Trenching Equipment Market- Global Industry Analysis and Forecasts (2025-2032)

The Global Trenching Equipment Market size was valued at USD 159.56 Bn. in 2024 and the total Global Trenching Equipment Market revenue is expected to grow at a CAGR of 4.7% from 2025 to 2032, reaching nearly USD 230.41 Bn.

Format : PDF | Report ID : SMR_2152

Global Trenching Equipment Market Overview

The Trenching Equipment Market produces, distributes, and uses Equipment made for trench excavation in a variety of soil types and terrains is known as the trenching Equipment market. This market includes a broad range of specialized machineries, such as backhoes, trenchers, excavators, and attachments, that are designed to precisely and efficiently excavate ground surfaces for a variety of uses, such as installing utilities or laying pipes, cables, and drainage systems. Several factors, such as urbanization, infrastructure development, Advanced Farming techniques, and the rising demand for efficient utility systems worldwide, are driving this market's expansion.

The growing construction and agricultural sectors further drive the requirement for trenching Equipment, which is encouraging market expansion. Important companies that innovate, study, and develop to provide more affordable, ecologically friendly, and sustainable Equipment to the market have an impact on it. Regulations about emissions and safety requirements can have an impact on market dynamics and product development. Asia-Pacific region is dominating this market with countries like China and India are growing developing economies.

To get more Insights: Request Free Sample Report

Global Trenching Equipment Market Dynamics

Electric-type Trencher Equipment products are the fastest growing market during the forecasted period, in terms of value. The battery technology is not well-developed enough to operate the standard and large-capacity for off-road vehicles. Due to the limited battery capacity, the electricity power is limited to mini-construction vehicles such as mini excavators and compact/skid loaders. Few companies offer cable-connected off-road vehicles, where charging limitations are reduced. Thus, the hybrid-electric technology used in Trencher Equipment requires more power to operate. The major hybrid-electric construction Equipment are dozers and mine dump trucks.

Asia Pacific is expected to be the fastest market growth for electric trencher Equipment during the forecast period, due to the development of big construction projects. With the growing electrification and the presence of many leading Equipment manufacturers, the North American electric heavy Equipment market is forecasted to grow with the record highest CAGR of 5.7% during the forecasted period.

Increasing government spending on the upgradation of infrastructure activities in developing countries. India is highly focused on the road infrastructure to facilitate the rapid transportation of resources.

- In June 2023, the Indian Ministry of Road Transport and Highways announced the opening of 15 new national highway projects worth USD 1.7 billion in Patna and Hajipur in Bihar.

- In Mach 2023, the Singapore government announced that it would commence the construction of new terminal 5 (T5) at Changi Airport in 2025. The T5 addition to the existing airport is focused on lowering the air passenger traffic at Changi Airport. This increasing road construction activity is growing demand for material handling and road construction Equipment such as forklifts, pavers, dozers, etc., further supporting the growth of the global construction Equipment market.

Technological advancements in trencher Equipment are expected to foster the growth market over the forecast period. Trencher Equipment manufacturers are capitalizing on this as an opportunity to launch new products and expand their business in the Trenching Equipment Market.

- In January 2023, John Deere announced the launch of building and farming Equipment powered by batteries. The company states that when John Deere released new farming and building technologies, factors such as a growing population, dwindling amounts of arable land, and rising greenhouse gas emissions were all considered.

Challenge: High cost of Equipment One of the biggest challenges faced by the Trenching Equipment Market is its high capital investment. The Trencher Equipment Service providers have to invest huge amounts for the purchase and maintenance of the Equipment. For industries, it is important for their survival and growth that a good balance is kept between the requirement of the Equipment and its ability to generate profits or obtain financing. This requirement for huge investments requirement also creates entry barriers to the market, which constrains the volume demand for the Equipment, leading to a low scope for price reductions, owing to low economies of scale.

Due to the high cost of products and contractors leading towards adopting rental Equipment are some important factors expected to hamper the growth of the global Trenching Equipment Market. Contractors are going towards renting the construction Equipment for the specified project's timeline against being in charge of vehicle ownership. Construction Equipment ownership ties up a significant amount of capital, impacting other business operations.

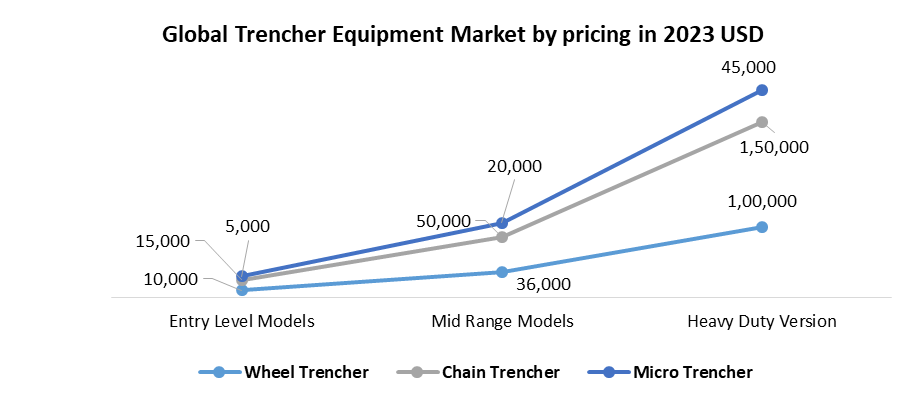

Trenching Equipment Market Pricing Analysis, Trenchers come in various types suited for different project scales and applications. Wheel trenchers are available in entry-level models starting at $10,000 for small projects, mid-range models ranging from $20,000 to $50,000 with enhanced horsepower, and heavy-duty versions costing $100,000 or more for large construction sites. Chain trenchers start at around $15,000 for basic models, climb to $30,000 to $60,000 for mid-tier versions featuring hydraulic systems and adjustable digging depths, and can exceed $150,000 for high-capacity models used in industrial settings.

Micro trenchers, designed primarily for fiber optic cable installation, start at $5,000 for basic models and can reach up to $20,000 for advanced models with precision cutting capabilities. Additional costs such as specialized attachments and ongoing maintenance for oil changes, blade replacements, and wear parts should also be factored into the overall budget when considering the purchase of a trencher.

Global Trenching Equipment Market Segment Analysis

The material handling machinery segment leading the market growth, accounting for 38.5% in 2023. This segment has growth factors such as rising demand for automation and rapid industrialization in material handling machinery. In developed countries, completely automated industrial facilities growing automation adoption and technological advancements in the market. It is expected that the market for material handling Equipment will grow due to the modern transformation of industrial infrastructures and facilities to increase their production capacity.

The earthmoving machinery is expected to record a rapid growth rate over the forecast period. The growth construction sector, both in developed and emerging economies, has significantly contributed to the earthmoving machinery of the Trenching Equipment Market. Increasing investments in commercial, residential, and industrial construction projects require the use of trencher Equipment. Earthmoving Equipment working is used for excavation, grading, and material handling, enabling efficient and timely completion of construction projects.

The crawler excavator is expected for the largest market during the forecasted period

Crawler excavators recorded for the maximum share in all construction Equipment types. excavators are used for demolishing infrastructures, trenching, digging sites, and lifting heavy objects. With rising development in infrastructure (roads, metros, airports, etc.), real estate business, and others, crawler excavators are the most preferred Equipment due to their versatile work nature in limited spaces. Further, crawler excavators have applications for excavating and collections in the agriculture, landscaping, and forestry industries. Additionally, key players offer advanced-designed crawler excavators like CASE excavators, which deliver up to 19% more horsepower, faster cycle times, and lower fuel costs. Also,

- In 2023, Develon and Doosan Group launched its new DX140LC-7K (14.6 tonnes) crawler excavator. These Crawler excavators are designed for high performance and strength.

Trencher Equipment is multipurpose and it can be equipped with various attachments such as hammers, buckets, hydraulics, grapples, and drills, making them suitable for multiple applications from digging and grading to demolition and material handling.

By Import-Export: In 2023, The top exporters of trencher Equipment were China ($ 15.8 billion), the United States ($6,57 Billion) Germany ($5.1 Billion), Italy (3.69 billion), and Japan ($2.71 Billion).

The top importers are the United States ($11.6B), Germany ($5.17B), Canada ($3.26B), Japan ($2.75B), and France ($2.66B).

Asia Pacific is estimated to be the dominant regional market.

Asia Pacific is projected to dominate the global Construction Equipment market by 2032. China is forecasted to be the largest market in Asia. Growing infrastructure development activities like constructing highway constructions, railway lines, new commercial complexes, and other infrastructures are driving the future demand for the Trenching Equipment Market.

In 2025, it is expected that the growth of Equipment sales, and the Indian market is forecasted to increase by 13%. Infrastructure investment drives this market growth. The JCB and Tata Hitachi, the executives in India's compact construction Equipment market, cater to this demand. In 2023, these manufacturers were top sellers of compact construction Equipment in India and catered to the 57% demand. The Asia Trenching Equipment Market contributes to investments by the key players in new product launches and expansion of their production plants in Asia which helps the company such as Shandong Yatai Machinery Co. Ltd, Zhengzhou Share Machinery Co., to serve the demand in the domestic market.

The report aims to provide industry stakeholders with a thorough study of the global Global Pharmacovigilance market. The research presents the industry's historical and present state together with projected market size and trends, analyzing complex data in an easy-to-read manner. The research includes PORTER and PESTEL analyses along with the possible effects of market microeconomic factors. The analysis of both internal and external elements that could have a good or negative impact on the firm will provide decision-makers with a clear picture of the industry's future. By understanding the market segments and projecting the size of the global Global Pharmacovigilance market, the reports also help in understanding the market's dynamics and structure.

Trenching Equipment Market Scope

|

Trenching Equipment Market |

|

|

Market Size in 2024 |

USD 159.56 Bn. |

|

Market Size in 2032 |

USD 230.41 Bn. |

|

CAGR (2025-2032) |

4.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Type Wheel Trencher Rockwheel Trenchers Chain Trencher Micro trenchers Others

|

|

By Operating Type Ride On Walk-Behind |

|

|

By Application Agricultural Trenching Construction Telecommunication Networks Sewers and Water Pipelines Installation Oil and Gas Pipeline Installation Energy Cables and Fiber Optic Laying Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Top Trenching Equipment Market Players

- Ditch Witch (USA)

- Vermeer (USA)

- Tesmec (Italy)

- Wolfe Heavy Equipment (Canada)

- EZ-Trench (USA)

- UNAC (France)

- Toro (USA)

- Guntert & Zimmerman (USA)

- Mastenbroek (UK)

- Shandong Gaotang trencher (China)

- Inter-Drain (USA)

- AFT Trenchers Ltd

- Allcons Maschinenbau

- Barreto Manufacturing

- Barth Hollanddrain

Frequently Asked Questions

The global Trenching Equipment Market size is estimated at US$ 159.56 billion in 2024. It is projected to reach US$ 230.41 billion by 2032.

Shandong Yatai Machinery Co. Ltd, Ditch Witch (USA), Vermeer (USA), Tesmec (Italy), and Zhengzhou Share Machinery Co., are the leading players in the Global Trenching Equipment Market.

The emergence of electric-type Equipment, and infrastructure development are the future trends that are diving market growth during the forecasted period.

Infrastructure development, new highways, and commercial buildings are driving the future opportunities of the global trencher market.

1. Trenching Equipment Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Trenching Equipment Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Business Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Trenching Equipment Market: Dynamics

3.1. Trenching Equipment Market Trends

3.2. Trenching Equipment Market Dynamics

3.2.1. Global Trenching Equipment Market Drivers

3.2.2. Global Trenching Equipment Market Restraints

3.2.3. Global Trenching Equipment Market Opportunities

3.2.4. Global Trenching Equipment Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Operating Type Roadmap

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

3.7. Key Opinion Leader Analysis for Trencher Equipment Industry

4. Trenching Equipment Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Trenching Equipment Market Size and Forecast, By Product (2024-2032)

4.1.1. Wheel Trencher

4.1.2. Mobile

4.1.3. Chain Trenchers

4.1.4. Micro trenchers

4.1.5. Others

4.2. Trenching Equipment Market Size and Forecast, By Operating Type (2024-2032)

4.2.1. RIDE-ON

4.2.2. Walk-behind

4.3. Trenching Equipment Market Size and Forecast, By Application (2024-2032)

4.3.1. Agricultural Trenching

4.3.2. Construction

4.3.3. Telecommunication Networks

4.3.4. Sewers and Water Pipelines Installation

4.3.5. Oil and Gas Pipeline Installation

4.3.6. Energy Cables and Fiber Optic Laying

4.3.7. Others

4.4. Trenching Equipment Market Size and Forecast, by region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Trenching Equipment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Trenching Equipment Market Size and Forecast, By Product (2024-2032)

5.1.1. Wheel Trencher

5.1.2. Rockwheel Trenchers

5.1.3. Chain Trenchers

5.2. North America Trenching Equipment Market Size and Forecast, By Operating Type (2024-2032)

5.2.1. Ride-on

5.2.2. Walk-behind

5.3. Trenching Equipment Market Size and Forecast, By Application (2024-2032)

5.3.1. Agricultural Trenching

5.3.2. Construction

5.3.3. Telecommunication Networks

5.3.4. Sewers and Water Pipelines Installation

5.3.5. Oil and Gas Pipeline Installation

5.3.6. Energy Cables and Fiber Optic Laying

5.3.7. Others

5.4. North America Trenching Equipment Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Trenching Equipment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Trenching Equipment Market Size and Forecast, By Product (2024-2032)

6.2. Europe Trenching Equipment Market Size and Forecast, By Operating Type (2024-2032)

6.3. Europe Trenching Equipment Market Size and Forecast, By Application (2024-2032)

6.4. Europe Trenching Equipment Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Trenching Equipment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Trenching Equipment Market Size and Forecast, By Product (2024-2032)

7.2. Asia Pacific Trenching Equipment Market Size and Forecast, By Operating Type (2024-2032)

7.3. Asia Pacific Trenching Equipment Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Trenching Equipment Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa Trenching Equipment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Trenching Equipment Market Size and Forecast, By Product (2024-2032)

8.2. Middle East and Africa Trenching Equipment Market Size and Forecast, By Operating Type (2024-2032)

8.3. Middle East and Africa Trenching Equipment Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Trenching Equipment Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America Trenching Equipment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Trenching Equipment Market Size and Forecast, By Product (2024-2032)

9.2. South America Trenching Equipment Market Size and Forecast, By Operating Type (2024-2032)

9.3. South America Trenching Equipment Market Size and Forecast, By Application (2024-2032)

9.4. South America Trenching Equipment Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Of South America

10. Company Profile: Key Players

10.1. Ditch Witch (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Tesmec (Italy)

10.3. Wolfe Heavy Equipment (Canada)

10.4. EZ-Trench (USA)

10.5. UNAC (France)

10.6. Toro (USA)

10.7. Guntert & Zimmerman (USA)

10.8. Mastenbroek (UK)

10.9. Shandong Gaotang trencher (China)

10.10. Inter-Drain (USA)

10.11. AFT Trenchers Ltd

10.12. Allcons Maschinenbau

10.13. Barreto Manufacturing

10.14. Barth Hollanddrain

11. Key Findings

12. Analyst Recommendations

13. Global Trenching Equipment Market: Research Methodology