South Sudan Petroleum Downstream Processing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

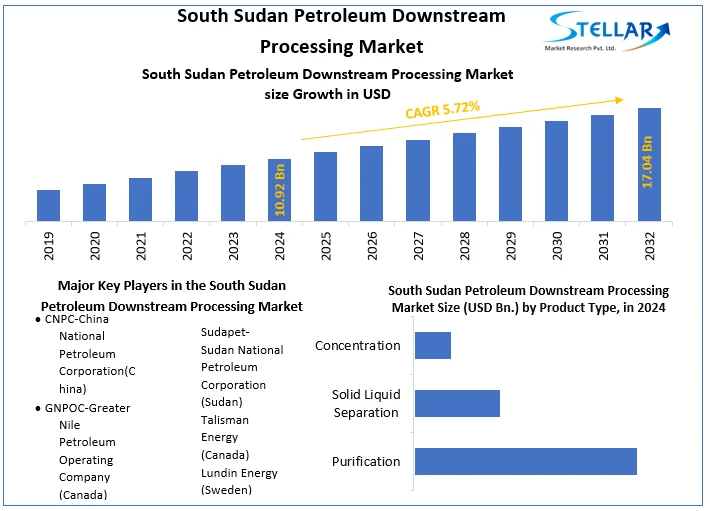

South Sudan Petroleum Downstream Processing Market was valued at USD 10.92 billion in 2024 and is estimated to reach a value of USD 17.04 billion in 2032. South Sudan Petroleum Downstream Processing Market size is estimated to grow at a CAGR of 5.72% over the forecast period.

Format : PDF | Report ID : SMR_573

South Sudan Petroleum Downstream Processing Market Definition:

Downstream processing means the recovery and purification of biosynthetic products from natural resources. It is a type of operation in which oil and gas processes that occur after the production to the point of sale. It acts as a final step in the production process and is represented by refiners of petroleum crude oil and natural gas processors, who bring usable products to end-users and consumers, and downstream process, it provides the products supplied to various industries as the upstream products.

To get more Insights: Request Free Sample Report

South Sudan Petroleum Downstream Processing Market Dynamics:

In South Sudan, the petroleum downstream processing industry is considered the first commercial flow in the country; reducing dependency on imported refined petroleum products coupled with the rise in the population is expected to drive the South Sudan petroleum downstream market during the forecasted period.

South Sudan is considered the major contributor to the power downstream processing market because it is attributed to the various factors like it is considered the major producer of the petroleum products, the most revenue generated by the country through this market only, it is considered as that for this country the 45% contributed towards country's GDP. The government was also investing more than 20-25% of their investments for the development of this market because as per the data by EIA, this market will further lead this country to a GDP growth of 10-15% in a year, the demand for petroleum is continuously increasing and the rapid expansion of urbanization is leading to have the market growth as well as the country's growth.

The refining sector gives opportunities for market growth for this country:

The downstream petroleum industry in South Sudan is an important sector in the country's economy as most of the country's export earnings are spent on imported refined products. South Sudan is inviting international and local investors to participate in refinery project development in the petroleum industry. As the reports by OEC in 2019, South Sudan oil production is increased up to 140 thousand billion barrels per day with a growth rate of 8.75% to proliferate the growth of the South Sudan petroleum downstream processing market during the forecasted period.

Increasing Demand for Petroleum Products is expected to drive the market:

Petroleum includes refined petroleum products such as gasoline, diesel fuel, jet fuels, unfinished oils, and other liquids such as fuel and ethanol, blending components for gasoline, and other refinery inputs which are widely required for various industries and it captures the profit for this market by 20% in a year. Domestic consumption of petroleum products grew significantly with increased industrialization, car ownership, and population, the population of South Sudan reached 11,122,026 in 2021, with a growth of 1.12%. South Sudan has a substantial amount of proven oil reserves. In 2020, the country had total proven oil reserves of about 3.2 thousand barrels with the proposed increase in construction refineries in South Sudan; the crude oil produced can be refined in the country itself to meet the rise in the demand for refined petroleum products.

Challenges to the growth of the petroleum downstream processing market in South Sudan:

South Sudan is highly prone and vulnerable to climate-related stocks that have a devastating impact on people as well as industries of this country. Since independence in 2011, the country has suffered several droughts and floods, severally impacting the country's development efforts. As per the reports of EIA- South Sudan has debt which affects the development as well as its effects on the investment by the government in this industry also, this is considered the major restraining factor for this market.

South Sudan Petroleum Downstream Processing Market Segment Analysis:

By Technique, Purification is considered the major segment which holds the largest market share in 2024. It helps the process because it involves the removal of solids and other impurities including water, gases, and sludge from oil and fuels. Oil purification forms an important part of the regular processing of petroleum. This process is the main process to extract the important product for future use, and it can do only in the extraction place.

Solid-Liquid is the other segment that holds the growth because it considers the second process after the purification, it has facilities like it removes contaminants and undesirable components or reduces their concentration so that the liquid becomes fit for its desired use. This process can be performed by industries also after the transport of purified products as per their usage.

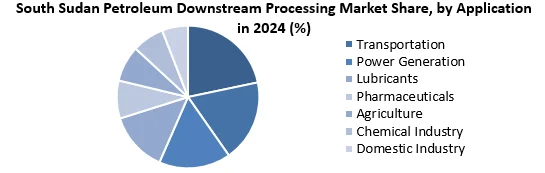

By Application, Petroleum is a key source of energy for transportation, it considers the major factor which is the most dominant segment for this market. More than two-thirds of transportation fuels are obtained from petroleum. The transportation fuels which are derived from petroleum include gasoline/petrol, diesel, liquefied petroleum gas (LPG), and other fuels. It considers that 55% of the consumption of petroleum is for the transportation industry.

Power generation is the second largest segment of this market because of the consumption of petroleum or other products for generating electricity, it takes 0.016 barrels to make 1 kWh. This is the product that is the most important and inseparable process to produce electricity. This factor is considered the major factor which is estimated to create the segment growth in the market.

Other segments also make considerable growth because producing their finished products requires petroleum products for production, and this leads to the growth of this market in various industries.

South Sudan Petroleum Downstream Processing Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in South Sudan, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

South Sudan Petroleum Downstream Processing Market Competitive Landscape:

Akon and CNPC are the major key players in this country because it is supported by the government and also the contribution, as well as the investment of these companies for this market in this country, is huge and they are continuously increasing their investment by 10% in a year. The government is also inviting to anticipate in the refining capacity industry as it leads to them have a strength in this market, it wants to increase their refining capacity by 50,000 barrels per day to Akon and to CNPC by 100,000 barrels per day to meet the requirements in the various industries.

The objective of the report is to present a comprehensive analysis of the South Sudan Petroleum Downstream Processing to the stakeholders in the industry. The report provides trends that are most dominant in the South Sudan Petroleum Downstream Processing market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the South Sudan Petroleum Downstream Processing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the South Sudan Petroleum Downstream Processing Market report is to help understand which market segments and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the South Sudan Petroleum Downstream Processing Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the South Sudan Petroleum Downstream Processing Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the South Sudan Petroleum Downstream Processing Market. The report also analyses if the South Sudan Petroleum Downstream Processing Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, and if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the South Sudan Petroleum Downstream Processing Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the South Sudan Petroleum Downstream Processing Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the South Sudan Petroleum Downstream Processing Market is aided by legal factors.

South Sudan Petroleum Downstream Processing Market Scope:

|

South Sudan Petroleum Downstream Processing Market |

Market Segmentation |

||

|

Market Indicators: |

Details |

by Product Type |

|

|

Historical Data: |

2019-2024 |

by Application |

|

|

Forecast Period: |

2025-2032 |

by Product Type |

|

|

Base Year: |

2024 |

||

|

CAGR: |

5.72 % |

||

|

Market Size in 2024: |

USD 10.92 Billion |

||

|

The market size in 2032: |

USD 17.04 Billion |

||

South Sudan Petroleum Downstream Processing Market KEY PLAYERS:

- CNPC-China National Petroleum Corporation(China)

- GNPOC-Greater Nile Petroleum Operating Company (Canada)

- PETRONAS- Petroliam Nasional Berhad (Malaysia)

- Sudapet- Sudan National Petroleum Corporation (Sudan)

- Talisman Energy (Canada)

- Lundin Energy (Sweden)

- OMV- Osterrichische Mineral Association in Vienna (Austria)

- Tri-Ocean Energy (Cairo, Egypt)

- ONGC- Oil and Natural Gas Corporation (India)

- Akon Refinery Company Limited (Italy)

- Others

Frequently Asked Questions

The market size of the South Sudan Petroleum Downstream Processing Market by 2032 is expected to reach USD 17.04 Billion.

The forecast period for the South Sudan Petroleum Downstream Processing Market is 2025-2032

The market size of the South Sudan Petroleum Downstream Processing Market in 2024 was valued at USD 10.92 Billion.

1. South Sudan Petroleum Downstream Processing Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. South Sudan Petroleum Downstream Processing Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. South Sudan Petroleum Downstream Processing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. South Sudan Petroleum Downstream Processing Market: Dynamics

4.1. South Sudan Petroleum Downstream Processing Market Trends

4.2. South Sudan Petroleum Downstream Processing Market Drivers

4.3. South Sudan Petroleum Downstream Processing Market Restraints

4.4. South Sudan Petroleum Downstream Processing Market Opportunities

4.5. South Sudan Petroleum Downstream Processing Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. South Sudan Petroleum Downstream Processing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. South Sudan Petroleum Downstream Processing Market Size and Forecast, by Product Type (2024-2032)

5.1.1. Purification

5.1.2. Solid Liquid Separation

5.1.3. Concentration

5.2. South Sudan Petroleum Downstream Processing Market Size and Forecast, by Application (2024-2032)

5.2.1. Transportation

5.2.2. Power Generation

5.2.3. Lubricants

5.2.4. Pharmaceuticals

5.2.5. Agriculture

5.2.6. Chemical Industry

5.2.7. Domestic Industry

6. Company Profile: Key Players

6.1. CNPC – China National Petroleum Corporation(China)

6.1.1. Company Overview

6.1.2. Business Segment

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. GNPOC-Greater Nile Petroleum Operating Company (Canada)

6.3. PETRONAS- Petroliam Nasional Berhad (Malaysia)

6.4. Sudapet- Sudan National Petroleum Corporation (Sudan)

6.5. Talisman Energy (Canada)

6.6. Lundin Energy (Sweden)

6.7. OMV- Osterrichische Mineral Association in Vienna (Austria)

6.8. Tri-Ocean Energy (Cairo, Egypt)

6.9. ONGC- Oil and Natural Gas Corporation (India)

6.10. Akon Refinery Company Limited (Italy)

6.11. Others

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook