Mexico Social Commerce Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

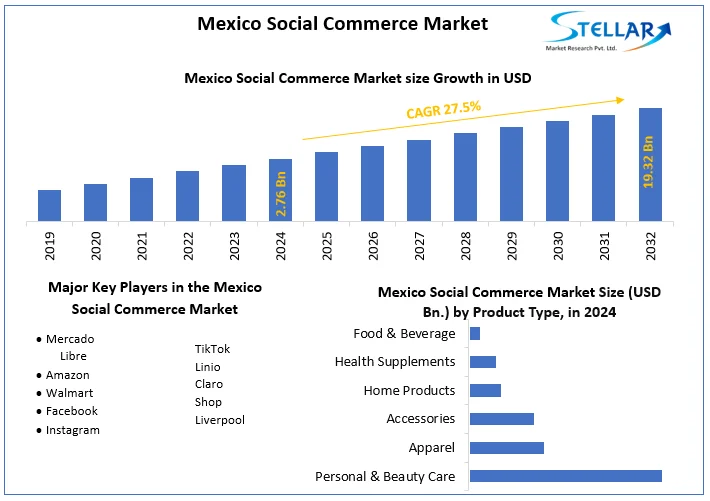

The Mexico Social Commerce Market size was valued at USD 2.76 Billion in 2024 and the total Mexico Social Commerce revenue is expected to grow at a CAGR of 27.5% from 2025 to 2032, reaching nearly USD 19.32 Billion.

Format : PDF | Report ID : SMR_1600

The social commerce sector actively promotes products and services through platforms such as Facebook, Instagram, and Twitter. Shoppable ads, posts, in-app purchases, influencer content, and videos on social media drive traffic to e-commerce sites. Consumer participation, measured by such as retweets, and shares, determines the effectiveness of social commerce.

- Mexico booms in social media with 90 million Facebook and 28 million Instagram users.

- With over 80% accessing the internet via smartphones, social commerce flourishes, complemented by booming e-commerce, showcasing a tech-savvy consumer shift.

The comprehensive report serves as a detailed analysis of the Mexico Social Commerce Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the Mexico Social Commerce Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Widespread Internet and Social Media Usage drives the Mexico Social Commerce Market.

The rise in internet and social media usage drives Mexico Social Commerce market growth and Instagram, Facebook, and TikTok streamline shopping, encouraging impulse buys. Social platforms broaden Mexico Social Commerce market reach, fostering innovation and customer engagement. Direct brand-consumer connections on social media improve personalized marketing, storytelling, and community building, boosting loyalty. Real-time customer service on these platforms increases satisfaction. The accessible nature of social commerce empowers micro-entrepreneurs, promoting economic diversity.

Continuous innovation is essential for the Mexico Social Commerce market distinction in the severely competitive social commerce landscape. Personal data sharing raises privacy concerns, necessitating transparency and adherence to regulations. If not promptly addressed, negative reviews on social media swiftly impact brand image. Frequent changes to platform algorithms disrupt brands, which heavily rely on them. The open nature of social media potentially harms users and businesses through misinformation and scams. Emphasizing responsible platform design and user awareness is crucial as excessive social media usage raises addiction and mental health concerns.

Additionally, Internet and social media effects differ based on platforms, products, and audiences. Regulations shape social commerce, safeguarding consumers. Empowering individuals for informed choices in the digital marketplace require continuous education and awareness campaigns.

Mexico Social Commerce Market Segment Analysis

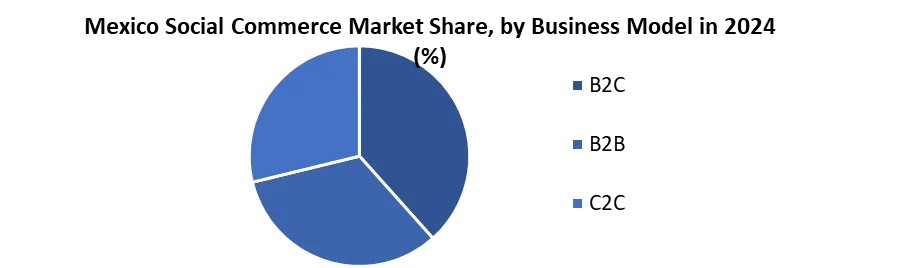

Based on the Business Model, the B2C segment held the largest market share of about 65% in the Mexico Social Commerce Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 29.6% during the forecast period. It stands out as the dominant segment within the Social Commerce Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The B2C brands drive Mexico Social Commerce market growth by leveraging social media for broader audience reach and community building. Social commerce platforms boost sales through convenient shopping, impulse purchases, and influencer marketing. Social media improves brand awareness, loyalty, and customer service, allowing real-time interactions and prompt issue resolution, ultimately improving satisfaction.

The Mexico Social Commerce industry's low entry barrier in social commerce intensifies competition, compelling brands to innovate. Sharing personal information on social media raises data privacy concerns, demanding transparency and compliance. If not promptly addressed, negative customer reviews on social media harm the brand image. Challenges arise from platform dependence and algorithm changes, requiring constant adaptation for sustained marketing effectiveness.

Social commerce impact varies across platforms, each catering to diverse demographics with unique functionalities, influencing B2C strategies. Product categories such as fashion, beauty, and home goods often excel. Tailoring strategies require a deep understanding of the target audience's social media habits and preferences.

|

Mexico Social Commerce Market Scope |

|

|

Market Size in 2024 |

USD 2.76 Billion |

|

Market Size in 2032 |

USD 19.32 Billion |

|

CAGR (2025-2032) |

27.5 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Business Model

|

|

By Product Type

|

|

|

By Sales Channel

|

|

Leading Key Players in the Mexico Social Commerce Market

- Mercado Libre

- Amazon

- Walmart

- TikTok

- Linio

- Claro Shop

- Liverpool

Frequently Asked Questions

Increased awareness and Data breaches and scandals are expected to be the major restraining factors for Mexico Social Commerce market growth.

The Mexico Social Commerce Market size was valued at USD 2.76 Billion in 2024 and the total Mexico Social Commerce revenue is expected to grow at a CAGR of 27.5 % from 2025 to 2032, reaching nearly USD 19.32 Billion By 2032.

1. Mexico Social Commerce Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Mexico Social Commerce Market: Dynamics

2.1.1 Market Driver

2.1.2 Market Restraints

2.1.3 Market Opportunities

2.1.4 Market Challenges

2.2 PORTER’s Five Forces Analysis

2.3 PESTLE Analysis

2.4 Regulatory Landscape

2.5 Analysis of Government Schemes and Initiatives for the Mexico Social Commerce Industry

2.6 The Pandemic and Redefining of The Mexico Social Commerce Industry Landscape

3. Mexico Social Commerce Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

3.1 Mexico Social Commerce Market Size and Forecast, by Business Model (2024-2032)

3.1.1 B2C

3.1.2 B2B

3.1.3 C2C

3.2 Mexico Social Commerce Market Size and Forecast, Product Type (2024-2032)

3.2.1 Personal & Beauty Care

3.2.2 Apparel

3.2.3 Accessories

3.2.4 Home Products

3.2.5 Health Supplements

3.2.6 Food & Beverage

3.3 Mexico Social Commerce Market Size and Forecast, Sales Channel (2024-2032)

3.3.1 Video Commerce (Live stream + Prerecorded)

3.3.2 Social Network-led Commerce

3.3.3 Social Reselling

3.3.4 Group Buying

3.3.5 Product Review Platforms

3.4 Mexico Social Commerce Market: Competitive Landscape

3.5 STELLAR Competition Matrix

3.6 Competitive Landscape

3.7 Key Players Benchmarking

3.7.1 Company Name

3.7.2 Service Segment

3.7.3 End-user Segment

3.7.4 Revenue (2024)

3.7.5 Company Locations

3.8 Leading Mexico Social Commerce Companies, by market capitalization

3.9 Market Structure

3.9.1 Market Leaders

3.9.2 Market Followers

3.9.3 Emerging Players

3.10 Mergers and Acquisitions Details

4. Company Profile: Key Players

4.1 Mercado Libre

4.1.1 Company Overview

4.1.2 Business Portfolio

4.1.3 Financial Overview

4.1.4 SWOT Analysis

4.1.5 Strategic Analysis

4.1.6 Scale of Operation (small, medium, and large)

4.1.7 Details on Partnership

4.1.8 Regulatory Accreditations and Certifications Received by Them

4.1.9 Awards Received by the Firm

4.1.10 Recent Developments

4.2 Amazon

4.3 Walmart

4.4 Facebook

4.5 Instagram

4.6 TikTok

4.7 Linio

4.8 Claro Shop

4.9 Liverpool

5. Industry Recommendations

6. Terms and Glossary

7. Mexico Social Commerce Market: Research Methodology