US Zero Trust Security Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

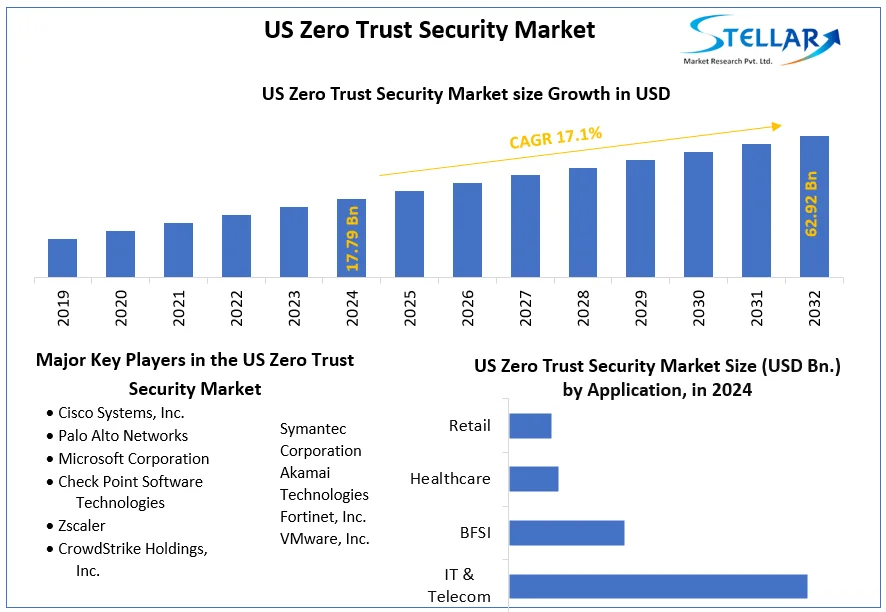

The US Zero Trust Security Market size was valued at USD 17.79 Billion in 2024 and the total US Zero Trust Security revenue is expected to grow at a CAGR of 17.1% from 2025 to 2032, reaching nearly USD 62.92 Billion.

Format : PDF | Report ID : SMR_1610

US Zero Trust Security Market Overview-

Zero Trust is a security framework that mandates continuous authentication and validation of users, whether inside or outside the organization's network. It operates on the assumption of no traditional network edge, accommodating local, cloud, or hybrid environments. Crucial for modern challenges, it secures remote work, and hybrid clouds, and counters ransomware threats, with recognized standards guiding its implementation.

This report analyses the US Zero Trust Security market and covers trends, technological advancements, and potential disruptions that shape the market. It assesses market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is analyzed, highlighting differentiation among key operators and drawing on historical data, industry insights, and the report forecasts sector. The economic downturn prompted this analysis and revealed the US Zero Trust Security industry's resilience challenges. The report aims to equip stakeholders with crucial, concise information for informed decision-making in this dynamic sector. The targeted audiences include People with Healthcare professionals, Secondary Audiences, Government agencies, policymakers, and pharmaceutical companies in the US Zero Trust Security industry.

To get more Insights: Request Free Sample Report

Rising Cybersecurity Awareness Impact on the US Zero Trust Security Market

The US Zero Trust Security Market increasing awareness of cyber threats drives the demand for robust security solutions, highlighting Zero Trust's prominence due to its continuous verification and least privilege access principles. This awareness is expected to drive significant market growth. The US government's Executive Order 14028 mandates the adoption of Zero Trust, establishing a captive market. The US Zero Trust Market aligning with data privacy regulations, simplifies compliance, enhancing security posture by offering improved control and visibility. In the era of hybrid and remote work, Zero Trust's granular access controls actively secure various access points, ensuring safe remote work environments.

Additionally, the US Zero Trust Security Market implementing a Zero Trust architecture poses challenges, demanding substantial resources and process changes. The cybersecurity talent shortage adds hurdles to effective adoption. Integrating with existing infrastructure causes delays and incurs costs. Concerns about vendor lock-in arise due to a lack of standardized solutions. Stricter access controls in Zero Trust incur slight performance impacts, especially in large IT environments, necessitating careful design and configuration.

Rising cybersecurity awareness is to drive substantial growth in the US Zero Trust security market. While positives outweigh negatives, organizations must be cautious, planning their Zero Trust adoption to maximize benefits and address potential challenges effectively.

Impact of Government Initiatives and Policies on the US Zero Trust Security Market

|

Initiative/Policy |

Impact on Market |

|

Federal Zero Trust Strategy (2022) |

- Creates large demand for zero trust solutions in the government sector. - Accelerates market growth and adoption. |

|

NIST Special Publication 800-207 |

- Provides standardization and best practices for zero trust implementation. - Fosters market stability and growth by aligning agencies and vendors. |

|

CISA Grants and Funding Programs |

- Increases accessibility of zero trust solutions for state and local governments. - Broadens the market beyond the federal level and accelerates adoption. |

|

DoD Cybersecurity Investments |

- Spurs innovation and development of advanced zero-trust solutions. - Benefits both government and commercial sectors. |

|

Cloud Smart Initiative |

- Drives demand for cloud-specific zero-trust solutions. - Encourages market differentiation and specialized solutions. |

|

Focus on Supply Chain Security |

- Broadens the market by requiring vendors to adhere to zero trust principles. - Ensures the security of solutions themselves and mitigates supply chain risks. |

|

NICCS Training and Workshops |

- Promotes awareness and education about zero trust security. - Fosters a skilled workforce for effective implementation and management. |

US Zero Trust Security Market Segment Analysis

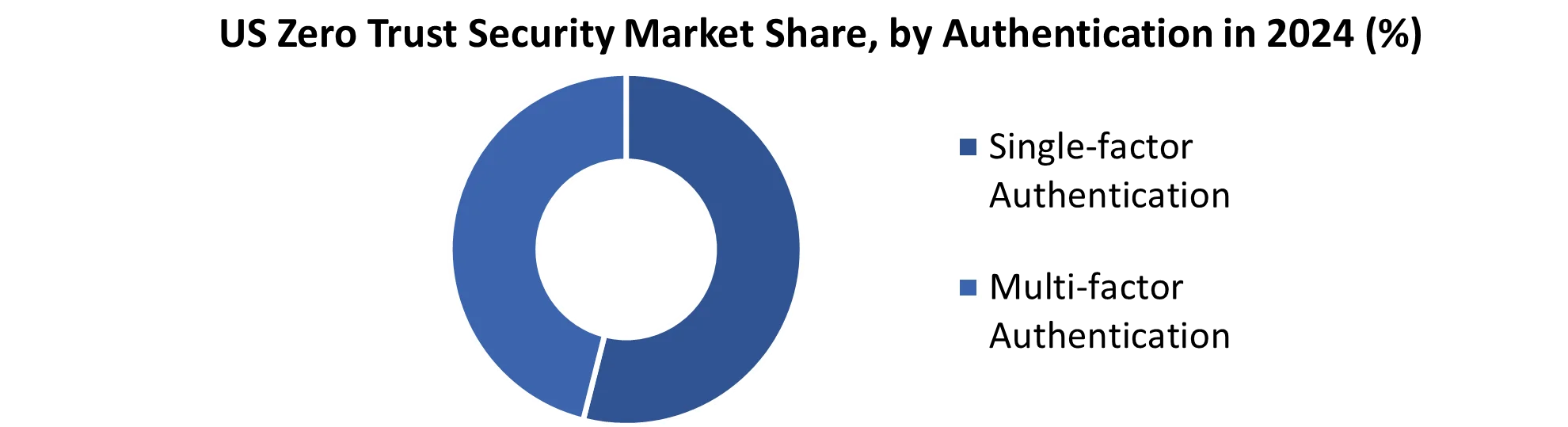

Based on Authentication, the Multi-factor Authentication segment held the largest market share of about 80% in the US Zero Trust Security Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 17.3% during the forecast period. It stands out as the dominant segment within the US Zero Trust Security Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The US Zero Trust Security Market Organizational security is improved by Multi-Factor Authentication (MFA), which introduces an additional layer of verification beyond passwords, aligning with the zero-trust principle. Studies indicate that data breach risks are significantly reduced by MFA, necessitating attackers to overcome additional verification factors. The US Zero Trust Security Market growth is driven by the adoption of MFA due to regulatory compliance, such as HIPAA and PCI DSS. An improved user experience is achieved through user-friendly MFA solutions that incorporate various authentication methods

Additionally, the US Zero Trust security market User resistance arises due to MFA inconvenience, especially with unfamiliar methods or frequent authentication. This resistance poses potential security risks if users resort to workarounds. Managing MFA complexity, particularly in large user bases, demands continuous training, support, and updates for sustained effectiveness. MFA, while valuable, isn't foolproof, as advanced attackers still bypass it, necessitating a layered security approach. Implementing and maintaining MFA increases IT costs, creating barriers for smaller organizations. The choice of MFA vendor is critical, but it leads to vendor lock-in, limiting flexibility and potentially raising costs.

In the US Zero Trust security market, the positive impact of MFA outweighs the drawbacks. It is crucial for robust security, aligning seamlessly with the Zero Trust philosophy, effectively reducing breach risks.

|

US Zero Trust Security Market Scope |

|

|

Market Size in 2024 |

USD 17.79 Billion |

|

Market Size in 2032 |

USD 62.92 Billion |

|

CAGR (2025-2032) |

17.1 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Security Type

|

|

By Deployment

|

|

|

Authentication

|

|

|

Application

|

|

Leading Key Players in the US Zero Trust Security Market

- Cisco Systems, Inc.

- Palo Alto Networks

- Microsoft Corporation

- Check Point Software Technologies

- Zscaler

- CrowdStrike Holdings, Inc.

- Symantec Corporation

- Akamai Technologies

- Fortinet, Inc.

- VMware, Inc.

Frequently Asked Questions

Ans. Potential Complexity and Resource Requirements Associated with Implementing a Zero Trust Architecture are expected to be the major restraining factors for the US Zero Trust Security market growth.

Ans. The US Zero Trust Security Market size was valued at USD 17.79 Billion in 2024 and the total US Zero Trust Security revenue is expected to grow at a CAGR of 17.1 % from 2025 to 2032, reaching nearly USD 62.92 Billion By 2032.

1. US Zero Trust Security Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. US Zero Trust Security Market: Dynamics

2.1.1 Market Drivers

2.1.2 Market Restraints

2.1.3 Market Opportunities

2.1.4 Market Challenges

2.2 PORTER’s Five Forces Analysis

2.3 PESTLE Analysis

2.4 Regulatory Landscape

2.5 Analysis of Government Schemes and Initiatives for the US Zero Trust Security Industry

2.6 The Pandemic and Redefining of The US Zero Trust Security Industry Landscape

3. US Zero Trust Security Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

3.1 US Zero Trust Security Market Size and Forecast, by Security Type (2024-2032)

3.1.1 Network Security

3.1.2 Data Security

3.1.3 Endpoint Security

3.1.4 Cloud Security

3.2 US Zero Trust Security Market Size and Forecast, by Deployment (2024-2032)

3.2.1 On-premises

3.2.2 Cloud

3.3 US Zero Trust Security Market Size and Forecast, by Authentication (2024-2032)

3.3.1 Single-factor Authentication

3.3.2 Multi-factor Authentication

3.4 US Zero Trust Security Market Size and Forecast, by Application (2024-2032)

3.4.1 IT & Telecom

3.4.2 BFSI

3.4.3 Healthcare

3.4.4 Retail

4. US Zero Trust Security Market: Competitive Landscape

4.1 STELLAR Competition Matrix

4.2 Competitive Landscape

4.3 Key Players Benchmarking

4.3.1 Company Name

4.3.2 Service Segment

4.3.3 End-user Segment

4.3.4 Revenue (2024)

4.3.5 Company Locations

4.4 Leading US Zero Trust Security Companies, by market capitalization

4.5 Market Structure

4.5.1 Market Leaders

4.5.2 Market Followers

4.5.3 Emerging Players

4.6 Mergers and Acquisitions Details

5. Company Profile: Key Players

5.1 Cisco Systems, Inc.

5.1.1 Company Overview

5.1.2 Business Portfolio

5.1.3 Financial Overview

5.1.4 SWOT Analysis

5.1.5 Strategic Analysis

5.1.6 Scale of Operation (small, medium, and large)

5.1.7 Details on Partnership

5.1.8 Regulatory Accreditations and Certifications Received by Them

5.1.9 Awards Received by the Firm

5.1.10 Recent Developments

5.2 Palo Alto Networks

5.3 Microsoft Corporation

5.4 Check Point Software Technologies

5.5 Zscaler

5.6 CrowdStrike Holdings, Inc.

5.7 Symantec Corporation

5.8 Akamai Technologies

5.9 Fortinet, Inc.

5.10 VMware, Inc.

6. Key Findings

7. Industry Recommendations

8. Terms and Glossary

9. US Zero Trust Security Market: Research Methodology