July 2020, Boeing and GE Aviation announced a partnership to develop and manufacture a new family of wide-body aircraft.

- In August 2020, Airbus and Rolls-Royce announced a strategic partnership to develop and manufacture a new family of wide-body aircraft.

Wide-body Aircraft MRO Market Scope:

|

Wide-body Aircraft MRO Market |

|

|

Market Size in 2025 |

USD 96.18 Bn. |

|

Market Size in 2032 |

USD 127.43 Bn. |

|

CAGR (2026-2032) |

4.10 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Airframe and Modification Component Engine and Line Maintenance |

|

By Service Maintenance Services Engineering Services Technical Training Inventory Management Freight Conversions Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Wide-body Aircraft MRO Market Key Players:

- GE Aviation

- Honeywell Aerospace

- Lufthansa Technik

- Pratt & Whitney

- Rolls-Royce

- Abu Dhabi Aircraft Technologies

- Air France Industries Klm Engineering

- Maintenance

- MTU Aero Engines

- Singapore Technologies Aerospace

- Honeywell Aerospace

- Lufthansa Technik

- Pratt & Whitney

- Rolls-Royce plc

- Abu Dhabi Aircraft Technologies

- AFI KLM E&M

- KLM UK Engineering and Limited

- MTU Aero Engines

- Singapore Technologies Engineering Ltd

- Hong Kong Aircraft Engineering Company Limited

Frequently Asked Questions

Technology factors impacting maintenance needs is the major challenge for Wide-body Aircraft MRO market.

The Market size was valued at USD 96.18 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 4.10 % from 2026 to 2032, reaching nearly USD 127.43 Billion.

The segments covered in the market report are by Size, by type, by Service.

1. Wide-body Aircraft MRO Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Wide-body Aircraft MRO Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Wide-body Aircraft MRO Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Wide-body Aircraft MRO Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Wide-body Aircraft MRO Market Size and Forecast by Segments (by Value USD Million)

5.1. Wide-body Aircraft MRO Market Size and Forecast, By Type (2025-2032)

5.1.1. Airframe and Modification

5.1.2. Component

5.1.3. Engine and Line Maintenance

5.2. Wide-body Aircraft MRO Market Size and Forecast, By Service (2025-2032)

5.2.1. Maintenance Services

5.2.2. Engineering Services

5.2.3. Technical Training

5.2.4. Inventory Management

5.2.5. Freight Conversions

5.2.6. Others

5.3. Wide-body Aircraft MRO Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Wide-body Aircraft MRO Market Size and Forecast (by Value USD Million)

6.1. North America Wide-body Aircraft MRO Market Size and Forecast, By Type (2025-2032)

6.1.1. Airframe and Modification

6.1.2. Component

6.1.3. Engine and Line Maintenance

6.2. North America Wide-body Aircraft MRO Market Size and Forecast, By Service (2025-2032)

6.2.1. Maintenance Services

6.2.2. Engineering Services

6.2.3. Technical Training

6.2.4. Inventory Management

6.2.5. Freight Conversions

6.2.6. Others

6.3. North America Wide-body Aircraft MRO Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Wide-body Aircraft MRO Market Size and Forecast (by Value USD Million)

7.1. Europe Wide-body Aircraft MRO Market Size and Forecast, By Type (2025-2032)

7.2. Europe Wide-body Aircraft MRO Market Size and Forecast, By Service (2025-2032)

7.3. Europe Wide-body Aircraft MRO Market Size and Forecast, by Country (2025-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Wide-body Aircraft MRO Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Wide-body Aircraft MRO Market Size and Forecast, By Type (2025-2032)

8.2. Asia Pacific Wide-body Aircraft MRO Market Size and Forecast, By Service (2025-2032)

8.3. Asia Pacific Wide-body Aircraft MRO Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Wide-body Aircraft MRO Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Wide-body Aircraft MRO Market Size and Forecast, By Type (2025-2032)

9.2. Middle East and Africa Wide-body Aircraft MRO Market Size and Forecast, By Service (2025-2032)

9.3. Middle East and Africa Wide-body Aircraft MRO Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Wide-body Aircraft MRO Market Size and Forecast (by Value USD Million)

10.1. South America Wide-body Aircraft MRO Market Size and Forecast, By Type (2025-2032)

10.2. South America Wide-body Aircraft MRO Market Size and Forecast, By Service (2025-2032)

10.3. South America Wide-body Aircraft MRO Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. GE Aviation

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Honeywell Aerospace

11.3. Lufthansa Technik

11.4. Pratt & Whitney

11.5. Rolls-Royce

11.6. Abu Dhabi Aircraft Technologies

11.7. Air France Industries Klm Engineering

11.8. Maintenance

11.9. MTU Aero Engines

11.10. Singapore Technologies Aerospace

11.11. Honeywell Aerospace

11.12. Lufthansa Technik

11.13. Pratt & Whitney

11.14. Rolls-Royce plc

11.15. Abu Dhabi Aircraft Technologies

11.16. AFI KLM E&M

11.17. KLM UK Engineering and Limited

11.18. MTU Aero Engines

11.19. Singapore Technologies Engineering Ltd

11.20. Hong Kong Aircraft Engineering Company Limited

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook