Tactical Headset Market Global Industry Analysis and Forecast (2026-2032)

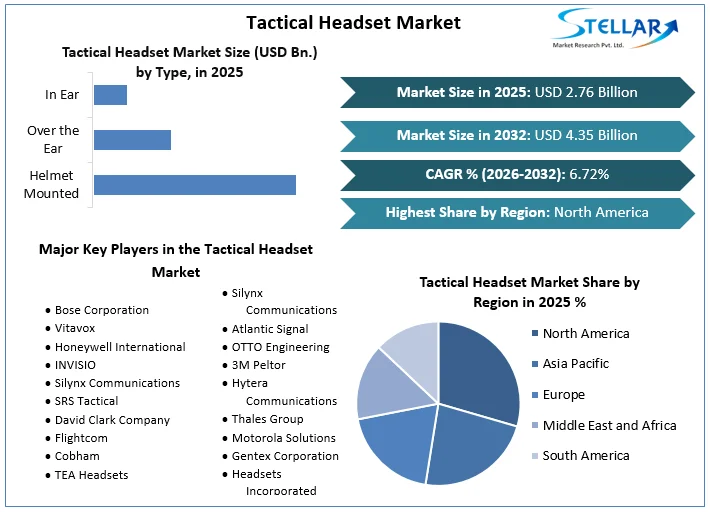

Tactical Headset Market size was valued at USD 2.76 Bn. in 2025 and the total Tactical Headset Market size is expected to grow at a CAGR of 6.72 % from 2026 to 2032, reaching nearly USD 4.35 Bn. by 2032.

Format : PDF | Report ID : SMR_2019

Tactical Headset Market Overview

Tactical headsets are advanced communication devices that integrate headphones, microphones, and often additional features like noise cancellation, radio connectivity, and hearing protection. They are specifically engineered to provide clear, reliable communication while minimizing ambient noise and maximizing situational awareness in challenging environments.

Numerous factors, including drivers, opportunities, constraints, challenges, and others, that affected the market's growth have been included in the report. The development of creative tactical headset solutions with enhanced sound quality and features like noise cancellation, etc., has been made possible by technological advancements. Consequently stimulating the market's growth. Businesses have to innovate, stand out from the competition, and meet changing customer needs in the tactical headset market. Though, there are drawbacks as well that call for careful consideration and adjustment. According to segments such as connectivity, communication, type, and application, the Tactical Headset Market Report classifies a wide range of applications, each with distinct qualities that appeal to consumers. Manufacturers customize their products to precisely match the preferences and demands of their customers thanks to segmentation, which provides a thorough understanding of market dynamics.

To get more Insights: Request Free Sample Report

Tactical Headset Market Dynamics

Essential Role of Tactical Headsets in Enhancing Communication, Situational Awareness, and Hearing Protection Drives Market Growth

The ability to communicate, improve situational awareness, and protect hearing in difficult situations has made tactical headsets an essential tool for both professionals and enthusiasts resulting in escalating the market growth. Increased demand for tactical headsets has driven the market's growth as it facilitates clear communication in noisy settings, allowing teams to work together efficiently and react quickly to changing circumstances. The demand for tactical headsets has increased as it reduce background noise and provide clear audio.

It also assists users in maintaining situational awareness, which is essential for both safety and mission success. Built-in hearing protection features in many tactical headsets protect users from loud noises that have harmed their hearing. By using hands-free communication, users are able to continue to be mobile and focused without having to worry about carrying an earpiece or microphone around.

Challenges in the Adoption of Tactical Headsets

The advanced features and functionality of tactical headsets tend to make them more expensive than regular ones, which has hindered their widespread adoption, especially in developing countries. Many people find it too expensive to invest in them as a practical solution. The incompatibility of tactical headsets manufactured by different manufacturers is one of the main factors preventing the market leaders in the tactical Headset Industry. These limit the use of tactical headsets in joint military operations and create issues with interoperability.

Tactical headsets have been dangerous because of their strong reliance on wireless technology, which makes them vulnerable to cyberattacks when used in military or law enforcement applications where communication security is crucial. As it has raised grave security issues. The market potential for tactical headsets is limited because they are designed for particular situations, like law enforcement or combat zones. Tactical headsets have to abide by several regulations set forth by the Federal Communications Commission (FCC) in the US. The time and cost involved in meeting these requirements may have prevented tactical headset adoption.

Tactical Headset Market Segment Analysis

Based on Communication Mode, The Dual Channel segment has witnessed significant growth and is expected to dominate through the forecast period with an increase in CAGR. The market demand for dual-mode headsets has increased thanks to their capacity to switch between various communications modes, such as secure and non-secure channels or radio and intercom systems. Their adaptability is vital in tactical scenarios where it's necessary to communicate seamlessly across different platforms and scenarios. In a variety of dynamic settings, tactical operations frequently call for trustworthy and transparent communication. Employee safety and mission success are ensured by dual-mode headsets, which allow personnel to continue communicating even if one mode malfunctions or is compromised.

Recent developments in communication technology have improved the effectiveness, dependability, and user-friendliness of dual-mode headsets. Their performance has improved and is now more appealing to military and law enforcement organizations thanks to features like noise cancellation, improved audio clarity, and integration with other communication devices. Tactical missions in the modern era frequently entail intricate operations that call for reliable communication solutions. The versatility required to transition between various networks and channels of communication is offered by dual-mode headsets, meeting the various requirements of tactical teams.

Tactical Headset Market Regional Analysis

North America dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. Thanks to the strong presence of market leaders, significant defense funding, stringent training requirements, and a strong industrial base, the tactical headset market has experienced rapid development, driving up demand for the device in North America. Key factors such as significant defense spending, cutting-edge military and law enforcement training initiatives, a robust industrial base, and technological innovation have boosted the market growth.

The United States has dominated the tactical headset market in the North American region. A significant number of innovative technology companies that have fuelled innovation in the tactical headset market are located in North America, especially in the US. To create cutting-edge products, Market Leaders are investing a lot of money in Research and Development. For instance, the Bose Corporation, renowned for its exceptional noise-canceling technology, supplies tactical headsets to various U.S. s. military divisions. S. Defense. Their sophisticated noise cancellation technology is well known, and it comes in very handy during combat.

The United States of America has one of the largest defense budgets globally. It is feasible to buy top-notch tactical gear, like headsets, thanks to the significant financial commitment. Modern equipment is required to accurately simulate real-world scenarios in North America's rigorous training programs. The development and use of sophisticated tactical heads have been spurred by this increased demand.

The integration of advanced manufacturing techniques ensures high-quality and durable products. For Instance, Silynx Communications: Based in the U.S., Silynx designs and manufactures tactical headsets that offer modularity, allowing users to adapt their gear to different missions. Their products are known for durability and versatility, meeting the needs of various military and law enforcement operations.

Tactical Headset Market Competitive Landscape

- In May 2024, Silynxcom Ltd. (NYSE American: SYNX) (“Silynxcom” or the “Company”), a manufacturer and developer of ruggedized tactical communication headset devices as well as other communication accessories, announced the development of its ongoing collaboration with 3M PELTOR. Peltor and Silynxcom have agreed to expand their mutual conversion distributor agreement to include Peltor's latest innovative product – the Peltor ComTac™ VIII Headset. The ComTac VIII Headset offers improved sound protection, hardware design, and user application.

- In Jan 2024, 3M is expected to debut the world's first self-charging protective communications headset that converts outdoor and indoor light into clean electrical energy. The headset uses a patented solar cell technology called Powerfoyle that recharges a built-in lithium-ion battery and eliminates the need for single-use batteries.

- In April 2023, First Source Wireless, a critical communication dealer, won a contract of USD 45 thousand from the city of Clearwater, Florida, to provide tactical communication headsets and push-to-talk adapters. First source wireless is estimated to supply 37 3M Peltor Comtac VI Single Communication Headsets and 37 Tactical Silynx Push to Talk adapters for Harris XL 200 and Harris XL 100 Handheld Radios.

|

Tactical Headset Market |

|

|

Market Size in 2025 |

USD 2.76 Bn. |

|

Market Size in 2032 |

USD 4.35 Bn. |

|

CAGR (2026-2032) |

6.72 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Connectivity

|

|

By Communication

|

|

|

By Type

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Tactical Headset Market Key Players

- Bose Corporation

- Vitavox

- Honeywell International

- INVISIO

- Silynx Communications

- SRS Tactical

- David Clark Company

- Flightcom

- Cobham

- TEA Headsets

- Silynx Communications

- Atlantic Signal

- OTTO Engineering

- 3M Peltor

- Hytera Communications

- Thales Group

- Motorola Solutions

- Gentex Corporation

- Headsets Incorporated

- Sensear

- XXX

Frequently Asked Questions

Expensive to invest has restrained the market growth.

The Market size was valued at USD 2.76 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 6.72 % from 2026 to 2032, reaching nearly USD 4.35 Billion.

The segments covered in the market report are Connectivity, Communication, Type, and Application.

1. Tactical Headset Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Tactical Headset Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Tactical Headset Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Tactical Headset Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Tactical Headset Market Size and Forecast by Segments (by Value USD Million and Volume in Units)

5.1. Tactical Headset Market Size and Forecast, By Connectivity (2025-2032)

5.1.1. Wired

5.1.2. Wireless

5.2. Tactical Headset Market Size and Forecast, By Communication (2025-2032)

5.2.1. Single Channel

5.2.2. Dual Channel

5.3. Tactical Headset Market Size and Forecast, By Type (2025-2032)

5.3.1. Helmet Mounted

5.3.2. Over the Ear

5.3.3. In Ear

5.4. Tactical Headset Market Size and Forecast, By Application (2025-2032)

5.4.1. Military

5.4.2. Law Enforcement

5.4.3. Rescue/Disaster Recovery

5.4.4. Other

5.5. Tactical Headset Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Tactical Headset Market Size and Forecast (by Value USD Million and Volume in Units)

6.1. North America Tactical Headset Market Size and Forecast, By Connectivity (2025-2032)

6.1.1. Wired

6.1.2. Wireless

6.2. North America Tactical Headset Market Size and Forecast, By Communication (2025-2032)

6.2.1. Single Channel

6.2.2. Dual Channel

6.3. North America Tactical Headset Market Size and Forecast, By Type (2025-2032)

6.3.1. Helmet Mounted

6.3.2. Over the Ear

6.3.3. In Ear

6.4. North America Tactical Headset Market Size and Forecast, By Application (2025-2032)

6.4.1. Military

6.4.2. Law Enforcement

6.4.3. Rescue/Disaster Recovery

6.4.4. Other

6.5. North America Tactical Headset Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Tactical Headset Market Size and Forecast (by Value USD Million and Volume in Units)

7.1. Europe Tactical Headset Market Size and Forecast, By Connectivity (2025-2032)

7.2. Europe Tactical Headset Market Size and Forecast, By Communication (2025-2032)

7.3. Europe Tactical Headset Market Size and Forecast, By Type (2025-2032)

7.4. Europe Tactical Headset Market Size and Forecast, By Application (2025-2032)

7.5. Europe Tactical Headset Market Size and Forecast, by Country (2025-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Tactical Headset Market Size and Forecast (by Value USD Million and Volume in Units)

8.1. Asia Pacific Tactical Headset Market Size and Forecast, By Connectivity (2025-2032)

8.2. Asia Pacific Tactical Headset Market Size and Forecast, By Communication (2025-2032)

8.3. Asia Pacific Tactical Headset Market Size and Forecast, By Type (2025-2032)

8.4. Asia Pacific Tactical Headset Market Size and Forecast, By Application (2025-2032)

8.5. Asia Pacific Tactical Headset Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Tactical Headset Market Size and Forecast (by Value USD Million and Volume in Units)

9.1. Middle East and Africa Tactical Headset Market Size and Forecast, By Connectivity (2025-2032)

9.2. Middle East and Africa Tactical Headset Market Size and Forecast, By Communication (2025-2032)

9.3. Middle East and Africa Tactical Headset Market Size and Forecast, By Type (2025-2032)

9.4. Middle East and Africa Tactical Headset Market Size and Forecast, By Application (2025-2032)

9.5. Middle East and Africa Tactical Headset Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Tactical Headset Market Size and Forecast (by Value USD Million and Volume in Units)

10.1. South America Tactical Headset Market Size and Forecast, By Connectivity (2025-2032)

10.2. South America Tactical Headset Market Size and Forecast, By Communication (2025-2032)

10.3. South America Tactical Headset Market Size and Forecast, By Type (2025-2032)

10.4. South America Tactical Headset Market Size and Forecast, By Application (2025-2032)

10.5. South America Tactical Headset Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Bose Corporation

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Vitavox

11.3. Honeywell International

11.4. INVISIO

11.5. Silynx Communications

11.6. SRS Tactical

11.7. David Clark Company

11.8. Flightcom

11.9. Cobham

11.10. TEA Headsets

11.11. Silynx Communications

11.12. Atlantic Signal

11.13. OTTO Engineering

11.14. 3M Peltor

11.15. Hytera Communications

11.16. Thales Group

11.17. Motorola Solutions

11.18. Gentex Corporation

11.19. Headsets Incorporated

11.20. Sensear

11.21. XXX

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook