Sweden Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

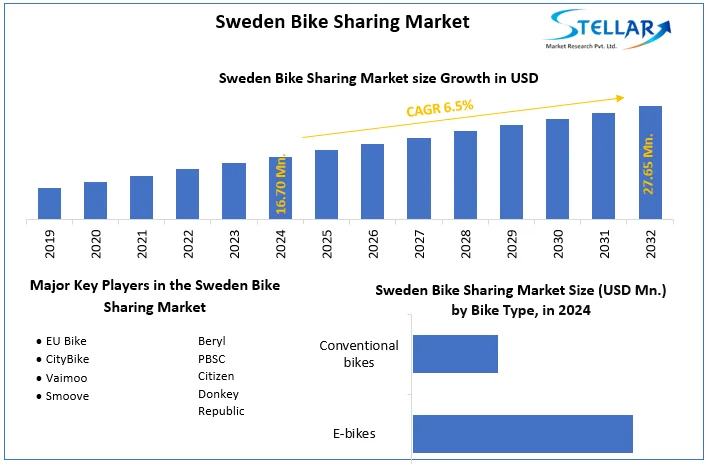

Sweden Bike Sharing Market size was valued at US$ 16.70 Million in 2024 and the total Sweden Bike Sharing Market revenue is expected to grow at 6.5% through 2025 to 2032, reaching nearly US$ 27.65 Million.

Format : PDF | Report ID : SMR_187

Sweden Bike Sharing Market Overview:

The city of Stockholm, Sweden, has signed a contract to implement a new urban electric bike sharing service. The new service will be operated by CityBike Global, a Spanish micromobility company that is part of the Moventia Group, which operates in Europe and Latin America with more than 30,000 vehicles. Sweden bike sharing market is expected to register CAGR of 6.5% during the forecast period.

Sweden Bike Sharing Market Dynamics:

CityBike Global, part of the Moventia Group, has partnered with Italian e-bike company Vaimoo on the project. The companies claim the bikes are both efficient and durable thanks to recycled aluminum frames and high-capacity, quick-replaceable batteries. “This deal brings e-bikes to another cycling capital of the world,” said Vaimoo CEO and Founder. Moreover, easy replacement policies given by E bike providers in the country is driving the market growth. Sustainable and inclusive. E-bikes will cost 10 SEK ($1.16) to rent per day or 149 SEK for an annual subscription, with the service being funded by advertising and user fees.

To get more Insights: Request Free Sample Report

With more and more cities offering e-bike sharing, personal e-bikes have grown in popularity over the past few years, especially since the pandemic. Research by Bosch eBike Systems earlier this month found that 55% of UK adults are now considering buying an e-bike. The study asked more than 2,000 people across the UK about their perceptions of mobility and how these perceptions have changed since the start of the pandemic. It is found that 32% of respondents said they would use a car less in favor of e-bikes and 66% would consider buying an e-bike if the government commits to introducing programs.

Subsidy program:

In 2020, the EU e-bike market is up 68% compared to 2019, of those considering buying an e-bike, 23% say they are more likely to buy one. E-bikes than before the pandemic began. Swedish government has announced initiation of subsidies for E bike usage. For every bike ride.

Stockholm's bike-sharing scheme to receive an electrifying upgrade:

Stockholm has signed a new contract for its bike-sharing program, upgrading 1,200 standard bike fleets to 5,000 hybrid electric models. The new electric bike is available 24 hours a day, 7 days a week, in contrast to the current system, which operates only from 6 am to 10 pm in the summer.

The existing bicycle sharing system is popular with more than 500,000 rides in 2016 alone, but the city is aiming for a larger and more flexible system. With 5,000 bikes distributed throughout the city, the fleet will more than quadruple. In addition, all bicycles will be the latest electric models with replaceable batteries. If you want to use the battery, you will receive it when you register for the program. If you want a standard bike, it's easy to use without a battery. This flexibility allows people of all abilities to use their bicycles both short and long distances.

The objective of the report is to present a comprehensive analysis of the Sweden Bike Sharing Market to the stakeholders in the industry. The report provides trends that are most dominant in the Sweden Bike Sharing Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Sweden Bike Sharing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Sweden Bike Sharing Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Bike Sharing Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Sweden Bike Sharing Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Sweden Bike Sharing Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Sweden Bike Sharing Market is aided by legal factors.

Sweden Bike Sharing Market Scope:

|

Sweden Bike Sharing Market |

|

|

Market Size in 2024 |

USD 16.70 Mn. |

|

Market Size in 2032 |

USD 27.65 Mn. |

|

CAGR (2025-2032) |

6.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Bike Type

|

|

By Model

|

|

|

|

By Sharing System

|

Sweden Bike Sharing Market Players:

Frequently Asked Questions

Stockholm region have the highest growth rate in the Sweden Bike Sharing market.

EU bike, City Bike, Vaimoo, Smoove, Beryl, Donkey Republic and others are the key players in the Sweden Bike Sharing market.

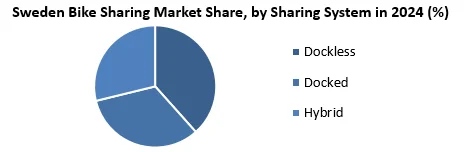

Station based model segment is dominating the regional market of Sweden with market share of approximately 80% with YOY growth rate of 5.62%. Moreover, P2P bike sharing models are also popular in Sweden.

1. Sweden Bike Sharing Market: Research Methodology

1.1. Research Process

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Sweden Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Sweden Bike Sharing Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Business Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Sweden Bike Sharing Market: Dynamics

4.1. Market Trends

4.2. Market Driver

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Sweden Bike Sharing Market Size and Forecast by Segments (by Value in USD Million)

5.1. Sweden Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Sweden Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station based

5.3. Sweden Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key players

6.1. EU Bike

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.3. Business Portfolio

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. CityBike

6.3. Vaimoo

6.4. Smoove

6.5. Beryl

6.6. PBSC

6.7. Citizen

6.8. Donkey Republic

7. Key Findings

8. Industry Recommendations