Mexico Zero Trust Security Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

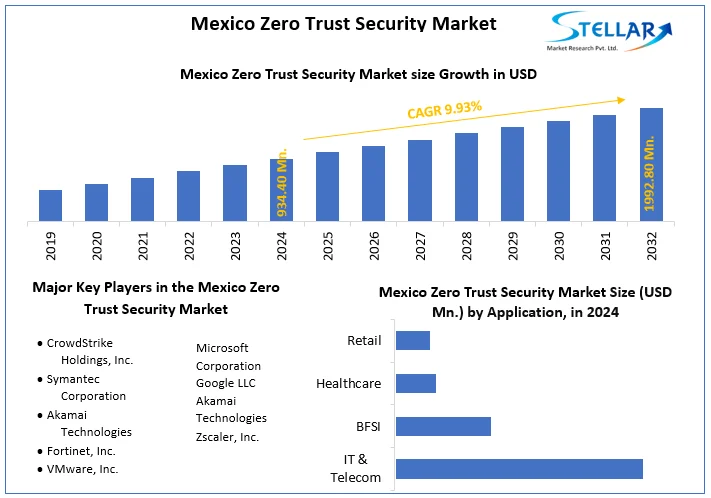

The Mexico Zero Trust Security Market size was valued at USD 934.40 Mn in 2024 and the total Mexico Zero Trust Security revenue is expected to grow at a CAGR of 9.93% from 2025 to 2032

Format : PDF | Report ID : SMR_1607

Mexico Zero Trust Security Market Overview-

Zero Trust is a security framework that mandates continuous authentication and validation of users, whether inside or outside the organization's network. It operates on the assumption of no traditional network edge, accommodating local, cloud, or hybrid environments. Crucial for modern challenges, it secures remote work, and hybrid clouds, and counters ransomware threats, with recognized standards guiding its implementation.

This report analyses the Mexico Zero Trust Security market and covers trends, technological advancements, and potential disruptions that shape the market. It assesses market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is analyzed, highlighting differentiation among key operators and drawing on historical data, industry insights, and the report forecasts sector. The economic downturn prompted this analysis and revealed the Mexico Zero Trust Security industry's resilience challenges. The report aims to equip stakeholders with crucial, concise information for informed decision-making in this dynamic sector. The targeted audiences include People with Healthcare professionals, Secondary Audiences, Government agencies, policymakers, and pharmaceutical companies in the Mexico Zero Trust Security industry.

To get more Insights: Request Free Sample Report

Rising Cybersecurity Awareness Impact on the Mexico Zero Trust Security Market

The Mexico Zero Trust Security Market demand for Zero Trust solutions is rising as organizations recognize their effectiveness against cyber threats. Factors such as government cybersecurity initiatives and increased investment in cybersecurity contribute to this trend. Implementing Zero Trust principles enhances security by reducing the attack surface, detecting threats more effectively, and improving the user experience through streamlined access controls and simplified workflows.

Additionally, Mexican organizations face challenges in implementing Zero Trust, requiring them to assess security gaps, select appropriate solutions, integrate with existing systems, and train employees. Careful evaluation is necessary for cost considerations, covering implementation expenses and potential disruptions. A skills gap in cybersecurity professionals might hinder effective implementation, and a lack of awareness about Zero Trust's benefits act as a barrier to adoption.

The growth of the Mexico Zero Trust security market is expected to benefit from increasing cybersecurity awareness. Organizations that overcome implementation hurdles and leverage Zero Trust improve security, improve user experience, and comply with regulations, positioning themselves effectively for the long run.

Mexico Zero Trust Security Market Segment Analysis

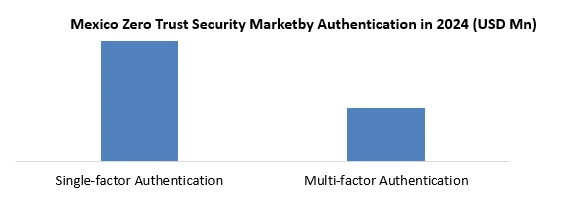

Based on Authentication, the Single-factor Authentication segment held the largest market share of about 77% in the Mexico Zero Trust Security Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 9.95% during the forecast period. It stands out as the dominant segment within the Mexico Zero Trust Security Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Mexico Zero Trust Security Market Single-factor authentication (SFA) simplifies user experience by requiring just one credential, such as a username and password, making resource access easier. Industries with less tech-savvy users or numerous low-risk access points benefit. Implementing SFA is generally cheaper than multi-factor authentication (MFA), pleasing to smaller organizations or those with limited budgets due to requiring less infrastructure. SFA results in faster login times compared to MFA, potentially enhancing user productivity and workflow with only one factor to verify.

Single-factor authentication (SFA) poses an increased security risk as the weakest form, making organizations susceptible to attacks like phishing and credential stuffing, especially those handling sensitive data or facing high cyber threats. Limited access control, lacking granularity based on user context, device, or location, risks unauthorized access and potential data breaches. SFA contradicts Zero Trust principles by relying on user credentials without verifying the identity or potential risk.

In Mexico Zero Trust Security Market Increasing cybersecurity awareness in Mexican organizations reduces the adoption of Single-Factor Authentication (SFA) as businesses prioritize stronger authentication. Government regulations, particularly in the financial sector, mandate Multi-Factor Authentication (MFA) for specific access, restricting SFA use in certain industries. Mexico's evolving tech infrastructure, marked by growing internet penetration and mobile device usage, facilitates the adoption of more secure and convenient MFA solutions.

Mexico Zero Trust Security Market Scope:

|

Mexico Zero Trust Security Market |

|

|

Market Size in 2024 |

USD 934.40 Million |

|

Market Size in 2032 |

USD 1992.80 Million |

|

CAGR (2025-2032) |

9.93 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Security Type

|

|

By Deployment

|

|

|

Authentication

|

|

|

Application

|

|

Leading Key Players in the Mexico Zero Trust Security Market

- CrowdStrike Holdings, Inc.

- Symantec Corporation

- Akamai Technologies

- Fortinet, Inc.

- VMware, Inc.

- Microsoft Corporation

- Google LLC

- Akamai Technologies

- Zscaler, Inc.

Frequently Asked Questions

Potential Complexity and Resource Requirements Associated with Implementing a Zero Trust Architecture are expected to be the major restraining factors for the Mexico Zero Trust Security market growth.

The Mexico Zero Trust Security Market size was valued at USD 934.40 Million in 2024 and the total Mexico Zero Trust Security revenue is expected to grow at a CAGR of 9.93 % from 2025 to 2032, reaching nearly USD 1992.80 Million By 2032.

1. Mexico Zero Trust Security Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. Mexico Zero Trust Security Market: Dynamics

2.1.1 Market Drivers

2.1.2 Market Restraints

2.1.3 Market Opportunities

2.1.4 Market Challenges

2.2 PORTER’s Five Forces Analysis

2.3 PESTLE Analysis

2.4 Regulatory Landscape

2.5 Analysis of Government Schemes and Initiatives for the Mexico Zero Trust Security Industry

2.6 The Pandemic and Redefining of The Mexico Zero Trust Security Industry Landscape

3. Mexico Zero Trust Security Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

3.1 Mexico Zero Trust Security Market Size and Forecast, by Security Type (2024-2032)

3.1.1 Network Security

3.1.2 Data Security

3.1.3 Endpoint Security

3.1.4 Cloud Security

3.2 Mexico Zero Trust Security Market Size and Forecast, by Deployment (2024-2032)

3.2.1 On-premises

3.2.2 Cloud

3.3 Mexico Zero Trust Security Market Size and Forecast, by Authentication (2024-2032)

3.3.1 Single-factor Authentication

3.3.2 Multi-factor Authentication

3.4 Mexico Zero Trust Security Market Size and Forecast, by Application (2024-2032)

3.4.1 IT & Telecom

3.4.2 BFSI

3.4.3 Healthcare

3.4.4 Retail

4. Mexico Zero Trust Security Market: Competitive Landscape

4.1 STELLAR Competition Matrix

4.2 Competitive Landscape

4.3 Key Players Benchmarking

4.3.1 Company Name

4.3.2 Service Segment

4.3.3 End-user Segment

4.3.4 Revenue (2024)

4.3.5 Company Locations

4.4 Leading Mexico Zero Trust Security Companies, by market capitalization

4.5 Market Structure

4.5.1 Market Leaders

4.5.2 Market Followers

4.5.3 Emerging Players

4.6 Mergers and Acquisitions Details

5. Company Profile: Key Players

5.1 Cisco Systems, Inc.

5.1.1 Company Overview

5.1.2 Business Portfolio

5.1.3 Financial Overview

5.1.4 SWOT Analysis

5.1.5 Strategic Analysis

5.1.6 Scale of Operation (small, medium, and large)

5.1.7 Details on Partnership

5.1.8 Regulatory Accreditations and Certifications Received by Them

5.1.9 Awards Received by the Firm

5.1.10 Recent Developments

5.2 CrowdStrike Holdings, Inc.

5.3 Symantec Corporation

5.4 Akamai Technologies

5.5 Fortinet, Inc.

5.6 VMware, Inc.

5.7 Microsoft Corporation

5.8 Google LLC

5.9 Akamai Technologies

5.10 Zscaler, Inc.

6. Key Findings

7. Industry Recommendations

8. Terms and Glossary

9. Mexico Zero Trust Security Market: Research Methodology